Originally Posted by

CurtainTwitcher

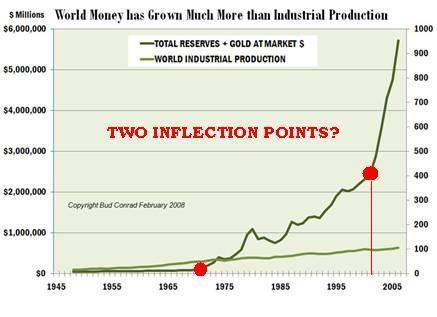

Events of Sunday the 15th of August 1971 set in motion the debt train wreck that was always going to happen. The only problem was identifying the date of the accident with any accuracy.

Notice how the amount of debt (credits = money to the counterparty) outstripped production from not long after that date. We have lived in a debt as money world since 1971, the outcome was inevitable. We were ALL forced to play the game.

Source:

https://web.archive.org/web/20130518...nflation-5.JPG

Finally, someone I can relate to who isn’t inside the matrix! Spot on, Nixon and his puppet masters pulled a stunt that ultimately would force most people away from the one thing the Fed can’t ‘fake’ - gold. Everything since then has been ‘fake’ wealth - printed money, paper bonds, algorithms on a PC. They don’t want gold as a currency because they can’t fully control it, manipulate it, fake it and so on. Metals are actually real. Sadly, the chickens have come home to roost. Interestingly when you study economics and finance you see a historical pattern where we have a ‘reset’ roughly every 40 years. The match on the current Ponzi scheme was lit in 1971 and its now a full blown inferno. COVID-19 is the straw that finally broke the camels back. The worlds economies have been failing/propped up/failing for years. Think about it - negative interest rates, quantitative easing (printing money), or even worse - digital money backed by nothing and printed on nothing. Fake money. The more they print the greater the eventual collapse. It has helped to destroy the middle class and cause inflation that is so high that you need to earn $150k per year upwards just to have a moderately comfortable existence. The 2008 GFC was the ‘precursor bubble’ - banks, financial institutions and corporations went bust. The big bubble, the real bubble has started to burst - bankrupt countries and we’ve already seen Greece, Spain, Portugal as examples. Now the only remaining and supposedly strong fiscal country Germany is deep in the crap, along with the UK and USA. The USA has a confirmed debt of $23 trillion with real estimates of up to $300 trillion. It was never going to last.

Hold onto your hats, this **** is about to get real.