Slán Alan , hello ....

A ‘mountain of capex’ awaits new Qantas chief Vanessa Hudson

A ‘mountain of capital expenditure’ awaits incoming Qantas CEO Vanessa Hudson, after a brief honeymoon period. Robyn IronsideAviation Writer

Robyn IronsideAviation Writer@ironsider

2 min read

May 3, 2023 - 2:19PMThe Australian Business Network

Strategic Aviation Solutions Chairman Neil Hansford says the “old boys club” will make it difficult for incoming Qantas CEO Vanessa Hudson as she will have to do “twice as well” than what a male would to be recognised for her achievements.Newly appointed Qantas chief executive Vanessa Hudson faces a “mountain of capital expenditure” when she takes over from Alan Joyce, ensuring she will get an all-too-brief honeymoon in the job.

The grim forecast from analysts came as Ms Hudson basked in a flood of congratulations, led by her main rival, Virgin Australia CEO Jayne Hrdlicka.

“Vanessa will be an exceptional CEO for Qantas. She is a natural leader, an excellent executive and a great person,” said Ms Hrdlicka who was the first woman to lead a major Australian airline following her 2012 appointment as Jetstar CEO.

Ms Hrdlicka also reached out to her former colleague on LinkedIn, noting Ms Hudson’s promotion was “hard-earned and well deserved”.

Virgin Australia CEO Jayne Hrdlicka offered her “warm congratulations” to Vanessa Hudson following the news of her appointment as the next Qantas CEO. Picture: Brendan RadkeEmirates’ Australasia vice president Barry Brown offered his congratulations as well, noting he had worked with Ms Hudson on many occasions, particularly through the airlines’ now ten-year-old codeshare partnership.

Virgin Australia CEO Jayne Hrdlicka offered her “warm congratulations” to Vanessa Hudson following the news of her appointment as the next Qantas CEO. Picture: Brendan RadkeEmirates’ Australasia vice president Barry Brown offered his congratulations as well, noting he had worked with Ms Hudson on many occasions, particularly through the airlines’ now ten-year-old codeshare partnership.Congratulations also came from Air New Zealand boss Greg Foran, who said his airline and Qantas had a “long history of driving each other to be better for customers”.

“I look forward to that continuing under (Ms Hudson’s) leadership,” Mr Foran said.

The generally well-received announcement by Qantas on Tuesday, was only tempered by a negative sharemarket reaction and analyst warnings that Ms Hudson faced a “mountain of capital expenditure”.

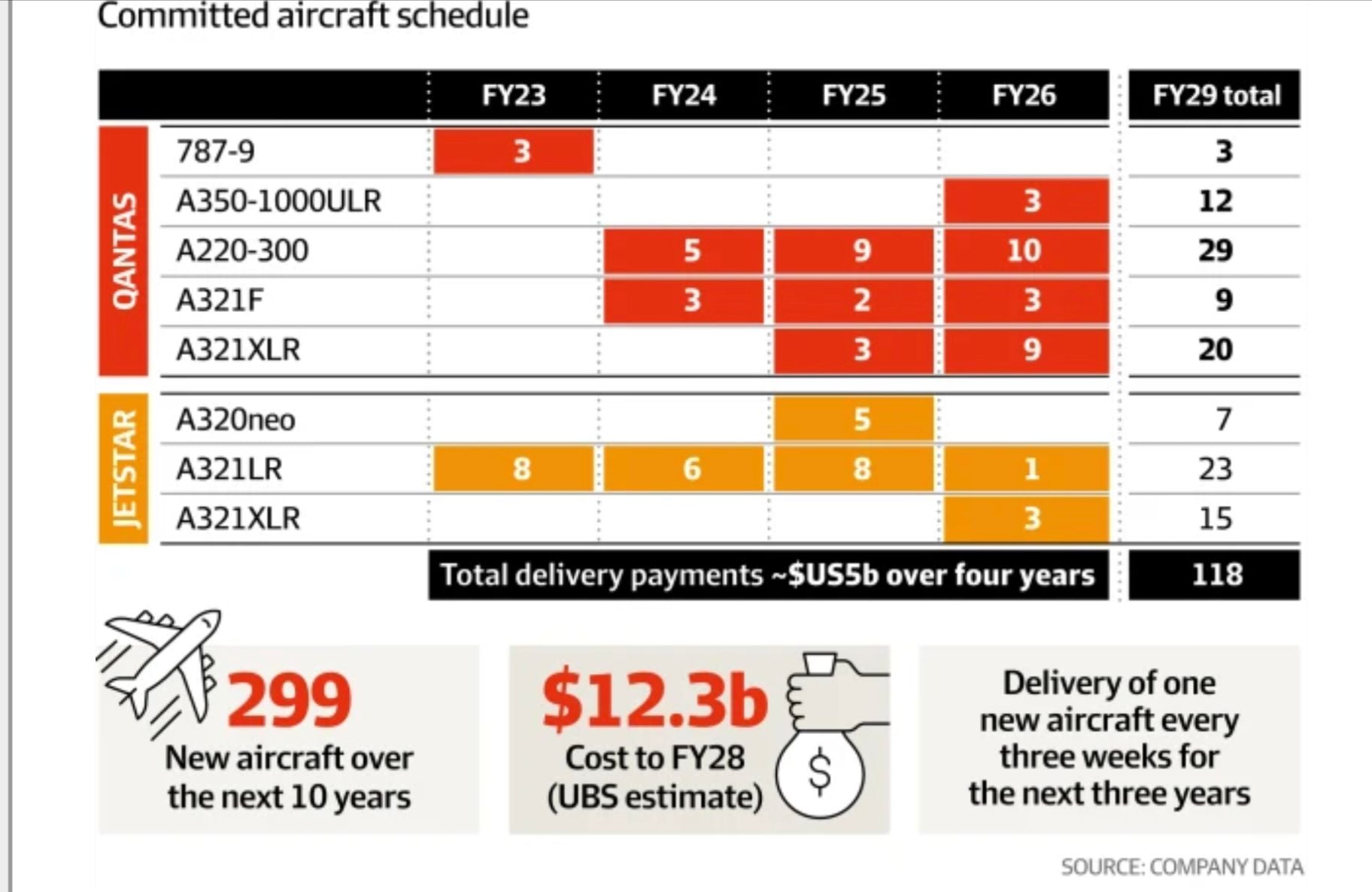

Morningstar equity analyst Angus Hewitt estimated Qantas would need to spend about $15bn over the next five years on its ageing fleet, or more than double that of the past five years.

“Qantas’ fleet of more than 300 planes represents substantial capital investment, and Covid-19 delays and cancellations in aircraft deliveries have exacerbated Qantas’ already ageing fleet,” Mr Hewitt said.

“With the first new aircraft deliveries now beginning to come online, we estimate the Qantas fleet is about 14-years old on average and about 11-years old for the Jetstar brand.

“This compares with about 11-years for Virgin Australia and about nine years for Air New Zealand.”

Qantas’ outgoing boss Alan Joyce, with his successor Vanessa Hudson. Picture: Gaye GerardOver the long term, Mr Hewitt predicted that fleet expansion, replacement and refurbishment would “absorb meaningful cashflow and constrain returns to shareholders”.

Qantas’ outgoing boss Alan Joyce, with his successor Vanessa Hudson. Picture: Gaye GerardOver the long term, Mr Hewitt predicted that fleet expansion, replacement and refurbishment would “absorb meaningful cashflow and constrain returns to shareholders”. “While new aircraft can offer higher customer appeal and significant benefits, including lower fuel costs and less frequent heavy maintenance, these benefits are often offset by the additional capital cost and are typically competed away over time.”

In the meantime, Qantas was enjoying optimal conditions with demand for travel strong, capacity constrained and jet fuel prices moderating.

Mr Hewitt suggested that was unlikely to last as Virgin Australia looked to pick up market share ahead of a potential float, Rex expanded its footprint and Bonza gained momentum.

“We don’t think Qantas has carved a competitive advantage as it fundamentally faces the same challenges confronted by all airlines,” he said.

“Airlines globally lack economic moats due to a business model with high fixed costs not conducive to rational pricing, a lack of barriers to entry and low switching costs. We expect these conditions which plagued the airline industry before the pandemic to return.”

Samuel Seow of Citi Research took a similar view, pointing out Qantas had some “emerging issues in the next leg of recovery like market share, ticket reductions and fleet renewal”.

“Subsequently, we thought the business needed an updated strategy,” said Mr Seow, adding that it was “good timing” for a new CEO as the airline entered a new phase.

Qantas shares continued to lose ground in morning trade on Wednesday, to be down 1.5 per cent at midday, at $6.45

The following users liked this post:

‘Delighted’: Qantas engineers and pilots respond to Alan Joyce’s departure

The longtime CEO may be going, but the announcement of his replacement, Vanessa Hudson, hasn't raised the spirits of many staff.MICHAEL SAINSBURY

MAY 03, 2023

15

Give this article

OUTGOING QANTAS CEO ALAN JOYCE AND HIS REPLACEMENT, VANESSA HUDSON (IMAGE: (AAP/BIANCA DE MARCHI)There was barely a wet eye in the house among Qantas’ engineers, pilots, cabin crew and middle management when the departure of longtime chief executive Alan Joyce was finally announced yesterday.

OUTGOING QANTAS CEO ALAN JOYCE AND HIS REPLACEMENT, VANESSA HUDSON (IMAGE: (AAP/BIANCA DE MARCHI)There was barely a wet eye in the house among Qantas’ engineers, pilots, cabin crew and middle management when the departure of longtime chief executive Alan Joyce was finally announced yesterday.Still, his replacement, Qantas chief financial officer Vanessa Hudson, will have to cool her heels until Joyce completes a six-month victory lap ending with a triumphant annual general meeting. It’s there shareholders should lock in the last tranche of bonuses that will see Joyce walk away at least $125 million richer for his 15 years as CEO. He will also get millions in post-employment travel up the front of the plane, as will his husband, as per the airline’s remuneration scheme.

If shareholders love him and customers increasingly dislike him after enduring a year of post-COVID chaos, his staff hold mixed views. He is more loved by employees at the top where he had feathered the nests of senior management, and far less popular with on-the-ground workers.

Qantas soars back into profit but keeps its millions in JobKeeper. That seem right?

Read MoreThat Joyce has finally been replaced certainly seemed enough for many staff. One engineer told Crikey: “Frankly, we are just happy to see him go.”A pilot said: “Everyone will be delighted that he is going. He effectively blackmailed us into taking lower pay for flying 787s by threatening to outsource the jobs. He denies it now but that’s what happened.”Pilots on the aircraft arriving in coming years will also take another pay hit.

Unions were understandably thrilled at the imminent departure of their nemesis as they head to the High Court this week over the sacking of 1700 Qantas ground staff, which the Federal Court twice found was illegal.

“Over a decade Alan Joyce has systematically splintered his workforce and driven down standards to the point where Qantas is a shadow of what it once was,” Transport Workers’ Union general secretary Michael Kaine said.

“Joyce’s position became untenable because Qantas was treated as a corporate vessel for excessive executive bonuses and shareholder dividends. Vanessa Hudson must be courageous enough to steer Qantas back to its core purpose: high-quality service for passengers and investment in the hard-working people who built the spirit of Australia.”

Some insiders questioned his replacement, who has been with the company for 28 years. “Well, she’s hardly a breath of fresh air, is she?” one middle manager told Crikey. Another said there are some staff who “reckon [Hudson] will just continue Joyce’s legacy”.

But the general feeling was summed up by one insider: “I also think [Hudson] will be a fall guy for the high debt levels that will be needed to refleet the airline. But everyone is looking forward to the end of the Joyce/Goyder/Clifford years [referring to former chairman Leigh Clifford who hired Joyce]. Hopefully the board will be gutted as well.”

The estimated $12 billion to renew the airline’s fleet has been well documented. Less well-known is the deteriorating state of planes and maintenance facilities.

“The 787 cabins are atrocious for such new aircraft due to the Los Angeles facility still being a basket case,” an engineer told Crikey. He claimed Qantas management had been asking engineers with 787 and A380 licences who took redundancies if they are keen on 12-month contracts in LAX.

“This reeks of desperation,“ he said.

Qantas’ week from hell was a long time coming — are its engines finally failing?

Read MoreSources said business class and premium economy seats are locked out on most aircrafts as engineers wait on parts and enough ground time to fix things: “They are trying to achieve 10 hours of maintenance in a three-hour transit and it doesn’t work. They are being flogged.”The situation with the domestic workhorse 737 also continues to deteriorate as Qantas awaits replacement planes from Airbus, whose orders were delayed time and again by management, according to people in operations who describe the fleet as a “disaster”.

Fifteen years at the top of any company is generally seen as poor corporate governance, but chairman Richard Goyder and his board had found it strangely difficult to part with their often controversial chief executive, who he praised as “the best CEO in Australia by a length of a straight”.

That’s understandable. Joyce brought his fellow directors ever-increasing board payments while the wages of other employees were systematically slashed. Qantas failed to deliver a single new aircraft ordered by Joyce — who did not bite the bullet until 2019. The first delivery is due at the earliest late this year. Better still, their Qantas shareholdings have soared in value on the back of menial capital spend, record ticket prices and a round of share buybacks.

Meanwhile, Tuesday over at Qantas Loyalty, its boss Olivia Wirth — runner-up in the CEO race — held a scheduled lunchtime “town hall” meeting with staff. Sources said she ruefully noted “I’m still here” before skipping out at about 2pm.

Australians hope the board has made the right choice with Hudson, despite missing a rare opportunity to bring fresh eyes to an airline about to be squeezed with more competition both domestically and internationally. Whatever the case, after 15 years of Joyce’s headline-hogging tenure, boring may be something of a relief.

Man Bilong Balus long PNG

Join Date: Apr 2002

Location: Looking forward to returning to Japan soon but in the meantime continuing the never ending search for a bad bottle of Red!

Age: 69

Posts: 2,976

Received 104 Likes

on

59 Posts

that will see Joyce walk away at least $125 million richer for his 15 years as CEO.

The only term I can come up with is 'an obscenity,' but that still seems grossly inadequate.

The following users liked this post:

I think after this year’s largesse it will be well over $150 million PLUS unlimited first class confirmed travel for him and his husband while in retirement.

$125 million he walks away with

The company successfully threatened 250 or so Second Officers with redundancy when Covid hit to take LWOP or risk losing their jobs, all because on stand-down provisions they accumulate 6 weeks of AL per year.

Someone made a coloured version of the seniority list indicating in red which SO's took the LWOP out of fear of their jobs. It was heavily red towards the bottom of the list as the junior pilots, many of whom have 25-35 years left in this career, were scared into taking LWOP.

The bounce back happened and they began begging them to return early. Most took 3+ years. Some took 5 years. Company after 2 years was begging them to return, and still is as some refuse.

What do 250 SO's accumulating 6 weeks of AL cost the company per year? About $3.5million. They saved maybe $7 million over two years but now are left with hundreds (if not all) of jaded pilots who absolutely hate senior flight ops management and are absolutely fed up.

Bravo. They'll be carrying that burden for the remainder of their careers for decades to come. What a culture. What a vibe.

The company successfully threatened 250 or so Second Officers with redundancy when Covid hit to take LWOP or risk losing their jobs, all because on stand-down provisions they accumulate 6 weeks of AL per year.

Someone made a coloured version of the seniority list indicating in red which SO's took the LWOP out of fear of their jobs. It was heavily red towards the bottom of the list as the junior pilots, many of whom have 25-35 years left in this career, were scared into taking LWOP.

The bounce back happened and they began begging them to return early. Most took 3+ years. Some took 5 years. Company after 2 years was begging them to return, and still is as some refuse.

What do 250 SO's accumulating 6 weeks of AL cost the company per year? About $3.5million. They saved maybe $7 million over two years but now are left with hundreds (if not all) of jaded pilots who absolutely hate senior flight ops management and are absolutely fed up.

Bravo. They'll be carrying that burden for the remainder of their careers for decades to come. What a culture. What a vibe.

The following 4 users liked this post by soseg:

Nice work if you can get it but surely someone who has siphoned such largesse from the QANTAS coffers, does not need to be gifted free first class travel for life for two people. What do other employees get for 15 years service and substantially less pay? I mean, it’s not as if he wouldn’t have done the job if that cherry wasn’t on the cake. It illustrates exactly what is wrong with the C-suite generally, exaggerated self-entitlement and a grandiose sense of self-worth which spits in the eyes of employees. From the sounds of it, QANTAS isn’t exactly in good shape so where’s the value for money with this CEO?

The following 4 users liked this post by Chronic Snoozer:

As a long time Platinum FF, I hope his departure will also remove the woke'ness he bought to Qantas. I also hope customer service improves, the lounge in Karratha is barely open and the lounge in Broome, the customer is treated like a primary school child in the school canteen.

and assume he was Hard Working, Loyal and ever Productive - even while jetting around the world to attend whatever conference or appear on Bloomberg and the likes:

and assume he was Hard Working, Loyal and ever Productive - even while jetting around the world to attend whatever conference or appear on Bloomberg and the likes:- 12 Hours a Day

- 5 Days a Week (no discount for Public Holidays)

- 48 Weeks a Year

- 4 Weeks Annual Leave

- 15 Years Service

Funny how international gets 3 new aircraft in 2026 for a total of 12 by 2029 and that’s because Qantas international is going to become even more of an irrelevancy and I would suggest Jetstar will replace its clapped out 787s with 321 XL and XLR.

... Joyce brought his fellow directors ever-increasing board payments...

For starters, CEOs do not determine Board remuneration.

More to the point, however, is that over the course of Joyce's 15 years as CEO, Qantas Board remuneration has risen by a total of some 15.6 percent (12.1 percent for the Chairman, and 16.2 percent for Board members). The CPI over the same period has risen by about 40 percent. In other words, Board remuneration has declined in real terms.

With any number of legitimate criticisms of Joyce's time at the helm of Qantas, it's beyond odd that anyone would feel compelled to make stuff up.

Clearly written by someone who has NFI what he is talking about.

For starters, CEOs do not determine Board remuneration.

With any number of legitimate criticisms of Joyce's time at the helm of Qantas, it's beyond odd that anyone would feel compelled to make stuff up.

For starters, CEOs do not determine Board remuneration.

With any number of legitimate criticisms of Joyce's time at the helm of Qantas, it's beyond odd that anyone would feel compelled to make stuff up.

Last edited by Chronic Snoozer; 3rd May 2023 at 23:54.

I have taken this from 2009 compared to 2022.

Chairman (base pay) 2009 $444,000

Chairman (base pay) 2022 $586,000

percentage increase 32%

Board member is a lot harder as they appear to all earn different amounts so I have taken base pay of the first director under the chairman who both elect to be paid superannuation.

Peter Cosgrove 2009. $167,135

Maxine Brenner 2022. $201,000

Percentage increase. 20.25%

Chairman (base pay) 2009 $444,000

Chairman (base pay) 2022 $586,000

percentage increase 32%

Board member is a lot harder as they appear to all earn different amounts so I have taken base pay of the first director under the chairman who both elect to be paid superannuation.

Peter Cosgrove 2009. $167,135

Maxine Brenner 2022. $201,000

Percentage increase. 20.25%

I have taken this from 2009 compared to 2022.

Chairman (base pay) 2009 $444,000

Chairman (base pay) 2022 $586,000

percentage increase 32%

Board member is a lot harder as they appear to all earn different amounts so I have taken base pay of the first director under the chairman who both elect to be paid superannuation.

Peter Cosgrove 2009. $167,135

Maxine Brenner 2022. $201,000

Percentage increase. 20.25%

Chairman (base pay) 2009 $444,000

Chairman (base pay) 2022 $586,000

percentage increase 32%

Board member is a lot harder as they appear to all earn different amounts so I have taken base pay of the first director under the chairman who both elect to be paid superannuation.

Peter Cosgrove 2009. $167,135

Maxine Brenner 2022. $201,000

Percentage increase. 20.25%

Your 2009 Chairman's base pay of $444,000 is based on Leigh Clifford's actual remuneration for that reporting period but does not include the $100,000 in superannuation that he received.

Board remuneration is spelled out in each annual report. For 2009, it appears on page 69. The annual fees for 2009 were:

Chairman - $544,000

Member - $136,000

For 2022, board remuneration appears on page 60. The annual fees for 2022 were:

Chairman - $610,000

Member - $158,000

The respective increases were:

Chairman - 12.1 percent

Member - 16.2 percent

Last edited by MickG0105; 4th May 2023 at 01:14. Reason: Formatting

Cash $444,000

Cash $586,000

Thank you, that illustrates my point perfectly.

Remuneration is the sum of cash and superannuation.

In 2009 Leigh Clifford took $444,000 in cash and $100,000 in super for a total of $544,000 (precisely the same sum as detailed in the 2009 Annual Report as the Chairman's Director's Fee).

In 2022 Richard Goyder took $586,000 in cash and $24,000 in super for a total of $610,000 (again precisely the same sum as detailed in the 2022 Annual Report as the Chairman's Director's Fee).

The difference between the 2009 and 2022 Chairman's remuneration is 12.1 percent.

Remuneration is the sum of cash and superannuation.

In 2009 Leigh Clifford took $444,000 in cash and $100,000 in super for a total of $544,000 (precisely the same sum as detailed in the 2009 Annual Report as the Chairman's Director's Fee).

In 2022 Richard Goyder took $586,000 in cash and $24,000 in super for a total of $610,000 (again precisely the same sum as detailed in the 2022 Annual Report as the Chairman's Director's Fee).

The difference between the 2009 and 2022 Chairman's remuneration is 12.1 percent.

Earning thát coin for attending 17 Meetings a year (roughly 1 every 3 weeks)

Surely he walks away and spends the next 2-3 weeks working day in/out on strategies for just the next meeting - No, as he has to do the same for Woodside Energy, the AFL Commission, the West Australian Symphony Orchestra & the Channel 7 Telethon Trust.

"Shareholders and proxy advisers have previously expressed concern to Goyder about his workload" - The Sydney Morning Herald

Thank you, that illustrates my point perfectly.

Remuneration is the sum of cash and superannuation.

In 2009 Leigh Clifford took $444,000 in cash and $100,000 in super for a total of $544,000 (precisely the same sum as detailed in the 2009 Annual Report as the Chairman's Director's Fee).

In 2022 Richard Goyder took $586,000 in cash and $24,000 in super for a total of $610,000 (again precisely the same sum as detailed in the 2022 Annual Report as the Chairman's Director's Fee).

The difference between the 2009 and 2022 Chairman's remuneration is 12.1 percent.

Remuneration is the sum of cash and superannuation.

In 2009 Leigh Clifford took $444,000 in cash and $100,000 in super for a total of $544,000 (precisely the same sum as detailed in the 2009 Annual Report as the Chairman's Director's Fee).

In 2022 Richard Goyder took $586,000 in cash and $24,000 in super for a total of $610,000 (again precisely the same sum as detailed in the 2022 Annual Report as the Chairman's Director's Fee).

The difference between the 2009 and 2022 Chairman's remuneration is 12.1 percent.