AFPS (Lifetime Allowance).

The '75 pension could be drawn from a retirement age of 60 and the UK life expectancy is 80.

Also, the 20 used is across public sector and private sector defined benefit pension schemes. They all have different retirement ages.

So I’m not convinced that is where the 20 came from?

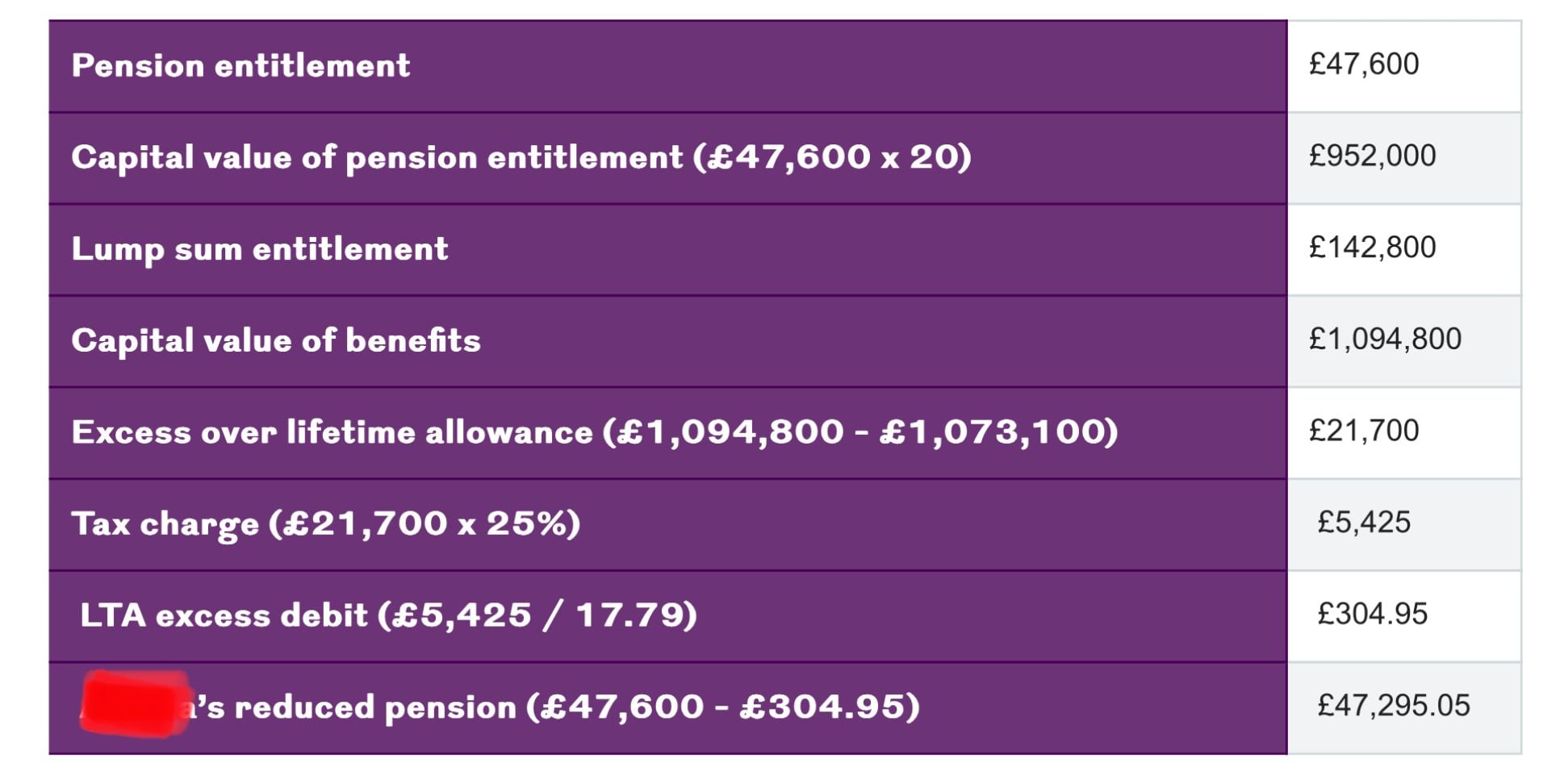

Anyway, for many that poke just over the LTA the effects are fairly minor - here is a worked example on the internet. The figures used are the sort of pensions that a PAS OF3, OF4 or OF5 might see. As you can see in the example a £20k excursion over the LTA reduces the amount by just £5k, but it’s still worth getting the bigger pension as you’ll still be getting £15k more! Here is that wormed example:

Join Date: Apr 2004

Location: uk

Posts: 70

Likes: 0

Received 0 Likes

on

0 Posts

I retired a few years ago and was just short of breaching the LTA. Will subsequent index linking take me over the limit or is the 20 times plus gratuity calculation done at the point of retirement?

Originally Posted by Lima Juliet

it’s still worth getting the bigger pension as you’ll still be getting £15k more!

In my opinion there is very little public sympathy for the idea that the tax burden should be eased on people in the fortunate position of being faced with these sorts of decisions.

* The only one I can think of is where index-linking of a crystallised pension would outstrip any increase in pensionable salary, in which case early retirement could make long term sense. But that only applies to people who've topped out their incremental progression, not to those facing a choice over promotion.

I expect that if you have PENSION in payment then you’ll be fine. But if you have EDP in payment then it will be valued when it switches to PENSION.

Easy Street - yes, it’s like the bonkers-brigade that left before 1 Apr 22 as they would be ‘forced’ onto AFPS15 after that. Despite trying to explain that everything that they had earned up to that point would still be their’s and actually, as a career-averaging pension, they would likely be even better off at age 60 with the AFPS15 pension added to what they had got (AFPS75 stops paying any more after 34 years for OFs and 37 years for ORs, or AFPS05 after 40 years (so a few that joined at age 17/18/19 would dip out)). A few still left

Easy Street, Lima Juliet and others. I agree, I will still get a very decent pension even after the extra tax is paid. The LTA freeze will understandably be seen by many as a first world problem. What infuriates me is the betrayal of principle by the politicians.

I joined the RAF in the very early 80’s and have been financially prudent. I invested in AVCs because my flying pay was not pensionable and the rules at the time encouraged it. I did not leave at 38 years old because I was promised a decent pension if I stayed which ameliorated the need to leave and chase Mammon with the airlines or the corporate world. I even managed promotion (accidentally). I left at 54 ½ years old with a lump sum and EDP income (because the rules encouraged it, based on the LTA being index-linked, or at least occasionally), straight into a great job with another pension scheme, with a generous employer contribution to double my own. My AVC pension-pot, my new job’s pension pot combined with my entirely hypothetical RAF pension pot will be over the LTA freeze as I reach my 65th birthday.

My argument is that, a, the politicians have moved the goalposts, in effect breaking a promise as one needs to plan decades ahead with respect to pensions, not knee-jerk every few years, b, it is a tax on financial prudence, and c, if I am to be taxed on a hypothetical MOD pension pot, at least give me the pot, let me invest it as I see fit after any LTAtheft tax.

And yes, I will take some serious advice before I dip into either of my 2 extra pensions, and in any case before my 65th. I realise that I should not be surprised at anything politicians or The Treasury do, but I did not see this one coming.

I expect to be laughed at, have my argument challenged, my grammar critiqued and to learn something; please go ahead, just writing this has improved my mood.

I joined the RAF in the very early 80’s and have been financially prudent. I invested in AVCs because my flying pay was not pensionable and the rules at the time encouraged it. I did not leave at 38 years old because I was promised a decent pension if I stayed which ameliorated the need to leave and chase Mammon with the airlines or the corporate world. I even managed promotion (accidentally). I left at 54 ½ years old with a lump sum and EDP income (because the rules encouraged it, based on the LTA being index-linked, or at least occasionally), straight into a great job with another pension scheme, with a generous employer contribution to double my own. My AVC pension-pot, my new job’s pension pot combined with my entirely hypothetical RAF pension pot will be over the LTA freeze as I reach my 65th birthday.

My argument is that, a, the politicians have moved the goalposts, in effect breaking a promise as one needs to plan decades ahead with respect to pensions, not knee-jerk every few years, b, it is a tax on financial prudence, and c, if I am to be taxed on a hypothetical MOD pension pot, at least give me the pot, let me invest it as I see fit after any LTA

And yes, I will take some serious advice before I dip into either of my 2 extra pensions, and in any case before my 65th. I realise that I should not be surprised at anything politicians or The Treasury do, but I did not see this one coming.

I expect to be laughed at, have my argument challenged, my grammar critiqued and to learn something; please go ahead, just writing this has improved my mood.

Join Date: Apr 2004

Location: uk

Posts: 70

Likes: 0

Received 0 Likes

on

0 Posts

A Benefit Crystallisation Event (BCE) used to value LTA is normally a once off event, but there are other things that can trigger a re show. They are know as BCE 1-9. They are listed here: https://www.gov.uk/hmrc-internal-man...nual/ptm088100

I expect that if you have PENSION in payment then you’ll be fine. But if you have EDP in payment then it will be valued when it switches to PENSION.

I expect that if you have PENSION in payment then you’ll be fine. But if you have EDP in payment then it will be valued when it switches to PENSION.

Join Date: Nov 2019

Location: Looking north out to sea

Posts: 50

Likes: 0

Received 9 Likes

on

4 Posts

Afternoon

Just to through the cat amongst the pigeons re the assumption that your military pension has a x 20 figure to calculate the percentage of the lifetime allowance….. It may, but not for all…

I left the RAF at my 16/38 point in 97 taking a reduced pension, but with a lump sum. This pension went up to the full rate at age 55.

In the meantime, I joined the civil airlines where I initially had a final salary pension which was later moved to a money purchase scheme.

At age 60, I took my pension from the airline final salary scheme. This generated a crystallisation event. This pension was calculated with the x 20 figure equating to approx 48% of the lifetime allowance. However…. as I was already in receipt of my military pension this was calculated with a x 25 figure making up 41.72% of the LTA! I don’t know why, but I have the letter in front of me. This calculation is available via Veterans U.K. Kentigern House Glasgow.

Now, it doesn’t take a genius to work out that I have less than 1% of the LTA available to use on my money purchase scheme. Whilst it my make me feel good looking at it, I would need to be desperate to use it as I would pay an extra 25% tax, ie a minimum of 55% on money taken.

Whilst not destitute, it would be nice to be able to use the pension that I have built up over the last 40 years and not having it sit there waiting for the Government to pounce. And no doubt, there will be more trouble ahead. Forty years ago £1million was a lot. I could have bought 10 big houses. Today, it is not.

Goalpost moving. Now where have I seen that before?

Me

Just to through the cat amongst the pigeons re the assumption that your military pension has a x 20 figure to calculate the percentage of the lifetime allowance….. It may, but not for all…

I left the RAF at my 16/38 point in 97 taking a reduced pension, but with a lump sum. This pension went up to the full rate at age 55.

In the meantime, I joined the civil airlines where I initially had a final salary pension which was later moved to a money purchase scheme.

At age 60, I took my pension from the airline final salary scheme. This generated a crystallisation event. This pension was calculated with the x 20 figure equating to approx 48% of the lifetime allowance. However…. as I was already in receipt of my military pension this was calculated with a x 25 figure making up 41.72% of the LTA! I don’t know why, but I have the letter in front of me. This calculation is available via Veterans U.K. Kentigern House Glasgow.

Now, it doesn’t take a genius to work out that I have less than 1% of the LTA available to use on my money purchase scheme. Whilst it my make me feel good looking at it, I would need to be desperate to use it as I would pay an extra 25% tax, ie a minimum of 55% on money taken.

Whilst not destitute, it would be nice to be able to use the pension that I have built up over the last 40 years and not having it sit there waiting for the Government to pounce. And no doubt, there will be more trouble ahead. Forty years ago £1million was a lot. I could have bought 10 big houses. Today, it is not.

Goalpost moving. Now where have I seen that before?

Me

ItsonlyMeagain - that is because the multiplier before 1 Apr 2006 was 25 and not 20. But then again the LTA was much larger in real terms - there is an example here: https://adviser.royallondon.com/tech...ts-are-tested/

NATOPotato - sadly various Governments have agreed to rob tax our pension arrangements over the years. In 2006 LTA was £1.5M and so it didn’t affect most of us (apart from CDS), then by 2011/12 it was up to £1.8M before the gradual reductions happened. It was only really when it got to about £1.25M that any of us started noticing in 2014/15. Now it reduced to £1M in 2016/17 and then went up with inflation to £1.073M by 2020/21 and then it was frozen. Now with eye-watering inflation it is really starting to bite.

There are many reasons for thisgrab taxation of pension - economic challenges from the 2007 crash, “Austerity”, Brexit, COVID, Russia vs Ukraine, etc… etc… But the bottom line is that it affects a small, say 3-5% of the population, and so most politicians don’t care right now. I think that is starting to shift as they are seeing more people quit their well-paid jobs (inducing a “brain drain”) that is starting to see fewer, Doctors, Judges, Lawyers, VSOs, high-end Civil Servants all starting to quit early. When the wheels start to come off of the wagons that these folks support, just maybe then we’ll see the politician’s and HMT’s ears starting to prick up.

But until that happens, if it does, then we just have to suck it up…

There are many reasons for this

But until that happens, if it does, then we just have to suck it up…

The Judges' pension scheme received an exemption and is not subject to the LTA.

We can't have their Lordships subject to the same rules as the rest of us proles after all...

We can't have their Lordships subject to the same rules as the rest of us proles after all...

Cole Burner - Judicial Pension Scheme (JPS) 1993 was unregistered, so no LTA or AA. JPS15 is registered for tax and so AA and LTA apply. As is Judicial AVC and Judicial Added Pension. But you are right that the recently introduced JPS22 in 2022 is unregistered for tax to try and increase recruitment of Judges.

It's not my intention to defend the judiciary and their pension however I feel it right to point out the following, drawn from the .Gov website:

A world class pension scheme for your military service

When a member of the armed forces reaches their retirement age, they receive one of the most generous pensions available in the UK. This fairly reflects the unique sacrifice they have provided their country throughout their career.

All members of the armed forces are automatically enrolled into the Armed Forces Pension Scheme. Unlike all other public schemes, members pay 0% in contributions each month. The scheme is unfunded and paid from the public purse.

If I may draw your attention to the points I've highlighted in bold, particularly the 0% contribution element. AVC's aside a military pension is non contributory unlike those of other employees who also risk their lives in the line of duty: police, fire fighters, nurses, RFA,

HM Coastguard. The list is quite extensive, the point being it is not just those in the military who may be asked to make the ultimate sacrifice. Please just remember when you're picking the bones out of your pension offer and bemoaning your LTA breach that most other public servants have contributed to their pensions.

A world class pension scheme for your military service

When a member of the armed forces reaches their retirement age, they receive one of the most generous pensions available in the UK. This fairly reflects the unique sacrifice they have provided their country throughout their career.

All members of the armed forces are automatically enrolled into the Armed Forces Pension Scheme. Unlike all other public schemes, members pay 0% in contributions each month. The scheme is unfunded and paid from the public purse.

If I may draw your attention to the points I've highlighted in bold, particularly the 0% contribution element. AVC's aside a military pension is non contributory unlike those of other employees who also risk their lives in the line of duty: police, fire fighters, nurses, RFA,

HM Coastguard. The list is quite extensive, the point being it is not just those in the military who may be asked to make the ultimate sacrifice. Please just remember when you're picking the bones out of your pension offer and bemoaning your LTA breach that most other public servants have contributed to their pensions.

It's not my intention to defend the judiciary and their pension however I feel it right to point out the following, drawn from the .Gov website:

A world class pension scheme for your military service

When a member of the armed forces reaches their retirement age, they receive one of the most generous pensions available in the UK. This fairly reflects the unique sacrifice they have provided their country throughout their career.

All members of the armed forces are automatically enrolled into the Armed Forces Pension Scheme. Unlike all other public schemes, members pay 0% in contributions each month. The scheme is unfunded and paid from the public purse.

If I may draw your attention to the points I've highlighted in bold, particularly the 0% contribution element. AVC's aside a military pension is non contributory unlike those of other employees who also risk their lives in the line of duty: police, fire fighters, nurses, RFA,

HM Coastguard. The list is quite extensive, the point being it is not just those in the military who may be asked to make the ultimate sacrifice. Please just remember when you're picking the bones out of your pension offer and bemoaning your LTA breach that most other public servants have contributed to their pensions.

A world class pension scheme for your military service

When a member of the armed forces reaches their retirement age, they receive one of the most generous pensions available in the UK. This fairly reflects the unique sacrifice they have provided their country throughout their career.

All members of the armed forces are automatically enrolled into the Armed Forces Pension Scheme. Unlike all other public schemes, members pay 0% in contributions each month. The scheme is unfunded and paid from the public purse.

If I may draw your attention to the points I've highlighted in bold, particularly the 0% contribution element. AVC's aside a military pension is non contributory unlike those of other employees who also risk their lives in the line of duty: police, fire fighters, nurses, RFA,

HM Coastguard. The list is quite extensive, the point being it is not just those in the military who may be asked to make the ultimate sacrifice. Please just remember when you're picking the bones out of your pension offer and bemoaning your LTA breach that most other public servants have contributed to their pensions.

Military pay is indeed abated by a fixed percentage to account for our non-contributory pension.

The Pay Review Board decides what our job is worth. That amount is then adjusted by the "X" factor upwards & abated for the non-contributory pension. We then arrive at the Pay Scale we actually get paid. If you decide not to join the AFPS of whatever flavour you have available, you do not get the abatement back!

The Pay Review Board decides what our job is worth. That amount is then adjusted by the "X" factor upwards & abated for the non-contributory pension. We then arrive at the Pay Scale we actually get paid. If you decide not to join the AFPS of whatever flavour you have available, you do not get the abatement back!

the politicians have moved the goalposts, in effect breaking a promise

Bottom line is that they promised a certain conditions, then after you've done the service they are not honouring it, It may appear smallish numbers at the moment, but the way they are cheating us out if our promises are increasing through fiscal-drag and effectively removing years of previously protected entitlement. Imagine if they removed all of our pension entitlement through these taxes - there would be utter outrage - but they are fleecing us slowly in a way that few yet recognise so they are dipping in for more and more each year.

I have nothing against negotiating for reduction in future conditions - I can make the decision based on current conditions whether to continue service - but to take the service then reduce terms is just wrong whether you are Marshal of the Royal Air Force or a lowly worker.

Military pay is indeed abated by a fixed percentage to account for our non-contributory pension.

The Pay Review Board decides what our job is worth. That amount is then adjusted by the "X" factor upwards & abated for the non-contributory pension. We then arrive at the Pay Scale we actually get paid. If you decide not to join the AFPS of whatever flavour you have available, you do not get the abatement back!

The Pay Review Board decides what our job is worth. That amount is then adjusted by the "X" factor upwards & abated for the non-contributory pension. We then arrive at the Pay Scale we actually get paid. If you decide not to join the AFPS of whatever flavour you have available, you do not get the abatement back!