Easyjet pilot in The Guardian (re: pay)

Join Date: Sep 2022

Location: Perpetually circling LAM for some reason

Posts: 113

Received 0 Likes

on

0 Posts

If it were completely up to me I’d advocate taxing Centrica at the moment.

You'd imagine that quite a few MPs are encountering the 62% bracket, but yet it doesn't get smoothed out in the way it would with a progressive system. Oh silly me, of course MPs aren't normal tax paying people ;-)

Join Date: Feb 2023

Location: Up North

Posts: 2

Likes: 0

Received 0 Likes

on

0 Posts

What is the collective wisdom to avoid the tax trap?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

What is the collective wisdom to avoid the tax trap?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

You could also lower your gross by things like buying a bike on a ride to work scheme or even now an electric vehicle, or look at some unpaid leave to get back under the £100k.

What is the collective wisdom to avoid the tax trap?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

Must admit it’s snuck up on me this year, first time earning £100K+.

Is it as simple as thus:

Earn £110K Gross…

…Overpay pension by £10,100, “taxable income” becomes £99,900.

Fill in a tax return to be relieved circa £6K in income tax?

Therefore disposable cash reduced in theory by approx £4K, but my pension has £10K extra and I’ve given considerably less to HMRC…?

No-one should be missing the opportunity to get the government to add up to 50% to their savings!

Join Date: Apr 2006

Location: where I lay my hat

Posts: 151

Likes: 0

Received 0 Likes

on

0 Posts

You're doing something seriously wrong if your pension only benefits £10K when you put £10K into it. You should be claiming tax relief so with employer's NI contribution refund added your £10K becomes more like £15K.

No-one should be missing the opportunity to get the government to add up to 50% to their savings!

No-one should be missing the opportunity to get the government to add up to 50% to their savings!

If you put £10k into your pension, don't give the government credit for gifting you money - they don't - it was your money, - it's just that you don't have to pay tax on it. In practice, if you pay into a SIPP from cash you've earned (ie already paid tax on), it's gets a basic rate tax refund top up within a couple of weeks, and then you'll get the higher rate refund (on the tax you've already paid) by doing an end of year tax return. Plus of course, the employer will contribute to a company pension - but all the same, there's no government contribution - all you're getting is a waiver from tax. The company can credit you with the saved employer NI, but usually they pocket that amount. How long the government give full tax relief on pension contributions remains open to speculation.

Join Date: Apr 2012

Location: UK

Posts: 287

Likes: 0

Received 0 Likes

on

0 Posts

Looking at it, wouldn't it make sense for an employer to offer a DB scheme with fairly high employee contributions in return for a salary freeze for a couple of years? It dumps quite a bit of risk on the airline but it'd be a great way to retain flight crew.

For those in the LHS with childcare requirements, surely part-time is currently a no-brainer.

For those in the LHS with childcare requirements, surely part-time is currently a no-brainer.

Join Date: Jan 2010

Location: Earth

Posts: 213

Likes: 0

Received 0 Likes

on

0 Posts

Overall, the core&trunk of the global pilot pool lives nowhere near the pleasant and enviable life settings you have. Such as owning a prime property, not needing to provide for the family, and not having the PIC responsibility on the job.

Please share more on how aviation works well for the smart and successful. What you are missing is that the rest of us are neither.

Please share more on how aviation works well for the smart and successful. What you are missing is that the rest of us are neither.

Think you got wires crossed. Living in a flat is hardly prime property. Unfortunate family circumstances allowed us to receive an inheritance far earlier than I was expecting. Without that we wouldn’t have had a deposit for a property.

Of course I provide for family. My partner earns a tad more than me but I certainly not enough to have a single earning household.

https://www.theguardian.com/business...ays-uk-economy

interesting.

EasyJet pilot McKenzie, a father of three, has similar plans: he will soon trade his full-time contract for a part-time one and flip properties on the side.

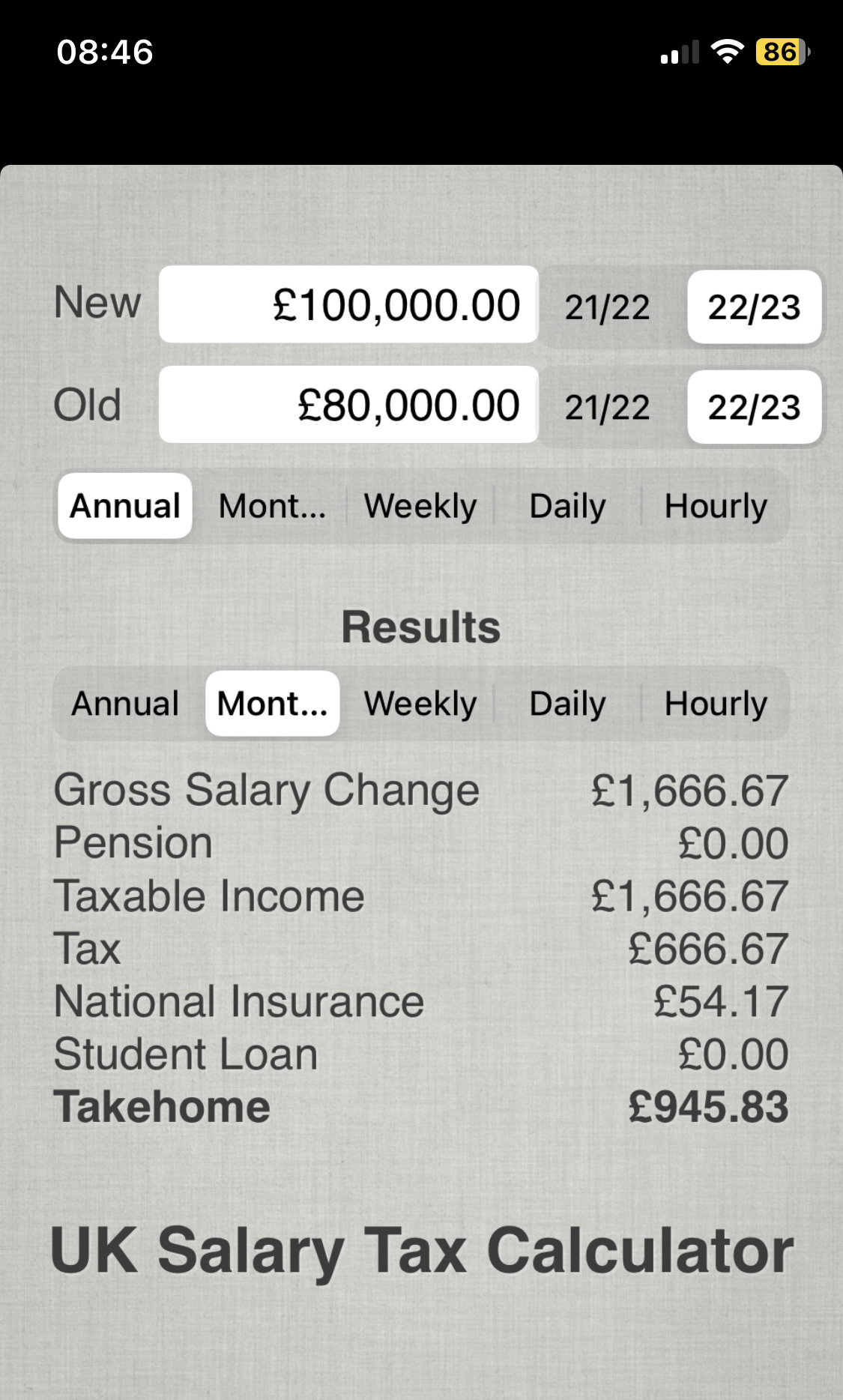

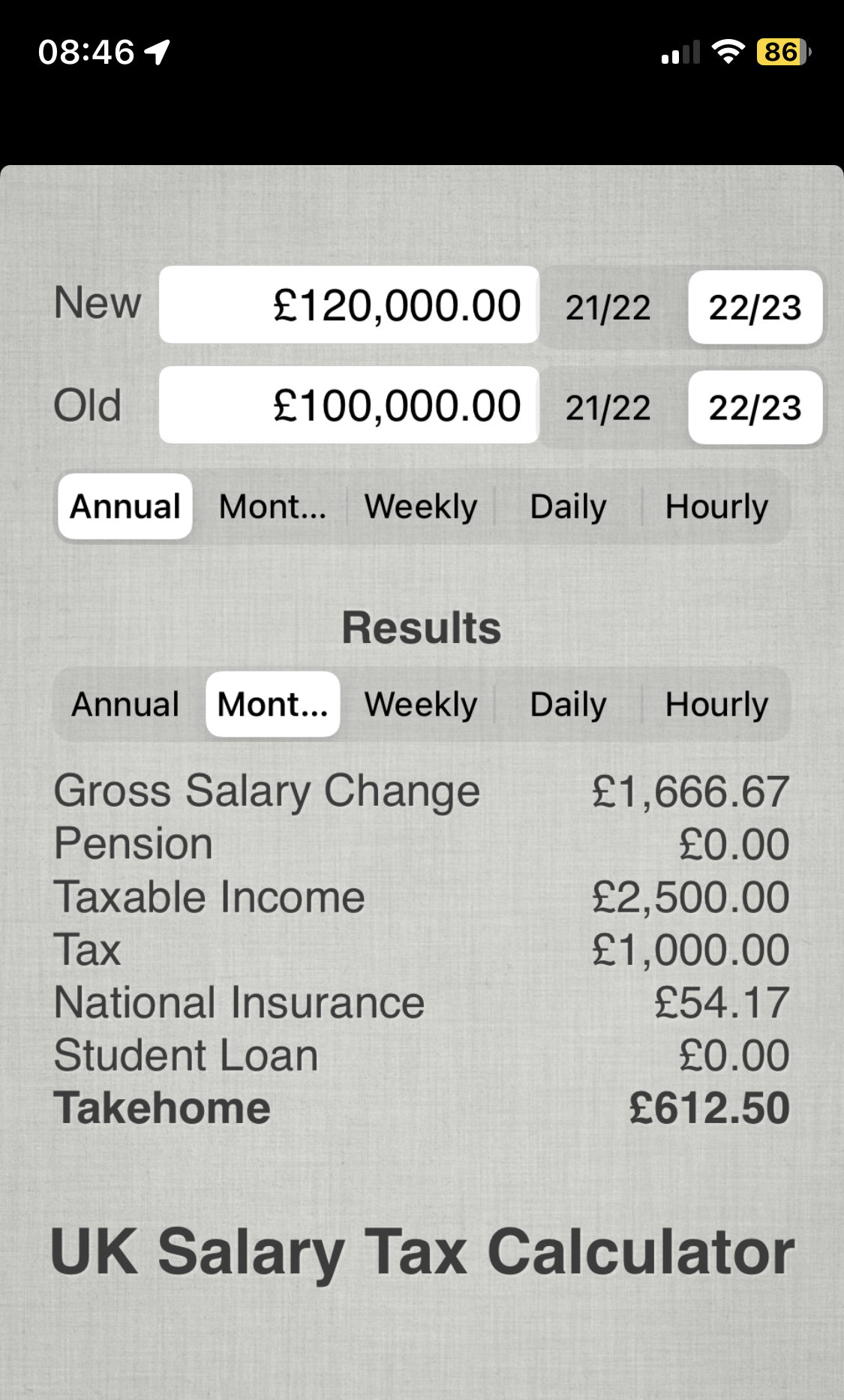

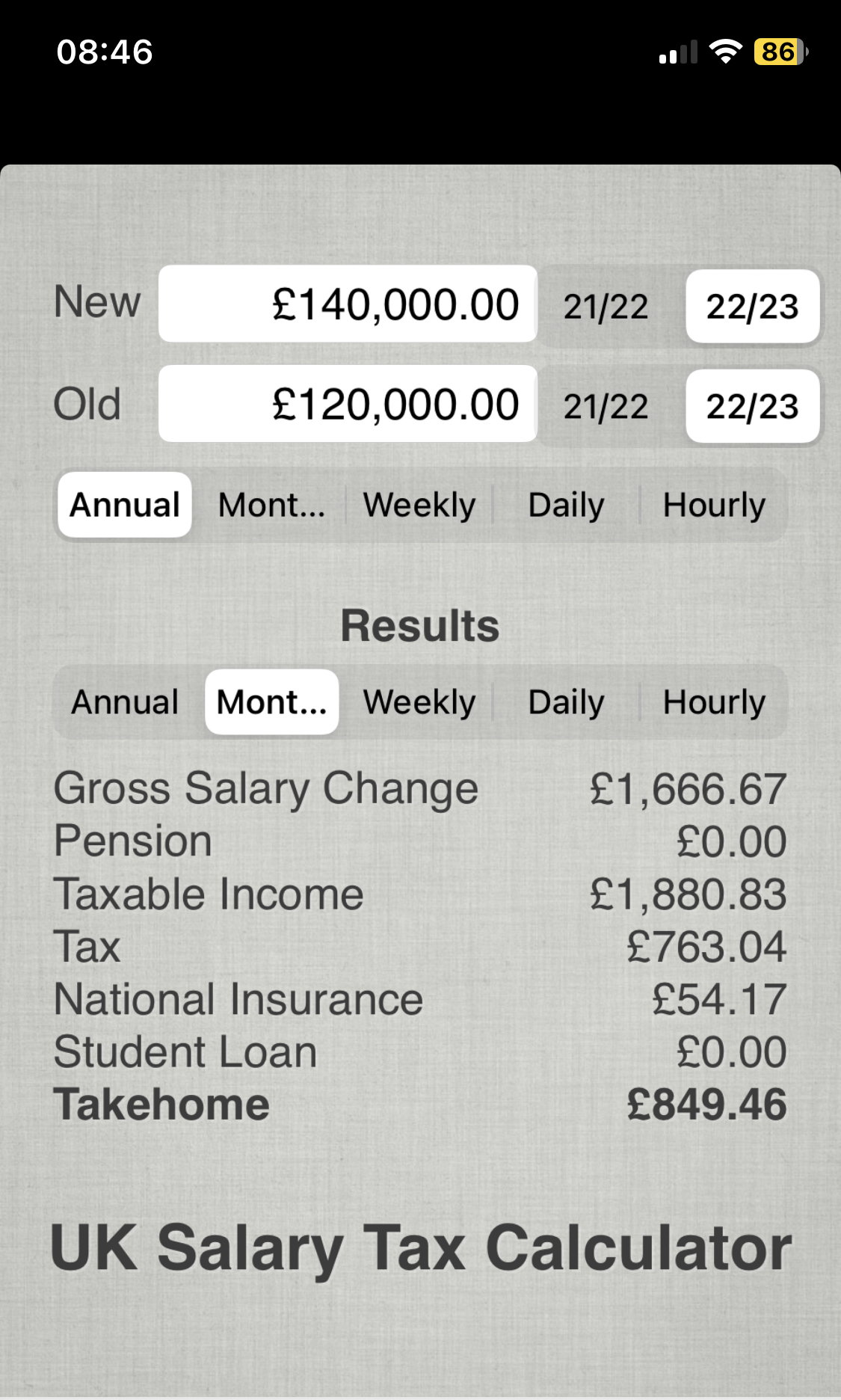

“I’m a captain, and the only reason I’m still working full-time is because my pension pot is small, due to time abroad. I currently contribute the maximum £40,000 to my pension, but in a few years I’ll absolutely go part-time, like a significant number of my colleagues already have, to avoid paying an effective tax rate of 62% [including 2% national insurance, on income between £100,000 and £125,140 due to the loss of the personal tax-free allowance].

“It’s just not worth it to wake up every day at 3am to work in the job I trained for: I’ll have the same take-home pay as I do now – £5,000 a month – by going part-time and reducing my pension contributions.

interesting.

EasyJet pilot McKenzie, a father of three, has similar plans: he will soon trade his full-time contract for a part-time one and flip properties on the side.

“I’m a captain, and the only reason I’m still working full-time is because my pension pot is small, due to time abroad. I currently contribute the maximum £40,000 to my pension, but in a few years I’ll absolutely go part-time, like a significant number of my colleagues already have, to avoid paying an effective tax rate of 62% [including 2% national insurance, on income between £100,000 and £125,140 due to the loss of the personal tax-free allowance].

“It’s just not worth it to wake up every day at 3am to work in the job I trained for: I’ll have the same take-home pay as I do now – £5,000 a month – by going part-time and reducing my pension contributions.

Effective rate for £120.000 is £40.460 (total tax) / £120.000 (total income) = 34%.

Join Date: Apr 2006

Location: where I lay my hat

Posts: 151

Likes: 0

Received 0 Likes

on

0 Posts

Correct - the term is marginal.

The effect of very high marginal rates and fiscal drag, is that people reduce their productivity as they get pushed into this 62% band.

Net effect; so crewing want a day off worked for the DO payment - no thanks, ⅔ of it goes to Hunt, so what's the point. Or in my case, ten years of being pestered to become a desperately needed LTC - but again why work much harder to have little to show for it in the pay packet. At the macro scale, GDP suffers.

Plus the government lose rather than gain revenue on pay over£100k, because all of it goes into a pension. (At least now, the £40k contribution limit is gone, so maybe I will do training. Retirement is looking pretty sweet!)

The effect of very high marginal rates and fiscal drag, is that people reduce their productivity as they get pushed into this 62% band.

Net effect; so crewing want a day off worked for the DO payment - no thanks, ⅔ of it goes to Hunt, so what's the point. Or in my case, ten years of being pestered to become a desperately needed LTC - but again why work much harder to have little to show for it in the pay packet. At the macro scale, GDP suffers.

Plus the government lose rather than gain revenue on pay over£100k, because all of it goes into a pension. (At least now, the £40k contribution limit is gone, so maybe I will do training. Retirement is looking pretty sweet!)

Join Date: Jul 2021

Location: Not in UK

Posts: 84

Likes: 0

Received 0 Likes

on

0 Posts

Join Date: Nov 2007

Location: europe

Posts: 25

Likes: 0

Received 0 Likes

on

0 Posts