Roll up, roll up, for Bain and Jayne’s pea and thimble trick

After 100 hours of line experience and they get sent back for the third bar to be sewn on. You can't make this **** up.

The following users liked this post:

Virgin Australia says passengers will not suffer service disruptions despite hundreds of the carrier’s licensed engineers gearing up to strike at airports across the country next week over pay and conditions.

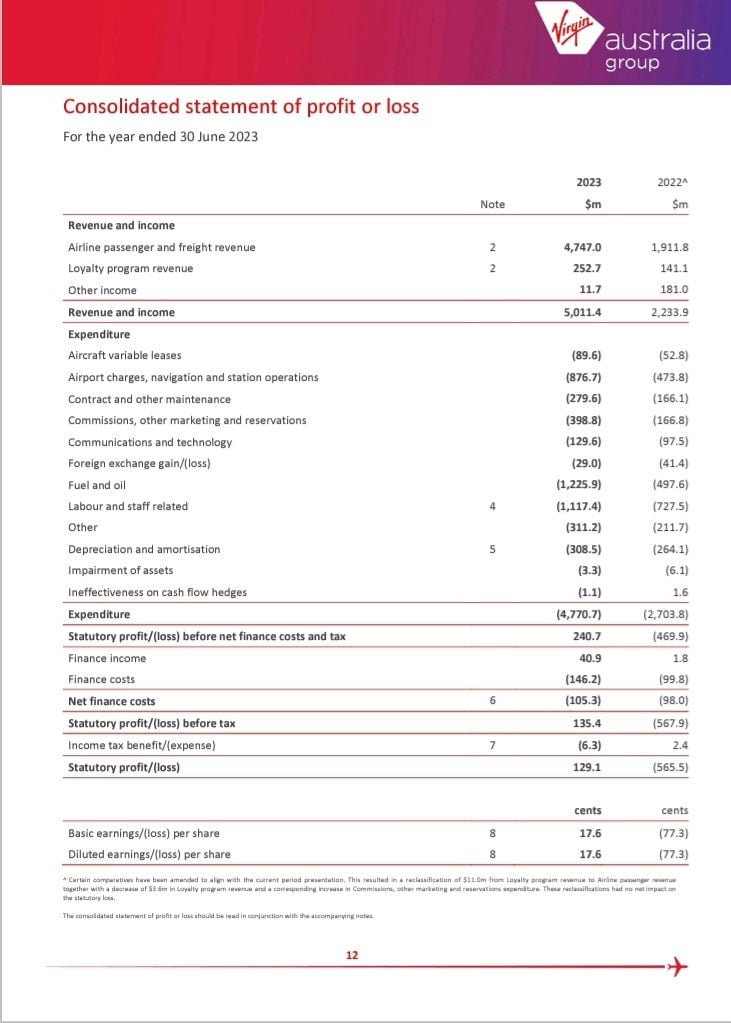

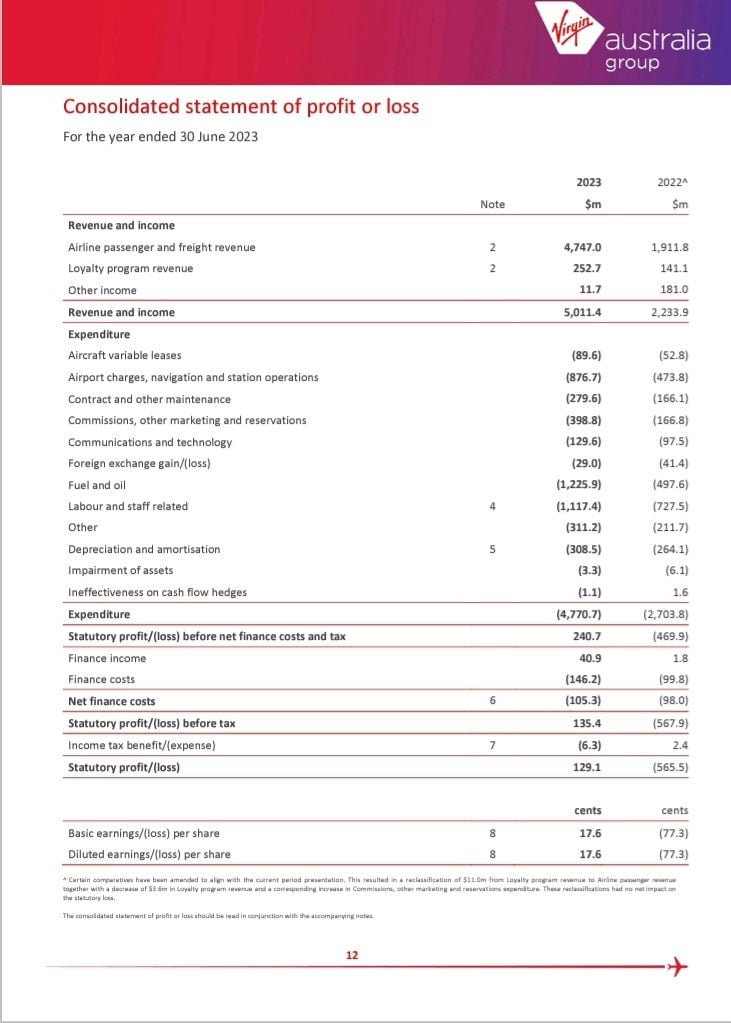

Virgin's FY23 financial statement has been filed with ASIC, and it is nothing to write home about.

With the lowest cost base they'll likely ever achieve, $129.1 million statutory profit from $5 billion in revenue, off of probably the best RASK we'll see for a while.

While Velocity revenue of $330 million off the back of a claimed 11.5 million members looks anaemic, the underlying EBIT of $77 million looks even more so.

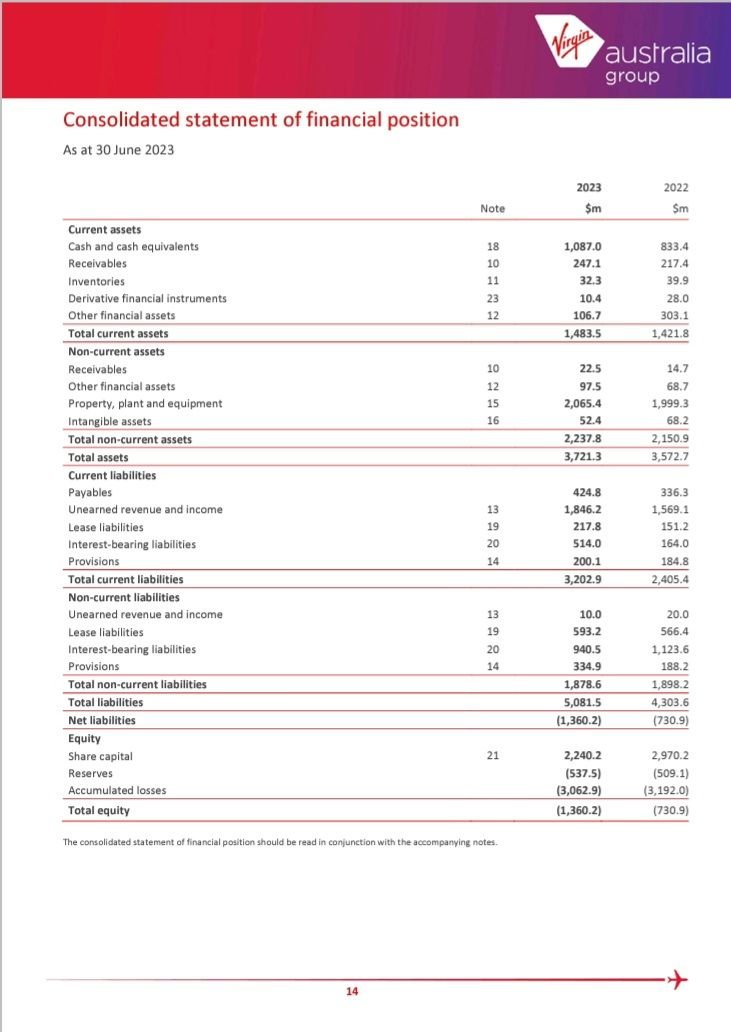

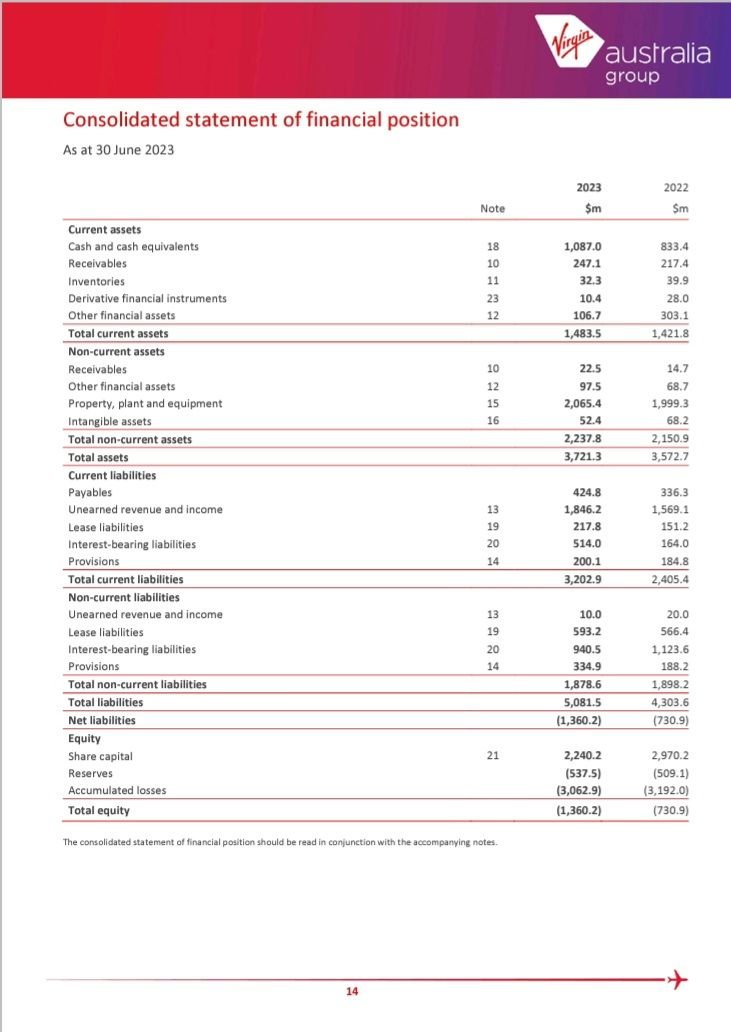

And their balance sheet is underwater to the tune of $1.36 billion. That position is in a large part due to Bain recouping their $730 million in acquisition costs, funded by a combination of ratting $430 million from the business's cash reserves together with a $300 million loan. Yes, you have read that correctly - the business took on additional debt in the form of a $300 million bridge loan to partly fund the capital return to Bain. It's good to be the King.

And then there's the statement that

The filing date of the report is 21 September and there were statements made by VA subsequently that the expiry of $120 million in COVID credits would be extended to 30 June 2025. That appears to leave $300 million in flight credits that have not been extended past 31 December 2023. Media outrage on that appears to be zero.

With the lowest cost base they'll likely ever achieve, $129.1 million statutory profit from $5 billion in revenue, off of probably the best RASK we'll see for a while.

While Velocity revenue of $330 million off the back of a claimed 11.5 million members looks anaemic, the underlying EBIT of $77 million looks even more so.

And their balance sheet is underwater to the tune of $1.36 billion. That position is in a large part due to Bain recouping their $730 million in acquisition costs, funded by a combination of ratting $430 million from the business's cash reserves together with a $300 million loan. Yes, you have read that correctly - the business took on additional debt in the form of a $300 million bridge loan to partly fund the capital return to Bain. It's good to be the King.

And then there's the statement that

... the Group holds $420.2 million of flight credits that are currently due to expire by 31 December 2023.

Wasted too much money on the pathetic and meaningless "WONDERFUL" campaign. Define wonderful in context of what it was before wonderful. I'd say exactly the same.

After the kicking Qantas got for trying to disappear 'flight credits' by imposing an 'expiry date', can Virgin get away with it?

Given that domestic airlines have pocketed probably the easiest revenue they've enjoyed in recent history over the last year, and Virgin's cost base is as low as you're ever likely to see it, that the best they could do was a 6.7 percent margin on an underlying basis has got to be a concern. More so when you consider the amount of pain that has been inflicted on that business.

The following users liked this post:

Thread Starter

Mick, the HS reported that H1 was $125m and H2 was $4m due to…

Poor operating performance in the last half would be a big driver also, some of the worst performance this company has ever recorded was in the last half. No idea if they have fixed that issue.

Airline insiders put the significantly smaller second half profit down to a “normalisation” of supply and demand, and a major workforce expansion.

- H2 is traditionally the weaker half for revenue.

- Some businesses don't fully account for all the abnormals and non-cash adjustments in their H1 accounts, rather they all tend to come home to roost in the final report.

Whichever way you slice or dice it, there is nothing compelling in those results. I have no doubt that QAN trading back above $5 is to a large extent because the market has noted that, for all the QF Group's troubles, they really don't have a strong competitor in the domestic market (not coincidentally, Rex is close to flatlining at sub-90 cents).

Thread Starter

H2 is weak but not that weak. You have three periods of school holidays in the half also. Seems to be a bit weird and certainly has me asking some questions if I was an investor. They acknowledged increased headcount costs, so perhaps it’s just a once off. We won’t likely see another H2 before a float.

Jetstar Domestic recorded about 50% of its profit in the half, Qantas was about 30% in the second half.

Any float would clearly be based on a H1. With the bridging loan due in May 2025, this half is likely the half. Finance Audit in Jan, Roadshows in Feb, public in May.

Jetstar Domestic recorded about 50% of its profit in the half, Qantas was about 30% in the second half.

Any float would clearly be based on a H1. With the bridging loan due in May 2025, this half is likely the half. Finance Audit in Jan, Roadshows in Feb, public in May.

It's weird that their EBIT margin is only 8.8% compared to Qantas's 18% target which they reckon they can keep going for a while. Sure, oil is higher, but it seems that the cost benefits of the administration have not really brought unit costs down. Something is still broken here. The demand environment has probably never been better so they should be reaping more hay while the sun shines brightest. Unless things improve further down the line, potential IPO investors should be wary.

Thread Starter

Virgin has always struggled in H2. That's why they moved towards attracting business customers as leisure airlines always struggle in the down season from Feb to June, two weeks of school holidays won't prop up a balance sheet over 26 weeks. I think J* making good H2 profits is creative accounting at it's best... QF can have stable profits year round due to their commuter base and business custom, and everything else they have expanded into. And yes if they are still struggling despite the great Covid exhale/escape then next year will be a struggle, considering fuel is going up, leases and rates will be up and the competition for experienced crew has only just started to heat up.

Very much depends in the fall out to the groups woes, financially they are fine for now. If the government really rears up to carve into it's effective monopoly of Australia it could be hard times for the group. I can't see them getting any tie ups or buy outs approved in the near future and the small possibility they are forced to offload some subsidiaries, which might finally see J* cut loose, as nothing else would sell for enough or do enough to change market share figures for them. At least then we would see how much mother props up it's silver baby.

Whichever way you slice or dice it, there is nothing compelling in those results. I have no doubt that QAN trading back above $5 is to a large extent because the market has noted that, for all the QF Group's troubles, they really don't have a strong competitor in the domestic market (not coincidentally, Rex is close to flatlining at sub-90 cents).

Behind a paywall...

https://www.afr.com/street-talk/virg...box=1697525024

https://www.reuters.com/business/aer...ns-2023-10-17/

DAVID MARR manager of the IPO resigns.

https://www.afr.com/street-talk/virg...box=1697525024

https://www.reuters.com/business/aer...ns-2023-10-17/

DAVID MARR manager of the IPO resigns.

The following users liked this post: