Warren Buffett sells $6 billion in airline stock

Thread Starter

Join Date: Dec 2018

Location: Canada

Posts: 170

Likes: 0

Received 0 Likes

on

0 Posts

Warren Buffett sells $6 billion in airline stock

https://www.forbes.com/sites/sergeik.../#53d5ddda5c74

Warren Buffett sold all $6 billion of the stock he owned in 4 major American airlines.

Warren Buffett sold all $6 billion of the stock he owned in 4 major American airlines.

Also reported by the Beeb here: https://www.bbc.co.uk/news/world-us-canada-52518186

Pegase Driver

Join Date: May 1997

Location: Europe

Age: 74

Posts: 3,692

Likes: 0

Received 0 Likes

on

0 Posts

Amazing times : selling in the middle of a dip and saying : I made a mistake but I only lost only 4 Billions .. More than the annual GDP of South Sudan ...

That said bad news for us , as he has probably access to good information , and when those guys are starting betting against an aviation recovery is not a good sign for all of us .

That said bad news for us , as he has probably access to good information , and when those guys are starting betting against an aviation recovery is not a good sign for all of us .

Thread Starter

Join Date: Dec 2018

Location: Canada

Posts: 170

Likes: 0

Received 0 Likes

on

0 Posts

Join Date: Jun 2001

Location: Rockytop, Tennessee, USA

Posts: 5,898

Likes: 0

Received 1 Like

on

1 Post

Buffett says 'never again' to airline business

Andrea RothmanPARIS

ANDREA ROTHMAN Bloomberg News

Published March 29, 2001

Billionaire investor Warren Buffett said he's sworn off investing in airline stocks since his $358-million (U.S.) "mistake" in US Airways Group Inc.

"Now if I get the urge to invest in airlines, I call an 800 number, and I say: 'Hello, my name is Warren, and I'm an air-o-holic,' " he said.

The 70-year-old chairman and chief executive officer of Berkshire Hathaway Inc. said in 1996 that the deal was a "mistake." Berkshire acquired the stake in the form of preferred stock for $358-million in 1989. It has since sold the stake, later converted to common shares, without saying whether it made money.

Mr. Buffett told journalists aboard a London-to-Paris flight on Tuesday that in the last 20 years, 130 U.S. airlines have gone broke. "It's unbelievable," he said, offering to dig out a list of the failed companies he keeps back in his office in Omaha, Neb., to show doubters.

"The airline business from the time of Wilbur and Orville Wright through 1991 made zero money, net," he said. "If capitalists had been present at Kitty Hawk when the Wright brothers' plane first took off, they should have shot it down."

Mr. Buffett invited journalists on the trip aboard a Boeing business jet to discuss Executive Jet Inc., a Berkshire Hathaway company that sells partial shares in business planes.

Join Date: Nov 2001

Location: Where the Money Takes Me

Posts: 947

Likes: 0

Received 0 Likes

on

0 Posts

Why oh why is this even being given the air time? He thought he was investing in safer times for a return. Oh well Mr Sage, you failed on this one.

Who cares, you've lost some cash - most of us in the industry will lose our livelihoods.

Move on, nothing to see here.

Who cares, you've lost some cash - most of us in the industry will lose our livelihoods.

Move on, nothing to see here.

Join Date: Dec 2008

Location: uk

Posts: 913

Likes: 0

Received 0 Likes

on

0 Posts

There is something to see and worry about here, probably for you. Buffett holds billions of dollars of peoples retirement savings in Berkshire Hathaway and it is entirely possible that your own pension provider holds airline shares directly or indirectly. If Buffet and Munger have dropped a clanger in holding airline shares, then the less talented managers of UK pension funds have probably done the same or worse. There are no winners here.

Seeing some similarities to the oil service industry. Really hope it's not going to be the case as well with overcapacity and little demand where newly built ships to drill cannot find work and are scrapped eventually... Buffett was spot on earlier though as airlines for a brief period was able to deliver some decent returns for a few years at least Delta and UAL in the US.

Join Date: May 2010

Location: Madrid

Posts: 44

Likes: 0

Received 0 Likes

on

0 Posts

Just wanted to add this. Warren said the same 20 years ago.

In other words, how to push retail investors into selling, so he can scrap cheap. I might be wrong as well, of course.

https://www.theglobeandmail.com/repo...ticle25435835/

In other words, how to push retail investors into selling, so he can scrap cheap. I might be wrong as well, of course.

https://www.theglobeandmail.com/repo...ticle25435835/

Isn't this taking navel-gazing to an extreme, even for this forum ? A huge investor who has said that his preferred time to hold an investment is "forever " has sold 10% stakes in the four biggest US airlines and you say "so what " ? His words and actions are intensely scrutinised by large numbers of economic observers, politicians, journalists and fund managers and will have a massive impact in the way many of these folk speculate/invest/legislate for post-covid. Those brave folk who have recently bought EZY shares and made up to 40% gain from the low-point may well be wondering whether it would be a good idea to take profit rather than hang on. I would say one thing is certain though, and that is there will be very few people saying " so what " ?

Join Date: Jan 2017

Location: Warwick

Posts: 197

Likes: 0

Received 0 Likes

on

0 Posts

Buffett is big enough to push the market price in either direction he may even have bought them for less and was taking a profit.

Buffet has a huge war chest of cash (~$50B) ... which he DIDN'T spend during the stockmarket lows in March

More investors are concerned about these implications than the Berkshire Hathaway losses this quarter.

More investors are concerned about these implications than the Berkshire Hathaway losses this quarter.

No, there was intention of delivering physical commodity – that's why prices went negative. Producers had nowhere to put the stuff, so they were paying traders to take it away. The alternative was to shut in wells and stop producing, but if you shut in oil wells of the kind that you find all over the main US oil-producing region, they tend to clag up and need expensve workover to get going again. Rock and hard place. It was a brief dip, and happened only in the US market (West Texas Intermediate). Elsewhere in the world, prices didn't go negative (e.g. Brent crude).

Join Date: Mar 2001

Location: I wouldn't know.

Posts: 4,498

Likes: 0

Received 0 Likes

on

0 Posts

And funny enough chimes in with my own gut feeling that we will see much lower prices in the not too distant future, and that might be a good time to buy (except Amazon probably).

Join Date: Jun 2001

Location: Rockytop, Tennessee, USA

Posts: 5,898

Likes: 0

Received 1 Like

on

1 Post

Yep, I quoted the 2001 Reuters article a few posts earlier in this thread.

Two decades later his quip would probably be deemed insensitive to the challenges of recovering ethanol inebriates who disproportionately come from disenfranchised indigenous communities of color.

Will the Big Three U.S. airlines be BK qualified once more and shed their 'onerous' contractual obligations to the employee groups? 'Too big to fail, etc...'

May 1, 2020, 9:44 AM EDT

American Airlines Group Inc. received a big blow from Wall Street on Friday as Evercore ISI analyst Duane Pfennigwerth slashed his price target on the Fort Worth, Texas-based carrier to $1 from $10.

That would imply a 92% rout in the stock, which closed at $12.01 on Thursday.

The airline, which entered the coronavirus-fueled crisis with the weakest balance sheet in the group, may not see “meaningful” recovery in its share price, the analyst said. As American, and the entire industry, tries to raise additional liquidity, Evercore estimates its net debt will far exceed revenue by the end of this year.

American’s total debt stood at a little more than $34 billion as of March 31.

https://www.bloomberg.com/news/artic...ck-at-evercore

"Now if I get the urge to invest in airlines, I call an 800 number, and I say: 'Hello, my name is Warren, and I'm an air-o-holic,' " he said.

American Air’s $1 Price Target at Evercore Implies 92% Collapse

By Esha DeyMay 1, 2020, 9:44 AM EDT

American Airlines Group Inc. received a big blow from Wall Street on Friday as Evercore ISI analyst Duane Pfennigwerth slashed his price target on the Fort Worth, Texas-based carrier to $1 from $10.

That would imply a 92% rout in the stock, which closed at $12.01 on Thursday.

The airline, which entered the coronavirus-fueled crisis with the weakest balance sheet in the group, may not see “meaningful” recovery in its share price, the analyst said. As American, and the entire industry, tries to raise additional liquidity, Evercore estimates its net debt will far exceed revenue by the end of this year.

American’s total debt stood at a little more than $34 billion as of March 31.

Join Date: Dec 1998

Posts: 185

Likes: 0

Received 0 Likes

on

0 Posts

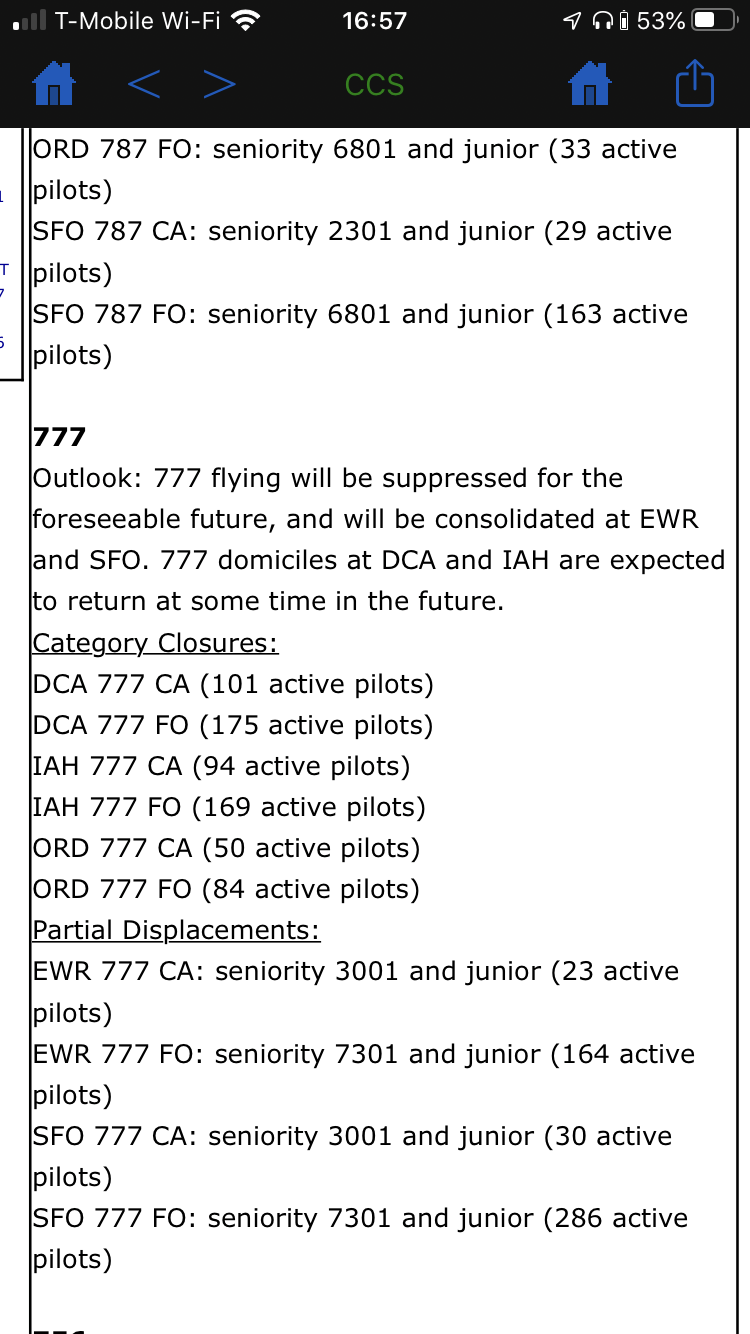

...perhaps these number from A Major US Carrier will explain the depth of disaster the airlines around the world are experiencing. Multiply this by all the other US carriers, and then extrapolate onto the European airlines etc...

Join Date: Jun 2001

Location: Rockytop, Tennessee, USA

Posts: 5,898

Likes: 0

Received 1 Like

on

1 Post

The European carriers and the expat carriers can do 'redundancies' out of seniority order and unlike a U.S. airline furlough, there is no guarantee of being rehired if things ever pick back up. Or, as BA suggests for an opener, sack everyone and rehire them at greatly reduced wages and benefits. If at all.