UK military ill-prepared to defend an attack, says retired chief

Join Date: Feb 2006

Location: Hanging off the end of a thread

Posts: 33,076

Received 2,942 Likes

on

1,253 Posts

For example the bold decision taken to peg defence spending at 2% of GDP reversed the decline of decades. I thought that was courageous and very successful.

Thread Starter

Join Date: Apr 2010

Location: London

Posts: 7,072

Likes: 0

Received 0 Likes

on

0 Posts

depnds on the relative performance of the economy and inflation in defence costs

as defence costs seems to increase much faster than any others then yes you gradually slip behind.

On the other hand if you keep up the provision (such as on the NHS) the country eventually runs out of cash for anything else

as defence costs seems to increase much faster than any others then yes you gradually slip behind.

On the other hand if you keep up the provision (such as on the NHS) the country eventually runs out of cash for anything else

Anyway, you Russkies will be out of cash just over a year from now.

Ouch.

Ouch.

Russia debt to GDP 17.7%

UK debt to GDP 89.2 %

Russia Gold reserves 1500 tonnes

UK Gold 310 tonnes

Thread Starter

Join Date: Apr 2010

Location: London

Posts: 7,072

Likes: 0

Received 0 Likes

on

0 Posts

Bloomberg:-

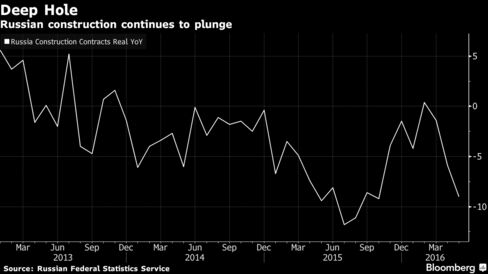

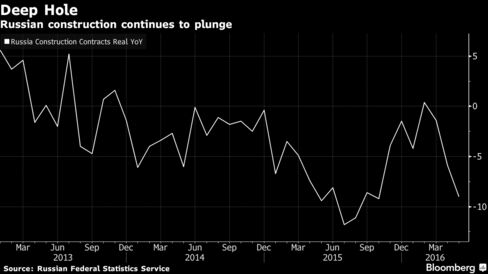

As Russia’s government counts the months to an economic rebound, a bellwether of investment is nearing levels of distress last seen during the throes of a recession seven years ago.

The value of construction works plunged 9 percent from a year earlier in May, the worst showing since October, even as industrial production grew for a second month and consumer indicators from real wages to unemployment improved. A gauge of business confidence in construction dropped to minus 19 last quarter, only two points above the trough reached in 2009, according to a report by an institute at the Higher School of Economics in Moscow.“The recession we are seeing in construction is significantly more painful than in other main industries of the economy,” said Georgy Ostapkovich, head of the Institute for Statistical Studies and Economics of Knowledge that conducted the study based on Federal Statistics Service data.

President Vladimir Putin is looking to harness investment to guide the economy from the longest recession of his 16 years in power after consumer demand collapsed and the worst oil crash in a generation clobbered the public finances of the world’s biggest energy exporter. Together with real estate operations, construction -- which VTB Capital and Goldman Sachs Group Inc. say is a close proxy for investment -- contributed almost 16 percent to gross domestic product in 2015.

ecord Slump

If the outlook and performance of the industry is any indication, an investment-led spurt will be slow to materialize. Capital spending has already posted the longest stretch of declines since at least 1995, when Bloomberg started compiling the data. The Economy Ministry forecasts it will shrink as much 3.1 percent this year.

A bout of falling prices is also afflicting construction, continuing uninterrupted since June 2015. In dollar terms, prices for real estate are down 65 percent since their peak in 2008. The ruble has appreciated more than 12 percent against the dollar this year after a 20 percent loss in 2015.

As Russians wait for prices to rebound, the risk is that the release of pent-up demand will eventually translate into a spike in prices and inflation expectations, according to Ostapkovich.

“Some potential buyers are caught in a deflation trap,” he said. “They are waiting for prices for housing to decline further, trying to catch the bottom.”

As Russia’s government counts the months to an economic rebound, a bellwether of investment is nearing levels of distress last seen during the throes of a recession seven years ago.

The value of construction works plunged 9 percent from a year earlier in May, the worst showing since October, even as industrial production grew for a second month and consumer indicators from real wages to unemployment improved. A gauge of business confidence in construction dropped to minus 19 last quarter, only two points above the trough reached in 2009, according to a report by an institute at the Higher School of Economics in Moscow.“The recession we are seeing in construction is significantly more painful than in other main industries of the economy,” said Georgy Ostapkovich, head of the Institute for Statistical Studies and Economics of Knowledge that conducted the study based on Federal Statistics Service data.

President Vladimir Putin is looking to harness investment to guide the economy from the longest recession of his 16 years in power after consumer demand collapsed and the worst oil crash in a generation clobbered the public finances of the world’s biggest energy exporter. Together with real estate operations, construction -- which VTB Capital and Goldman Sachs Group Inc. say is a close proxy for investment -- contributed almost 16 percent to gross domestic product in 2015.

ecord Slump

If the outlook and performance of the industry is any indication, an investment-led spurt will be slow to materialize. Capital spending has already posted the longest stretch of declines since at least 1995, when Bloomberg started compiling the data. The Economy Ministry forecasts it will shrink as much 3.1 percent this year.

A bout of falling prices is also afflicting construction, continuing uninterrupted since June 2015. In dollar terms, prices for real estate are down 65 percent since their peak in 2008. The ruble has appreciated more than 12 percent against the dollar this year after a 20 percent loss in 2015.

As Russians wait for prices to rebound, the risk is that the release of pent-up demand will eventually translate into a spike in prices and inflation expectations, according to Ostapkovich.

“Some potential buyers are caught in a deflation trap,” he said. “They are waiting for prices for housing to decline further, trying to catch the bottom.”