Qantas Employee Costs - It's all about the AUD

Thread Starter

Join Date: May 2007

Location: Singapore

Posts: 270

Likes: 0

Received 0 Likes

on

0 Posts

Qantas Employee Costs - It's all about the AUD

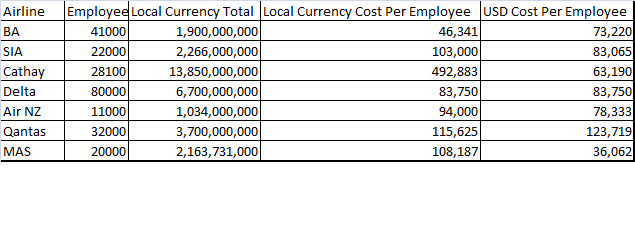

Since everyone's going on and on about QF employee costs, I compiled the cost per employee for a basket of airlines: (Using Group consolidated accounts for each airline for 2010/2011 financial years)

QF has the highest cost per employee, but that's largely because of the AUD. SQ and Delta have a tie on the second highest cost per employee, higher than NZ, much higher than BA and CX.

CX's cost per employee would look low right now (30% lower than SQ) because the USD, to which the HKD is pegged to, has depreciated by that amount against the SGD in the past 5 years. If the SGD:HKD rate stayed the same, SQ and CX would have the same costs per employee.

In fact, using 2006 exchange rates, SQ would have the second lowest cost per employee in that basket of airlines, instead of having the second highest. BA in turn would have the highest cost per employee (based on 2006 exchange rates) due to the relative strength of the pound then.

In local currency terms, QF employees have not faced a wage blowout. However measured in USD, they have, and any Australian employee's cost would look very expensive by world standards.

SQ's costs per employee also look very expensive compared to its peers, and it is no surprise considering that after the AUD, the SGD has been the best performing currency against the USD in the Asia Pacific region in the past 5 years. In fact from the people I know in the aerospace/aviation circles in SIN, the cost of a skilled engineer in Singapore these days is more than the USA.

QF has the highest cost per employee, but that's largely because of the AUD. SQ and Delta have a tie on the second highest cost per employee, higher than NZ, much higher than BA and CX.

CX's cost per employee would look low right now (30% lower than SQ) because the USD, to which the HKD is pegged to, has depreciated by that amount against the SGD in the past 5 years. If the SGD:HKD rate stayed the same, SQ and CX would have the same costs per employee.

In fact, using 2006 exchange rates, SQ would have the second lowest cost per employee in that basket of airlines, instead of having the second highest. BA in turn would have the highest cost per employee (based on 2006 exchange rates) due to the relative strength of the pound then.

In local currency terms, QF employees have not faced a wage blowout. However measured in USD, they have, and any Australian employee's cost would look very expensive by world standards.

SQ's costs per employee also look very expensive compared to its peers, and it is no surprise considering that after the AUD, the SGD has been the best performing currency against the USD in the Asia Pacific region in the past 5 years. In fact from the people I know in the aerospace/aviation circles in SIN, the cost of a skilled engineer in Singapore these days is more than the USA.

Join Date: Nov 2004

Location: on skybeds

Age: 43

Posts: 194

Likes: 0

Received 0 Likes

on

0 Posts

very interesting comparison

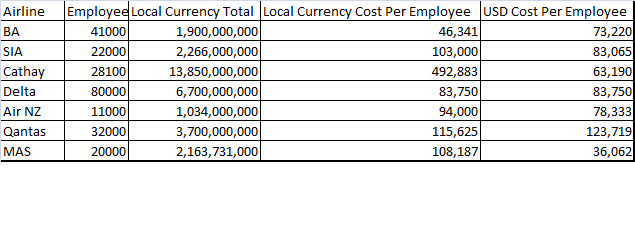

the next graph Dr. Pepz should be management costs(and i am not talking about the CEO alone).then you take these costs out from consolidated accounts and then the picture would change somewhat greatly.

without doubt QF management cost would be amongst if not the hightest in the aviation industry.

without doubt QF management cost would be amongst if not the hightest in the aviation industry.

Thread Starter

Join Date: May 2007

Location: Singapore

Posts: 270

Likes: 0

Received 0 Likes

on

0 Posts

nitpicker: Of course cost per employee doesn't tell even part of the story. However I just presented the information as it is. What I personally found interesting was that SQ has higher costs per employee than BA, NZ, CX and are on par with Delta - bearing in mind the American carriers also constantly claim their workforce is too expensive and Delta themselves use Singapore MROs to maintain their A330s.

While QF does get the vast majority of its revenue in AUD, on international routes, it is competing with airlines who have costs in a foreign currency and revenue in AUD. QF has costs in AUD and revenue in AUD.

Of course it doesn't help that QF is using aging 747s on international routes, and in any currency that will be an expensive venture compared to A380s and 777s!

Labour costs are definitely not the be all and end all. If not, SQ should have lost money for the last 10 years with costs per employee 2.5x that of MAS.

While QF does get the vast majority of its revenue in AUD, on international routes, it is competing with airlines who have costs in a foreign currency and revenue in AUD. QF has costs in AUD and revenue in AUD.

Of course it doesn't help that QF is using aging 747s on international routes, and in any currency that will be an expensive venture compared to A380s and 777s!

Labour costs are definitely not the be all and end all. If not, SQ should have lost money for the last 10 years with costs per employee 2.5x that of MAS.

Join Date: Apr 2008

Location: Australia

Posts: 490

Likes: 0

Received 0 Likes

on

0 Posts

The exchange rate is a problem for every industry that faces competition from overseas. Manufacturing, agriculture, IT, even things like accounting and legal work where you can ship the work electronically.

Aviation is actually in a better position than many industries, as you do have to be in Australia to transport someone from Melbourne to Sydney.

Mining isn't exempt. The exchange rate impacts any profits from mining exports kept in Australia. Mining profits that go overseas are not impacted so much, as they will be converted to/from the dollar at similar exchange rates...

Aviation is actually in a better position than many industries, as you do have to be in Australia to transport someone from Melbourne to Sydney.

Mining isn't exempt. The exchange rate impacts any profits from mining exports kept in Australia. Mining profits that go overseas are not impacted so much, as they will be converted to/from the dollar at similar exchange rates...

Join Date: Nov 2004

Location: on skybeds

Age: 43

Posts: 194

Likes: 0

Received 0 Likes

on

0 Posts

Dr.Pepz says

Of course it doesn't help that QF is using aging 747s on international routes, and in any currency that will be an expensive venture compared to A380s and 777s!

correct, just imagine they would have replaced half of the aging 747 with 777.

places like DFW/FRA/NRT/ etc. might be (more)profitable. places like CDG/SFO/PEK/ LHR toPER,LHR to HGK might not have been scrapped.

deliberate destruction of an airline

correct, just imagine they would have replaced half of the aging 747 with 777.

places like DFW/FRA/NRT/ etc. might be (more)profitable. places like CDG/SFO/PEK/ LHR toPER,LHR to HGK might not have been scrapped.

deliberate destruction of an airline

...And when the AUD goes UP the cost of jet fuel in USD goes DOWN, then there are all those spare parts and consumables that get cheaper as well. Then there are the capital costs of the aircraft and borrowings, their cost in AUD just went down as well.

All this stuff is supposed to be taken care of by the Qantas Treasury who would be hedging everything.

To put that another way, when the AUD appreciated by 10%, does Qantas cut its prices by 10%?

Of course not, it just howls to the media about how expensive Australian staff are...

All this stuff is supposed to be taken care of by the Qantas Treasury who would be hedging everything.

To put that another way, when the AUD appreciated by 10%, does Qantas cut its prices by 10%?

Of course not, it just howls to the media about how expensive Australian staff are...

Join Date: Nov 2007

Location: Bexley

Posts: 1,792

Likes: 0

Received 0 Likes

on

0 Posts

Thnx Dr Pepz for the info, although not good news for us trying to fight to retain employment here we need to face the facts. The strong Aus dollar does make it hard to compete on the labour front. I think our best asset is quality though so in Engineering the figures need to take into account many matters.

I estimate however that Qantas are collecting at least 85% of revenue in Aus dollars which for them is an absolute windfall. Whilst Qf compete with Cx, they aren't carrying as many Aussies on their aircraft as us in percentage terms however we still have to match their fares in a global market. Of course our Domestic revenue collection is all cream.

Qf's biggest Ops expenses are manpower (26%), aircraft (19%) and fuel (25%). The comination of the last two there of course benefiting completely from the strong dollar. Overall Qantas would be loving having the buck up because the 44% of their expenses that benefit exceed the 26% that don't.

They will of course continue to attack labour costs regardless of the dollar. I don't remember them demanding more work be done here when it was at 70 cents.

I estimate however that Qantas are collecting at least 85% of revenue in Aus dollars which for them is an absolute windfall. Whilst Qf compete with Cx, they aren't carrying as many Aussies on their aircraft as us in percentage terms however we still have to match their fares in a global market. Of course our Domestic revenue collection is all cream.

Qf's biggest Ops expenses are manpower (26%), aircraft (19%) and fuel (25%). The comination of the last two there of course benefiting completely from the strong dollar. Overall Qantas would be loving having the buck up because the 44% of their expenses that benefit exceed the 26% that don't.

They will of course continue to attack labour costs regardless of the dollar. I don't remember them demanding more work be done here when it was at 70 cents.

This is what Oz is fighting against in a world market.

An ex student of mine is now an FO with China Southern on the 777. he's making 15,000 RMB per month. Thats $2500 AUD.

I think the days of QF salaries will draw to an end in the next decade or so. The same goes for all the legacy carriers around the world, they will gradually disapear. It's not a pretty picture, but is the reality.

Gone already, Pan Am, Sabena, Continental, Braniff, Swissair, Ansett and others long forgotten.

An ex student of mine is now an FO with China Southern on the 777. he's making 15,000 RMB per month. Thats $2500 AUD.

I think the days of QF salaries will draw to an end in the next decade or so. The same goes for all the legacy carriers around the world, they will gradually disapear. It's not a pretty picture, but is the reality.

Gone already, Pan Am, Sabena, Continental, Braniff, Swissair, Ansett and others long forgotten.

The trouble is with reducing wages to make a Co more profitable just means those effected (the employees) are still living in a world where prices only ever go up ! We all mainly only want higher pay top cover the day to day cost of just surviving! The likes of AJ don't need to be concerned that fuel for his car went up 10 cents a ltr last week, groceries going up all the time & with utilities sky rocketing he's got enuf money to cover all that & some!!. It's the guy at the coal face that brings AJ & the likes the silk lined life they lead who is suffering out there !

The only reall variable that the CEO's of the world have at their disposal to line their pockets with is the human element in the cost of running a business.

The world is like a merry-go-round there's no end to it !

Wmk2

The only reall variable that the CEO's of the world have at their disposal to line their pockets with is the human element in the cost of running a business.

The world is like a merry-go-round there's no end to it !

Wmk2

Join Date: Aug 2006

Location: Australia

Posts: 165

Likes: 0

Received 0 Likes

on

0 Posts

What I find interesting (if these figures are correct) is that after 11 years service to Qantas mainline & as a B737 FO, I am only making slightly more than the average Qantas employee. I knew I was being underpaid.

Are the figures pre-tax or post-tax and the same for each airline? Even a comparison of say Cathay and Qantas will make a significant difference to the figures dependent upon whether tax has or hasn't been accounted for.

Thread Starter

Join Date: May 2007

Location: Singapore

Posts: 270

Likes: 0

Received 0 Likes

on

0 Posts

I took them from the Group Consolidated Accounts under "Staff Expenses" or "Employee Expenses". All these expenses are pre tax (from the company's point of view) but include superannuation or provident fund expenses or their equivalent for each country. The figures are thus what each employee costs to the airline (this would include allowances, training programmes, superannuation etc), and do not represent the take home pay of each individual employee.

From the employee's point of view of course not the entire amount goes to them in their take home pay. Australia's superannuation is 9%, Singapore's is 16% etc. From a disposable income point of view, the average SQ employee on say SGD100,000 would have more post-tax income plus superannuation than the average QF employee on AUD100,000.

All in all there are a large number of factors that influence the costs of operating an airline including wage costs. EK can pay staff 30-40% lower than QF because there is no income tax in the UAE, resulting in staff having the same or even slightly more disposable income.

QF may complain that Australia is in a poor position for air travel being an end of the road country. But Australia is in a prime position to export minerals to China, compared to say Brazil which is too far away. As such, QF's complaints about their disadvantaged geography would be the same as Vale complaining they can't complete with BHP because Brazil is disadvantaged geographically.

From the employee's point of view of course not the entire amount goes to them in their take home pay. Australia's superannuation is 9%, Singapore's is 16% etc. From a disposable income point of view, the average SQ employee on say SGD100,000 would have more post-tax income plus superannuation than the average QF employee on AUD100,000.

All in all there are a large number of factors that influence the costs of operating an airline including wage costs. EK can pay staff 30-40% lower than QF because there is no income tax in the UAE, resulting in staff having the same or even slightly more disposable income.

QF may complain that Australia is in a poor position for air travel being an end of the road country. But Australia is in a prime position to export minerals to China, compared to say Brazil which is too far away. As such, QF's complaints about their disadvantaged geography would be the same as Vale complaining they can't complete with BHP because Brazil is disadvantaged geographically.

Join Date: Aug 2007

Location: Down South

Posts: 46

Likes: 0

Received 0 Likes

on

0 Posts

Are the QF bosses worth the value of over 100 Pilots. Shows where the cash goes.

Basic Compensation

Name$ Fiscal Year Total

Leigh Clifford

$635,000

Alan Joyce

$5,008,000

Gareth Evans

$1,357,000

Bruce Buchanan

$1,413,000

Simon Hickey

$1,406,000

Brett Johnson

$1,254,000

Rob Gurney

$1,405,000

Carla Hrdlicka

$361,000

Lyell Strambi

$1,695,000

Basic Compensation

Name$ Fiscal Year Total

Leigh Clifford

$635,000

Alan Joyce

$5,008,000

Gareth Evans

$1,357,000

Bruce Buchanan

$1,413,000

Simon Hickey

$1,406,000

Brett Johnson

$1,254,000

Rob Gurney

$1,405,000

Carla Hrdlicka

$361,000

Lyell Strambi

$1,695,000

Last edited by Ero-plano; 9th Feb 2012 at 10:18. Reason: layout

Join Date: Apr 2008

Location: Sydney

Posts: 265

Likes: 0

Received 0 Likes

on

0 Posts

Dr Pepz,

one could use that example in some other uses.

China and Dubai have no coal so they import it from countries that have a competitive advantage in coal production - Australia and Brazil

China and Dubai have a competitive advantage in flight crewing costs, so they export...

one could use that example in some other uses.

China and Dubai have no coal so they import it from countries that have a competitive advantage in coal production - Australia and Brazil

China and Dubai have a competitive advantage in flight crewing costs, so they export...

An ex student of mine is now an FO with China Southern on the 777. he's making 15,000 RMB per month. Thats $2500 AUD. I think the days of QF salaries will draw to an end in the next decade or so.

I recently went to a 711 store in Bangkok and bought a can of Heiniken, two bottles of Lipton iced tea, a small bottle of iced coffee, two pieces of banana bread and a roll of mints - the total cost was 130 Thai Baht (about $4 AUS). I imagine that it would be difficult to buy a can of Heiniken, alone, for $4 in Australia. I have no research to support this, but I reckon that Australia must currently have one of the highest costs of living in the world.

If the buying power of your US dollar is four times higher in Thailand than it is in Australia (for example), then for the same lifestyle, you only need a quarter of the wage in US dollars. I would love to see someone convert the table at the beginning of this thread to take into account the buying power of the US dollar in each of the countries mentioned, so that we had a true comparison of apples and apples.