Growing Evidence That The Upturn Is Upon Us

Back on topic...

We've seen nothing yet. There is absolutely no way that we can avoid some major household name airlines going bust in 2009/10.

This is going to be much worse than 1990/91.

WWW

Germany has clung steadfastly to budget orthodoxy but the downturn has now begun to engulf Europe's biggest economy with shocking speed. The Bundesbank is now expecting the worst recession since the terrible year of 1949, according to Deutsche Press Agentur.

Howard Archer, Europe economist at Global Insight, said the blizzard of dire data from the eurozone now points to a severe manufacturing slump. "Output, total orders, exports orders all contracted at record rates in November, which was alarming," he said.

The broad IFO index of German confidence fell to the lowest since 1993 in November, but it was the unprecedented slide in the expectations index that most worried economists.

"This is extremely bad, it's even worse than the dog days of early 1970s," Julian Callow, Europe economist at Barclays Capital. "German exports to the US, UK, Spain, and Italy have all collapsed, and the next shoe yet to drop is Eastern Europe," he said. Latvia has joined the queue waiting for an IMF bail-out, while Russia devalued the rouble again yesterday.

Howard Archer, Europe economist at Global Insight, said the blizzard of dire data from the eurozone now points to a severe manufacturing slump. "Output, total orders, exports orders all contracted at record rates in November, which was alarming," he said.

The broad IFO index of German confidence fell to the lowest since 1993 in November, but it was the unprecedented slide in the expectations index that most worried economists.

"This is extremely bad, it's even worse than the dog days of early 1970s," Julian Callow, Europe economist at Barclays Capital. "German exports to the US, UK, Spain, and Italy have all collapsed, and the next shoe yet to drop is Eastern Europe," he said. Latvia has joined the queue waiting for an IMF bail-out, while Russia devalued the rouble again yesterday.

We've seen nothing yet. There is absolutely no way that we can avoid some major household name airlines going bust in 2009/10.

This is going to be much worse than 1990/91.

WWW

Join Date: Nov 2004

Location: The Desert but shortly to be HK!)

Age: 49

Posts: 474

Likes: 0

Received 0 Likes

on

0 Posts

and how exactly tupues did you post add more to the debate than WWW? You just looked like a kn*b (maybe that was your intention).

Had an interesting meeting with our internal travel folks today who are busy renegotiating deals with the airlines (top customer of several).... aparently they are ****ting themselves as business travel is/will fall off a cliff.

Everyone going to economy only for shorthaul and you have to have a darned good reason to travel longhaul.... as WWW has said the oil price is now a side show.

Had an interesting meeting with our internal travel folks today who are busy renegotiating deals with the airlines (top customer of several).... aparently they are ****ting themselves as business travel is/will fall off a cliff.

Everyone going to economy only for shorthaul and you have to have a darned good reason to travel longhaul.... as WWW has said the oil price is now a side show.

Join Date: Apr 2008

Location: UK

Age: 50

Posts: 212

Likes: 0

Received 0 Likes

on

0 Posts

biaeghh wrote:

Might I direct you to my thread yesterday... (relevant bit cut and pasted to save you looking):

I was recently in my bank in Windsor and happened to overhear a young woman asking about loans for flight training; a quick chat later I gleamed she was on an offer from CTC, thought Oxford was the best and didn't like to read PPRuNe as its too negative, didn't know about CTC/Easy's large hold pool etc....

Again, I draw your attention to your own post:

One would assume... but you'd be wrong.

iX

PS, tupues, enough cut and past for you ;-)

...Please change your condescending attitude to the people who might actually want a career in aviation. One would assume these people do have a degree of common sense and understand the economic crisis we are in at the moment.

I was recently in my bank in Windsor and happened to overhear a young woman asking about loans for flight training; a quick chat later I gleamed she was on an offer from CTC, thought Oxford was the best and didn't like to read PPRuNe as its too negative, didn't know about CTC/Easy's large hold pool etc....

Again, I draw your attention to your own post:

One would assume these people do have a degree of common sense and understand the economic crisis we are in at the moment.

iX

PS, tupues, enough cut and past for you ;-)

Join Date: Jan 2006

Location: Eghh

Posts: 75

Likes: 0

Received 0 Likes

on

0 Posts

IX,

Thanks for all the cutting and pasting...it would take me a while to trawl through this thread and look up the relevant posts.

WWW

Perhaps you could indulge me with answers to the questions.

Regards my position, can't say too much other that i have a suitable perch at BIA, where i have witnessed the comings and goings of a number of companies, and have witnessed a number of people been adversley affected.

Thanks for all the cutting and pasting...it would take me a while to trawl through this thread and look up the relevant posts.

WWW

Perhaps you could indulge me with answers to the questions.

Regards my position, can't say too much other that i have a suitable perch at BIA, where i have witnessed the comings and goings of a number of companies, and have witnessed a number of people been adversley affected.

Join Date: Jun 2003

Location: Over Mache Grande?

Posts: 563

Likes: 0

Received 0 Likes

on

0 Posts

Why don't you click on his profile button?

However, if you are too blind (or don't want to) see...

Join Date: Nov 2007

Location: Polymer Records

Posts: 597

Likes: 0

Received 0 Likes

on

0 Posts

I was recently in my bank in Windsor and happened to overhear a young woman asking about loans for flight training; a quick chat later I gleamed she was on an offer from CTC, thought Oxford was the best and didn't like to read PPRuNe as its too negative, didn't know about CTC/Easy's large hold pool etc....

As Tupues says, maybe if you cut & paste just one more story of economic doom like its some underground news story they'll all start to listen? You can lead a horse to water...

Join Date: Jul 2008

Location: the moon

Posts: 55

Likes: 0

Received 0 Likes

on

0 Posts

The only reason oil is a sideshow now is because it costs 50 dollars a barrell. If it was still costing 147 O'Learys predicition of 4 European airlines would have probably already come to pass.

My earlier contention that oil was a sideshow was based on the fact that:

1) At $147 the fuel only accounted for about £23 on a typical European flight. Its doubling only £12. Probably less than the car park fee went up this year.

2) There was a recession coming which will result in people not travelling AT ANY PRICE.

3) Oil was a bubble that would do what bubbles always do (though shrinking by 2/3rds in 3 months is way beyond what I thought would happen).

At the lower end of the market airlines are going to be stuffed by people just not travelling. At the upper end of the market the airlines are going to be stuffed by people just travelling economy.

In general airlines are stuffed. Even the freight boys.

WWW

1) At $147 the fuel only accounted for about £23 on a typical European flight. Its doubling only £12. Probably less than the car park fee went up this year.

2) There was a recession coming which will result in people not travelling AT ANY PRICE.

3) Oil was a bubble that would do what bubbles always do (though shrinking by 2/3rds in 3 months is way beyond what I thought would happen).

At the lower end of the market airlines are going to be stuffed by people just not travelling. At the upper end of the market the airlines are going to be stuffed by people just travelling economy.

In general airlines are stuffed. Even the freight boys.

WWW

The usual suspects who whine about cut n' paste always ignore the posts where primary and secondary data are posted but what the hell:

Thats is a cliff that just got fell off.

Here's why it matters;

The Baltic Dry Index is a daily average of prices to ship raw materials. It represents the cost paid by an end user to have a shipping company transport raw materials across seas on the Baltic Exchange, the global marketplace for brokering shipping contracts. The Baltic Exchange is similar to the New York Merc in that it is a medium for buyers and sellers of contracts and forward agreements (futures) for delivery of dry bulk cargo.

The Baltic is owned and operated by the member buyers and sellers. The exchange maintains prices on several routes for different cargoes and then publishes its own index, the BDI, as a summary of the entire dry bulk shipping market. This index can be used as an overall economic indicator as it shows where end prices are heading for items that use the raw materials that are shipped in dry bulk.

The BDI is one of the purest leading indicators of economic activity. It measures the demand to move raw materials and precursors to production, as well as the supply of ships available to move this cargo. Consumer spending and other economic indicators are backward looking, meaning they examine what has already occurred. The BDI offers a real time glimpse at global raw material and infrastructure demand.

Unlike stock and commodities markets, the Baltic Dry Index is totally devoid of speculative players. The trading is limited only to the member companies, and the only relevant parties securing contracts are those who have actual cargo to move and those who have the ships to move it.

Things are happening now which haven't happened for 50+ years. Pilots will be flipping burgers by next Christmas. I have retained pretty good burger flipping skills thankfully.

Unemployment at 3 million is a certainty. Its whether we breach 4 million which interests me. I give it a 50:50 chance.

Protect yourself.

WWW

Thats is a cliff that just got fell off.

Here's why it matters;

The Baltic Dry Index is a daily average of prices to ship raw materials. It represents the cost paid by an end user to have a shipping company transport raw materials across seas on the Baltic Exchange, the global marketplace for brokering shipping contracts. The Baltic Exchange is similar to the New York Merc in that it is a medium for buyers and sellers of contracts and forward agreements (futures) for delivery of dry bulk cargo.

The Baltic is owned and operated by the member buyers and sellers. The exchange maintains prices on several routes for different cargoes and then publishes its own index, the BDI, as a summary of the entire dry bulk shipping market. This index can be used as an overall economic indicator as it shows where end prices are heading for items that use the raw materials that are shipped in dry bulk.

The BDI is one of the purest leading indicators of economic activity. It measures the demand to move raw materials and precursors to production, as well as the supply of ships available to move this cargo. Consumer spending and other economic indicators are backward looking, meaning they examine what has already occurred. The BDI offers a real time glimpse at global raw material and infrastructure demand.

Unlike stock and commodities markets, the Baltic Dry Index is totally devoid of speculative players. The trading is limited only to the member companies, and the only relevant parties securing contracts are those who have actual cargo to move and those who have the ships to move it.

Things are happening now which haven't happened for 50+ years. Pilots will be flipping burgers by next Christmas. I have retained pretty good burger flipping skills thankfully.

Unemployment at 3 million is a certainty. Its whether we breach 4 million which interests me. I give it a 50:50 chance.

Protect yourself.

WWW

Join Date: Dec 2005

Location: UK

Posts: 1,164

Likes: 0

Received 0 Likes

on

0 Posts

WWW,

Oil was never a sideshow. The oil price spike earlier this year claimed more victims than any previous recession or even Sept 11th ever did(the data is there for those who wish to google it). More airlines fell as a result of unsustainable fuel costs than could have been possibly predicted. Fuel hedging will do nothing to alevaite those problems over the coming year. Those are the facts. 'Yes' the recession will claim its expected toll in 2009, but the downfall might have been an awful lot less painless, minus obsene fuel costs.

And 'flipping burgers', as you repeatedly suggest, is patronising and condescending. There are thousands of good people(pilots included) out there that are facing unemployment and extremely tough times this xmas and next year. They dont have the luxury of an Ezy pilots salary coming in.

Oil was never a sideshow. The oil price spike earlier this year claimed more victims than any previous recession or even Sept 11th ever did(the data is there for those who wish to google it). More airlines fell as a result of unsustainable fuel costs than could have been possibly predicted. Fuel hedging will do nothing to alevaite those problems over the coming year. Those are the facts. 'Yes' the recession will claim its expected toll in 2009, but the downfall might have been an awful lot less painless, minus obsene fuel costs.

And 'flipping burgers', as you repeatedly suggest, is patronising and condescending. There are thousands of good people(pilots included) out there that are facing unemployment and extremely tough times this xmas and next year. They dont have the luxury of an Ezy pilots salary coming in.

Last edited by MIKECR; 26th Nov 2008 at 23:39.

Join Date: Nov 2003

Location: Canada

Age: 46

Posts: 253

Likes: 0

Received 0 Likes

on

0 Posts

Wee Weasley Welshman,

The issue of what role the oil price has played in the economic downturn is the one point I disagree with you on in your general prognosis. Whilst I agree that the major driver of the downturn in the UK specifically has been the credit crunch and the subsequent housing market crash, the credit crunch itself on a global scale (caused by American mortgage defaults) was caused by the oil price.

What other reason can explain why the first neighbourhoods in American cities to experience housing price falls were the exurbs (where lifestyles have by far the heaviest reliance on cheap fuel), followed by the suburbs? As the crash has played out, these have also been the areas that have been hit the hardest. All this points to the credit crunch being an effect, not the primary cause.

One way to prove or disprove this theory will be to observe how the regional property markets in the US behave once the effects of $50 oil is taken into account. Although it's probably too early to tell yet, since oil price variations historically take 12 months to filter through.

Of course, another factor that led to the housing crunch was the rising interest rate (and irresponsibly-arranged mortgages resetting to unaffordable levels). But the reason base rates were increased was to combat rising inflation - again brought about by the oil price.

Interesting point about the Baltic Dry

The issue of what role the oil price has played in the economic downturn is the one point I disagree with you on in your general prognosis. Whilst I agree that the major driver of the downturn in the UK specifically has been the credit crunch and the subsequent housing market crash, the credit crunch itself on a global scale (caused by American mortgage defaults) was caused by the oil price.

What other reason can explain why the first neighbourhoods in American cities to experience housing price falls were the exurbs (where lifestyles have by far the heaviest reliance on cheap fuel), followed by the suburbs? As the crash has played out, these have also been the areas that have been hit the hardest. All this points to the credit crunch being an effect, not the primary cause.

One way to prove or disprove this theory will be to observe how the regional property markets in the US behave once the effects of $50 oil is taken into account. Although it's probably too early to tell yet, since oil price variations historically take 12 months to filter through.

Of course, another factor that led to the housing crunch was the rising interest rate (and irresponsibly-arranged mortgages resetting to unaffordable levels). But the reason base rates were increased was to combat rising inflation - again brought about by the oil price.

Interesting point about the Baltic Dry

Join Date: Dec 1999

Location: UK

Posts: 1,608

Likes: 0

Received 0 Likes

on

0 Posts

Chinese airline growth collapses

Southern comfort - FT.com

Published: November 27 2008 09:08 | Last updated: November 27 2008 11:35

A climber scaling a rock-face needs three points of contact to make progress. Chinas economic ascent, say officials, will be assured if it maintains a trio of major state-owned airlines.

That commitment made sense on paper six years ago, when the government forcibly consolidated a fragmented industry. Between them, the three carved up the Chinese mainland: China Southern in Guangzhou, China Eastern in Shanghai, and Air China the intercontinental flag carrier in Beijing. But the economic contraction, and the wretched state of balance sheets, should be forcing a rethink.

An industry set up for growth in staffing, order books and capital structure is now experiencing the opposite. Fuel surcharges have priced out travellers who had just started to embrace air travel as a viable alternative to road or rail. Air traffic in China rose 2.4 per cent in the first ten months to 160m passengers, according to the aviation regulator well short of the anticipated 14 per cent surge. The three national champs have lost over four-fifths of their market capitalisations this year.

China Eastern, the weakest carrier, with 15 times more debt than equity, has suspended its shares while it holds out for state aid. China Southern announced late on Wednesday that it had secured a Rmb3bn ($440m) capital injection. Handy, but barely enough to cover one-tenth of the bank loans and aircraft leasing obligations it faces next year.

The state can continue to tweak taxes and ignore unpaid landing fees. But more radical action is needed. As cross-border consolidation is not an option like America, China limits foreign ownership of carriers to 25 per cent for a single shareholder, and 49 per cent in aggregate the answers must come from within.

Li Jiaxiang, former chairman of Air China, now head of the industry regulator, has repeatedly pushed for a megalithic Chinese airline to match Delta-Northwest. Soon, he may find that officials start to listen.

Quick point on Baltic Dry - looks disasterous, and certainly is for some shippers. Point is that it measures short-term spot market charters. In a recession, these marginal charters evaporate, and shippers rely on the long-term contracts already agreed. It is not a measure of total demand, but marginal demand, so careful what conclusions you draw. (i.e. long periods of low indices would be a disaster for everyone - it is a disaster for some only at the moment).

Published: November 27 2008 09:08 | Last updated: November 27 2008 11:35

A climber scaling a rock-face needs three points of contact to make progress. Chinas economic ascent, say officials, will be assured if it maintains a trio of major state-owned airlines.

That commitment made sense on paper six years ago, when the government forcibly consolidated a fragmented industry. Between them, the three carved up the Chinese mainland: China Southern in Guangzhou, China Eastern in Shanghai, and Air China the intercontinental flag carrier in Beijing. But the economic contraction, and the wretched state of balance sheets, should be forcing a rethink.

An industry set up for growth in staffing, order books and capital structure is now experiencing the opposite. Fuel surcharges have priced out travellers who had just started to embrace air travel as a viable alternative to road or rail. Air traffic in China rose 2.4 per cent in the first ten months to 160m passengers, according to the aviation regulator well short of the anticipated 14 per cent surge. The three national champs have lost over four-fifths of their market capitalisations this year.

China Eastern, the weakest carrier, with 15 times more debt than equity, has suspended its shares while it holds out for state aid. China Southern announced late on Wednesday that it had secured a Rmb3bn ($440m) capital injection. Handy, but barely enough to cover one-tenth of the bank loans and aircraft leasing obligations it faces next year.

The state can continue to tweak taxes and ignore unpaid landing fees. But more radical action is needed. As cross-border consolidation is not an option like America, China limits foreign ownership of carriers to 25 per cent for a single shareholder, and 49 per cent in aggregate the answers must come from within.

Li Jiaxiang, former chairman of Air China, now head of the industry regulator, has repeatedly pushed for a megalithic Chinese airline to match Delta-Northwest. Soon, he may find that officials start to listen.

Quick point on Baltic Dry - looks disasterous, and certainly is for some shippers. Point is that it measures short-term spot market charters. In a recession, these marginal charters evaporate, and shippers rely on the long-term contracts already agreed. It is not a measure of total demand, but marginal demand, so careful what conclusions you draw. (i.e. long periods of low indices would be a disaster for everyone - it is a disaster for some only at the moment).

Join Date: Apr 2008

Location: Socialist Republic of Europe

Posts: 92

Likes: 0

Received 0 Likes

on

0 Posts

WWW is right. Oil price was at worst the trigger, not the cause.

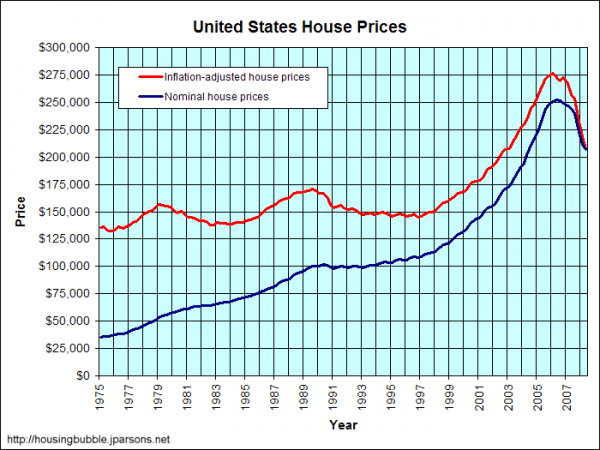

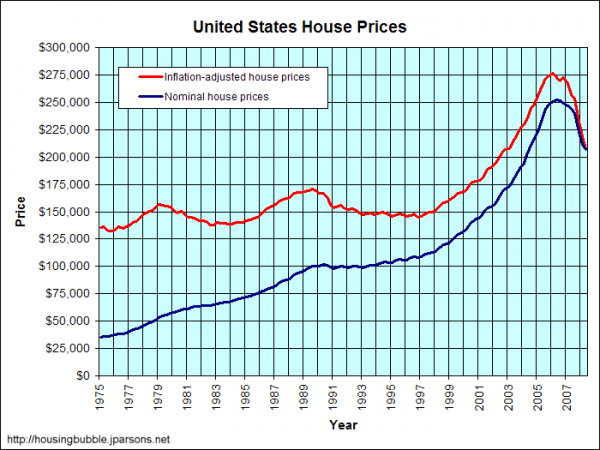

The cause was twofold: cheap credit extended to people who couldn't afford it even when it was still cheap, and a housing bubble.

The banks screwed up the risk spreading when they valued the loans too highly, and in the process they made such complicated arrangements that it was impossible to judge who actually was at risk. Therefore no-one knew whether any debt-based assets owned by a company would be defaulted on. Therefore suddenly banks didn't know whether other banks could cover their debts, so stopped lending to each other. This was bound to happen as soon as there was any extra pressure on home-owners' budgets, like oil price increases, so those struggling most defaulted.

The banks had to stop giving the cheap credit, and spooked the housing market which burst the bubble, worsening the whole problem by making sure that most of those bad loans would not be recovered by the sale of the house on which they were secured, as they were in negative equity.

This graph gets to the heart of the issue.

The cause was twofold: cheap credit extended to people who couldn't afford it even when it was still cheap, and a housing bubble.

The banks screwed up the risk spreading when they valued the loans too highly, and in the process they made such complicated arrangements that it was impossible to judge who actually was at risk. Therefore no-one knew whether any debt-based assets owned by a company would be defaulted on. Therefore suddenly banks didn't know whether other banks could cover their debts, so stopped lending to each other. This was bound to happen as soon as there was any extra pressure on home-owners' budgets, like oil price increases, so those struggling most defaulted.

The banks had to stop giving the cheap credit, and spooked the housing market which burst the bubble, worsening the whole problem by making sure that most of those bad loans would not be recovered by the sale of the house on which they were secured, as they were in negative equity.

This graph gets to the heart of the issue.

Join Date: Oct 2008

Location: wherever I can fly for money!

Posts: 138

Likes: 0

Received 0 Likes

on

0 Posts

BDI

WWW

I totally agree..absolutely correct evidence-base!

BUT ... this is only for today and tomorrow...& it's not an accurate indicator for what could happen on the long run

Cheers

Unlike stock and commodities markets, the Baltic Dry Index is totally devoid of speculative players.

This index can be used as an overall economic indicator as it shows where end prices are heading for items that use the raw materials that are shipped in dry bulk.

BUT ... this is only for today and tomorrow...& it's not an accurate indicator for what could happen on the long run

Cheers

Join Date: Oct 2008

Location: wherever I can fly for money!

Posts: 138

Likes: 0

Received 0 Likes

on

0 Posts

today's cut back are tomorrow's shortages

I would perfer saying: today's cut back plus today's supply = limiting tomorrow's shortages (the least)!

...and so on..bit by bit until the sum is shifting to the positive side of the scale.

Well it's really impossible to tell how/when the mess is gonna end up...but actually it's not that type of endless vicious circle...it will come to break..just let's save the dimes & be patient folks!!

Thank god we are all here in just a rumour's network...talking to each other only... or otherwise we will always keep it on the negative side and never get out of hell!

Good luck

Join Date: Dec 1999

Location: UK

Posts: 1,608

Likes: 0

Received 0 Likes

on

0 Posts

BMI warns of biggest loss in its history - FT

BMI British Midland, the second biggest airline operating at London Heathrow, has warned employees it will suffer the largest loss in its history this year.

Nigel Turner, chief executive, has told staff the group had to restructure as it seeks "to ride out what is probably the worst crisis the aviation industry has faced".

He warned the airline, which is shortly to be taken over by Germany's Lufthansa, expected to remain in loss in 2009 despite "further aggressive action on costs".

BMI would be "in intensive care for some considerable time", he said.

The disclosure of the rapid deterioration in the group's finances comes only four weeks after Lufthansa disclosed that Sir Michael Bishop, BMI chairman, had decided to exercise his option, agreed in a deal struck nine years ago, to force the German carrier to take over his majority stake.

Lufthansa, which already owns a stake of 30 per cent minus one share, will pay about 400m (£334m) for Sir Michael's stake of 50 per cent plus one share. The remaining 20 per cent stake in the lossmaking group is held by SAS Scandinavian Airlines, which also wants to dispose of its holding.

In a memorandum to the group's 5,000 staff, Mr Turner said: "Our financial results this year will produce the largest loss we have ever recorded by a considerable margin." BMI made an operating loss of £29m in 2001 and a pre-tax loss of £19.6m in 2002.

He said: "The combination of falling consumer demand and increases to costs in areas wholly outside of our control, like airport charges, makes our task extremely difficult." A previous agreement under which Lufthansa and SAS carried the bulk of BMI losses expired at the end of 2007.

Mr Turner also warned employees they should expect little relief from the Lufthansa takeover, which is expected to be completed in mid-January.

"Be under no illusions, they will not be prepared to sit back and watch us lose money," he said. "They will, and do, expect us to reshape the business to remove unprofitable flying to the greatest extent possible."

Mr Turner said BMI would freeze pay in 2010 and the directors would have no pay increase in 2009.

The airline would honour the terms of its present three-year pay deal, which included an increase of inflation plus half of 1 per cent in 2009, which would add costs of £7m next year and which the group could not afford, he said.

The airline was planning to cut capacity in its BMIbaby low-cost subsidiary by about 15 per cent next summer. It is cutting the fleet from 20 to 17 by returning aircraft at the end of their leases.

Lufthansa said earlier this month it would consider disposing of the BMIbaby business next year.

Nigel Turner, chief executive, has told staff the group had to restructure as it seeks "to ride out what is probably the worst crisis the aviation industry has faced".

He warned the airline, which is shortly to be taken over by Germany's Lufthansa, expected to remain in loss in 2009 despite "further aggressive action on costs".

BMI would be "in intensive care for some considerable time", he said.

The disclosure of the rapid deterioration in the group's finances comes only four weeks after Lufthansa disclosed that Sir Michael Bishop, BMI chairman, had decided to exercise his option, agreed in a deal struck nine years ago, to force the German carrier to take over his majority stake.

Lufthansa, which already owns a stake of 30 per cent minus one share, will pay about 400m (£334m) for Sir Michael's stake of 50 per cent plus one share. The remaining 20 per cent stake in the lossmaking group is held by SAS Scandinavian Airlines, which also wants to dispose of its holding.

In a memorandum to the group's 5,000 staff, Mr Turner said: "Our financial results this year will produce the largest loss we have ever recorded by a considerable margin." BMI made an operating loss of £29m in 2001 and a pre-tax loss of £19.6m in 2002.

He said: "The combination of falling consumer demand and increases to costs in areas wholly outside of our control, like airport charges, makes our task extremely difficult." A previous agreement under which Lufthansa and SAS carried the bulk of BMI losses expired at the end of 2007.

Mr Turner also warned employees they should expect little relief from the Lufthansa takeover, which is expected to be completed in mid-January.

"Be under no illusions, they will not be prepared to sit back and watch us lose money," he said. "They will, and do, expect us to reshape the business to remove unprofitable flying to the greatest extent possible."

Mr Turner said BMI would freeze pay in 2010 and the directors would have no pay increase in 2009.

The airline would honour the terms of its present three-year pay deal, which included an increase of inflation plus half of 1 per cent in 2009, which would add costs of £7m next year and which the group could not afford, he said.

The airline was planning to cut capacity in its BMIbaby low-cost subsidiary by about 15 per cent next summer. It is cutting the fleet from 20 to 17 by returning aircraft at the end of their leases.

Lufthansa said earlier this month it would consider disposing of the BMIbaby business next year.