RAF Coningsby Food Bank

Disclaimer: Gen Xer here, very comfortably off with a large property on a long fixed mortgage at a low rate, with a big AFPS75-heavy pension to come, so what I'm about to write is not motivated out of jealousy, frustration or lack of financial nous. I'm doing very well indeed. But I also pay close attention to the issues facing younger people now.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

The following users liked this post:

I respect your post and I understand where you are coming from. However, I stand by the exhortation for budgetary discipline, something which unfortunately is still not properly taught in schools and possibly not handed from one generation to another by caring parents who are setting their child up for life.

When my two were of a suitable age, about 10, I sat them down and spread out all the household bills, my bank statements and credit cards and cheque book. I explained why I frequently asked them to turn off the lights in rooms that did not need them. I taught them that credit was OK as long as you could afford to repay it. 0% finance was the way to go. Just because cheques were in the cheque book did not mean that the money was in the bank to pay for the amount and so on.

We have always eaten well and when we had something different from usual the question would be, "Was this on offer?"

Now they are in their thirties, they love to tell me how they got a particular item with £1000 discount through 'canny shopping'. My daughter is on minimum wage yet has built up personal savings that I never had at her age while enjoying life to the full, driving a car and eating out sensibly from time to time and taking overseas holidays with friends.

The secret is not a secret, it's called financial responsibility, and I taught her so I'm proud about it.

When my two were of a suitable age, about 10, I sat them down and spread out all the household bills, my bank statements and credit cards and cheque book. I explained why I frequently asked them to turn off the lights in rooms that did not need them. I taught them that credit was OK as long as you could afford to repay it. 0% finance was the way to go. Just because cheques were in the cheque book did not mean that the money was in the bank to pay for the amount and so on.

We have always eaten well and when we had something different from usual the question would be, "Was this on offer?"

Now they are in their thirties, they love to tell me how they got a particular item with £1000 discount through 'canny shopping'. My daughter is on minimum wage yet has built up personal savings that I never had at her age while enjoying life to the full, driving a car and eating out sensibly from time to time and taking overseas holidays with friends.

The secret is not a secret, it's called financial responsibility, and I taught her so I'm proud about it.

The following 3 users liked this post by Nil_Drift:

Disclaimer: Gen Xer here, very comfortably off with a large property on a long fixed mortgage at a low rate, with a big AFPS75-heavy pension to come, so what I'm about to write is not motivated out of jealousy, frustration or lack of financial nous. I'm doing very well indeed. But I also pay close attention to the issues facing younger people now.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

You don't mention property or children in your description of your daughter's lifestyle. Unless society as a whole is willing to increase reliance on expensive IVF, or return to the bygone norm of older financially-secure men marrying fertile young women - neither of which I think we are - we need an economy which enables people to start families no later than their mid-thirties. It may be that your daughter has achieved some spending power because she is yet to start a family, or perhaps shares her home with others. If so, I would join you in being delighted that she as an individual is able to make choices and do more than just get by, but in the wider societal context I would hardly see her situation as a ringing endorsement of the idea that exhorting budgetary discipline is the most important thing we can do for the younger generations.

[If, on the other hand, she is raising a family on the minimum wage while sitting on a savings pot and taking holidays with friends, then she is super-human and you should be earning good money as a personal finance coach!]

Last edited by Easy Street; 13th Jun 2023 at 01:12.

The following 2 users liked this post by Easy Street:

Easystreet

Disclaimer: Gen Xer here, very comfortably off with a large property on a long fixed mortgage at a low rate, with a big AFPS75-heavy pension to come, so what I'm about to write is not motivated out of jealousy, frustration or lack of financial nous. I'm doing very well indeed. But I also pay close attention to the issues facing younger people now.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

Boomers. It is no use harking back to 15% interest rates and disciplined budgeting and refraining from luxuries, etc etc etc. There are fundamental differences between the economic situation in which you paid those mortgage rates and the situation which millennials and Gen Zers have experienced for almost their entire adult lives. One, your interest rate spikes were more or less matched by wage inflation, at least if you had an effective union (as many more civilians did). Two, your mortgage interest was tax deductible. Three, your mortgages were restricted to a lower multiple of earnings, which kept a lid on house prices and deposit sizes. Four, the large increase in City remuneration following deregulation of investment banking and the slightly later influx of foreign money to London property had not yet had their distorting effects on the market, with ripples out along commuter lines and into the regions via second homes. Five, housebuilding has fallen ever further behind population growth, constrained by the grip of NIMBY voters on local planning authorities and compounded by changing social norms which have increased the number of single-occupant and single-parent households. All of that makes getting onto the property ladder without some form of windfall support an increasingly hopeless task for young people.

Making life doubly miserable for them in the latest crisis is the fact that wages are emphatically not keeping pace with inflation, and rents (for those not fortunate enough to be eligible for social housing) are astronomical due to the imbalance between supply and demand.

My parents had completely unremarkable careers which if they'd been military might have seen Dad rising to FS and Mum to Cpl with 10 years out of the workplace mid-career. Yet they were able to retire before either reached 60, mortgage free in a house which (had they not sold it to top up Dad's superb final salary pension) would today be worth almost a million pounds, having put a child through private school at their own expense and holidayed at least once per year (a rate which has increased since retirement). The idea that a young couple of similar standing today could accrue such wealth or aspire to such a lifestyle is simply laughable. Their discretionary spending could be zero, and it would still be impossible.

So, please save the exhortations to budgetary discipline. The best way you can help younger people to get on is to write letters in support of every planning application for housing in your district, green belt or not. Be a YIMBY. If you want to go all in, vote for election candidates who promise to support housebuilding. Yes, it will erode the paper value of your property. No, you did not earn all of it.

BV

The following 3 users liked this post by Bob Viking:

Of course if you were in the military (and this is a mil forum) you did not benefit from wage inflation. Also MIRAS (the tax benefit) was only available on the first 30K which was not a great asset even when I first bought in the mid 80s.

Last edited by vascodegama; 13th Jun 2023 at 05:54. Reason: typo

Just because cheques were in the cheque book did not mean that the money was in the bank to pay for the amount and so on.

MIRAS (the tax benefit) was only available on the first 30K which was not a great asset even when iI first bought in the mid 80s.

I see another Sky News article was posted, this time a video. Perhaps the AFPRB announcement is coming and it's low; and this news article/articles are playing in the UK Armed Forces favour.

I wonder what's next 😆

~ Pilot Retention

~ Trade Group 1 (Aircraft Engineers) Retention

~ Quality of Food offered by "Pay as you dine"

Place your bets!

I wonder what's next 😆

~ Pilot Retention

~ Trade Group 1 (Aircraft Engineers) Retention

~ Quality of Food offered by "Pay as you dine"

Place your bets!

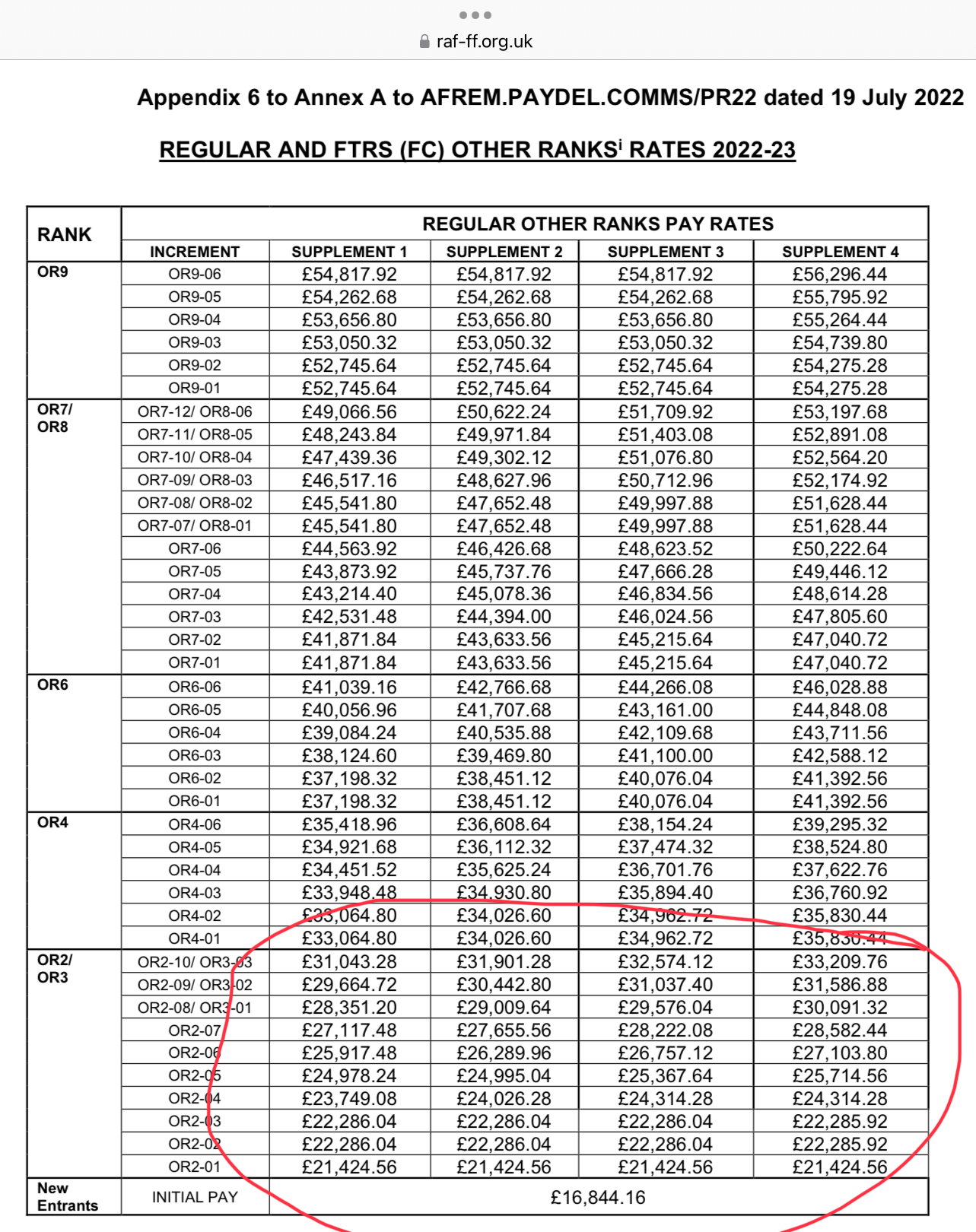

I have just looked at the RAF Pay scales online and LAC to SAC earn 22-25k per year. This is the same as a cashier at Tesco, according to Indeed and Tesco's own site. The question I ask is, 'Is that fair?'. The SAC has joined to defend the nation, may go to war, and may not retuen based on the experiences of Iraq and particularly Afganistan. They will be told where to live, when to move, and may spend many months away from their family - whilst earning Tesco money. I do not dispute that the Army are recruiting at 33k, although I cannot find it. However, I can assure you that the RAF are not paying such sums. Add in appalling accommodation and a management structure that could not care less about you if you happen to be a white male, and it does not appeal as a career

I served from 1990-2018, pilot, no ground tours, no promotion, I just flew. I saw the steady decline in benefits, lifestyle and the increase in staff-speak, bull$hit bingo, and soft and fluffy wokeism in favour of being a credible fighting force. I should have left many years before I did and regret not doing so, the RAF told me that the grass was not greener outside, and I now know that to be a bare-faced lie.

My personal advice to anyone thinking of joing the RAF would be this - do it. Get in, get as much training as possible, gain every qualification on offer, then get out as fast as you can. The training and skills that the RAF will give you are hugely valued, in demand, and can bring significant compensation. But not in the RAF.

I served from 1990-2018, pilot, no ground tours, no promotion, I just flew. I saw the steady decline in benefits, lifestyle and the increase in staff-speak, bull$hit bingo, and soft and fluffy wokeism in favour of being a credible fighting force. I should have left many years before I did and regret not doing so, the RAF told me that the grass was not greener outside, and I now know that to be a bare-faced lie.

My personal advice to anyone thinking of joing the RAF would be this - do it. Get in, get as much training as possible, gain every qualification on offer, then get out as fast as you can. The training and skills that the RAF will give you are hugely valued, in demand, and can bring significant compensation. But not in the RAF.

To save you looking again, then these are the salaries for Air Recruit, Air Specialist (Class 2), Air Specialist (Class 1) and Air Specialist (Class 1) Technician - the LAC and SAC that you mention are long gone!

So depending on the “Trade Supplement” then those rank groups would be on somewhere between £16,844 (as an Air Recruit) and £32,574 (as an Air Specialist (Class 1) Technician with significant seniority). Supplement 4 only applies to AAC Soldier Pilots in training, Cyber and SFC personnel, but your techies, int, air traffic and NCA are all in the Supplement 3 band.

To be really clear that is £21.5k to £32.5k in Supp 3 for techies, int, air traffic and NCA in training.

So there is a bit of fake news (or quote a “lie”) resolved in your post, right there

I had to post immediately after reading this. That is the single best post I have ever seen on this or any other forum. You have absolutely nailed the issue. I could rant on for ages with further examples to support your statements but I needn’t bother. You said it all perfectly.

BV

BV

How does that £60k at age 60 on AFPS15 compare to AFPS75 - with the PAS supplements added it would pay about £36k according to the pension tables. For AFPS05 it would pay 42/70ths of PAS Level 30 - which is £51k. So the AFPS15 is the best of breed for those going to age 60.

LJ

I knew I could rely on you. I hacked my watch to wonder how long your reply would take.

You’re absolutely right on pensions but that was not the main thrust of ES’s post and my vociferous agreement. I was more concerned with the UK housing market and the relative affordability of houses and mortgages now vs 30-40 years ago.

Just ask my brother and sister in law who are earning decent salaries but can neither afford to rent or buy anywhere near their home and work locations and are not eligible for social housing.

If you want to bring it back to RAF specifics then, as good as the pension currently is, you have to stay for a full career to get it and all that time you’ll struggle to get on the housing ladder anywhere. As a result more people will leave sooner and seek employment elsewhere. Which of course will lower the pensions bill significantly as a result of the increased staff turnover. Which does make you wonder if that’s not the true master plan.

BV

You’re absolutely right on pensions but that was not the main thrust of ES’s post and my vociferous agreement. I was more concerned with the UK housing market and the relative affordability of houses and mortgages now vs 30-40 years ago.

Just ask my brother and sister in law who are earning decent salaries but can neither afford to rent or buy anywhere near their home and work locations and are not eligible for social housing.

If you want to bring it back to RAF specifics then, as good as the pension currently is, you have to stay for a full career to get it and all that time you’ll struggle to get on the housing ladder anywhere. As a result more people will leave sooner and seek employment elsewhere. Which of course will lower the pensions bill significantly as a result of the increased staff turnover. Which does make you wonder if that’s not the true master plan.

BV

Part of the problem one thinks may be traced back to pay as you dine.

The things that get me are the loss of JT and change over to SAC Tech, changes from airman and women to aviator, changes in Uniform adding a belt and the sh*tehawk on the shoulders, plus another uniform in the wings, changes in Stations where the Staish no longer rules the roost and 1 star officers are often over them.............

They all add up to squandered monies, why change a badge and rank when there was no need, how much did that cost with a new paperwork trail, new uniforms the same, more cost, aviator from airman / airwoman, again means everything relating to the previous ranks needs to be amended etc.... all of it is just a waste of money, money that could have been better spent on ensuring accomodation and housing is sorted.

The things that get me are the loss of JT and change over to SAC Tech, changes from airman and women to aviator, changes in Uniform adding a belt and the sh*tehawk on the shoulders, plus another uniform in the wings, changes in Stations where the Staish no longer rules the roost and 1 star officers are often over them.............

They all add up to squandered monies, why change a badge and rank when there was no need, how much did that cost with a new paperwork trail, new uniforms the same, more cost, aviator from airman / airwoman, again means everything relating to the previous ranks needs to be amended etc.... all of it is just a waste of money, money that could have been better spent on ensuring accomodation and housing is sorted.

Join Date: Feb 2006

Location: Hanging off the end of a thread

Posts: 33,002

Received 2,893 Likes

on

1,238 Posts

Trade Group 1 (Aircraft Engineers) Retention

RyanAir is paying £50K for an A licence which is basically a licence with nothing on it,

and £80-85K for a 737 type rated licence.

The following 2 users liked this post by NutLoose:

Food Bank? Whatever happened to 'Eating's Cheating' and 'There's a pork chop in every pint'? For the Gen Zers benefit, those of us 'Boomers' who couldn't afford a house in the late 70's were more concerned with inflation being over 20% and having to spend our 'cost of living' pay supplement on keeping the car going for another week so that we could drive back from Happy Hour pissed on a Friday night ;-)

I got maried in 70s with 15% interest rates etc etc , MIRAS was ahelp but before MIRAS i think all mortage interest was tax free?

The thing is as L P Hartley wrote,' the past is a foreign country, they do things differently there' and 2020s Britain is another plannet from 1975 when it comes to what peopels expectations are about basics and luxuries. In 1975 there were no TV shows about Briatins most expensive houses, no idiotic realitiy TV , no glorifying peopel who get on TV for beign stupid. Its alive for today world too and I ahve nothign buyt sympathy for many ordinary people-ie 75% of the population . Its no good harping back to how we scrimped and saved and did this or that - ref Monty Pythons reminscing northerners sketch and thatwas broadcast in the 70s.

I am not a miliaristic person and do not think we need a large military -but while we have a moderate sized one it should not be at the expense of those who serve and live a very different life to civilians in UK. The articles on here about military housing are shocking , Half the QE2 Funeral and C3R coronation costs should have gone to serving families housing and support not thrown away for few days glamour. Miliary personnel and families do make sacrifices in terms of seperation, unsocial hours, non optional moves around the country and we should as a nation ensure they have at least a decent standard of living .

The thing is as L P Hartley wrote,' the past is a foreign country, they do things differently there' and 2020s Britain is another plannet from 1975 when it comes to what peopels expectations are about basics and luxuries. In 1975 there were no TV shows about Briatins most expensive houses, no idiotic realitiy TV , no glorifying peopel who get on TV for beign stupid. Its alive for today world too and I ahve nothign buyt sympathy for many ordinary people-ie 75% of the population . Its no good harping back to how we scrimped and saved and did this or that - ref Monty Pythons reminscing northerners sketch and thatwas broadcast in the 70s.

I am not a miliaristic person and do not think we need a large military -but while we have a moderate sized one it should not be at the expense of those who serve and live a very different life to civilians in UK. The articles on here about military housing are shocking , Half the QE2 Funeral and C3R coronation costs should have gone to serving families housing and support not thrown away for few days glamour. Miliary personnel and families do make sacrifices in terms of seperation, unsocial hours, non optional moves around the country and we should as a nation ensure they have at least a decent standard of living .

The following users liked this post:

The past is indeed a different country ...... I suspect that my generation is the Golden one, for which I am grateful.

In contrast to young folk's fortunes, this is my summary. Its not a brag, many of my peer group did better, few worse.

Definitely virtuous working class grandparents and parents, who made grammar school possibe. "If I can afford it, we can have it. Otherwise not".

Age 18 left school hatfull of O levels, 3 science A levels, entered MoD Met at lowest grade

23: married, wife stopped paid work and never returned, ever.

Age 31 family complete, four children

Had a proper UK holiday every year, always on property ladder, always had new cars and ran them for no longer than 3 years.

Ensured all children educated to 18, all with good A levels, two to uni, two to management.

Moved house at Her Majesty's command every 3 years or so.

Moved up greasy pole and up housing ladder.

Retired at 60 to nice village, 5 beds, been drawing super pension 26 years.

Regardless of military versus civil, that synopsis is unobtainable these days without the bank of Mum and Dad or a legacy. My grandchildren flatly disbelieve that we are not posh and privileged. The grandchildren married couples, house owners, with £100,000 combined salaries can not afford anything like my life-style.

I suspect this is the pattern in the developed world. That's Life.

In contrast to young folk's fortunes, this is my summary. Its not a brag, many of my peer group did better, few worse.

Definitely virtuous working class grandparents and parents, who made grammar school possibe. "If I can afford it, we can have it. Otherwise not".

Age 18 left school hatfull of O levels, 3 science A levels, entered MoD Met at lowest grade

23: married, wife stopped paid work and never returned, ever.

Age 31 family complete, four children

Had a proper UK holiday every year, always on property ladder, always had new cars and ran them for no longer than 3 years.

Ensured all children educated to 18, all with good A levels, two to uni, two to management.

Moved house at Her Majesty's command every 3 years or so.

Moved up greasy pole and up housing ladder.

Retired at 60 to nice village, 5 beds, been drawing super pension 26 years.

Regardless of military versus civil, that synopsis is unobtainable these days without the bank of Mum and Dad or a legacy. My grandchildren flatly disbelieve that we are not posh and privileged. The grandchildren married couples, house owners, with £100,000 combined salaries can not afford anything like my life-style.

I suspect this is the pattern in the developed world. That's Life.

Langley B, I am assuming we ae simialr age and I agree with you that we are/were a fortunate generation. I didnt go to University, though I did have 2 A levels and undertook day relase managemnt qualifactions , do companies give youa day off a week these days. Made it to one level be;low board in UK company with 40,000 people and VP in a US company with many more.

Would I have got that far sans degree these days I rather doubt it.

Have had to give son substantial help to get his first house. A buold from scratch in Czech republic which he feels gives him a better standard of living and work life balance than UK and is in the Eu of course so no travel nonesonse. Daughter will need at least as much when she finally settles down and unless you work for Google or gamble with my and your pension in the City it will need two decent saleries to get a mortgage and how high will rates go.

Despite usual age bias annoyances I feel sorry for majprity of young people today in the UK which is a real have a lot -5% ; dont have quite enough or nowhere near enough 95%

PB

Would I have got that far sans degree these days I rather doubt it.

Have had to give son substantial help to get his first house. A buold from scratch in Czech republic which he feels gives him a better standard of living and work life balance than UK and is in the Eu of course so no travel nonesonse. Daughter will need at least as much when she finally settles down and unless you work for Google or gamble with my and your pension in the City it will need two decent saleries to get a mortgage and how high will rates go.

Despite usual age bias annoyances I feel sorry for majprity of young people today in the UK which is a real have a lot -5% ; dont have quite enough or nowhere near enough 95%

PB

Join Date: Jul 2007

Location: Wales

Posts: 82

Likes: 0

Received 0 Likes

on

0 Posts

Please, please stop calling it 'The Property Ladder'. That presupposes that once on everything will be rosy and your 'asset' will continue to grow in value. I can see some broken rungs in the 'ladder' coming.

This has been an issue for a while. My son was a grunt. During his deployment to Afghanistan in 2006 I had to put money into his bank account so he could afford decent food at Bastion and the FOBs he detached to.

Apologies in advance for thread drift. Personally I (literally) cannot bear Ms Burley. How she's survived despite so many gaffes is beyond me.

Her interviews in the run up to the 2019 general election were so dumbed down and biased I was surprised no party personalities (especially Mr Farage) didn't report her to the BSA.

NEO

Apologies in advance for thread drift. Personally I (literally) cannot bear Ms Burley. How she's survived despite so many gaffes is beyond me.

Her interviews in the run up to the 2019 general election were so dumbed down and biased I was surprised no party personalities (especially Mr Farage) didn't report her to the BSA.

NEO