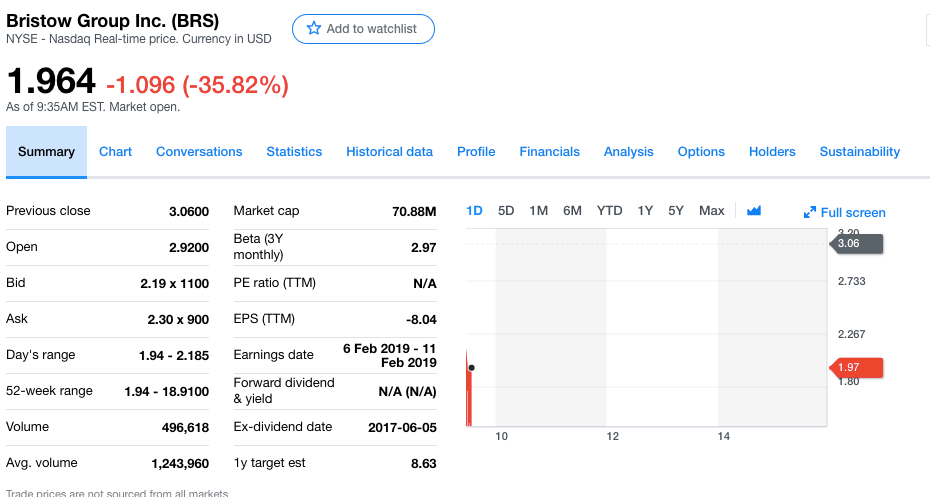

BRS stock crashing

I hope all the Bristow pilots made redundant get a severance of two times their base salary.

Difficult to comprehend how the top guy in a company can get paid so much money for losing so much more money.

Difficult to comprehend how the top guy in a company can get paid so much money for losing so much more money.

Columbia got a nice severance package.....20 Million Dollars!

Just a bit less than one Month's Gross Revenue from its operations last year

Just a bit less than one Month's Gross Revenue from its operations last year

Easy.

Translation:- "We are trying everything we possibly can to make it seem that the company is viable not completely doomed as it would appear. We are also trying to stave off the share price disappearing altogether while we pay a MASSIVE undeserved severance package to the outgoing CEO that has done NOTHING to save the operation."

If Baliff had any decency he would forego his payout and leave quietly but, he won't.

Translation:- "We are trying everything we possibly can to make it seem that the company is viable not completely doomed as it would appear. We are also trying to stave off the share price disappearing altogether while we pay a MASSIVE undeserved severance package to the outgoing CEO that has done NOTHING to save the operation."

If Baliff had any decency he would forego his payout and leave quietly but, he won't.

Last edited by Evil Twin; 13th Feb 2019 at 09:47.

SASless at post #27 gets my vote for having a crack at running the company. He'd do more constructive things in the first 9 minutes than the previous incumbent did in 9 years. If not $1 profit in 9 years is true would be an utter disgrace and the whole Board should hang their heads in shame for lack of prudent oversight.

It makes. you wonder if some genuinely smart guy with serious money will come along and start buying up some of these large companies that are in severe distress and cobble together a single operation that can begin to compete effectively and run profitably.

Is it not about time that Helicopter operators start kicking back against these highly profitable oil giants?

In the downturn the contracts were cut so fine that they were barely profitable, if at all. Now companies like Shell are posting 36% year on year profit increases to an astonishing $21bn, isn’t it about time we all worked together to force these costs back up?

CHC had to file, Bristows look like they are near it. 2 of the lead pack were/are in trouble due to these cuts. Surely it’s time to fight back? They have to take some responsibility in the demise of Helicopter operation profitability.

Does anyone know how profitable contracts are in 2019 in comparison to how they were back in 2015/16?

In the downturn the contracts were cut so fine that they were barely profitable, if at all. Now companies like Shell are posting 36% year on year profit increases to an astonishing $21bn, isn’t it about time we all worked together to force these costs back up?

CHC had to file, Bristows look like they are near it. 2 of the lead pack were/are in trouble due to these cuts. Surely it’s time to fight back? They have to take some responsibility in the demise of Helicopter operation profitability.

Does anyone know how profitable contracts are in 2019 in comparison to how they were back in 2015/16?

Unfortunately you're up against mega corporations who get their own way. Every time we went down to a duopoly on the North Sea, the oil majors went and facilitated someone to come in (eg Bond in the early 2000's). There's always someone willing to do it for a slimmer margin when they see the incumbents making decent profits. In the end everyone loses (apart from the oilco). BRS suffered a further disadvantage when CHC went into Ch11. Time for them to do the same probably. Rinse/repeat.

Helicopter Operators stand together.....surely you jest!

They cut their rates in a flash in order to keep their machines flying....even at a loss at times.

Rather than just walk away from a contract that does not allow for a proper profit.....they all race to the bottom.

They cut their rates in a flash in order to keep their machines flying....even at a loss at times.

Rather than just walk away from a contract that does not allow for a proper profit.....they all race to the bottom.

Mitchaa wrote:

New bid contracts in the recent cut throat era, probably not so profitable. Longer term contracts have built in escalations which protect the helicopter operator against general inflationary increases, OEM hourly price rises and even price rises caused by pilot and engineer pay rises under union contracts. If the bid price was right to begin with, they should make reasonable money. In 2014, helicopters were in demand and contract prices were peak. If a helicopter operator can't make money under older long term contracts then they either didn't bid the right price or don't manage their business very well.

There is a rule of how many non pilots and engineers you can have hanging off the skids before your helicopter won't get airborne. Guess what, $ million dollar salaries even for CEOs are very heavy. Even if its managed properly, the helicopter business doesn't enough money to have layers of "management" on multi million $ salaries.

Does anyone know how profitable contracts are in 2019 in comparison to how they were back in 2015/16?

There is a rule of how many non pilots and engineers you can have hanging off the skids before your helicopter won't get airborne. Guess what, $ million dollar salaries even for CEOs are very heavy. Even if its managed properly, the helicopter business doesn't enough money to have layers of "management" on multi million $ salaries.

5 will get you 10 Bristows wonít enter Chapter 11. The first hearing is convincing the court appointee that the company has sufficient liquidity to see the company through a restructuring process - I suspect Bristows Are well past that milestone and are heading for Chapter 7 rather than Chapter 11.

Additionally, Chapter 11 paid off for CHC as they had a high proportion of idle leased fleet assets; Bristows have a different fleet profile and wonít reap the same benefits of court appointed restructuring.

They either need to raise a significant amount of cash very quickly, or enter Chapter 7 bankruptcy. Fingers crossed itís the former, but I canít really see it.

Additionally, Chapter 11 paid off for CHC as they had a high proportion of idle leased fleet assets; Bristows have a different fleet profile and wonít reap the same benefits of court appointed restructuring.

They either need to raise a significant amount of cash very quickly, or enter Chapter 7 bankruptcy. Fingers crossed itís the former, but I canít really see it.

Minigun

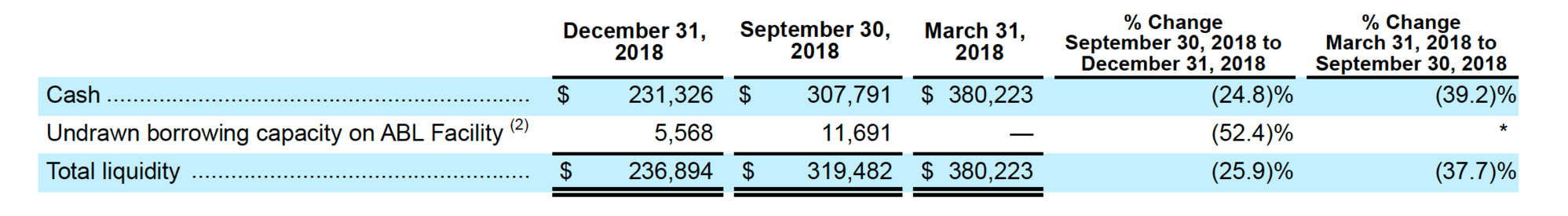

I would suggest that BRS liquidity while down on the previous reporting period is down, $236mil is still quite a lot of cash, enough for CH 11. BRS has sold and leased back quite a lot of aircraft to generate cash, but as you can see above, they burned through $60m in 6 months of 2018 and $83m in the last quarter alone. That indicates to me that they are burning through cash to sustain operations and therefore making an operating loss. Making a long term operating loss is death to an aviation company.

Last edited by industry insider; 14th Feb 2019 at 03:45. Reason: typo

Minigun

I would suggest that BRS liquidity while down on the previous reporting period is down, $236mil is still quite a lot of cash, enough for CH 11. BRS has sold and leased back quite a lot of aircraft to generate cash, but as you can see above, they burned through $60m in 6 months of 2018 and $83m in the last quarter alone. That indicates to me that they are burning through cash to sustain operations and therefore making an operating loss. Making a long term operating loss is death to an aviation company.

On cash alone they have well under 8 months. I suspect the creditors will have taken a view on recovering their money before then. The lawsuits will always follow but what looks to be deliberately misleading financial statements mean that someone should go to jail at least. Not that will be much succor for those about to lose their jobs though. Chapter 7 is the most likely option now because (as MGD noted), the options to CHC with a leased fleet of about 75% simply is not available to BRS who own a much higher %. The creditors will simply step in, padlock the doors and take a share of the aircraft in accordance with how much BRS owe them.

The other operators must be wetting themselves with excitement about poaching contracts from them. CHC could buy the BRS GOM operation, NHV the Norway operation, BMCS the UK operation etc.

The other operators must be wetting themselves with excitement about poaching contracts from them. CHC could buy the BRS GOM operation, NHV the Norway operation, BMCS the UK operation etc.

Last edited by nowherespecial; 14th Feb 2019 at 07:27. Reason: Typo and CAPS missing