Originally Posted by

SpamCanDriver

Are you a UK tax specialist?

Because I'm fairly sure this is not correct, if you meet the SRT test you will be liable to pay UK tax.

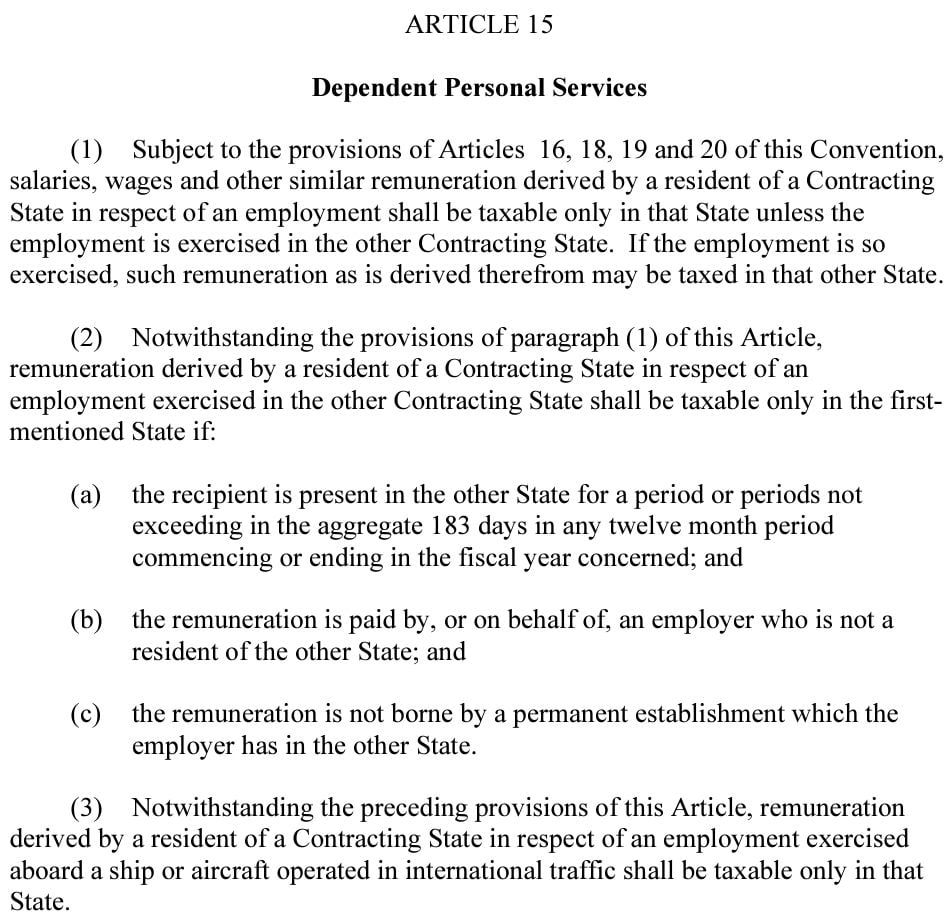

I’m enough of a taxation specialist to know how Article 15 of the DTA’s applies and particularly how Paragraph (3) of Article 15 of the treaty applies, relative to the criteria stipulated in Paragraphs (1) & (2) of said treaty, specifically in relation to fiscal residency in the various fiscal jurisdictions.

UK-KSA DTA. Bilateral Tax Agreement 2009.

The taxation strategy utilised by many BA, Virgin Atlantic pilots, as well as other UK pilots, since the mid 1980’s, to effectively reduce their taxation on their pilot salaries to negligible amounts was engineered by myself back in the early 1980’s. In particular, how the bilateral DTA’s were applied between the UK and many EU fiscal jurisdictions. In this regard France comes to mind, followed by Spain, Portugal, Germany, Ireland & Switzerland.

Back in the mid 1980’s there were literally only a handful of UK pilots utilising the strategy, myself amongst them. A decade later there were hundreds utilising it. I’ve also advised UK and European aircrew colleagues, as well as others over the years, on how to utilise the strategy in fiscal jurisdictions in Hong Kong, North America, Singapore and Australasia.

I was first in Saudi Arabia in the early 1980’s. From 2012 I worked for Saudi Arabian Airlines, where I was amongst a handful of British expats working for that airline on one of their long haul fleets. I commuted each month as an ACM back to the UK & Europe. Throughout the 10 years I was with Saudi Arabian I didn’t pay any UK tax despite visiting every month, having a property there and submitting a Self Assessment Tax Return each year.

BTW, for those “not in the know”, Saudi Arabian was always the highest paid of ALL the Middle Eastern carriers by a long margin and had always been since the early 1980’s. If you were a top scale Captain at that airline, during that time period, then your salary was nearly the equivalent to that earned in the big American legacy carriers and tax free at that. It was the best paid flying job outside of the big USA legacy carriers by a big margin, excepting perhaps Cathy Pacific in its heyday when their “A” scale still existed.

So, in closing, I wouldn’t say I’m an expert on this particular taxation issue or strategy but without being immodest, I’m probably as much as an expert on this subject as you’ll find on this forum..

PS. If I were a betting man, then I’d wager that in 5 to 10 years time, RIA will the one of the best, highest paying, expatriate flying jobs around.

Throughout the late 1970’s, through to the mid 1990’, Saudi Arabian utilised reverse basing for their crews. They had crew bases in Athens, Bangkok, Jeddah, London, New York, Manila & Paris. My wife worked for them during that era, initially being based in Jeddah but subsequently based in Bangkok, then London. During that whole period her salary as a Flight Attendant with Saudia was more than my salary as a junior First Officer at British Airways.

The salary of a Saudia Captain during that era was easily double what an equivalent long haul BA Captain was earning.

Once RIA gets going and starts to expand rapidly, then I wouldn’t underestimate the possibility that it’ll become one of the best, if not the best, expatriate flying job available.