Qantas ripe for Private Equity takeover

Nunc est bibendum

20 years in Qantas would be a VERY junior 747 captain at the moment given that those of us with 17 1/2 years are very junior 767 Captains. Perhaps he's been around a bit longer than that.

If he (or she) is only doing 500 hours a year it's because they're rotating onto a blank line every 8 weeks. Given the reduction in flying, there are more guys and gals on reserve than their used to be and thus less flying for everyone to do. I'm a rotator and I'm doing 500 hours a year. I'd LOVE to be doing more- as would all of us.

Doing more than 100 hours in the month? Yahoo for you. Sadly, FTLs prohibit QF crew from doing the same!

Yep. The question we should be asking is why isn't Qantas expanding? According to you logic it's all down to pilot salaries. Whilst I agree there are inefficiencies that need to be addressed, why is it the pilot's fault that these are not being addressed? Over multiple EBAs Qantas itself have signed off on these conditions as being acceptable. Over multiple EBAs (including the current one) Qantas has wanted to 'simplify' the EBA only to back away from making wholesale change. Even on this current one I bet they won't get the simplification they were after because they were too stupid to negotiate and instead are going to leave it to the FWA who I suspect will go the 'minimalist' route in sorting the thing out.

So enlighten me as to how the bid line system prohibits flexibility? The flying is the flying. You put it into trips that are as efficient as possible. You allocate the flying in seniority order. That doest prohibit any flexibility at all.

Got a gripe against rotating? So do most Qantas pilots and believe if it were shared around not only the average hours pick up and the O/T for assigning some people over divisor would come down. My understanding is that there is some agreement between AIPA reps and company pilot reps on this issue for the EA under arbitration at the moment. Whether AJ will ratify these agreed points remains to be seen. If past behaviour is a pointer to future behaviour I wouldn't put any money on him taking the sensible option. That said, it wasn't that long ago that crew on reserve were doing more flying and hours than those on rostered patterns due to crew shortages. At that time many crew were regularly knocking up against the flight time limits for 30/7, 100/30, 900/365. So tell me again why QF crew were inefficient?

So, it appears that so far, your comments about the hours are poorly sourced or selective of a situation that isn't the normal state of operation at Qantas. It appears that your comments about the willingness of Qantas pilots to adapt is incorrect. Your assertion about bid lines is partially correct in terms of having some crew doing not much flying on reserve but it wasn't long ago crew on reserve were at max hours- as were many on rostered blocks of flying- so that's not a solid basis to be basing your assertion on. Do you want to keep trying?

If he (or she) is only doing 500 hours a year it's because they're rotating onto a blank line every 8 weeks. Given the reduction in flying, there are more guys and gals on reserve than their used to be and thus less flying for everyone to do. I'm a rotator and I'm doing 500 hours a year. I'd LOVE to be doing more- as would all of us.

Doing more than 100 hours in the month? Yahoo for you. Sadly, FTLs prohibit QF crew from doing the same!

Yep. The question we should be asking is why isn't Qantas expanding? According to you logic it's all down to pilot salaries. Whilst I agree there are inefficiencies that need to be addressed, why is it the pilot's fault that these are not being addressed? Over multiple EBAs Qantas itself have signed off on these conditions as being acceptable. Over multiple EBAs (including the current one) Qantas has wanted to 'simplify' the EBA only to back away from making wholesale change. Even on this current one I bet they won't get the simplification they were after because they were too stupid to negotiate and instead are going to leave it to the FWA who I suspect will go the 'minimalist' route in sorting the thing out.

So enlighten me as to how the bid line system prohibits flexibility? The flying is the flying. You put it into trips that are as efficient as possible. You allocate the flying in seniority order. That doest prohibit any flexibility at all.

Got a gripe against rotating? So do most Qantas pilots and believe if it were shared around not only the average hours pick up and the O/T for assigning some people over divisor would come down. My understanding is that there is some agreement between AIPA reps and company pilot reps on this issue for the EA under arbitration at the moment. Whether AJ will ratify these agreed points remains to be seen. If past behaviour is a pointer to future behaviour I wouldn't put any money on him taking the sensible option. That said, it wasn't that long ago that crew on reserve were doing more flying and hours than those on rostered patterns due to crew shortages. At that time many crew were regularly knocking up against the flight time limits for 30/7, 100/30, 900/365. So tell me again why QF crew were inefficient?

So, it appears that so far, your comments about the hours are poorly sourced or selective of a situation that isn't the normal state of operation at Qantas. It appears that your comments about the willingness of Qantas pilots to adapt is incorrect. Your assertion about bid lines is partially correct in terms of having some crew doing not much flying on reserve but it wasn't long ago crew on reserve were at max hours- as were many on rostered blocks of flying- so that's not a solid basis to be basing your assertion on. Do you want to keep trying?

Join Date: May 2009

Location: Australia, maybe

Posts: 559

Likes: 0

Received 0 Likes

on

0 Posts

The info came from 74 skipper, he has only been in QF around 20 years

swh,

You seem to compare apples with oranges. A few facts:

Joyce has recently admitted Jestar Asia longhaul is losing money (but wont say how much). Jetstar Asia has NEVER made a decent return (except on fudging leases). Profit last year $14m - WOW! Accumulated losses to date $S81m!

In Aus, Joyce will not say whether Jetstar International makes any money. Happy to split QF Int v QF Dom, why not show the results for Jetstar Int?

QF Dom has always been a huge profit driver for the group but unfortunately, the mismanagement and narrow focus on Jetstar is now allowing Virgin to leap over QF Dom.

I posted this previously about last years results:

So using your argument, why not put the service on the routes that generates the greatest profit? And that would be?

You seem to compare apples with oranges. A few facts:

Joyce has recently admitted Jestar Asia longhaul is losing money (but wont say how much). Jetstar Asia has NEVER made a decent return (except on fudging leases). Profit last year $14m - WOW! Accumulated losses to date $S81m!

In Aus, Joyce will not say whether Jetstar International makes any money. Happy to split QF Int v QF Dom, why not show the results for Jetstar Int?

QF Dom has always been a huge profit driver for the group but unfortunately, the mismanagement and narrow focus on Jetstar is now allowing Virgin to leap over QF Dom.

I posted this previously about last years results:

If QF international lost $200m, the EBIT for QF Domestic and Qlink would be $428m.

Total QF Domestic (including Qlink) passengers is 21,930,000. So each passenger earns QF $19.50 profit.

Total Jetstar passengers is 15,315,000, with an EBIT of $169m So each passenger earns Jetstar $11.03 profit.

When you look at the ASK's, QF Domestic makes a profit of $0.012 per ASK. Jetstar makes $0.0049 per ASK.

So QF Domestic is 2.5 times more profitable than Jetstar per ASK and makes 77% more profit per passenger.

Total QF Domestic (including Qlink) passengers is 21,930,000. So each passenger earns QF $19.50 profit.

Total Jetstar passengers is 15,315,000, with an EBIT of $169m So each passenger earns Jetstar $11.03 profit.

When you look at the ASK's, QF Domestic makes a profit of $0.012 per ASK. Jetstar makes $0.0049 per ASK.

So QF Domestic is 2.5 times more profitable than Jetstar per ASK and makes 77% more profit per passenger.

Jetstar Asia made $A14.25m. That gives it a profit of $5.28 per passenger or $0.0024 per ASK. QF domestic is thus about 3.7 times more profitable per passenger or 5 times more profitable per ASK.

Jetstar Pacific is obviously such a complete basket case, they provide 2 lines on it with not a single financial detail.

If you take Jetstar Asia out of the Jetstar numbers, then the Jetstar profit per pax increases slightly to $12.27 and the ASK profit rises to $0.0054. Still a long way off QF domestic!!!

All these numbers are based on the financials provided by QF in the annual results including the $200m international losses, I have made NO assumptions, just broken down the numbers. Even if we did say QF had exaggerated the international losses and say said that QF international lost only $50m and so QF domestic made $278m, the QF domestic business still far outperforms the Jetstar business in profit per ASK and profit per passenger

Jetstar Pacific is obviously such a complete basket case, they provide 2 lines on it with not a single financial detail.

If you take Jetstar Asia out of the Jetstar numbers, then the Jetstar profit per pax increases slightly to $12.27 and the ASK profit rises to $0.0054. Still a long way off QF domestic!!!

All these numbers are based on the financials provided by QF in the annual results including the $200m international losses, I have made NO assumptions, just broken down the numbers. Even if we did say QF had exaggerated the international losses and say said that QF international lost only $50m and so QF domestic made $278m, the QF domestic business still far outperforms the Jetstar business in profit per ASK and profit per passenger

So using your argument, why not put the service on the routes that generates the greatest profit? And that would be?

Keg,

I said 600, not 500. I do not have their exact start date, I just know the 20 year mark has been passed. From the 2 month roster that was discussed, I was at work for about the same amount of time they were at home over a 2 month period.

The The,

Those numbers for Jetstar look about right, they are in line with other LCCs. LCCs work by moving lots of passengers, for minimum costs, and charge them for extras everywhere. Jetstar offer fares very similar to Virgin, and with a lower cost base, I think they are making money. It is not like they are flying around empty and charging nothing. I do not know enough about the overseas operations to comment in detail, however staff costs should be a lot lower than Australia, fuel cost should be better, and the cost of leasing the aircraft probably would be higher than planned with the historically high AUD.

The difference between the legacy (QF) and LCC (Jetstar) is in the same as IATA has reported in Europe. Easyjet earns about 35% less, and Ryanair about 55% less per ASK than legacy carriers, that has not stopped them from being very profitable despite being in a higher cost environment than Australia. It also has not stopped the some legacy carriers from succeeding, at the same time a lot have failed while the LCCs have flourished.

Virgin has carved a large market share in Australia, they have not done so with the highest yields in the market, they have done it with a good product at a reasonable price, that is reliable. So many time I hear now of QF staff flying full fare on Virgin domestically, even international you have QF staff traveling on other airlines over staff travel on QF.

I see a lot of QF people snivel or complain in a peevish, self-pitying way about how Jetstar is taking over their flying and routes. I think you will find where the real value was ripped out of the QF domestic network has been the expansion of Virgin, they have taken volume AND yield. Having the highest yield is nothing, if your market share is declining, that goes for international and domestic.

Tankengine,

100 hrs a month is not worldwide, you are allowed to do over double that in some countries in commercial operations. I have done 80 hrs in 10 sectors so far this month with 4 days off.

I said 600, not 500. I do not have their exact start date, I just know the 20 year mark has been passed. From the 2 month roster that was discussed, I was at work for about the same amount of time they were at home over a 2 month period.

The The,

Those numbers for Jetstar look about right, they are in line with other LCCs. LCCs work by moving lots of passengers, for minimum costs, and charge them for extras everywhere. Jetstar offer fares very similar to Virgin, and with a lower cost base, I think they are making money. It is not like they are flying around empty and charging nothing. I do not know enough about the overseas operations to comment in detail, however staff costs should be a lot lower than Australia, fuel cost should be better, and the cost of leasing the aircraft probably would be higher than planned with the historically high AUD.

The difference between the legacy (QF) and LCC (Jetstar) is in the same as IATA has reported in Europe. Easyjet earns about 35% less, and Ryanair about 55% less per ASK than legacy carriers, that has not stopped them from being very profitable despite being in a higher cost environment than Australia. It also has not stopped the some legacy carriers from succeeding, at the same time a lot have failed while the LCCs have flourished.

Virgin has carved a large market share in Australia, they have not done so with the highest yields in the market, they have done it with a good product at a reasonable price, that is reliable. So many time I hear now of QF staff flying full fare on Virgin domestically, even international you have QF staff traveling on other airlines over staff travel on QF.

I see a lot of QF people snivel or complain in a peevish, self-pitying way about how Jetstar is taking over their flying and routes. I think you will find where the real value was ripped out of the QF domestic network has been the expansion of Virgin, they have taken volume AND yield. Having the highest yield is nothing, if your market share is declining, that goes for international and domestic.

Tankengine,

100 hrs a month is not worldwide, you are allowed to do over double that in some countries in commercial operations. I have done 80 hrs in 10 sectors so far this month with 4 days off.

100 hrs a month is not worldwide, you are allowed to do over double that in some countries in commercial operations. I have done 80 hrs in 10 sectors so far this month with 4 days off.

Join Date: Oct 2007

Location: Brisbane

Age: 48

Posts: 11

Likes: 0

Received 0 Likes

on

0 Posts

You got senior captains working what 15 out of 60 days, doing 600 hours a year, and SOs doing less, you could get rid of 400 pilots and still have enough crew to legally fill the roster.

That is because QF gave all the work to jetstar. It's not what we choose to do. And yes this does exist, but it's not normal unless you are junior long haul.

We joined an airline like you did, hoping for opportunities, but they have all dried up...

FFS

Join Date: Apr 2008

Location: Sydney

Posts: 265

Likes: 0

Received 0 Likes

on

0 Posts

TheThe,

Suggest you look at the books a bit further.

QF Int v QF Dom v JQ etc.

You have quoted EBIT figures and are comparing them to pax, ASKs this is totally misleading... Why...

For a leased plane the "operating lease" is an expense and hence is already deducted before you get to EBIT.

For an owned plane (or at least debt funded), only the depreciation is deducted, the interest "the I" part is not.

As far as I am aware JQ Int and Dom run predominately leased fleet so their EBIT on any metrics will always be at a comparative disadvantage to a carrier with a decent percentage of owned jets (ie QF Int and Dom)

Because of the fact that Jetstar and its offshoots leases almost everything the equity, or cash contributed is very low... I suspect Jetstar (in all its guises) return (profit not EBIT) on investment is far superior.

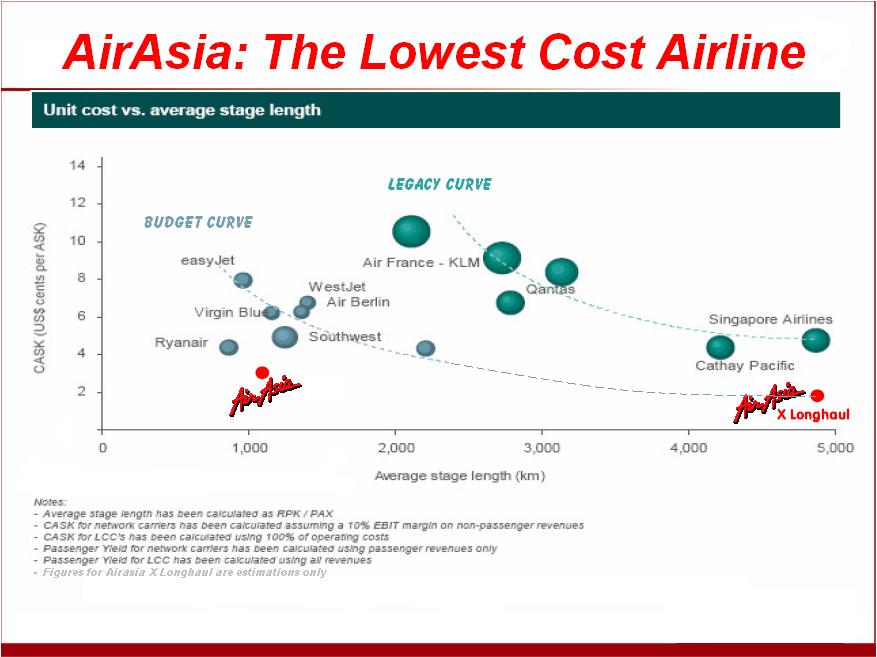

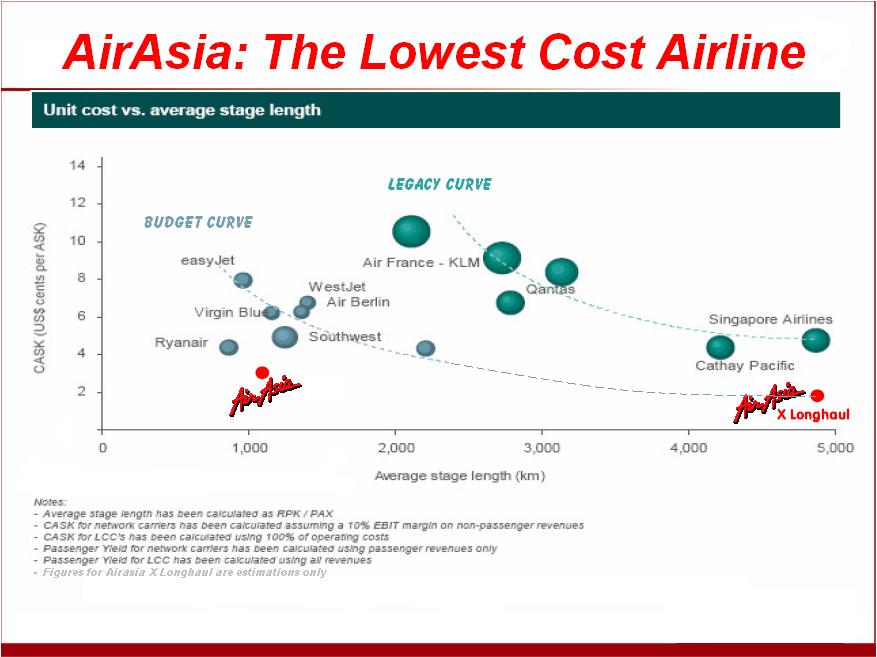

The AirAsia chart is very telling (is Jetstar the dot not marked??)

Also see if you can find a prospectus for Cebu Pacific (Philippines) - even lower again.

Jetstar Pacific - Qantas only owns 30%, has limited control so doesn't report/ consolidate. That said I am not aware of any further equity injections here so it is not loss making - As it is with only 6 narrowbodies it is small in the scheme of things.

Suggest you look at the books a bit further.

QF Int v QF Dom v JQ etc.

You have quoted EBIT figures and are comparing them to pax, ASKs this is totally misleading... Why...

For a leased plane the "operating lease" is an expense and hence is already deducted before you get to EBIT.

For an owned plane (or at least debt funded), only the depreciation is deducted, the interest "the I" part is not.

As far as I am aware JQ Int and Dom run predominately leased fleet so their EBIT on any metrics will always be at a comparative disadvantage to a carrier with a decent percentage of owned jets (ie QF Int and Dom)

Because of the fact that Jetstar and its offshoots leases almost everything the equity, or cash contributed is very low... I suspect Jetstar (in all its guises) return (profit not EBIT) on investment is far superior.

The AirAsia chart is very telling (is Jetstar the dot not marked??)

Also see if you can find a prospectus for Cebu Pacific (Philippines) - even lower again.

Jetstar Pacific - Qantas only owns 30%, has limited control so doesn't report/ consolidate. That said I am not aware of any further equity injections here so it is not loss making - As it is with only 6 narrowbodies it is small in the scheme of things.

Last edited by moa999; 15th Jul 2012 at 13:45.

kellykelpie,

Not all commercial operations can be conducted year round, regulators in other parts of the world understand that. In Canada for example float operators which are limited to warmer parts of the year can do 900 hrs in 180 days. Airline pilots can do 60 hours in a week, 120 hours a month, 300 hours in 90 days, and 1200 hours a year.

Bundy Bear,

QF never owned the flying or passengers, nothing was given away. Passenger vote with their feet, not only to Jetstar, Virgin, and Tiger. More and more passenger vote with their feet and buy tickets on other airlines to fly internationally.

If you want opportunities, there are plenty of jobs overseas, if you have the guts to move out of your comfort zone. There are even very attractive packages with Chines carriers based in SYD with a tax paid salary.

Not all commercial operations can be conducted year round, regulators in other parts of the world understand that. In Canada for example float operators which are limited to warmer parts of the year can do 900 hrs in 180 days. Airline pilots can do 60 hours in a week, 120 hours a month, 300 hours in 90 days, and 1200 hours a year.

Bundy Bear,

QF never owned the flying or passengers, nothing was given away. Passenger vote with their feet, not only to Jetstar, Virgin, and Tiger. More and more passenger vote with their feet and buy tickets on other airlines to fly internationally.

If you want opportunities, there are plenty of jobs overseas, if you have the guts to move out of your comfort zone. There are even very attractive packages with Chines carriers based in SYD with a tax paid salary.

There only needs to be reasonably minor changes to gain significant productivity. Long haul needs to give Syd-Per return 2 pilot. Syd-Singapore 2 pilot, modify overtime and get rid of things like home transport. Cherry picking the 48 exemption, is the answer. Whilst at it, dismantling the existing bidding seniority will allow better balance and share the workload for all.

smh, Cathay work the same or less days than QF long haul. I would suggest for the very senior in long haul at QF it is around 10-14 days/ calendar month, not your figures. i.e. LA return and London return. If you are to do this job for 30 years flogging yourself year in year out is not going to work.

smh, Cathay work the same or less days than QF long haul. I would suggest for the very senior in long haul at QF it is around 10-14 days/ calendar month, not your figures. i.e. LA return and London return. If you are to do this job for 30 years flogging yourself year in year out is not going to work.

Fair enough moa999.

But what if you take out the lease costs and depreciation? QF also publish an EBITDAR that excludes fleet operating lease rentals. QF still earns more per pax (59.12/30.70) and per ASK (0.017/0.014). QF yield is 44% better than JQ.

But what if you take out the lease costs and depreciation? QF also publish an EBITDAR that excludes fleet operating lease rentals. QF still earns more per pax (59.12/30.70) and per ASK (0.017/0.014). QF yield is 44% better than JQ.

Last edited by The The; 15th Jul 2012 at 23:20.

Join Date: Aug 2006

Location: Oz

Posts: 179

Likes: 0

Received 0 Likes

on

0 Posts

Passenger vote with their feet, not only to Jetstar, Virgin, and Tiger. More and more passenger vote with their feet and buy tickets on other airlines to fly internationally.

QF lost a major Australian company's account over this very issue.

Last edited by ga_trojan; 15th Jul 2012 at 22:04.

Nunc est bibendum

Long haul needs to give Syd-Per return 2 pilot. Syd-Singapore 2 pilot, modify overtime and get rid of things like home transport. Cherry picking the 48 exemption, is the answer. Whilst at it, dismantling the existing bidding seniority will allow better balance and share the workload for all.

PER returns (daylight) have been on the table previously. I'm not sure why they've never come off. My understanding is that they were on the table this time as well. That's gone pretty quiet though so not sure where it's at. PER returns overnight are permissible under the exemption but are dangerous to the point of stupidity. I'm not sure how any objective risk assessment can permit them.

Home transport is an interesting one. I'd be interested in trading it away for something- particularly if that 'something' wasn't a big cost to the company. Not sure what though. Then again, it is handy turning up to work having already read the weather and NOTAMs.

Overtime? Yeah, there are better ways of doing that... I'm just not sure what they are. The hassle is that so many people are addicted to the sweet sugar that is the extra 15-25% (for the heavier fleets) that it's a massive drama to 'fix'. Then again, if the AUD were at 60c to the USD, it wouldn't be the massive problem it is at the moment.

Join Date: Jul 2010

Location: Melbourne

Age: 54

Posts: 113

Likes: 0

Received 0 Likes

on

0 Posts

Gees! talk about flogging a dead horse

ASIC makes corporate reform proposals to Treasury

By Andrew Fraser

ASIC chairman Greg Medcraft says it is now up to federal Treasury to recommend if there are to be any changes to the takeover laws, after confirming the regulator has lodged three proposals for corporate reform, including one on the "creep" provisions.

While most public attention has been focused on his proposal to limit creep provisions so that company takeovers by stealth are made more difficult, Mr Medcraft said ASIC had also made recommendations to Treasury concerning the level of disclosure of holdings and the role of schemes of arrangement in takeovers.

ASIC makes corporate reform proposals to Treasury

By Andrew Fraser

ASIC chairman Greg Medcraft says it is now up to federal Treasury to recommend if there are to be any changes to the takeover laws, after confirming the regulator has lodged three proposals for corporate reform, including one on the "creep" provisions.

While most public attention has been focused on his proposal to limit creep provisions so that company takeovers by stealth are made more difficult, Mr Medcraft said ASIC had also made recommendations to Treasury concerning the level of disclosure of holdings and the role of schemes of arrangement in takeovers.

Join Date: Dec 2004

Location: Australia

Posts: 112

Likes: 0

Received 0 Likes

on

0 Posts

If Qantas needs extra revenue (which it does), I can't understand why they can't offer a much broader staff travel policy.

Ie VA staff staff can give away sectors to unlisted people and have birthday fares to give away confirmed etc.

Imagine if every QF employee could list friends for cost plus (x) percent to see this downtime through.

Profit = Revenue - Costs

Costs can only be cut so far..... this would be an opportunity to grow revenue.

It would be a brave (foolish) private equity firm that would take on QF whilst the price of oil is so high and perhaps now almost certainly totally detached from fundamental supply and demand pricing.

I'm not sure where to look for this "lead". Perhaps US foreign policy, perhaps China devaluing the Yuan, perhaps the sovereign owned oil companies that now dwarf companies like Exxon/BP/Chevron.

Buffett has always cited Airlines as a must not buy stock for two reasons:

1) Highly unionised workforce

2) Price competitive - lowest price generally wins no "durable" competitive advantage.

People will always need to travel, so that is good news. Bad news is airline ROE and ROA is rubbish. People want to travel from A-B for $69 when a taxi to the airport costs $30 bucks and that is just fact.....

Its a race to the bottom and that is sad........

I don't think it will be too long before Netjets or an equivalent sets up here and then the fractional ownership of jets will make the circus of parking/security/expensive coffee obsolete for the "juicy" corporate clients.

I think the harsh reality is airline travel is now just public transport and that is sad for a highly skilled profession like pilots.

At least we don't have a high speed train network doing the golden triangle.........yet

Ie VA staff staff can give away sectors to unlisted people and have birthday fares to give away confirmed etc.

Imagine if every QF employee could list friends for cost plus (x) percent to see this downtime through.

Profit = Revenue - Costs

Costs can only be cut so far..... this would be an opportunity to grow revenue.

It would be a brave (foolish) private equity firm that would take on QF whilst the price of oil is so high and perhaps now almost certainly totally detached from fundamental supply and demand pricing.

I'm not sure where to look for this "lead". Perhaps US foreign policy, perhaps China devaluing the Yuan, perhaps the sovereign owned oil companies that now dwarf companies like Exxon/BP/Chevron.

Buffett has always cited Airlines as a must not buy stock for two reasons:

1) Highly unionised workforce

2) Price competitive - lowest price generally wins no "durable" competitive advantage.

People will always need to travel, so that is good news. Bad news is airline ROE and ROA is rubbish. People want to travel from A-B for $69 when a taxi to the airport costs $30 bucks and that is just fact.....

Its a race to the bottom and that is sad........

I don't think it will be too long before Netjets or an equivalent sets up here and then the fractional ownership of jets will make the circus of parking/security/expensive coffee obsolete for the "juicy" corporate clients.

I think the harsh reality is airline travel is now just public transport and that is sad for a highly skilled profession like pilots.

At least we don't have a high speed train network doing the golden triangle.........yet

Join Date: Jul 2008

Location: south pacific vagrant

Posts: 1,334

Likes: 0

Received 0 Likes

on

0 Posts

PER returns overnight are permissible under the exemption but are dangerous to the point of stupidity. I'm not sure how any objective risk assessment can permit them.

Funny how that works.