Hainan Airlines

Join Date: Jun 2011

Location: hang on let me check

Posts: 654

Likes: 0

Received 0 Likes

on

0 Posts

Yes, disregarding what roster pattern you get, as long as you live in China as a full time resident and donít have your wife and kids living anywhere else in the world (going to school, using doctors etc..) then you of course pay taxes only in China. I wouldnít see a problem with doing that, in fact it could be a nice adventure.

Knowing my fellow colleagues though, I strongly suspect a lot do not plan to do that, and if your kids go to school in the uk for example, then there is where you will be paying (a lot of) taxes, even if you spend there 30 days per year.

Knowing my fellow colleagues though, I strongly suspect a lot do not plan to do that, and if your kids go to school in the uk for example, then there is where you will be paying (a lot of) taxes, even if you spend there 30 days per year.

Only half a speed-brake

Join Date: May 2017

Location: Beijing

Posts: 15

Likes: 0

Received 0 Likes

on

0 Posts

Not correct. Some countries like Australia, have double taxation agreements. I am a resident of both China and Australia for taxation purposes. I submit my tax return in Australia and pay zero tax. So I get to keep the full amount of my USD salary.

Join Date: Jun 2011

Location: hang on let me check

Posts: 654

Likes: 0

Received 0 Likes

on

0 Posts

Join Date: May 2017

Location: Beijing

Posts: 15

Likes: 0

Received 0 Likes

on

0 Posts

Wrong again. China has over 100 agreements with countries on the avoidance of double taxation. You may want to google it for your own information.

Join Date: Aug 2018

Location: Earth

Posts: 4

Likes: 0

Received 0 Likes

on

0 Posts

Thanks for your comments guys, really helpful indeed.

I am doing ok tax wise as before I sign a contract I am planning to seek advice from a tax consultant.

Brigbackthe80s - I like your conservative approach. Believe me that's what I would be doing too just to ensure that I keep all contingencies in mind.

FlyingUpsideDown- Thanks mate. Will definitely do more research on the double tax agreement!

Cheers

I am doing ok tax wise as before I sign a contract I am planning to seek advice from a tax consultant.

Brigbackthe80s - I like your conservative approach. Believe me that's what I would be doing too just to ensure that I keep all contingencies in mind.

FlyingUpsideDown- Thanks mate. Will definitely do more research on the double tax agreement!

Cheers

Join Date: Oct 2018

Location: Canada

Posts: 4

Likes: 0

Received 0 Likes

on

0 Posts

Safest country in the world bud

Join Date: Nov 2004

Location: China

Posts: 12

Likes: 0

Received 0 Likes

on

0 Posts

Lostmywaycanuk, you must be a really unlucky guy, on my flights when instructors made the checks, they are using E-cigarettes something I donít bother me. Of course, between more than 2000 pilots a few maybe break the rules

Only half a speed-brake

It never hurts to refresh old knowledge.

US-PRC

UK-PRC

Nothing seems to have changed since 5 NOV, lucky me can stick with the old tricks. Feel free to PM me when you are ready to discuss Article 22.

2 pc of advice for your wait:

- never take a tax advice from a pilot

- never take a tax advice from a online forum

US-PRC

UK-PRC

Nothing seems to have changed since 5 NOV, lucky me can stick with the old tricks. Feel free to PM me when you are ready to discuss Article 22.

2 pc of advice for your wait:

- never take a tax advice from a pilot

- never take a tax advice from a online forum

Join Date: Dec 2007

Location: ASIA

Posts: 42

Likes: 0

Received 0 Likes

on

0 Posts

It never hurts to refresh old knowledge.

US-PRC

UK-PRC

Nothing seems to have changed since 5 NOV, lucky me can stick with the old tricks. Feel free to PM me when you are ready to discuss Article 22.

2 pc of advice for your wait:

- never take a tax advice from a pilot

- never take a tax advice from a online forum

US-PRC

UK-PRC

Nothing seems to have changed since 5 NOV, lucky me can stick with the old tricks. Feel free to PM me when you are ready to discuss Article 22.

2 pc of advice for your wait:

- never take a tax advice from a pilot

- never take a tax advice from a online forum

You have just proven me right and you wrong. Thank you.

Only half a speed-brake

Let's agree in writing then. Otherwise, this may get confusing for people not on our expert level.

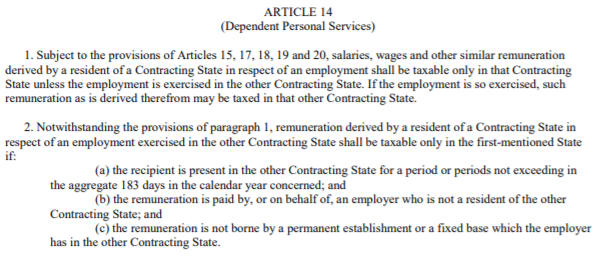

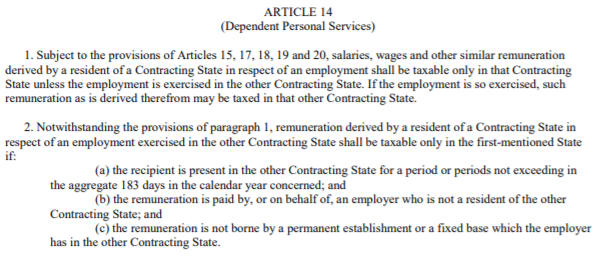

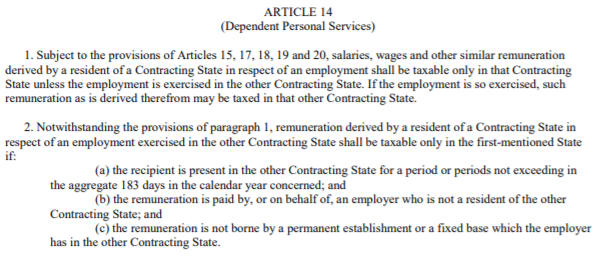

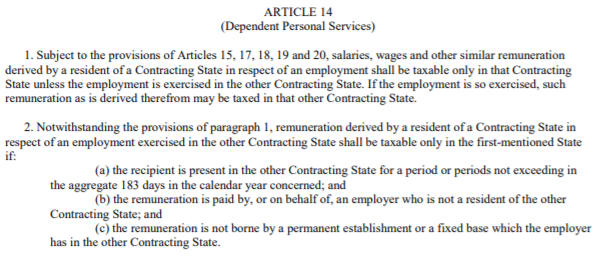

"The number of days per the calendar year one stays in PR China, or abroad from own's country, does not change a thing about how the taxes should be done. In avoidance of doubt, namely the (result of) half-a-year test (183 days)

Signed: ........

"The number of days per the calendar year one stays in PR China, or abroad from own's country, does not change a thing about how the taxes should be done. In avoidance of doubt, namely the (result of) half-a-year test (183 days)

- [for US] Has no effect. Paragraph 2 will be activated if all (a)+(b)+(c) = TRUE. In our situation discussed both (b) as well as (c) are FALSE indeed, thus regardless of (a) the paragraph 2 is always void."

- [non-US] Does not enter the equation at all /see notwithstanding here/.

Signed: ........

Last edited by FlightDetent; 29th Oct 2018 at 21:39. Reason: grammar

Join Date: Nov 2018

Location: World

Posts: 9

Likes: 0

Received 0 Likes

on

0 Posts

Chinese law prohibits direct employment by any Chinese airline, all flight crews are employed by an agency.

For tax reasons for the airlines most (probably all) are located in Hongkong. You are employed and paid by the agency. The agency then puts you on a service agreement with the Chinese airline, you are leased back for which the agency gets a fee.

Basically there are two contracts: 1 between you and the agency and 2 service contract between the agency and the airline.

You need to legally dissect the tax agreement:

All tax treaties are based on the OECD model treaty and adapted to the specific situation between the contracting states.

Remember the treaty is not written with the tax payer in mind, but with the tax collector in mind, the title is misleading (as usual...)

Part 1 of all the treaties describes which state CAN collect the tax, it decides which state gets the full 'lute'.

Part 2 describes if the other state can still get some of the tax if the tax is higher than in the first state (preventing double taxation).

Incidentally that gives the outcome for us personally; as where to pay which tax.

First you will have to find out where you are a resident, that depends on art. 4

If you only have a permanent home in your home country, you are a resident there.

If you only have a permanent home in China, you are resident there.

If you have both a permanent home in your home country and China, it depends on where the centre of vital interest is; where your family is, schools, clubs, etc

If you have no permanent home in either, you are a resident where you have your habitual abode (where are you normally spend most of your time)

If all the above is not applicable you are deemed a resident from the State your are a national of.

Permanent home is not a hotel....

For arguments sake lets put it that you are deemed a resident of your home country:

Art. 14/15 would then be as follows:

1. In principle your home country (contracting state) can collect tax on your world income, however if part of that is earned in China (other state), China can tax you on that part.

As a general rule taxes in our home countries are higher than in China, according to art. 23 from the model (different per treaty, for instance UK art. 22)

the home country can then collect the difference between the two.

2. Notwithstanding: even though article 1 gives China the right to collect tax, in case of the following 3 are true, ONLY the home country can collect tax:

a) backward reasoning: you have been less than 183 days in China (more than 183 days in your home country)

AND

b) your are paid by your agency which is in itself NOT a resident of China (they reside in Hongkong)

AND

c) The agency is a separate entity form the airline.

Normally we are more than 183 days in China (or less the 183 days in your home country)

a) is not true...

b) is true

c) might be true depending on your agency

As it was AND for all 3 that means that paragraph 2 is not applicable and both China and your home country may collect tax.

Then art 15 paragraph 3:

Notwithstanding: Even if art 1+2 where applicable, if the employment involves international traffic on aircraft, China (the other state) may collect tax.

Which is the case for us, so China may collect tax as well as your home country.

Mark the difference between the wording in art. 1+3 and art. 2: In art. 2 it explicitly mentions that ONLY the home country can collect tax, in 1+3 the wording is such that BOTH the home country and China can collect tax, in that case you pay full tax in China where that amount is then deducted towards tax owed in your home country.

If your are deemed a China resident it is all very simple, you only pay taxes in China unless you have income in your home country.

So make sure you are seen as a resident of China!

Different treaties have different rules concerning double tax and what you own to whom, but this is the basic, so check your home countries tax agreement with China to see what needs to be payed and do inform yourself with expert councel.

For tax reasons for the airlines most (probably all) are located in Hongkong. You are employed and paid by the agency. The agency then puts you on a service agreement with the Chinese airline, you are leased back for which the agency gets a fee.

Basically there are two contracts: 1 between you and the agency and 2 service contract between the agency and the airline.

You need to legally dissect the tax agreement:

All tax treaties are based on the OECD model treaty and adapted to the specific situation between the contracting states.

Remember the treaty is not written with the tax payer in mind, but with the tax collector in mind, the title is misleading (as usual...)

Part 1 of all the treaties describes which state CAN collect the tax, it decides which state gets the full 'lute'.

Part 2 describes if the other state can still get some of the tax if the tax is higher than in the first state (preventing double taxation).

Incidentally that gives the outcome for us personally; as where to pay which tax.

First you will have to find out where you are a resident, that depends on art. 4

If you only have a permanent home in your home country, you are a resident there.

If you only have a permanent home in China, you are resident there.

If you have both a permanent home in your home country and China, it depends on where the centre of vital interest is; where your family is, schools, clubs, etc

If you have no permanent home in either, you are a resident where you have your habitual abode (where are you normally spend most of your time)

If all the above is not applicable you are deemed a resident from the State your are a national of.

Permanent home is not a hotel....

For arguments sake lets put it that you are deemed a resident of your home country:

Art. 14/15 would then be as follows:

1. In principle your home country (contracting state) can collect tax on your world income, however if part of that is earned in China (other state), China can tax you on that part.

As a general rule taxes in our home countries are higher than in China, according to art. 23 from the model (different per treaty, for instance UK art. 22)

the home country can then collect the difference between the two.

2. Notwithstanding: even though article 1 gives China the right to collect tax, in case of the following 3 are true, ONLY the home country can collect tax:

a) backward reasoning: you have been less than 183 days in China (more than 183 days in your home country)

AND

b) your are paid by your agency which is in itself NOT a resident of China (they reside in Hongkong)

AND

c) The agency is a separate entity form the airline.

Normally we are more than 183 days in China (or less the 183 days in your home country)

a) is not true...

b) is true

c) might be true depending on your agency

As it was AND for all 3 that means that paragraph 2 is not applicable and both China and your home country may collect tax.

Then art 15 paragraph 3:

Notwithstanding: Even if art 1+2 where applicable, if the employment involves international traffic on aircraft, China (the other state) may collect tax.

Which is the case for us, so China may collect tax as well as your home country.

Mark the difference between the wording in art. 1+3 and art. 2: In art. 2 it explicitly mentions that ONLY the home country can collect tax, in 1+3 the wording is such that BOTH the home country and China can collect tax, in that case you pay full tax in China where that amount is then deducted towards tax owed in your home country.

If your are deemed a China resident it is all very simple, you only pay taxes in China unless you have income in your home country.

So make sure you are seen as a resident of China!

Different treaties have different rules concerning double tax and what you own to whom, but this is the basic, so check your home countries tax agreement with China to see what needs to be payed and do inform yourself with expert councel.

This might be true in your case, but not for others.

It is in no way applicable to my case, for example.

Agency in Austria, taxable in China, paid by the airline in China, 183 days rule does not apply (any more).

And so on. Each case is different, mostly depending on your home countries' rules.

To us article 15 means that only China can tax our income.

It is in no way applicable to my case, for example.

Agency in Austria, taxable in China, paid by the airline in China, 183 days rule does not apply (any more).

And so on. Each case is different, mostly depending on your home countries' rules.

To us article 15 means that only China can tax our income.

Join Date: Nov 2018

Location: World

Posts: 9

Likes: 0

Received 0 Likes

on

0 Posts

This might be true in your case, but not for others.

It is in no way applicable to my case, for example.

Agency in Austria, taxable in China, paid by the airline in China, 183 days rule does not apply (any more).

And so on. Each case is different, mostly depending on your home countries' rules.

To us article 15 means that only China can tax our income.

It is in no way applicable to my case, for example.

Agency in Austria, taxable in China, paid by the airline in China, 183 days rule does not apply (any more).

And so on. Each case is different, mostly depending on your home countries' rules.

To us article 15 means that only China can tax our income.

But this is what the model contract is, and most tax treaties follow the model.

Your home countries rules all depend on that countries tax treaty with CN, so yes there are variations, but the given example is how this one works out, not my home country btw.

Only half a speed-brake

Nothing to do with Austria. Yours arrangement is different to others.

The contracts I saw were tri-party plus the agency-pilot addendum just like you say, however strictly employed by the airline direct (in observance of, and governed by the Chinese law, with Chinese master version in case of dispute). With several statements explaining the role of the agent to be: an agent as opposed to an employer.

Still I agree with how you dissect the situation.

1) the individual's country of tax residency is determined [Art 4], then

2) it is determined where the taxes arising from the employment are to be deducted [Art 14/15] then

3) a clause is provided that

- allows the country of residence to claim the delta of taxes if in their favour

- forces the country of residence to credit all amounts of taxes already paid

Let's not hijack the thread any further.

a) The claim that 183 days test directly changes your tax residence (1) is pure nonsense. In the UK case, e.g., it is not even part of the assessment conditions.

b) IN GENERAL, the 183 days test is a part of the matrix that affects the outcome of (2) Art 14/15. Typically FOR PILOTS the treaty would have a stand-alone paragraph directly explaining the aircrew situation, without the use of the 183 days test.

The contracts I saw were tri-party plus the agency-pilot addendum just like you say, however strictly employed by the airline direct (in observance of, and governed by the Chinese law, with Chinese master version in case of dispute). With several statements explaining the role of the agent to be: an agent as opposed to an employer.

Still I agree with how you dissect the situation.

1) the individual's country of tax residency is determined [Art 4], then

2) it is determined where the taxes arising from the employment are to be deducted [Art 14/15] then

3) a clause is provided that

- allows the country of residence to claim the delta of taxes if in their favour

- forces the country of residence to credit all amounts of taxes already paid

Let's not hijack the thread any further.

a) The claim that 183 days test directly changes your tax residence (1) is pure nonsense. In the UK case, e.g., it is not even part of the assessment conditions.

b) IN GENERAL, the 183 days test is a part of the matrix that affects the outcome of (2) Art 14/15. Typically FOR PILOTS the treaty would have a stand-alone paragraph directly explaining the aircrew situation, without the use of the 183 days test.

Join Date: Nov 2018

Location: World

Posts: 9

Likes: 0

Received 0 Likes

on

0 Posts

@FlightDetent

It helps if you state whom you (dis)agree with.

The HNA contracts are between two parties; the agency and the pilot, HNA is mentioned in the contract, but only as the service airline and is not a signatory. Only the two main parties (agency/pilot) sign the contract. At least in the 2017 versions. The service agreement is strictly between HNA and agency, you don't get to see that one....

Some 'agents' are only intermediate parties where they get a onetime finders fee, then you end up signing with HNA's own agency which is a separate entity and located in HKG, others are real agents which you sign a contract with and are employed by them.

Since the beginning of the 2018 I believe they have a NTR transition contract which is a tripartite (HNA/agent/pilot) contract concerning and limited to a training bond. That goes together with the individual contract between the agent and the pilot.

Th individual countries implement the different treaties their own way, but from a strict legal viewpoint this is what you get. And yes paragraph 3 of art. 15 usually allows the other state to collect the taxes where the home state can collect any surplus.

Btw it's the first time I've seen a good conversation about taxes, which is an important issue fn decision making wether to go the expat/china way.

Many people just throw something in what they might have heard or think to be true, but if you just dive into your home countries tax treaty it is not that hard, though it usually means that you owe more taxes than you would like

It helps if you state whom you (dis)agree with.

The HNA contracts are between two parties; the agency and the pilot, HNA is mentioned in the contract, but only as the service airline and is not a signatory. Only the two main parties (agency/pilot) sign the contract. At least in the 2017 versions. The service agreement is strictly between HNA and agency, you don't get to see that one....

Some 'agents' are only intermediate parties where they get a onetime finders fee, then you end up signing with HNA's own agency which is a separate entity and located in HKG, others are real agents which you sign a contract with and are employed by them.

Since the beginning of the 2018 I believe they have a NTR transition contract which is a tripartite (HNA/agent/pilot) contract concerning and limited to a training bond. That goes together with the individual contract between the agent and the pilot.

Th individual countries implement the different treaties their own way, but from a strict legal viewpoint this is what you get. And yes paragraph 3 of art. 15 usually allows the other state to collect the taxes where the home state can collect any surplus.

Btw it's the first time I've seen a good conversation about taxes, which is an important issue fn decision making wether to go the expat/china way.

Many people just throw something in what they might have heard or think to be true, but if you just dive into your home countries tax treaty it is not that hard, though it usually means that you owe more taxes than you would like

Join Date: Dec 2018

Location: China

Age: 37

Posts: 6

Likes: 0

Received 0 Likes

on

0 Posts

Hainan Airline steward here, for those wondering about the financial situation we indeed went trhough some hard time recently; us cabin crew saw our salary delayed for a few months.

But as someone said in this post, HNA seems to big to fail, government recently injected some money in our company. This support from the party could make HNA a safer bet i guess.

On a side note, Pilots working here are pretty satisfied with the salary and commuting options. We fly A330 B737 B787 and HNA will be acquiring more A350 so pilots with this QT might be interested.

But as someone said in this post, HNA seems to big to fail, government recently injected some money in our company. This support from the party could make HNA a safer bet i guess.

On a side note, Pilots working here are pretty satisfied with the salary and commuting options. We fly A330 B737 B787 and HNA will be acquiring more A350 so pilots with this QT might be interested.

Join Date: Nov 2005

Location: UK

Posts: 40

Likes: 0

Received 0 Likes

on

0 Posts

Hi all, quick question regarding NTR 330 positions in Hainan, what are these like? I would look to bring my family over with (a young son/wife etc) so thoughts on expat community and schools would be greatly appreciated. Is getting Hainan as a base unrealistic? Thought of sunshine is at the moment is more than tempting....��

Cheers,

Cheers,