Malindo Airine

INTENTIONALLY LEFT BLANK

Join Date: Dec 1998

Location: Europe

Posts: 350

Likes: 0

Received 0 Likes

on

0 Posts

Unless there is a typhoon overhead, yes that is a lot for a sheduled airline with a reputation to keep and an obligation to its paying customers.

Now back to the ATIS topic...Veloo Maniam, when is KLIA going to get DATIS? Years overdue.

Now back to the ATIS topic...Veloo Maniam, when is KLIA going to get DATIS? Years overdue.

Join Date: Mar 2006

Location: Somewhere out there

Posts: 189

Likes: 0

Received 0 Likes

on

0 Posts

Viability ??

Wasn't there supposed to be 10 NG's by Dec 2013, 20 by Dec-2014?

How many now?

Ambitious expansion plans when they are haemorrhaging cash while AirAsia and MAS hack it out and cut fares. Plus, they've already got everyone talking about their inability to maintain a schedule without cancelling flights - not the most stable platform on which to enter the market.

How many now?

Ambitious expansion plans when they are haemorrhaging cash while AirAsia and MAS hack it out and cut fares. Plus, they've already got everyone talking about their inability to maintain a schedule without cancelling flights - not the most stable platform on which to enter the market.

Last edited by ShinjukuHustler; 23rd Nov 2013 at 05:39. Reason: Typo

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

The entry of Malindo has cost MAS to go into red, loss of RM350m in the 3rd quarter as they fight for market share. It has also caused AA to lose 77% of its profit.

I dont know how much Malindo is bleeding, must respect their bottomless pockets.

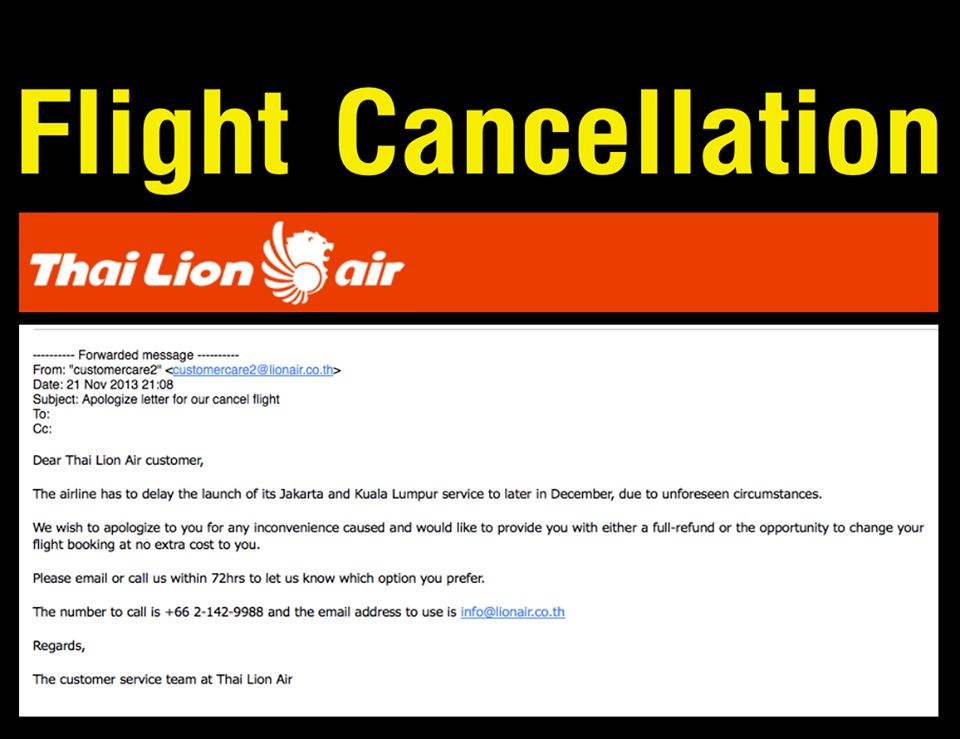

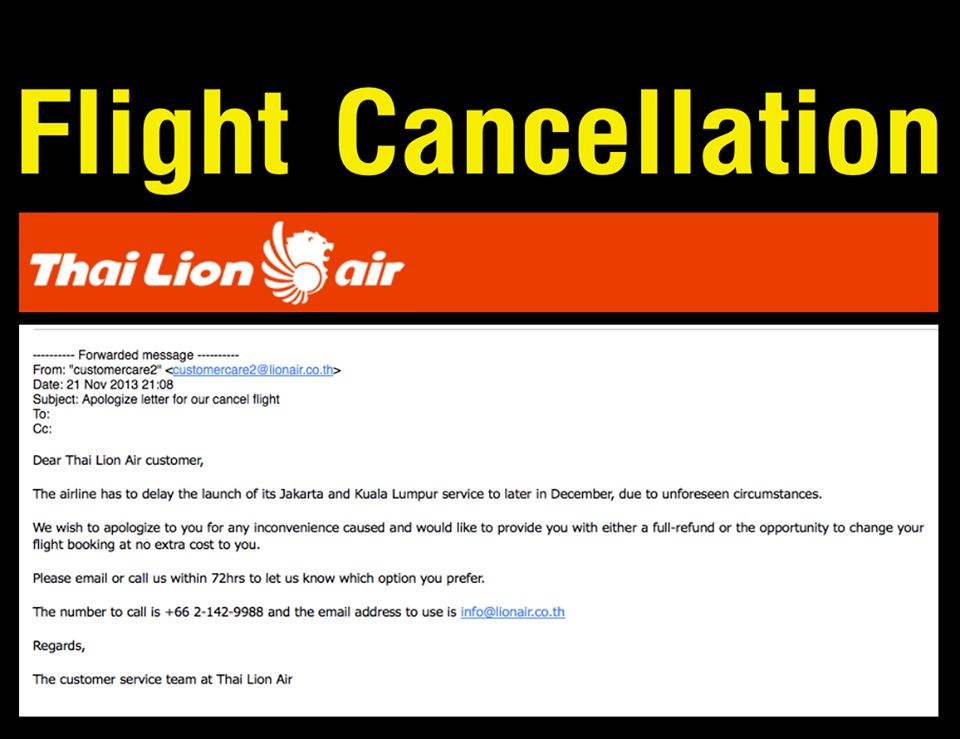

Seems Thai Lion Air on schedule for take off....but in Grand Lion Air's tradition, they already posting out letters to thousands of customers about flight cancellations to KL and Jakarta BEFORE they fly!

I dont know how much Malindo is bleeding, must respect their bottomless pockets.

Seems Thai Lion Air on schedule for take off....but in Grand Lion Air's tradition, they already posting out letters to thousands of customers about flight cancellations to KL and Jakarta BEFORE they fly!

Join Date: Mar 2013

Location: England

Age: 35

Posts: 58

Likes: 0

Received 0 Likes

on

0 Posts

@twins i think lion air group pays you to talk good about them lol

i am attaching an article that says mas actually improving slowly but surely rather than just gone in to the red due to entry on malindo.

Despite optimism for improvements this year, national carrier Malaysian Airline System Bhd (MAS) reported a loss of RM375.44 million for its third-quarter (3Q) ended Sept 30. Earnings per share showed a loss of 2.25 sen, compared to 0.52 sen previously. The losses were made despite a 12.4% improvement in revenue to RM3.91 billion from the RM3.47 billion it made in the corresponding quarter last year, in which it posted a RM37.08 million net profit.

For the cumulative nine months, MAS’ net loss widened to RM830.25 million from RM483.96 million previously. Revenue for the period improved to RM11.22 billion from RM9.89 billion in 2012.

The loss was reported late yesterday when MAS stocks closed unchanged at 35 sen, but strong trading movements are expected today.

The loss, which went against market expectations, is an indication that the worst is not over for MAS, which is undergoing a comprehensive turnaround plan that is scheduled to bring the company back into the black by the end of 2014. This goal is expected to be deferred for the third time.

Last week, analysts covering the national carrier had expressed confidence that MAS would break even in the 3Q. Maybank Investment Bank Bhd expected the airline to report a RM17 million net profit on the back of seasonally strong 3Q and a better load factor.

The airline’s 3Q load factor stood at 84.8% — a historic peak for the 41-year-old carrier.

MAS said its operating expenditure in the last quarter was higher by 16% compared to the same quarter last year due to higher fuel and non-fuel variable costs, which rose in line with capacity increase and the weakening of the ringgit against the US dollar.

“Fuel and non-fuel costs for the airline increased by 16%. The increase in operating expenditure is also attributed to a one-off cost incurred for redelivery of aircraft.

“In addition, the group intensified its advertising and promotional activities amid intense competition as part of its long-term strategy to continuously strengthen presence in key markets,” MAS said in a filing to Bursa Malaysia yesterday.

Despite the loss, the carrier said its cash position remains strong at RM5.4 billion.

MAS said its operating revenue improved 13% to RM3.78 billion compared to the same quarter last year due to an increase in seat factor by 10.3 percentage points to 84.8%, on the back of a 20% increase in capacity.

“Passenger yield continued to be under pressure as competition for market share intensified regionally and globally.

Airline revenue increased by 14% while cargo revenue was comparable to last year.” MAS said it is looking to sustain strong growth in both passenger traffic and seats for the remainder of the year.

“Competition, on both the domestic and international fronts, has intensified over the year. With average fares falling across the board, the group continues to monitor market demand and focus on driving business efficiency.”

MAS said it faces competition locally from no-frill operator AirAsia Bhd and hybrid airline Malindo Air.

It said the arrival of more new aircraft will further improve its product offerings while simultaneously reducing the average age of the fleet.

The additional capacity will be used to increase frequencies to meet passenger demand and fly to new destinations, it added, while claiming that aggressive marketing and promotions, better capacity management, optimisation of asset utilisation and increasing productivity will continue to be the central focus of its business model.

In an August report, CIMB Research rated MAS ‘Underperform’ with a target price of 17 sen in anticipation that the carrier will continue registering losses for at least the next three years, with losses potentially widening further in 2014 on the back of the weakening ringgit.

Alliance Research Sdn Bhd has a target price of 23 sen while maintaining its ‘Sell’ call on the stock, given that yield is under pressure and US dollar is appreciating.

“We expect MAS’ business turnaround to take longer than expected and to continue to suffer losses,” the research firm said in its latest report on the airline.

i am attaching an article that says mas actually improving slowly but surely rather than just gone in to the red due to entry on malindo.

Despite optimism for improvements this year, national carrier Malaysian Airline System Bhd (MAS) reported a loss of RM375.44 million for its third-quarter (3Q) ended Sept 30. Earnings per share showed a loss of 2.25 sen, compared to 0.52 sen previously. The losses were made despite a 12.4% improvement in revenue to RM3.91 billion from the RM3.47 billion it made in the corresponding quarter last year, in which it posted a RM37.08 million net profit.

For the cumulative nine months, MAS’ net loss widened to RM830.25 million from RM483.96 million previously. Revenue for the period improved to RM11.22 billion from RM9.89 billion in 2012.

The loss was reported late yesterday when MAS stocks closed unchanged at 35 sen, but strong trading movements are expected today.

The loss, which went against market expectations, is an indication that the worst is not over for MAS, which is undergoing a comprehensive turnaround plan that is scheduled to bring the company back into the black by the end of 2014. This goal is expected to be deferred for the third time.

Last week, analysts covering the national carrier had expressed confidence that MAS would break even in the 3Q. Maybank Investment Bank Bhd expected the airline to report a RM17 million net profit on the back of seasonally strong 3Q and a better load factor.

The airline’s 3Q load factor stood at 84.8% — a historic peak for the 41-year-old carrier.

MAS said its operating expenditure in the last quarter was higher by 16% compared to the same quarter last year due to higher fuel and non-fuel variable costs, which rose in line with capacity increase and the weakening of the ringgit against the US dollar.

“Fuel and non-fuel costs for the airline increased by 16%. The increase in operating expenditure is also attributed to a one-off cost incurred for redelivery of aircraft.

“In addition, the group intensified its advertising and promotional activities amid intense competition as part of its long-term strategy to continuously strengthen presence in key markets,” MAS said in a filing to Bursa Malaysia yesterday.

Despite the loss, the carrier said its cash position remains strong at RM5.4 billion.

MAS said its operating revenue improved 13% to RM3.78 billion compared to the same quarter last year due to an increase in seat factor by 10.3 percentage points to 84.8%, on the back of a 20% increase in capacity.

“Passenger yield continued to be under pressure as competition for market share intensified regionally and globally.

Airline revenue increased by 14% while cargo revenue was comparable to last year.” MAS said it is looking to sustain strong growth in both passenger traffic and seats for the remainder of the year.

“Competition, on both the domestic and international fronts, has intensified over the year. With average fares falling across the board, the group continues to monitor market demand and focus on driving business efficiency.”

MAS said it faces competition locally from no-frill operator AirAsia Bhd and hybrid airline Malindo Air.

It said the arrival of more new aircraft will further improve its product offerings while simultaneously reducing the average age of the fleet.

The additional capacity will be used to increase frequencies to meet passenger demand and fly to new destinations, it added, while claiming that aggressive marketing and promotions, better capacity management, optimisation of asset utilisation and increasing productivity will continue to be the central focus of its business model.

In an August report, CIMB Research rated MAS ‘Underperform’ with a target price of 17 sen in anticipation that the carrier will continue registering losses for at least the next three years, with losses potentially widening further in 2014 on the back of the weakening ringgit.

Alliance Research Sdn Bhd has a target price of 23 sen while maintaining its ‘Sell’ call on the stock, given that yield is under pressure and US dollar is appreciating.

“We expect MAS’ business turnaround to take longer than expected and to continue to suffer losses,” the research firm said in its latest report on the airline.

Join Date: Jul 2007

Location: Malaysia

Posts: 9

Likes: 0

Received 0 Likes

on

0 Posts

Gtr21,

Previously Air Asia was the culprit, taking passengers away from MAS, now ****ed to Malindo. MAS management have not learned their lesson well and still groping in the dark which direction to follow. In the 2nd quarter's report MAS CEO had claimed that they were on right track with their BTP and never mentioned about yield but glorified the load factor. But now, what happened. Same excuses dished out.

Previously Air Asia was the culprit, taking passengers away from MAS, now ****ed to Malindo. MAS management have not learned their lesson well and still groping in the dark which direction to follow. In the 2nd quarter's report MAS CEO had claimed that they were on right track with their BTP and never mentioned about yield but glorified the load factor. But now, what happened. Same excuses dished out.

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

cimb has very negative views on both MAS and Air Asia...both now recommend ... SELL!

Just 10 Malindo aircrafts can do that much damage. Next year, Malindo will double their presence to 20 aircrafts (adding 10 per year to 100 in 10 years.)

Just 10 Malindo aircrafts can do that much damage. Next year, Malindo will double their presence to 20 aircrafts (adding 10 per year to 100 in 10 years.)

Join Date: Sep 2002

Location: In someone pocket

Posts: 1,212

Likes: 0

Received 0 Likes

on

0 Posts

I heard from MAS friends. they have removed all transportation from cabincrew and flight crew probably to save money. There are a lot resignation from cabincrew .. who earn a peanut for there excellent work.

.. who earn a peanut for there excellent work.

.. who earn a peanut for there excellent work.

.. who earn a peanut for there excellent work.

Join Date: Mar 2006

Location: Somewhere out there

Posts: 189

Likes: 0

Received 0 Likes

on

0 Posts

Very rare to find any airline with bottomless pockets these days, there's almost always an extremely adverse reaction to deep losses.

At some point, if the airline doesn't stabilise, Malindo's benefactors will eventually get tired of pumping cash into the venture; it's the same old scenario that befalls many an ill-conceived or poorly run airline start-up venture. The forecasts on market strength are incorrect or exaggerated, the returns are not as fat or the losses as small as predicted and then the begging bowl comes out for a cash injection to keep the venture afloat.

Eventually you reach the point where the money pumped to keep it alive exceeds a decades worth of profits and shareholders start to regret ever getting involved. The baby airline becomes a drain on it's profitable older sibling and so talks of spinning it off to stand on its own begin to grow.

By the time you've got to this point they go through various management shuffles incl the CEO and other exec level types. The smart ones, if there are any, get out early, maybe go to a competitor and spill the beans on what life is really like around the boardroom table.

I could be completely wrong in applying this scenario to Lion Air's 'Malaysian Invasion' but I won't be surprised at all if I'm right.

At some point, if the airline doesn't stabilise, Malindo's benefactors will eventually get tired of pumping cash into the venture; it's the same old scenario that befalls many an ill-conceived or poorly run airline start-up venture. The forecasts on market strength are incorrect or exaggerated, the returns are not as fat or the losses as small as predicted and then the begging bowl comes out for a cash injection to keep the venture afloat.

Eventually you reach the point where the money pumped to keep it alive exceeds a decades worth of profits and shareholders start to regret ever getting involved. The baby airline becomes a drain on it's profitable older sibling and so talks of spinning it off to stand on its own begin to grow.

By the time you've got to this point they go through various management shuffles incl the CEO and other exec level types. The smart ones, if there are any, get out early, maybe go to a competitor and spill the beans on what life is really like around the boardroom table.

I could be completely wrong in applying this scenario to Lion Air's 'Malaysian Invasion' but I won't be surprised at all if I'm right.

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

Malindo should have focused more on their hybrid, connectivity, customer service, food than their cheap fares. I am sure lots of customers willing to pay a bit more for comfort and food. There is no need to draw blood from the LCC by offering lower fares than LCC and at the same time, try to outdo MAS on free luggage and food.

Now all 3 parties are bleeding. When did MAS withdraw their free transport?

Now all 3 parties are bleeding. When did MAS withdraw their free transport?

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

Malindo Air to begin Chittagong flights in 2014

Posted on 24 November 2013 - 07:03pm

[email protected]

Print

PETALING JAYA (Nov 24, 2013): Malindo Air will start thrice-weekly from Kuala Lumpur to Chittagong from Jan 2, 2014, marking its second route to Bangladesh.

The new flights will be operated by a new Boeing 737-900ER, said the hybrid airline in a statement last Friday.

Bookings are available now. The all-inclusive one-way fare starts from RM455 to Chittagong from Kuala Lumpur, and the all-in return fare is RM955.

Malindo Air CEO Chandran Rama Muthy said the new flights are the latest addition to the airline's long-term plan to convert Kuala Lumpur into its regional transit hub.

Posted on 24 November 2013 - 07:03pm

[email protected]

PETALING JAYA (Nov 24, 2013): Malindo Air will start thrice-weekly from Kuala Lumpur to Chittagong from Jan 2, 2014, marking its second route to Bangladesh.

The new flights will be operated by a new Boeing 737-900ER, said the hybrid airline in a statement last Friday.

Bookings are available now. The all-inclusive one-way fare starts from RM455 to Chittagong from Kuala Lumpur, and the all-in return fare is RM955.

Malindo Air CEO Chandran Rama Muthy said the new flights are the latest addition to the airline's long-term plan to convert Kuala Lumpur into its regional transit hub.

Join Date: Dec 2004

Location: borneo

Posts: 20

Likes: 0

Received 0 Likes

on

0 Posts

From the STAR

Malindo to fly KL-New Delhi route from Dec 30

by b.k. sidhu

PETALING JAYA: Malindo Air has got the nod to fly into New Delhi and Mumbai, destinations that low-cost airline AirAsia X gave up over a year ago.

The routes are currently only served by Malaysia Airlines and the entry of Malindo is likely to intensify competition and force airfares to fall.

India will be added to the Malindo network just nine months after the airline began operations in the country. It will also add Trichy, a southern point in India on Jan 3. It wil begin flying the KL-Delhi route on Dec 30 and KL-Mumbai on Feb 15. Malindo will use the slots given up by AAX for Dehli and Mumbai.

Malindo, which calls itself a hybrid airline, is a joint venture between Malaysia’s Nadi Sdn Bhd and Indonesia’s Lion Grup, which also owns Lion Air.

For starters, Malindo is offering a promotional all-inclusive one-way fare of RM599 each to Mumbai and Delhi. For Trichy the fare starts at RM399 one-way all-inclusive.

“The decision to start our services to these long-awaited new routes emphasises the value and importance of tourism, trade and business links between India and Malaysia,” Malindo chief executive officer Chandran Rama Muthy said.

Malindo has begun ticket sales and is said to have received numerous bookings for the flights to India.

Though it is targeting passengers from Malaysia, the airline is a vital link for Indonesia’s Lion Air gateway into that part of the world.

Malindo to fly KL-New Delhi route from Dec 30

by b.k. sidhu

PETALING JAYA: Malindo Air has got the nod to fly into New Delhi and Mumbai, destinations that low-cost airline AirAsia X gave up over a year ago.

The routes are currently only served by Malaysia Airlines and the entry of Malindo is likely to intensify competition and force airfares to fall.

India will be added to the Malindo network just nine months after the airline began operations in the country. It will also add Trichy, a southern point in India on Jan 3. It wil begin flying the KL-Delhi route on Dec 30 and KL-Mumbai on Feb 15. Malindo will use the slots given up by AAX for Dehli and Mumbai.

Malindo, which calls itself a hybrid airline, is a joint venture between Malaysia’s Nadi Sdn Bhd and Indonesia’s Lion Grup, which also owns Lion Air.

For starters, Malindo is offering a promotional all-inclusive one-way fare of RM599 each to Mumbai and Delhi. For Trichy the fare starts at RM399 one-way all-inclusive.

“The decision to start our services to these long-awaited new routes emphasises the value and importance of tourism, trade and business links between India and Malaysia,” Malindo chief executive officer Chandran Rama Muthy said.

Malindo has begun ticket sales and is said to have received numerous bookings for the flights to India.

Though it is targeting passengers from Malaysia, the airline is a vital link for Indonesia’s Lion Air gateway into that part of the world.

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

Malindo Air Domestic Operation Reductions from mid-Feb 2014

by JL

Update at 0900GMT 10JAN14

Malindo Air from 15FEB14 is reducing domestic operations, which see service to Kota Kinabalu, Langkawi and Johor Bahru being affected.

Kuala Lumpur – Kota Kinabalu Reduce from 21 to 18 weekly

OD1002 KUL0745 – 1020BKI 739 D

OD1028 KUL1640 – 1915BKI 739 D

OD1014 KUL1830 – 2100BKI 739 x467

OD1001 BKI1105 – 1340KUL 739 D

OD1027 BKI1955 – 2230KUL 739 D

OD1013 BKI2140 – 0015+1KUL 739 x467

Kuala Lumpur – Langkawi Reduce from 2 to 1 daily

OD2202 KUL1315 – 1415LGK 739 D

OD2201 LGK1500 – 1600KUL 739 D

Following service will be cancelled:

Johor Bahru – Kota Kinabalu

Johor Bahru – Kuala Lumpur

Hopefully, those who bought JB KK and JB KL will be refunded...lol!

by JL

Update at 0900GMT 10JAN14

Malindo Air from 15FEB14 is reducing domestic operations, which see service to Kota Kinabalu, Langkawi and Johor Bahru being affected.

Kuala Lumpur – Kota Kinabalu Reduce from 21 to 18 weekly

OD1002 KUL0745 – 1020BKI 739 D

OD1028 KUL1640 – 1915BKI 739 D

OD1014 KUL1830 – 2100BKI 739 x467

OD1001 BKI1105 – 1340KUL 739 D

OD1027 BKI1955 – 2230KUL 739 D

OD1013 BKI2140 – 0015+1KUL 739 x467

Kuala Lumpur – Langkawi Reduce from 2 to 1 daily

OD2202 KUL1315 – 1415LGK 739 D

OD2201 LGK1500 – 1600KUL 739 D

Following service will be cancelled:

Johor Bahru – Kota Kinabalu

Johor Bahru – Kuala Lumpur

Hopefully, those who bought JB KK and JB KL will be refunded...lol!

Join Date: Jul 2006

Location: In the Sun

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

So Mr C how to carry 3 million pax this year if you don't fly any sectors, rumor they want to stop kul Bkk Kul too no load. Stories flying around about unable to set prices and sell tickets as Mr C on holidays with the rich and famous in India. Like someone said MALINDO had the right ingredients to spoil the party for Air Asia and MAS, now just a thorn in there side as they slowly collapse inwards, due to bad planning, bad management, and just plain bad boss..

Off the subject, heard about 5 trouble makers who got fired from MALINDO sent to Thai Lion tried to tell Mr R what they should be paid and what their terms and conditions have to be, have now been kicked back to KL, no wonder he hates Pilots.

Everyone in Lion Group should wear clown hats and red noses as the place is a circus

Off the subject, heard about 5 trouble makers who got fired from MALINDO sent to Thai Lion tried to tell Mr R what they should be paid and what their terms and conditions have to be, have now been kicked back to KL, no wonder he hates Pilots.

Everyone in Lion Group should wear clown hats and red noses as the place is a circus

Join Date: Feb 2013

Location: Kuala Lumpur

Posts: 53

Likes: 0

Received 0 Likes

on

0 Posts

New Routes?

Malaysia’s Malindo Air is moving forward on its delayed expansion plans for India with four new routes which will quickly give the Lion Air Group affiliate a 15% share of the Malaysia-India market. Malindo is seeking to become a major player in the Malaysia-India market as well as offer connections in the fast growing Indonesia-India market.

Malindo is targeting the Kuala Lumpur-Delhi and Kuala Lumpur-Mumbai routes, which currently are only served by Malaysia Airlines (MAS). It will compete against AirAsia to Tiruchirappalli and will become the only carrier linking Kuala Lumpur with Ahmedabad.

The hybrid carrier is also adding a second destination in Bangladesh, Chittagong, as part of its push into South Asia. By its first anniversary in late Mar-2014, Malindo will account for 12% of total capacity between Malaysia and South Asia.

Malindo finally launches India, ending six-month delay

Malindo launched domestic services in late Mar-2013 and was initially planning to make India its first international destination with flights starting in Jun-2013. But Malindo had to postpone several times the launch of India services as it waited to secure the required approvals from Indian authorities.

See related report: Lion's Malindo breaks AirAsia-MAS duopoly in Malaysian domestic market. Next stop: Delhi

The carrier shifted gears in mid-2013 and decided to make Bangladesh its first international destination, with one daily flight on the Kuala Lumpur-Dhaka route launching at the end of Aug-2013. Two other international routes, daily services from Kuala Lumpur to Jakarta and Bali in Indonesia, were launched in late Sep-2013.

The approval process for new services to India is poorly defined as a result of which airlines face considerable uncertainty with respect to scheduling a start date. Malindo's application to launch four planned India routes frustratingly dragged on for several months until finally it cleared in early Dec-2013. A daily service to the Indian capital Delhi was launched on 30-Dec-2013 followed by a daily service to Tiruchirappalli in southern India on 2-Jan-2014.

Malindo has set a 15-Feb-2014 launch date for its third India route, Kuala Lumpur-Mumbai, which will initially operate five times per week. The carrier’s fourth Indian route, Kuala Lumpur-Ahmedabad, is now slated to be served four times per week from 19-Mar-2014. All of the carrier’s India routes will be operated with 180-seat 737-900ERs in two-class configuration. Malindo currently operates six 737-900ERs along with four ATR 72-600 turboprops.

Malindo to capture 15% of Malaysia-India market at the expense of MAS and AirAsia

The 23 weekly flights to India that Malindo plans to operate by the end of Mar-2014 will give the carrier 4,140 one-way seats in the Malaysia-India market. This equates to about a 15% share of total capacity in the Malaysia-India market.

Once all the Malindo flights are added, MAS will see its share of capacity in the Malaysia-India market drop by about 7ppts, from 53% in late Dec-2013 to 46% in late Mar-2014. AirAsia’s share will drop by about 8ppts from 43% to 35%.

MAS currently operates 66 weekly flights to six Indian destinations while AirAsia has 56 weekly flights to five Indian destinations, according to OAG data. All of AirAsia’s India flights are operated with A320s in 180-seat single-class configuration as A330 operator AirAsia X no longer serves India while 14 of MAS’ 66 flights are operated with widebodies and 42 with 737-800s in two-class configuration with 160 or 166 seats.

Over the past two years MAS has increased capacity to Malaysia by about 45%, according to CAPA and OAG data. MAS is keen to add more flights to India as part of its new business plan, which focuses on thickening its schedule within Asia-Pacific to maximise connections. But MAS has said it is currently unable to pursue further expansion in India due to bilateral restrictions.

The Malaysia-India air services agreement caps capacity to the six main Indian cities of Delhi, Mumbai, Bangalore, Chennai, Hyderabad and Kolkata. MAS serves all six of these cities except Kolkata. It added its first secondary Indian city, Kochi, in Sep-2013 and could potentially launch more secondary destinations but has more interest in increasing capacity to its existing destinations.

AirAsia also has increased capacity to India by about 50% since the beginning of 2012. But the approximately 3,200 weekly one-way seats it has added only partially offsets the approximately 4,100 weekly one-way seats sister carrier AirAsia X offered before pulling out of the Malaysia-India market in early 2012.

Approximately one million origin-destination (O-D) passengers travel between India and Malaysia per annum on non-stop services. Despite accounting for more than half the seat capacity on the route, MAS' share of O-D traffic is estimated to be around 25-30% as more than 50% of the passengers it carries on its Indian services connect at Kuala Lumpur to/from other points in Asia, Australasia and North America. AirAsia, with its focus on point-to-point passengers (traffic connecting beyond Kuala Lumpur to other ASEAN points only accounts for an estimated 6-8% of Indian carriage) has a share of close to 55% of O-D traffic.

irAsia is potentially interested in adding flights from Kuala Lumpur to India to better leverage network synergies with planned start-up AirAsia India. But as in the case with MAS, bilateral restrictions limit expansion opportunities to secondary cities. For example, more flights from Kuala Lumpur to Bangalore, Chennai or Kolkata – all of which are reported to be potential bases for AirAsia India – cannot be mounted without a new agreement. Alternatively, as and when the 5 year/20 aircraft qualification threshold is lifted for Indian start-up carriers seeking to operate international services, AirAsia India could launch services to Southeast Asia utilising Indian entitlements.

AirAsia would be able to add more capacity to Tiruchirappalli or Kochi and add other secondary destinations in southern India (central, northern or western India are not within the four-hour envelope from Kuala Lumpur that AirAsia sticks to). But opportunities to work with AirAsia India at such destinations would be limited. AirAsia X is also unable to re-enter the Delhi and Mumbai markets unless the bilateral is expanded.

Malindo seeks to add more Indian destinations after the initial four

Malindo essentially received the last available Malaysian allotments at the six main cities, taking over the rights which were previously used by AirAsia X for Delhi and Mumbai. With limited interest on the part of Indian carriers to operate to Kuala Lumpur, and that too primarily from Chennai only, the prospects for further expansion of the bilateral agreement may be limited, and any small incremental growth in seat entitlements would need to be split between three Malaysian carriers.

Malindo has said it is looking at adding more destinations in India later in 2014 as it takes delivery of up to eight additional 737-900ERs. Amristar, Chennai, Kochi, Madurai and Pune have been cited as potential destinations. Of these cities only Chennai is capped by the bilateral.

Malindo initially applied to serve Kochi, which was originally slated to be launched at the end of Jun-2013 along with Delhi. But the carrier subsequently switched gears and instead decided on Ahmedabad, which was not on its initial list of India routes.

As Malindo waited on Indian approvals, the Kuala Lumpur-Kochi route became more competitive with MAS announcing plans in early Jul-2013 to serve Kochi. MAS began daily 737-800 service to Kochi at the beginning of Sep-2013, giving it six destinations in India along with Bangalore, Chennai, Delhi, Hyderabad and Mumbai.

All of Malindo’s India routes have at most one direct competitor...

Malindo is wisely staying away from Kochi during its initial India expansion phase as it is a relatively small market that is also served from Kuala Lumpur by AirAsia with 10 weekly flights. All of Malindo’s India routes have at most one direct competitor – MAS to Delhi and Mumbai and AirAsia to Tiruchirappalli. Ahmedabad is not currently served non-stop by any carrier from Kuala Lumpur.

Malindo breaks the MAS monopoly on the Delhi and Mumbai routes

MAS enjoyed a monopoly on the Kuala Lumpur-Delhi and Mumbai routes since AirAsia X dropped both in early 2012. MAS currently serves Delhi with two daily flights, one using 737-800s and one using 777s, and Mumbai with 12 weekly flights, seven using 777s and five using 737-800s. MAS has increased capacity to Mumbai by about 40% since the AirAsia X pull-out but capacity has remained flat to Delhi.

Mumbai and Delhi are not the largest Indian markets from Malaysia. Chennai is larger as it is in the region of India where a big portion of Malaysia’s Indian population have their roots. AirAsia and MAS both operate two daily flights to Chennai. The only service to Malaysia by an Indian carrier is also from Chennai – a four times per week service from Air India Express. (Jet Airways served the Chennai-Kuala Lumpur route for several years until 2012, when it pulled out citing low yields.)

While Chennai potentially has the demand to support more capacity from Kuala Lumpur, yields are generally low as it is primarily a leisure or visiting friends and relatives (VFR) market and has a fair amount of competition. The Delhi and Mumbai markets have more business traffic and significantly less competition. Malindo’s two-class full service product is well positioned to compete for business traffic. Malindo offers complimentary meals, drinks, in-flight entertainment with seatback monitors and check-in luggage in both cabins.

Malindo also works closely with travel agents, which should help the carrier with sales in India...

Malindo also works closely with travel agents, which should help the carrier with sales in India. Local distribution was the main challenge for AirAsia X on its Indian routes as most Indians use travel agents or online travel agents for international flight bookings.

Delhi and Mumbai to Kuala Lumpur do have potential as business and leisure routes however with services to date largely restricted to full service operations the market has not been stimulated except for the brief attempt by AirAsia X, which had a weak distribution strategy. Kuala Lumpur is not yet perceived in the Indian market as attractive a destination as Bangkok or Singapore, however with more aggressive marketing of Malaysia and competitive pricing growth is possible.

Malindo is offering all inclusive one-way fares to Delhi and Mumbai starting at less than MYR600 (USD183) for economy and less than MRY1,000 (USD305) for business. With the right local distribution strategy it should be able to stimulate leisure demand and also attract some business traffic, particularly smaller companies and entrepreneurs.

Malindo to take on AirAsia in Tiruchirappalli market, an interesting battle

Kuala Lumpur-Tiruchirappalli is more of a VFR and leisure market with most demand coming from the Malaysia end. AirAsia has been very successful on the route, its largest to India with three daily flights. The second frequency was added in Oct-2012 and the third frequency less than one year later, in Sep-2013. The decision to add the third flight was likely a competitive response to Malindo’s planned entry.

Malindo will look to stimulate demand with a competitive fare while offering a full-service product. Malindo is offering all-inclusive one-way fares to Tiruchirappalli starting at about MYR300 (USD92). AirAsia fares start at about MYR200 (USD61) but when including bags and meals are about the same as Malindo. As a price-sensitive leisure and VFR route it remains to be seen how the market responds to a full service alternative to AirAsia. To strengthen its visibility on the route Malindo may need to consider an increase in frequency at the risk of excess capacity.

Malindo is only the fourth foreign carrier serving Tiruchirappalli, joining AirAsia, Tigerair and SriLankan Airlines. Air India Express also operates international services from Tiruchirappalli to Dubai and Singapore.

Malaysia’s Malindo Air is moving forward on its delayed expansion plans for India with four new routes which will quickly give the Lion Air Group affiliate a 15% share of the Malaysia-India market. Malindo is seeking to become a major player in the Malaysia-India market as well as offer connections in the fast growing Indonesia-India market.

Malindo is targeting the Kuala Lumpur-Delhi and Kuala Lumpur-Mumbai routes, which currently are only served by Malaysia Airlines (MAS). It will compete against AirAsia to Tiruchirappalli and will become the only carrier linking Kuala Lumpur with Ahmedabad.

The hybrid carrier is also adding a second destination in Bangladesh, Chittagong, as part of its push into South Asia. By its first anniversary in late Mar-2014, Malindo will account for 12% of total capacity between Malaysia and South Asia.

Malindo finally launches India, ending six-month delay

Malindo launched domestic services in late Mar-2013 and was initially planning to make India its first international destination with flights starting in Jun-2013. But Malindo had to postpone several times the launch of India services as it waited to secure the required approvals from Indian authorities.

See related report: Lion's Malindo breaks AirAsia-MAS duopoly in Malaysian domestic market. Next stop: Delhi

The carrier shifted gears in mid-2013 and decided to make Bangladesh its first international destination, with one daily flight on the Kuala Lumpur-Dhaka route launching at the end of Aug-2013. Two other international routes, daily services from Kuala Lumpur to Jakarta and Bali in Indonesia, were launched in late Sep-2013.

The approval process for new services to India is poorly defined as a result of which airlines face considerable uncertainty with respect to scheduling a start date. Malindo's application to launch four planned India routes frustratingly dragged on for several months until finally it cleared in early Dec-2013. A daily service to the Indian capital Delhi was launched on 30-Dec-2013 followed by a daily service to Tiruchirappalli in southern India on 2-Jan-2014.

Malindo has set a 15-Feb-2014 launch date for its third India route, Kuala Lumpur-Mumbai, which will initially operate five times per week. The carrier’s fourth Indian route, Kuala Lumpur-Ahmedabad, is now slated to be served four times per week from 19-Mar-2014. All of the carrier’s India routes will be operated with 180-seat 737-900ERs in two-class configuration. Malindo currently operates six 737-900ERs along with four ATR 72-600 turboprops.

Malindo to capture 15% of Malaysia-India market at the expense of MAS and AirAsia

The 23 weekly flights to India that Malindo plans to operate by the end of Mar-2014 will give the carrier 4,140 one-way seats in the Malaysia-India market. This equates to about a 15% share of total capacity in the Malaysia-India market.

Once all the Malindo flights are added, MAS will see its share of capacity in the Malaysia-India market drop by about 7ppts, from 53% in late Dec-2013 to 46% in late Mar-2014. AirAsia’s share will drop by about 8ppts from 43% to 35%.

MAS currently operates 66 weekly flights to six Indian destinations while AirAsia has 56 weekly flights to five Indian destinations, according to OAG data. All of AirAsia’s India flights are operated with A320s in 180-seat single-class configuration as A330 operator AirAsia X no longer serves India while 14 of MAS’ 66 flights are operated with widebodies and 42 with 737-800s in two-class configuration with 160 or 166 seats.

Over the past two years MAS has increased capacity to Malaysia by about 45%, according to CAPA and OAG data. MAS is keen to add more flights to India as part of its new business plan, which focuses on thickening its schedule within Asia-Pacific to maximise connections. But MAS has said it is currently unable to pursue further expansion in India due to bilateral restrictions.

The Malaysia-India air services agreement caps capacity to the six main Indian cities of Delhi, Mumbai, Bangalore, Chennai, Hyderabad and Kolkata. MAS serves all six of these cities except Kolkata. It added its first secondary Indian city, Kochi, in Sep-2013 and could potentially launch more secondary destinations but has more interest in increasing capacity to its existing destinations.

AirAsia also has increased capacity to India by about 50% since the beginning of 2012. But the approximately 3,200 weekly one-way seats it has added only partially offsets the approximately 4,100 weekly one-way seats sister carrier AirAsia X offered before pulling out of the Malaysia-India market in early 2012.

Approximately one million origin-destination (O-D) passengers travel between India and Malaysia per annum on non-stop services. Despite accounting for more than half the seat capacity on the route, MAS' share of O-D traffic is estimated to be around 25-30% as more than 50% of the passengers it carries on its Indian services connect at Kuala Lumpur to/from other points in Asia, Australasia and North America. AirAsia, with its focus on point-to-point passengers (traffic connecting beyond Kuala Lumpur to other ASEAN points only accounts for an estimated 6-8% of Indian carriage) has a share of close to 55% of O-D traffic.

irAsia is potentially interested in adding flights from Kuala Lumpur to India to better leverage network synergies with planned start-up AirAsia India. But as in the case with MAS, bilateral restrictions limit expansion opportunities to secondary cities. For example, more flights from Kuala Lumpur to Bangalore, Chennai or Kolkata – all of which are reported to be potential bases for AirAsia India – cannot be mounted without a new agreement. Alternatively, as and when the 5 year/20 aircraft qualification threshold is lifted for Indian start-up carriers seeking to operate international services, AirAsia India could launch services to Southeast Asia utilising Indian entitlements.

AirAsia would be able to add more capacity to Tiruchirappalli or Kochi and add other secondary destinations in southern India (central, northern or western India are not within the four-hour envelope from Kuala Lumpur that AirAsia sticks to). But opportunities to work with AirAsia India at such destinations would be limited. AirAsia X is also unable to re-enter the Delhi and Mumbai markets unless the bilateral is expanded.

Malindo seeks to add more Indian destinations after the initial four

Malindo essentially received the last available Malaysian allotments at the six main cities, taking over the rights which were previously used by AirAsia X for Delhi and Mumbai. With limited interest on the part of Indian carriers to operate to Kuala Lumpur, and that too primarily from Chennai only, the prospects for further expansion of the bilateral agreement may be limited, and any small incremental growth in seat entitlements would need to be split between three Malaysian carriers.

Malindo has said it is looking at adding more destinations in India later in 2014 as it takes delivery of up to eight additional 737-900ERs. Amristar, Chennai, Kochi, Madurai and Pune have been cited as potential destinations. Of these cities only Chennai is capped by the bilateral.

Malindo initially applied to serve Kochi, which was originally slated to be launched at the end of Jun-2013 along with Delhi. But the carrier subsequently switched gears and instead decided on Ahmedabad, which was not on its initial list of India routes.

As Malindo waited on Indian approvals, the Kuala Lumpur-Kochi route became more competitive with MAS announcing plans in early Jul-2013 to serve Kochi. MAS began daily 737-800 service to Kochi at the beginning of Sep-2013, giving it six destinations in India along with Bangalore, Chennai, Delhi, Hyderabad and Mumbai.

All of Malindo’s India routes have at most one direct competitor...

Malindo is wisely staying away from Kochi during its initial India expansion phase as it is a relatively small market that is also served from Kuala Lumpur by AirAsia with 10 weekly flights. All of Malindo’s India routes have at most one direct competitor – MAS to Delhi and Mumbai and AirAsia to Tiruchirappalli. Ahmedabad is not currently served non-stop by any carrier from Kuala Lumpur.

Malindo breaks the MAS monopoly on the Delhi and Mumbai routes

MAS enjoyed a monopoly on the Kuala Lumpur-Delhi and Mumbai routes since AirAsia X dropped both in early 2012. MAS currently serves Delhi with two daily flights, one using 737-800s and one using 777s, and Mumbai with 12 weekly flights, seven using 777s and five using 737-800s. MAS has increased capacity to Mumbai by about 40% since the AirAsia X pull-out but capacity has remained flat to Delhi.

Mumbai and Delhi are not the largest Indian markets from Malaysia. Chennai is larger as it is in the region of India where a big portion of Malaysia’s Indian population have their roots. AirAsia and MAS both operate two daily flights to Chennai. The only service to Malaysia by an Indian carrier is also from Chennai – a four times per week service from Air India Express. (Jet Airways served the Chennai-Kuala Lumpur route for several years until 2012, when it pulled out citing low yields.)

While Chennai potentially has the demand to support more capacity from Kuala Lumpur, yields are generally low as it is primarily a leisure or visiting friends and relatives (VFR) market and has a fair amount of competition. The Delhi and Mumbai markets have more business traffic and significantly less competition. Malindo’s two-class full service product is well positioned to compete for business traffic. Malindo offers complimentary meals, drinks, in-flight entertainment with seatback monitors and check-in luggage in both cabins.

Malindo also works closely with travel agents, which should help the carrier with sales in India...

Malindo also works closely with travel agents, which should help the carrier with sales in India. Local distribution was the main challenge for AirAsia X on its Indian routes as most Indians use travel agents or online travel agents for international flight bookings.

Delhi and Mumbai to Kuala Lumpur do have potential as business and leisure routes however with services to date largely restricted to full service operations the market has not been stimulated except for the brief attempt by AirAsia X, which had a weak distribution strategy. Kuala Lumpur is not yet perceived in the Indian market as attractive a destination as Bangkok or Singapore, however with more aggressive marketing of Malaysia and competitive pricing growth is possible.

Malindo is offering all inclusive one-way fares to Delhi and Mumbai starting at less than MYR600 (USD183) for economy and less than MRY1,000 (USD305) for business. With the right local distribution strategy it should be able to stimulate leisure demand and also attract some business traffic, particularly smaller companies and entrepreneurs.

Malindo to take on AirAsia in Tiruchirappalli market, an interesting battle

Kuala Lumpur-Tiruchirappalli is more of a VFR and leisure market with most demand coming from the Malaysia end. AirAsia has been very successful on the route, its largest to India with three daily flights. The second frequency was added in Oct-2012 and the third frequency less than one year later, in Sep-2013. The decision to add the third flight was likely a competitive response to Malindo’s planned entry.

Malindo will look to stimulate demand with a competitive fare while offering a full-service product. Malindo is offering all-inclusive one-way fares to Tiruchirappalli starting at about MYR300 (USD92). AirAsia fares start at about MYR200 (USD61) but when including bags and meals are about the same as Malindo. As a price-sensitive leisure and VFR route it remains to be seen how the market responds to a full service alternative to AirAsia. To strengthen its visibility on the route Malindo may need to consider an increase in frequency at the risk of excess capacity.

Malindo is only the fourth foreign carrier serving Tiruchirappalli, joining AirAsia, Tigerair and SriLankan Airlines. Air India Express also operates international services from Tiruchirappalli to Dubai and Singapore.