The Recession

Join Date: Jun 2005

Location: XXX

Posts: 297

Likes: 0

Received 0 Likes

on

0 Posts

hey tacoland!

its thanks to your country & all its specullators

w'r going through all of this in the 1st place

and in the airline im in

there is a FLOOD of "gringos" desperate for a job

free of taxes to give back to uncle sam!!!

and a coke for a dime!!!!!

son dont give me that nonsense c@#&

get real buddy......... not offended by the post here

its the main purspose of it....or not?

c ya

its thanks to your country & all its specullators

w'r going through all of this in the 1st place

and in the airline im in

there is a FLOOD of "gringos" desperate for a job

free of taxes to give back to uncle sam!!!

and a coke for a dime!!!!!

son dont give me that nonsense c@#&

get real buddy......... not offended by the post here

its the main purspose of it....or not?

c ya

Join Date: Oct 2005

Location: Away

Posts: 300

Likes: 0

Received 0 Likes

on

0 Posts

Whilst nothing is certain, market analysts I have followed since 1995 assign a high probability to more downside movement of stock markets the world over, quite a lot more, as we are at the end of the first stages of the beginning of a multi-decade decline in man's optimism, reflected in stock averages.

Using the DJIA as a benchmark, January 2000 marks the conventional all-time bull market high. A two year cyclical bear market followed, drawing down to the 2002 low. A six year cyclical bull market spanning 2002-2007 then moved markets up worldwide. Yet the larger trend down reasserted itself circa October 2007.

That impulsive move down has not ended. However, internal dynamics show near term ending of the current short-term bounce from the recent October 10, 2008 low (one year out from the Oct 2007 high).

When the bounce has ended, more downside movement will take out the October 10, 2008 low. The target with the break is below 7200.

The break to 7200 will be short and sharp. It will also be the end of the drop from October 2007, the DJIA's all-time high in points. Being the end of such a large move will provide a rallying point for the market to retrace these massive losses, before we begin another impulsive move down of an order that will dwarf the run down to October 10 low (which caused the world to panic).

Even this will not be the end of the bear market.

Markets move from mass optimism to mass pessimism and back again in cycles that are complex but defined by wave-like structures. Arguing with the market is arguing with mass psychology, which has never once proved to be profitable.

What to do about all this is quite a challenge for all of us.

Near-term, the auto industry in the USA is about to be bankrupted with the loss of millions of jobs. Mass bankruptcy of domestic and international airlines will be close behind.

Using the DJIA as a benchmark, January 2000 marks the conventional all-time bull market high. A two year cyclical bear market followed, drawing down to the 2002 low. A six year cyclical bull market spanning 2002-2007 then moved markets up worldwide. Yet the larger trend down reasserted itself circa October 2007.

That impulsive move down has not ended. However, internal dynamics show near term ending of the current short-term bounce from the recent October 10, 2008 low (one year out from the Oct 2007 high).

When the bounce has ended, more downside movement will take out the October 10, 2008 low. The target with the break is below 7200.

The break to 7200 will be short and sharp. It will also be the end of the drop from October 2007, the DJIA's all-time high in points. Being the end of such a large move will provide a rallying point for the market to retrace these massive losses, before we begin another impulsive move down of an order that will dwarf the run down to October 10 low (which caused the world to panic).

Even this will not be the end of the bear market.

Markets move from mass optimism to mass pessimism and back again in cycles that are complex but defined by wave-like structures. Arguing with the market is arguing with mass psychology, which has never once proved to be profitable.

What to do about all this is quite a challenge for all of us.

Near-term, the auto industry in the USA is about to be bankrupted with the loss of millions of jobs. Mass bankruptcy of domestic and international airlines will be close behind.

Last edited by 4PW's; 19th Nov 2008 at 01:22.

Join Date: Oct 2005

Location: Away

Posts: 300

Likes: 0

Received 0 Likes

on

0 Posts

Someone asked, I answered. I am sorry if my take offended you. Being able to answer the question doesn't make me an expert.

There's a difference between probability and certainty. The forecast in the post above is not certain, it's only highly likely. Time will tell.

If you traded markets for a living or as a past-time, I'm sure you'd eventually come to see their movement being irrespective of news, world events or the latest spin from the Federal Reserve or politicians.

Markets move as a reflection of mankind's swings from mass optimism to mass pessimism. You can fight that reality if you like, but you'll burn through a lot of money proving you were wrong.

There's a difference between probability and certainty. The forecast in the post above is not certain, it's only highly likely. Time will tell.

If you traded markets for a living or as a past-time, I'm sure you'd eventually come to see their movement being irrespective of news, world events or the latest spin from the Federal Reserve or politicians.

Markets move as a reflection of mankind's swings from mass optimism to mass pessimism. You can fight that reality if you like, but you'll burn through a lot of money proving you were wrong.

Join Date: Jul 2008

Location: somewhere in Asia

Posts: 162

Likes: 0

Received 0 Likes

on

0 Posts

if chinese airlines are looking for help how much more other airlines need help?

FT.com / UK - Chinese airlines seek emergency aid

Singapore Airlines limits passenger load factor decline in October, but cargo continues to fall | Centre for Asia Pacific Aviation

SQ

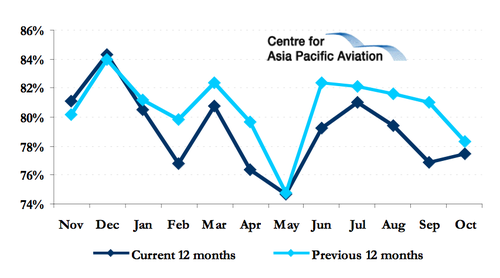

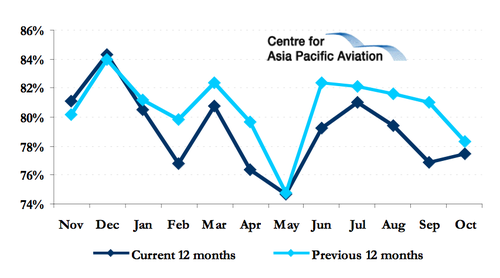

Singapore Airlines passenger load factor for rolling 12 months (%): Nov-08 to Oct-08

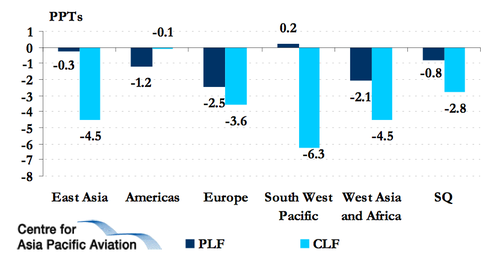

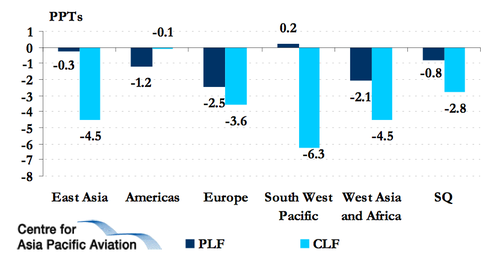

Singapore Airlines passenger load factor and cargo load factor growth by region (%): Nov-08 to Oct-08

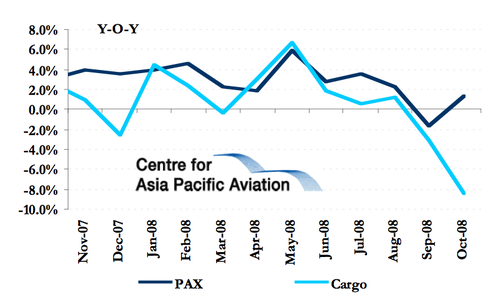

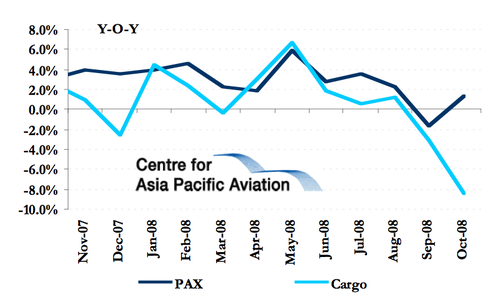

Singapore Airlines passenger numbers vs cargo volume growth (% change year-on-year): Nov-08 to Oct-08

KAL

Korean Air loses USD5.4 million per day in cruel third quarter | Centre for Asia Pacific Aviation

FT.com / UK - Chinese airlines seek emergency aid

China Eastern Airlines and China Southern Airlines, two of the country's three largest state-run carriers, have applied for emergency government subsidies to keep them airborne in the face of rising costs and falling passenger demand.

The airlines told the Financial Times that they had applied to the government for the subsidies after industry-wide losses in the first 10 months of the year totalled Rmb4.2bn ($615m).

The airlines told the Financial Times that they had applied to the government for the subsidies after industry-wide losses in the first 10 months of the year totalled Rmb4.2bn ($615m).

After struggling to cope with record high fuel costs over the past year, Chinese airlines have been hurt even more by the recent big drop in oil prices because of losses stemming from their hedging operations. They have also been hurt by a slowdown in the steady rise of China's currency, the renminbi, against the US dollar.

Most of the heavy debt-load of the Chinese airlines is denominated in US dollars, making them cheaper to service when the renminbi is appreciating.

China Southern's Hong Kong-listed shares, which can be traded freely by international investors, jumped 12 per cent yesterday, while China Eastern's rose 7.6 per cent and Air China's were up 2.5 per cent.

Most of the heavy debt-load of the Chinese airlines is denominated in US dollars, making them cheaper to service when the renminbi is appreciating.

China Southern's Hong Kong-listed shares, which can be traded freely by international investors, jumped 12 per cent yesterday, while China Eastern's rose 7.6 per cent and Air China's were up 2.5 per cent.

SQ

Singapore Airlines passenger load factor for rolling 12 months (%): Nov-08 to Oct-08

Singapore Airlines passenger load factor and cargo load factor growth by region (%): Nov-08 to Oct-08

Singapore Airlines passenger numbers vs cargo volume growth (% change year-on-year): Nov-08 to Oct-08

KAL

Korean Air loses USD5.4 million per day in cruel third quarter | Centre for Asia Pacific Aviation

Korean Air loses USD5.4 million per day in cruel third quarter

Korean Air's shares rose 6.4% on 17-Nov-08 despite the carrier unveiling its biggest quarterly loss in a decade in the third quarter (ended 30-Sep-08). The carrier's net loss reached a breathtaking USD495.7 million in the quarter, compared to a profit of KRW129.6 billion in the same period last year, despite a 16.4% year-on-year increase in revenue.

Korean Air stated, "given current economic conditions, air travel demand will continue to slow down during the fourth quarter and weak cargo demand will continue through the end of this year".

Despite the gloom, investors appear to have seized on management's predictions of an improvement in the airline's fourth-quarter performance on the back of a recent fall in oil prices.

Korean Air's fuel costs rose 83% in the three months to September, due to higher jet fuel prices and the won's sharp (13%) depreciation against the US dollar in the period, which contributed to larger foreign exchange losses and made overseas travel more expensive for Koreans. International travel demand departing from Korea fell 15% during the last quarter.

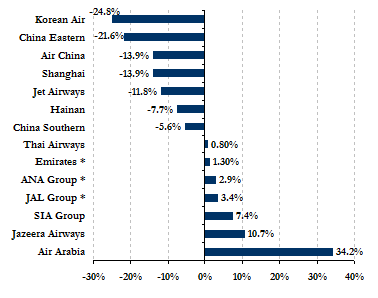

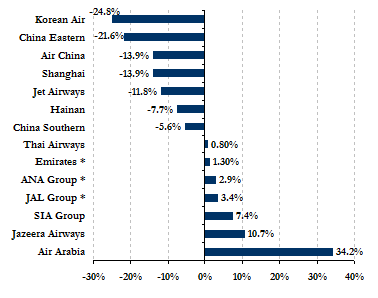

The confluence of bad news for KAL was enough to give it the worst net margin (-24.8%) among Asia Pacific carriers that have reported third quarter earnings to date. It was even worse than the chronic loss-maker, China Eastern, which turned in a negative 21.6% net margin in the quarter and now looks set to receive a multi-million dollar government bailout.

Selected Asia Pacific carriers' net profit margin for the three* months ended 30-Sep-08:

Korean Air's shares rose 6.4% on 17-Nov-08 despite the carrier unveiling its biggest quarterly loss in a decade in the third quarter (ended 30-Sep-08). The carrier's net loss reached a breathtaking USD495.7 million in the quarter, compared to a profit of KRW129.6 billion in the same period last year, despite a 16.4% year-on-year increase in revenue.

Korean Air stated, "given current economic conditions, air travel demand will continue to slow down during the fourth quarter and weak cargo demand will continue through the end of this year".

Despite the gloom, investors appear to have seized on management's predictions of an improvement in the airline's fourth-quarter performance on the back of a recent fall in oil prices.

Korean Air's fuel costs rose 83% in the three months to September, due to higher jet fuel prices and the won's sharp (13%) depreciation against the US dollar in the period, which contributed to larger foreign exchange losses and made overseas travel more expensive for Koreans. International travel demand departing from Korea fell 15% during the last quarter.

The confluence of bad news for KAL was enough to give it the worst net margin (-24.8%) among Asia Pacific carriers that have reported third quarter earnings to date. It was even worse than the chronic loss-maker, China Eastern, which turned in a negative 21.6% net margin in the quarter and now looks set to receive a multi-million dollar government bailout.

Selected Asia Pacific carriers' net profit margin for the three* months ended 30-Sep-08:

Join Date: Mar 2007

Location: South East Asia

Posts: 60

Likes: 0

Received 0 Likes

on

0 Posts

Reality Check?

B747,

Thank you for posting the charts which is as clear as "THE writing on the wall."

Currently the scenario for corporates is like.....Travel only IF required.

Most work now is carried out by Video Conferencing, Web Meeting etc etc.......

Airlines would be one of the last sector's where the boom (or so called +ve growth) will be seen. And the first one will be the Housing market. So only when the housing market starts to pickup once again in the future, should we start discussing about "The Great Upturn in Aviation Industry".

Till then it is Good Night.......I guess its going to be a long cold winter night......

Regards

Thank you for posting the charts which is as clear as "THE writing on the wall."

if chinese airlines are looking for help how much more other airlines need help?

Most work now is carried out by Video Conferencing, Web Meeting etc etc.......

Airlines would be one of the last sector's where the boom (or so called +ve growth) will be seen. And the first one will be the Housing market. So only when the housing market starts to pickup once again in the future, should we start discussing about "The Great Upturn in Aviation Industry".

Till then it is Good Night.......I guess its going to be a long cold winter night......

Regards