[UK] - Tax credit / Food expenses

Thread Starter

Join Date: May 2017

Location: EASA land

Posts: 16

Likes: 0

Received 0 Likes

on

0 Posts

Hi,

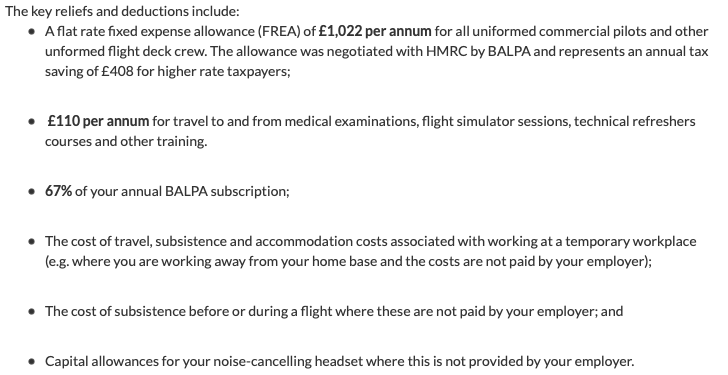

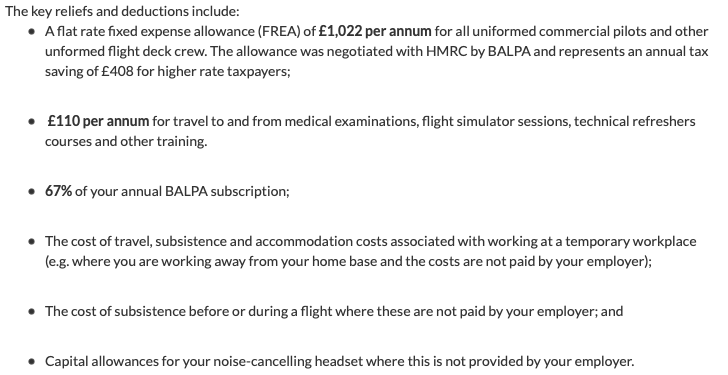

I am based in the UK where I pay my taxes (HMRC, PAYE). I already know the existence of the 1,022£ flat rate fixed expense allowance (FREA), which I am now using.

However, I was flying with a colleague who told me that whenever he was buying some food to be consumed in flight, he was keeping the receipts and claiming some tax credit on it.

At first I was a bit surprised but then, after looking on BALPA's website, I found the following:

BALPA reliefs

https://blog.balpa.org/Blog/January-...not-know-about

I don't have the BALPA tax guide where this is explained in further details.

Could someone please give me some more information about the "cost of subsistence before or during a flight" (how long before the flight, what to do with the receipts, are there any limits to be aware of, how to claim, ...)

Thank you for your help !

I am based in the UK where I pay my taxes (HMRC, PAYE). I already know the existence of the 1,022£ flat rate fixed expense allowance (FREA), which I am now using.

However, I was flying with a colleague who told me that whenever he was buying some food to be consumed in flight, he was keeping the receipts and claiming some tax credit on it.

At first I was a bit surprised but then, after looking on BALPA's website, I found the following:

BALPA reliefs

https://blog.balpa.org/Blog/January-...not-know-about

I don't have the BALPA tax guide where this is explained in further details.

Could someone please give me some more information about the "cost of subsistence before or during a flight" (how long before the flight, what to do with the receipts, are there any limits to be aware of, how to claim, ...)

Thank you for your help !

Join Date: Mar 2012

Location: Between 0 and 41000 ft

Age: 35

Posts: 169

Likes: 0

Received 0 Likes

on

0 Posts

This was valid in 2019/20 so it might be out of date. Your best bet is to call HMRC and ask.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

Thread Starter

Join Date: May 2017

Location: EASA land

Posts: 16

Likes: 0

Received 0 Likes

on

0 Posts

This was valid in 2019/20 so it might be out of date. Your best bet is to call HMRC and ask.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

Thank you for your answer, even if it might not be up to date it seems to be consistent with what my colleague told me. It clarifies a lot !

So I guess I will have to start to keep those receipts after all

Join Date: Mar 2012

Location: Between 0 and 41000 ft

Age: 35

Posts: 169

Likes: 0

Received 0 Likes

on

0 Posts

In fairness you will save more by eating proper meals that are cheaper than offseting tax from expensive crap food. Saying this, I know some of us don't have a choice sometimes.

Join Date: Dec 2012

Location: ...

Posts: 726

Likes: 0

Received 0 Likes

on

0 Posts

This was valid in 2019/20 so it might be out of date. Your best bet is to call HMRC and ask.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

Record of employment related expenses (trip related expenses):

The following notes provide specific guidance on the range of costs and expenses which, in practice, should attract tax relief. The guidance reflects HMRC policy, some of which is disputed by BALPA and, when a suitable test case is identified, will be challenged on appeal to the appropriate tribunal. In the meantime, the following is designed to assist members in recording expenditure which we believe is non-contentious.

Day flights (return to base)

• Food and refreshments (including snacks) purchased to supplement onboard crew meals and refreshments.

• Purchased at the airport within one hour of reporting for duty,

• Onboard purchases (additional food/drinks of the same type as provided free are not allowed).

If on board items are paid for at the end of a duty period, note this on the record of expenditure, otherwise HMRC will treat the claim as a multiple purchase for more than one person. Purchases made after return to base or very near the end of a duty period will not be allowed.

Night stops

Food and refreshments to supplement outward flights – the same rules as for day flights apply.

• Food and refreshments down route (meals, non-alcoholic drinks and snacks, etc.), including items purchased away from base between sectors

• Alcoholic drinks (in reasonable quantity but only if consumed with a meal)

• Taxi fares to restaurants away from the hotel but only where the hotel restaurant is unsuitable (i.e. the choice of a restaurant away from the hotel was not a matter of personal taste)

In the case of group bills, items consumed by the claimants should be noted on the receipt, otherwise HMRC will divide the bill by the number of covers shown. You should all keep a copy of the receipt.

Other points

• Pilots should always itemise purchases

• Where a receipt is not obtainable, record full details as to the nature of the expenditure and why

• Work related internet costs and work related phone call charges are allowable and should be recorded (and supported with a receipt)

• All purchases of food and drink made on return to base will be disallowed.

So, is that included in the frea or is something apart?

How do I get this item/receipt be actually relieved on tax return? With the accountant? I believe mine is already applying this frea relief, I'm not aware if I can claim more. I have a UK contract with and EU airline and I'm always out of base.

Join Date: Mar 2012

Location: Between 0 and 41000 ft

Age: 35

Posts: 169

Likes: 0

Received 0 Likes

on

0 Posts

Not part of the FREA AFAIK.

Make sure you are a UK resident for tax purposes (I'm assuming that you are out of base in the EU, not UK)

Make sure you are a UK resident for tax purposes (I'm assuming that you are out of base in the EU, not UK)

There are two issues here. FREA and subsistence allowance (SA). If you get SA, each company will negotiate with HMRC (UK) what proportion of that hourly rate will be taxed at your marginal rate and what will be tax free. To gauge that actual expenditure matches the tax free element of SA, pilots are sometimes asked to keep receipts of their actual expenditure over a period to check that they are actually spending the allowance on subsistence. Any SA paid over what is used is regarded as income and taxed as such. Obviously, this is averaged out over the workforce and not applied individually. If you feel that your expenditure exceeds your allowance, you may present receipts to HMRC.