Growing Evidence That The Upturn Is Upon Us

Over on my other forum (flying Instructors) there has been a lot of talk about the high volume of new applicants and the low volume of new jobs..

faux pidgin - maybe, but if its well done it legit I think..

WWW

faux pidgin - maybe, but if its well done it legit I think..

WWW

Join Date: Jul 2009

Location: The East

Posts: 6

Likes: 0

Received 0 Likes

on

0 Posts

Artie Flifkin

I not this A320rider you talk off, but I go on A320 once and wen it start it sound like old flower grinder that Uncle Boris have on his farm. It make me think that all not OK with Airbus so I now fly with Ryanair 737 coz it not make this sound.

I now think even more of WWW he not only know all about financial market but play trumpet as well.

I not this A320rider you talk off, but I go on A320 once and wen it start it sound like old flower grinder that Uncle Boris have on his farm. It make me think that all not OK with Airbus so I now fly with Ryanair 737 coz it not make this sound.

I now think even more of WWW he not only know all about financial market but play trumpet as well.

That would probably be the sound of the Power Transfer Unit which is a very noisy hydraulic motor which you sit overhead if you are in the middle of the cabin. If you feel safer on one of Mr O' Learys 737's then there is nowt so queer as folk.

If you're a troll you're good though.

WWW

If you're a troll you're good though.

WWW

Join Date: Nov 1999

Posts: 2,312

Likes: 0

Received 0 Likes

on

0 Posts

We are in a horrible mess. Paying off this debt will be a task still shackled around the neck of my newborn son on his retirement day. History will judge the UK economic management of the last decade as a reckless disgrace. And whilst I'm having a rant why the hell did I spend yesterday morning at the funeral of an 18 year old boy killed in Afghanistan? This government has managed the trick of beggaring us financially whilst spilling our brave servicemans blood pointlessly. The country is a bloody shambles and I feel sorry for any youngster trying to get any career off the ground never mind an aviation one.

Having just returned from visiting the rain soaked military headstone, that adorns one of my own childrens final resting place, it is some small comfort to think that your own newborn son might be spared a similiar fate in the future, and that you can continue to pontificate your clever soothsayer and pundit views from your comfy armchair, swimming pool or whatever other location you wish to brag about this week.

Join Date: Dec 1999

Location: UK

Posts: 1,608

Likes: 0

Received 0 Likes

on

0 Posts

I would join, but this discussion is edging towards JetBlast.

Lloyds results tomorrow. More write-downs expected to join the Rock's today, but then again, the rest of the business might be starting to recover...

Lloyds results tomorrow. More write-downs expected to join the Rock's today, but then again, the rest of the business might be starting to recover...

Join Date: Mar 2009

Location: Button Moon

Posts: 314

Likes: 0

Received 0 Likes

on

0 Posts

Bealzebub....

Thats quite possibly the most powerful and thought provolking posts I've ever read on PPRUNE. Firstly, sincere condolonces for your loss and believe me as a citizen of Britain (won't call it Great anymore), I am extremely grateful and in awe of the sacrafices made by our armed services on our behalf. The poor sods shouldn't be out in Afghanistan or Iraq in my opinion but thats merely my view.

Perhaps now the public seem to be gathering strength in parliament its about time we put our foot down and demand one of two things happen....either our soldiers are immediately properly equipped with everything they need to do their job or they ALL, every single one of them, comes home and we look to fight the war in a different way. (Sorry rant off, but this is a subject that strikes close to home!)

2W2R

Thats quite possibly the most powerful and thought provolking posts I've ever read on PPRUNE. Firstly, sincere condolonces for your loss and believe me as a citizen of Britain (won't call it Great anymore), I am extremely grateful and in awe of the sacrafices made by our armed services on our behalf. The poor sods shouldn't be out in Afghanistan or Iraq in my opinion but thats merely my view.

Perhaps now the public seem to be gathering strength in parliament its about time we put our foot down and demand one of two things happen....either our soldiers are immediately properly equipped with everything they need to do their job or they ALL, every single one of them, comes home and we look to fight the war in a different way. (Sorry rant off, but this is a subject that strikes close to home!)

2W2R

I introduced this subject to this thread so its my fault. The juxtaposition of my own sons birth whilst a neighbour buries her 18 year old son back from Afghanistan meant it was playing on my mind somewhat.

So we'll draw a line there Bealzebub and draw back closer to the thread topic.

------------------

The Northern Crock results were appalling. 39% of their book is in negative equity and as house prices continue to fall into the bleak winter of 2009/10 that is going to quickly get worse. And all that pious talk of "american sub-prime lending" - what the hell would you catagorise Northern Rock as if not a massive sub-prime lender?!

WWW

So we'll draw a line there Bealzebub and draw back closer to the thread topic.

------------------

The Northern Crock results were appalling. 39% of their book is in negative equity and as house prices continue to fall into the bleak winter of 2009/10 that is going to quickly get worse. And all that pious talk of "american sub-prime lending" - what the hell would you catagorise Northern Rock as if not a massive sub-prime lender?!

WWW

Join Date: Jun 2004

Location: uk

Posts: 139

Likes: 0

Received 0 Likes

on

0 Posts

Still deflating....

Cathay Pacific Sees No Signs Of Sustained Recovery - CEO Memo

Article - WSJ.com

Cathay Pacific Sees No Signs Of Sustained Recovery - CEO Memo

ONG KONG (Dow Jones)--Cathay Pacific Airways Ltd. (0293.HK) Chief Executive Tony Tyler said in a weekly memo to the airline's staff that he sees no signs of a sustained recovery for the airline, even though the latest revenue figures show the carrier's performance has bottomed out.

"Our latest revenue figures highlight the fact that we are still some way from climbing out of our deep hole," Tyler said in his latest weekly memo, seen by Dow Jones Newswires on Monday.

He said passenger revenue last week fell more than 15% short of the airline's weekly target, while cargo revenue missed the airline's target by 20%. "Not a pretty picture," he said.

Tyler said the Hong Kong-based carrier still faces a very challenging operating environment, and that other leading airlines have reported disappointing first-half results, reflecting the extent to which the economic downturn has hurt aviation.

Tyler also said Cathay Pacific's passenger revenue is 13% below its year-to-date target, while cargo revenue is 22.5% below target.

"Our latest revenue figures highlight the fact that we are still some way from climbing out of our deep hole," Tyler said in his latest weekly memo, seen by Dow Jones Newswires on Monday.

He said passenger revenue last week fell more than 15% short of the airline's weekly target, while cargo revenue missed the airline's target by 20%. "Not a pretty picture," he said.

Tyler said the Hong Kong-based carrier still faces a very challenging operating environment, and that other leading airlines have reported disappointing first-half results, reflecting the extent to which the economic downturn has hurt aviation.

Tyler also said Cathay Pacific's passenger revenue is 13% below its year-to-date target, while cargo revenue is 22.5% below target.

Join Date: Jan 2009

Location: Hallandale Beach, FL

Age: 53

Posts: 43

Likes: 0

Received 0 Likes

on

0 Posts

The Northern Crock results were appalling. 39% of their book is in negative equity and as house prices continue to fall into the bleak winter of 2009/10 that is going to quickly get worse. And all that pious talk of "american sub-prime lending" - what the hell would you catagorise Northern Rock as if not a massive sub-prime lender?!

... and why would anybody be surprised by this? They securitized the good stuff and flogged it off to outfits like the one I used to work for. What was left on the NR books was the garbage including the 'non-conforming' aka 'liar loans' which in the US is tagged 'sub-prime'. This is true for pretty much all the lenders who had securitization programs - which is nearly everyone. And the good stuff that was securitized turned out to be garbage as well and/or they built the MBS with insufficient margins based on a ludicrously low assumption of default correlation. Still, if you now rebook those MBS as investment positions which will one day redeem at par (these arent the droids you're looking for ) you can show a huge profit and pay yourself a nice bonus at Christmas.

) you can show a huge profit and pay yourself a nice bonus at Christmas.

And its going to get MUCH worse. The public sector hasn't felt the axe yet but its coming - 'Nice Dave' will have no choice but to swing it hard. That is when you're going to see a firesale and prices down 50% from the peak. Congrats on your market timing WWW and stay in your rental if you're still there.

One thing I take issue with - why are you only peeved about the economic management of the last decade? - this cluster is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.

... and why would anybody be surprised by this? They securitized the good stuff and flogged it off to outfits like the one I used to work for. What was left on the NR books was the garbage including the 'non-conforming' aka 'liar loans' which in the US is tagged 'sub-prime'. This is true for pretty much all the lenders who had securitization programs - which is nearly everyone. And the good stuff that was securitized turned out to be garbage as well and/or they built the MBS with insufficient margins based on a ludicrously low assumption of default correlation. Still, if you now rebook those MBS as investment positions which will one day redeem at par (these arent the droids you're looking for

) you can show a huge profit and pay yourself a nice bonus at Christmas.

) you can show a huge profit and pay yourself a nice bonus at Christmas.And its going to get MUCH worse. The public sector hasn't felt the axe yet but its coming - 'Nice Dave' will have no choice but to swing it hard. That is when you're going to see a firesale and prices down 50% from the peak. Congrats on your market timing WWW and stay in your rental if you're still there.

One thing I take issue with - why are you only peeved about the economic management of the last decade? - this cluster

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.

Join Date: Aug 2008

Location: Betwixt and between

Posts: 666

Likes: 0

Received 0 Likes

on

0 Posts

One thing I take issue with - why are you only peeved about the economic management of the last decade? - this clusterf*ck is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.

Join Date: Jun 2004

Location: uk

Posts: 139

Likes: 0

Received 0 Likes

on

0 Posts

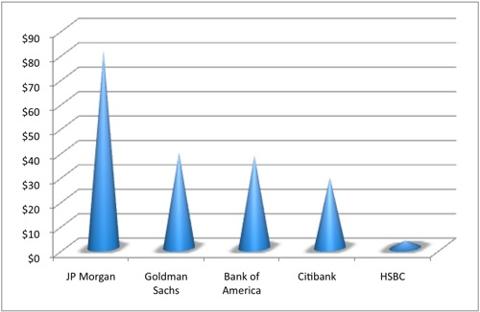

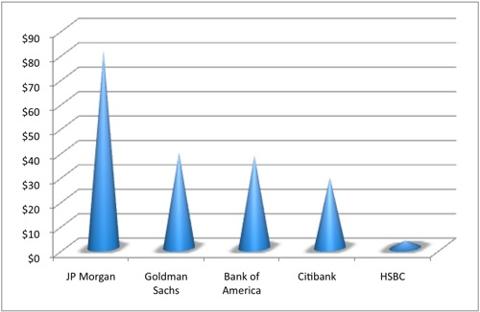

The $1 QUADRILLION Derivatives Time Bomb

Still a lot of printing to do........

Five Reasons the Market Could Crash This Fall -- Seeking Alpha

Few commentators care to mention that the total notional value of derivatives in the financial system is over $1.0 QUADRILLION (that’s 1,000 TRILLIONS).

US Commercial banks alone own an unbelievable $202 trillion in derivatives. The top five of them hold 96% of this.

By the way, the chart is in TRILLIONS of dollars:

As you can see, Goldman Sachs alone has $39 trillion in derivatives outstanding. That’s an amount equal to more than three times total US GDP. Amazing, but nothing compared to JP Morgan (JPM), which has a whopping $80 TRILLION in derivatives on its balance sheet.

Bear in mind, these are “notional” values of derivatives, not the amount of money “at risk” here. However, if even 1% of the $1 Quadrillion is actually at risk, you’re talking about $10 trillion in “at risk.”

What are the odds that Wall Street, when allowed to trade without any regulation, oversight, or audits, put a lot of money at risk? I mean… Wall Street’s track record regarding financial instruments that were ACTUALLY analyzed and rated by credit ratings agencies has so far been stellar.

After all, mortgage backed securities, credit default swaps, collateralized debt obligations… those vehicles all turned out great what with the ratings agencies, banks risk management systems, and various other oversight committees reviewing them.

I’m sure that derivatives which have absolutely NO oversight, no auditing, no regulation, will ALL be fine. There’s NO WAY that the very same financial institutions that used 30-to-1 leverage or more on regulated balance sheet investments would put $50+ trillion “at risk” (only 5% of the $1 quadrillion notional) when they were trading derivatives.

If Wall Street did put $50 trillion at risk… and 10% of that money goes bad (quite a low estimate given defaults on regulated securities) that means $5 trillion in losses: an amount equal to HALF of the total US stock market.

This of course assumes that Wall Street only put 5% of its notional value of derivatives at risk… and only 10% of the derivatives “at risk” go bad.

US Commercial banks alone own an unbelievable $202 trillion in derivatives. The top five of them hold 96% of this.

By the way, the chart is in TRILLIONS of dollars:

As you can see, Goldman Sachs alone has $39 trillion in derivatives outstanding. That’s an amount equal to more than three times total US GDP. Amazing, but nothing compared to JP Morgan (JPM), which has a whopping $80 TRILLION in derivatives on its balance sheet.

Bear in mind, these are “notional” values of derivatives, not the amount of money “at risk” here. However, if even 1% of the $1 Quadrillion is actually at risk, you’re talking about $10 trillion in “at risk.”

What are the odds that Wall Street, when allowed to trade without any regulation, oversight, or audits, put a lot of money at risk? I mean… Wall Street’s track record regarding financial instruments that were ACTUALLY analyzed and rated by credit ratings agencies has so far been stellar.

After all, mortgage backed securities, credit default swaps, collateralized debt obligations… those vehicles all turned out great what with the ratings agencies, banks risk management systems, and various other oversight committees reviewing them.

I’m sure that derivatives which have absolutely NO oversight, no auditing, no regulation, will ALL be fine. There’s NO WAY that the very same financial institutions that used 30-to-1 leverage or more on regulated balance sheet investments would put $50+ trillion “at risk” (only 5% of the $1 quadrillion notional) when they were trading derivatives.

If Wall Street did put $50 trillion at risk… and 10% of that money goes bad (quite a low estimate given defaults on regulated securities) that means $5 trillion in losses: an amount equal to HALF of the total US stock market.

This of course assumes that Wall Street only put 5% of its notional value of derivatives at risk… and only 10% of the derivatives “at risk” go bad.

Join Date: Jan 2009

Location: Hallandale Beach, FL

Age: 53

Posts: 43

Likes: 0

Received 0 Likes

on

0 Posts

Maybe I missed the point but the instruments mentioned - MBS, CDS, CDO - those ARE all derivatives - their value is derived from other financial instruments. So they are included in the very very big numbers if the analysis was done properly, which I doubt. Some folks think derivatives = options but that is far from being the whole story, just one subset.

If the point was to demonstrate the scary leverage of the casino-banks ... well, yes its pretty scary.

The interesting part of the article is the bit about the rationale behind high frequency trading ... if the article is correct that's a new one even to me and I've been in the financial markets for 15 years. Its cute though ... a pretty perfect arbitrage by gaming the computerized exchanges for a quarter point - if executed properly. No wonder Goldman were so upset when that Russian programmer walked off with some of the code.

An October stock market slump would hardly be a surprise ... its almost as predictable as a bull run in almost any given January.

If the point was to demonstrate the scary leverage of the casino-banks ... well, yes its pretty scary.

The interesting part of the article is the bit about the rationale behind high frequency trading ... if the article is correct that's a new one even to me and I've been in the financial markets for 15 years. Its cute though ... a pretty perfect arbitrage by gaming the computerized exchanges for a quarter point - if executed properly. No wonder Goldman were so upset when that Russian programmer walked off with some of the code.

An October stock market slump would hardly be a surprise ... its almost as predictable as a bull run in almost any given January.

Join Date: Dec 2006

Location: .

Age: 37

Posts: 649

Likes: 0

Received 0 Likes

on

0 Posts

High-speed rail 'spells demise of air travel' - The Scotsman

When our corrupt Government is trying to destroy the domestic aviation industry what hope do any of us have?

When our corrupt Government is trying to destroy the domestic aviation industry what hope do any of us have?

Join Date: May 2008

Location: FL 350

Posts: 346

Likes: 0

Received 0 Likes

on

0 Posts

Signs point to Britain being on the cusp of economic fightback

Britain appears to be on the verge of economic recovery amid signs that the worst downturn in decades may be coming to an end. Manufacturing output and house prices rose and the service sector yesterday reported its strongest spurt of growth for 17 months. The upbeat data prompted speculation in the City that the Bank of England would give a further sign today that the economy is on the mend and end its policy of quantitative easing, the process of injecting money into the economy to encourage growth, which has so far cost £125 billion.

Join Date: Apr 2007

Location: Frinton-on-Sea

Posts: 302

Likes: 0

Received 0 Likes

on

0 Posts

One thing I take issue with - why are you only peeved about the economic management of the last decade? - this cluster is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.[QUOTE][/QUOTE]

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.[QUOTE][/QUOTE]

Penguin 68, you are right in one respect but people seem to forget that a certain opposition leader by the name of Dave, actually wanted further de-regulation. The suggestion is that things could have been even worse under that administration, if that were possible!

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.[QUOTE][/QUOTE]

is the result of the ethos of self/no regulation and letting the dogs run free and it goes back to 79/80. Nouveau LieBlair was too spineless to swim against the tide but the die was cast by the 'Chicago Boys' a dead lousy B-movie actor and a dotty old lady from Grantham.[QUOTE][/QUOTE]Penguin 68, you are right in one respect but people seem to forget that a certain opposition leader by the name of Dave, actually wanted further de-regulation. The suggestion is that things could have been even worse under that administration, if that were possible!

Spin this one? Are you serious?

The next monthly UK unemployment figures are due soon - lets wait and see what the raw data says before we break out the bunting and organise a street party.

The WSJ prints this today:

Article - WSJ.com

IF ever I was a cocky son of a bitch its now when saying houses are going to go down, unemployment is going to go up and the economy is going to get much much much worse.

Lets see where UK house prices are in Oct/Nov/Dec this year and lets see how the unemployment figures look in Jan/Feb/Mar next year.

Its no suprise that printing £125,000,000,000 in the last 9 months has done *a little* to stimulate the economy. Shame the banks are parking most of it on reserve with the Fed/BoE....

Hyperinflation and massive Interest Rates for 2014 - someone print that and put it on their office wall and call me back on it 5 years on!

WWW

The next monthly UK unemployment figures are due soon - lets wait and see what the raw data says before we break out the bunting and organise a street party.

The WSJ prints this today:

The Bank of England signaled doubts Thursday about the sustainability of a recent improvement in the U.K. economy, surprising markets with a larger-than-expected increase in a bond-buying program aimed at fending off recession.

Prices of U.K. government bonds surged and the British pound fell after the central bank announced that it would expand its so-called quantitative easing program by GBP50 billion to a total of GBP175 billion. Analysts had been split on whether the central bank would add even GBP25 billion to the program, under which it buys mostly government securities with freshly created money.

Prices of U.K. government bonds surged and the British pound fell after the central bank announced that it would expand its so-called quantitative easing program by GBP50 billion to a total of GBP175 billion. Analysts had been split on whether the central bank would add even GBP25 billion to the program, under which it buys mostly government securities with freshly created money.

IF ever I was a cocky son of a bitch its now when saying houses are going to go down, unemployment is going to go up and the economy is going to get much much much worse.

Lets see where UK house prices are in Oct/Nov/Dec this year and lets see how the unemployment figures look in Jan/Feb/Mar next year.

Its no suprise that printing £125,000,000,000 in the last 9 months has done *a little* to stimulate the economy. Shame the banks are parking most of it on reserve with the Fed/BoE....

Hyperinflation and massive Interest Rates for 2014 - someone print that and put it on their office wall and call me back on it 5 years on!

WWW

Join Date: Apr 2001

Posts: 355

Likes: 0

Received 0 Likes

on

0 Posts

someone print that and put it on their office wall and call me back on it 5 years on!

WWW,

That apart , I missed this news somehow ....

The juxtaposition of my own sons birth

Regards

CP

Why? My first book of economics said "oil was a sideshow, sell you house, get out of the stock market and don't partake in flying training" on the dust cover blurb.

If you think *I* ever predicted $200 oil then I suggest you point me to the posting..

House prices are down 24%, then up a couple of % (cue actual Front Page Headlines in the Express proclaiming a "new boom" in house prices

!), and have another 15% to fall I believe.

!), and have another 15% to fall I believe.

Thank you for the congratulations.

WWW

If you think *I* ever predicted $200 oil then I suggest you point me to the posting..

House prices are down 24%, then up a couple of % (cue actual Front Page Headlines in the Express proclaiming a "new boom" in house prices

Thank you for the congratulations.

WWW

Join Date: Nov 2003

Location: Canada

Age: 46

Posts: 253

Likes: 0

Received 0 Likes

on

0 Posts

Originally Posted by clear prop!!!

That'll be to replace the poster that said oil would be $200 (or whatever) by last Xmas and that house prices will have fallen by 40% by now!....

And I still stand by it, BTW ... That within 5 years from now we'll see $200 a barrel oil. If you think that last years oil spike was a once-off that's history now then explain why oil isn't trading at $20 right now - that should be the middle-of-big-recession price, not $60-70.