Jetstar flying more pax than QF

Thread Starter

Join Date: Nov 2005

Location: Ozzzzzzz

Posts: 229

Likes: 0

Received 0 Likes

on

0 Posts

Jetstar flying more pax than QF

Budget airline Jetstar carrying more international passengers than Qantas | News.com.au

BUDGET airline Jetstar is carrying significantly more people on international flights than Qantas, which continues to lose passengers on overseas routes.

The October traffic update, published today, shows Jetstar International and Jetstar Asia carried a total of 3 million passengers in the last 12 months compared with Qantas Internationalís 1.9 million.

Month on month, Jetstar transported 758,000 overseas compared with 499,000 on the Flying Kangaroo.

Whereas Jetstarís passengers grew year on year by almost 100,000, Qantas lost ground to the tune of 24,000 passengers (1.2 per cent).

Time to demand more money Jetstar Pilots.

BUDGET airline Jetstar is carrying significantly more people on international flights than Qantas, which continues to lose passengers on overseas routes.

The October traffic update, published today, shows Jetstar International and Jetstar Asia carried a total of 3 million passengers in the last 12 months compared with Qantas Internationalís 1.9 million.

Month on month, Jetstar transported 758,000 overseas compared with 499,000 on the Flying Kangaroo.

Whereas Jetstarís passengers grew year on year by almost 100,000, Qantas lost ground to the tune of 24,000 passengers (1.2 per cent).

Time to demand more money Jetstar Pilots.

Agreed. How many Jetstar Asia pax are SIN-KUL for $7.99, plus the [optional] cost of a muffin?

Amaazing business model.

Correction: Actually [to my astonishment] I overquoted. The cheapest Jetstar flight next Tuesday quoted on Webjet is in fact $A4.47. Choice of several flights at this price.

From Webjet:

Amaazing business model.

Correction: Actually [to my astonishment] I overquoted. The cheapest Jetstar flight next Tuesday quoted on Webjet is in fact $A4.47. Choice of several flights at this price.

From Webjet:

Jetstar from Singapore to Kuala Lumpur Airfare $ 4.47

Payment and Service Fee (Jetstar Flights) $ 8.50

Jetstar Tax Fees $ 37.53

Payment and Service Fee (Jetstar Flights) $ 8.50

Jetstar Tax Fees $ 37.53

Last edited by Captain Gidday; 28th Nov 2014 at 20:15.

Time to demand more money Jetstar Pilots.

Pretty sure that ALL overseas operations including Jetstar NZ are counted as 'INTERNATIONAL'

Jetstar will never have more than 6 aircraft.

More disappointing than the lies was the fact that the majority of people lapped it up with a spoon.

Meanwhile the shifting of work to the cheaper cost base continued, largely uncontested, and some sheep with starry eyes jumped for a quick command.

So a few years on, luckily the only damage we have to show for it is one potentially rooted 787, and QF international an empty shell of its former self, particularly the international business.

When, and only when, Australia buries a FAR 25 aeroplane into the ground and there's actually blood on the walls will these minor details (and the current situation at the regulator) emerge as actually being important details.

Join Date: Sep 2011

Location: Hicks House

Age: 77

Posts: 88

Likes: 0

Received 0 Likes

on

0 Posts

What I want to know is, the 767 has 1 month left.

Most domestic legs are >85% pax capacity, so quite full.

Now with the removal of all 767's.. Where do the surplus pax go? Virgin? Tiger?

Most domestic legs are >85% pax capacity, so quite full.

Now with the removal of all 767's.. Where do the surplus pax go? Virgin? Tiger?

Lies, damned lies, and statistics...

Jetstar International has been gifted all of the intl flying ex PER and OOL and much of it ex MEL. They are acheduled to depart less than half an hour, often five minutes, before every Qantas service from SIN. The first departure gets priority on all of the booking sites. Yet they always have scores fewer passengers.

QF meanwhile has been hamstrung by idiotic schedules, routes via Dubai, an EK codeshare that is so skewed in favour of EK that we might as well not even bother. (Thanks, Joyce).

Oh...last year JQ lost $116 million. QF Intl was cash flow positive, and now that the looter executives have fixed the (fraudulent?) book values of aircraft is again profitable. So JQ's plan seems to be to lose a liitle money on every seat in the plane yet some how make it up with volume? Aaaaaamaaaaazing!

Jetstar International has been gifted all of the intl flying ex PER and OOL and much of it ex MEL. They are acheduled to depart less than half an hour, often five minutes, before every Qantas service from SIN. The first departure gets priority on all of the booking sites. Yet they always have scores fewer passengers.

QF meanwhile has been hamstrung by idiotic schedules, routes via Dubai, an EK codeshare that is so skewed in favour of EK that we might as well not even bother. (Thanks, Joyce).

Oh...last year JQ lost $116 million. QF Intl was cash flow positive, and now that the looter executives have fixed the (fraudulent?) book values of aircraft is again profitable. So JQ's plan seems to be to lose a liitle money on every seat in the plane yet some how make it up with volume? Aaaaaamaaaaazing!

The Qantas Group has almost the identical revenue now as it had in 2008($15.2 billion) yet it has 40% more aircraft. 2008 a profit if $1.4 billion, 2014 a loss of $2.8 billion,write-downs do affect shareholder value). The difference is? You work it out!

1st rule of business.

You WILL go broke selling dollar bills for 50c.

You WILL go broke selling dollar bills for 50c.

Qantas could have been and should be 'the gorilla' of Aviation in Australia and the Pacific Basin. It had the opportunity at its feet when Ansett collapsed but the damage was partly wrought by then with a Management obsesssed with domestic operations whose world ended at Darwin and Perth. The same attitudes appear to have continued to this day with a further obsession -Jetstar - that excludes the well-being of the core business. The agenda and strategy has to be a complete mystery.

Join Date: Mar 2007

Location: australia

Age: 74

Posts: 907

Likes: 0

Received 0 Likes

on

0 Posts

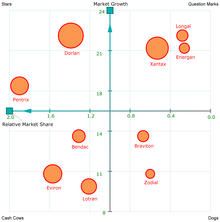

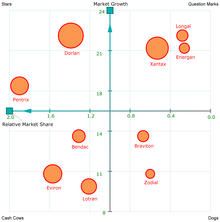

Is this/was the Game plan Qantas management are/were following?

Growth–share matrix

Portfolio growth–share matrix

As BCG stated in 1970:

BCG-matrix.png

"To be successful, a company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows. High growth products require cash inputs to grow. Low growth products should generate excess cash. Both kinds are needed simultaneously."—Bruce Henderson

For each product or service, the 'area' of the circle represents the value of its sales. The growth–share matrix thus offers a "map" of the organization's product (or service) strengths and weaknesses, at least in terms of current profitability, as well as the likely cashflows.

The need which prompted this idea was, indeed, that of managing cash-flow. It was reasoned that one of the main indicators of cash generation was relative market share, and one which pointed to cash usage was that of market growth rate.

Relative market share

This indicates likely cash generation, because the higher the share the more cash will be generated. As a result of 'economies of scale' (a basic assumption of the BCG Matrix), it is assumed that these earnings will grow faster the higher the share. The exact measure is the brand's share relative to its largest competitor. Thus, if the brand had a share of 20 percent, and the largest competitor had the same, the ratio would be 1:1. If the largest competitor had a share of 60 percent; however, the ratio would be 1:3, implying that the organization's brand was in a relatively weak position. If the largest competitor only had a share of 5 percent, the ratio would be 4:1, implying that the brand owned was in a relatively strong position, which might be reflected in profits and cash flows. If this technique is used in practice, this scale is logarithmic, not linear.

On the other hand, exactly what is a high relative share is a matter of some debate. The best evidence is that the most stable position (at least in fast-moving consumer goods markets) is for the brand leader to have a share double that of the second brand, and triple that of the third. Brand leaders in this position tend to be very stable—and profitable; the Rule of 123

The reason for choosing relative market share, rather than just profits, is that it carries more information than just cash flow. It shows where the brand is positioned against its main competitors, and indicates where it might be likely to go in the future. It can also show what type of marketing activities might be expected to be effective.

Market growth rate

Rapidly growing in rapidly growing markets, are what organizations strive for; but, as we have seen, the penalty is that they are usually net cash users – they require investment. The reason for this is often because the growth is being 'bought' by the high investment, in the reasonable expectation that a high market share will eventually turn into a sound investment in future profits. The theory behind the matrix assumes, therefore, that a higher growth rate is indicative of accompanying demands on investment. The cut-off point is usually chosen as 10 per cent per annum. Determining this cut-off point, the rate above which the growth is deemed to be significant (and likely to lead to extra demands on cash) is a critical requirement of the technique; and one that, again, makes the use of the growth–share matrix problematical in some product areas. What is more, the evidence, from fast-moving consumer goods markets at least, is that the most typical pattern is of very low growth, less than 1 per cent per annum. This is outside the range normally considered in BCG Matrix work, which may make application of this form of analysis unworkable in many markets. Where it can be applied, however, the market growth rate says more about the brand position than just its cash flow. It is a good indicator of that market's strength, of its future potential (of its 'maturity' in terms of the market life-cycle), and also of its attractiveness to future competitors. It can also be used in growth analysis.

Growth–share matrix

Portfolio growth–share matrix

- The growth–share matrix (aka the product portfolio, BCG-matrix, Boston matrix, Boston Consulting Group analysis, portfolio diagram) is a chart that was created by Bruce D. Henderson for the Boston Consulting Group in 1970 to help corporations to analyze their business units, that is, their product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis. Analysis of market performance by firms using its principles has recently called its usefulness into question.

Overview

To use the chart, analysts plot a scatter graph to rank the business units (or products) on the basis of their relative market shares and growth rates.

- Cash cows is where a company has high market share in a slow-growing industry. These units typically generate cash in excess of the amount of cash needed to maintain the business. They are regarded as staid and boring, in a "mature" market, yet corporations value owning them due to their cash generating qualities. They are to be "milked" continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

- Dogs, more charitably called pets, are units with low market share in a mature, slow-growing industry. These units typically "break even", generating barely enough cash to maintain the business's market share. Though owning a break-even unit provides the social benefit of providing jobs and possible synergies that assist other business units, from an accounting point of view such a unit is worthless, not generating cash for the company. They depress a profitable company's return on assets ratio, used by many investors to judge how well a company is being managed. Dogs, it is thought, should be sold off.

- Question marks (also known as problem children) are business operating in a high market growth, but having a low market share. They are a starting point for most businesses. Question marks have a potential to gain market share and become stars, and eventually cash cows when market growth slows. If question marks do not succeed in becoming a market leader, then after perhaps years of cash consumption, they will degenerate into dogs when market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

- Stars are units with a high market share in a fast-growing industry. They are graduated question marks with a market or niche leading trajectory, for example: amongst market share front-runners in a high-growth sector, and/or having a monopolistic or increasingly dominant USP with burgeoning/fortuitous proposition drive(s) from: novelty (e.g. Last.FM upon CBS Interactive's due diligence), fashion/promotion (e.g. newly prestigious celebrity branded fragrances), customer loyalty (e.g. greenfield or military/gang enforcement backed, and/or innovative, grey-market/illicit retail of addictive drugs, for instance the British East India Company's, late-1700s opium-based Qianlong Emperor embargo-busting, Canton System), goodwill (e.g. monopsonies) and/or gearing (e.g. oligopolies, for instance Portland cement producers near boomtowns), etc. The hope is that stars become next cash cows.

As BCG stated in 1970:

Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities. The balanced portfolio has:

Practical use- stars whose high share and high growth assure the future;

- cash cows that supply funds for that future growth; and

- question marks to be converted into stars with the added funds.

BCG-matrix.png

"To be successful, a company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows. High growth products require cash inputs to grow. Low growth products should generate excess cash. Both kinds are needed simultaneously."—Bruce Henderson

For each product or service, the 'area' of the circle represents the value of its sales. The growth–share matrix thus offers a "map" of the organization's product (or service) strengths and weaknesses, at least in terms of current profitability, as well as the likely cashflows.

The need which prompted this idea was, indeed, that of managing cash-flow. It was reasoned that one of the main indicators of cash generation was relative market share, and one which pointed to cash usage was that of market growth rate.

Relative market share

This indicates likely cash generation, because the higher the share the more cash will be generated. As a result of 'economies of scale' (a basic assumption of the BCG Matrix), it is assumed that these earnings will grow faster the higher the share. The exact measure is the brand's share relative to its largest competitor. Thus, if the brand had a share of 20 percent, and the largest competitor had the same, the ratio would be 1:1. If the largest competitor had a share of 60 percent; however, the ratio would be 1:3, implying that the organization's brand was in a relatively weak position. If the largest competitor only had a share of 5 percent, the ratio would be 4:1, implying that the brand owned was in a relatively strong position, which might be reflected in profits and cash flows. If this technique is used in practice, this scale is logarithmic, not linear.

On the other hand, exactly what is a high relative share is a matter of some debate. The best evidence is that the most stable position (at least in fast-moving consumer goods markets) is for the brand leader to have a share double that of the second brand, and triple that of the third. Brand leaders in this position tend to be very stable—and profitable; the Rule of 123

The reason for choosing relative market share, rather than just profits, is that it carries more information than just cash flow. It shows where the brand is positioned against its main competitors, and indicates where it might be likely to go in the future. It can also show what type of marketing activities might be expected to be effective.

Market growth rate

Rapidly growing in rapidly growing markets, are what organizations strive for; but, as we have seen, the penalty is that they are usually net cash users – they require investment. The reason for this is often because the growth is being 'bought' by the high investment, in the reasonable expectation that a high market share will eventually turn into a sound investment in future profits. The theory behind the matrix assumes, therefore, that a higher growth rate is indicative of accompanying demands on investment. The cut-off point is usually chosen as 10 per cent per annum. Determining this cut-off point, the rate above which the growth is deemed to be significant (and likely to lead to extra demands on cash) is a critical requirement of the technique; and one that, again, makes the use of the growth–share matrix problematical in some product areas. What is more, the evidence, from fast-moving consumer goods markets at least, is that the most typical pattern is of very low growth, less than 1 per cent per annum. This is outside the range normally considered in BCG Matrix work, which may make application of this form of analysis unworkable in many markets. Where it can be applied, however, the market growth rate says more about the brand position than just its cash flow. It is a good indicator of that market's strength, of its future potential (of its 'maturity' in terms of the market life-cycle), and also of its attractiveness to future competitors. It can also be used in growth analysis.

Last edited by blow.n.gasket; 29th Nov 2014 at 05:00.