4 Corners this Monday

Qantas leased a Boeing 747-21AC from Martinair (PH-MCF) for a number of years. It was painted in a hybrid livery. It had sensors fitted (presumably on the landing gear) as the Flight Crew would always compare the readings to the Loadsheet, sometimes question it. My impression was that because of variances in passenger actual weight versus standard weights used, it was not that useful for anything but detecting gross errors, which to my recollection, there were not any.

On the point of standard weights, I have heard that audits conducted found them to be acceptable with no real issues. The main thing that has changed in the last 20 years is the charge for baggage issues, so that now everybody is trying to cram as much into overhead bins as they can. Carry on baggage is generally only accounted for an average of 5 kg per passenger. Its quite obvious that is now the minimum people are carting. I've never seen so many flights where cabin bags have to be put in the hold due to absolutely no more space in the cabin, esp on 737s.

The saddest/most telling thing about the 4 Corners story was the last couple of quotes from staff:

”We feel like management hate us”

That sums up the way aviation management has evolved, particularly since the pilots dispute of 1989 and the privatisation of Australian/Qantas.

A similar thing has happened at Cathay Pacific recently, a textbook example of how to stuff up what was once a quality product. Invariably the cause is egotistical CEO’s, hellbent solely on shareholder returns and lining their own pockets.

The direct result is that inevitably the airline product suffers and once great airlines become mediocre at best.

Impractical and unrealistic to re-nationalise airlines (though we should have got a stake in QF after that huge government capital injection) but there’s got to be some circuit breaker to halt this corporate greed.

”We feel like management hate us”

That sums up the way aviation management has evolved, particularly since the pilots dispute of 1989 and the privatisation of Australian/Qantas.

A similar thing has happened at Cathay Pacific recently, a textbook example of how to stuff up what was once a quality product. Invariably the cause is egotistical CEO’s, hellbent solely on shareholder returns and lining their own pockets.

The direct result is that inevitably the airline product suffers and once great airlines become mediocre at best.

Impractical and unrealistic to re-nationalise airlines (though we should have got a stake in QF after that huge government capital injection) but there’s got to be some circuit breaker to halt this corporate greed.

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

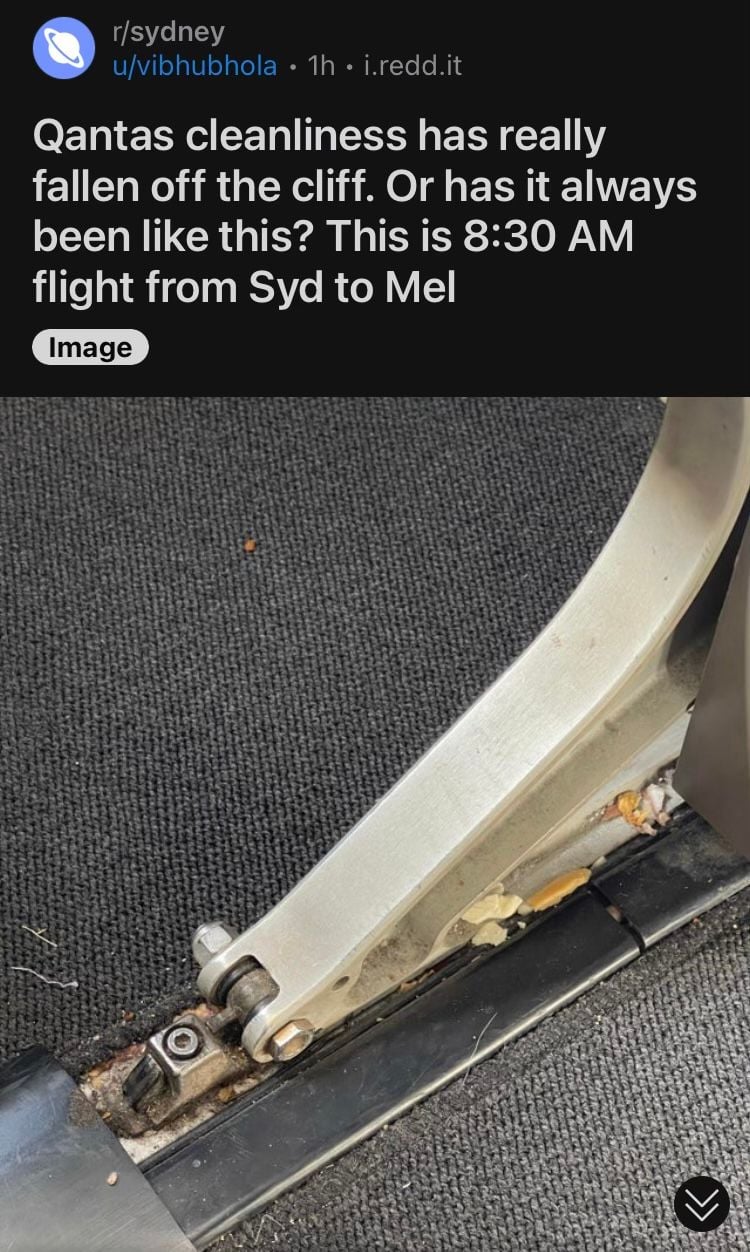

This has become the standard and it’s nothing new. Whoever took the photo is lucky they didn’t shove their hand down between the seat cushions, and whatever you do, never use the feral food tray - even if it ‘looks’ clean, by Christ it isn’t. In the good old days of the Ansett and Qantas duopoly most aircraft would undergo a thorough internal clean after the last flight of the night. First flight of the morning would be in a mostly clean, crisp aircraft. Today, it’s all aboard the ‘Salmonella Express’.

The other thing that you probably don't want to know is how often do the seats even get the slightest attention. QF has gone back to cloth seats so you can guarantee you are surrounded by whatever has gone before and is trapped in those fibers. At least the Leather seats you could wipe down with disinfectant every now and then, not surer they even do that. All you have to do is check out the windows for the grimy hair and face residues from previous passengers to have an idea of what soils the seats your head and backside are rubbing into. I've seen some pretty nasty stuff on seats, from urine, to blood to stuff I can't identify, usually a quick wipe to remove the visible evidence, and sounds like QF were using water wet cloths at best. I remember the days they had the small replaceable head covers on the seats, with velcro so they could be changed. Now your hair just wipes in whatever was before.

its huge .

The other thing that you probably don't want to know is how often do the seats even get the slightest attention. QF has gone back to cloth seats so you can guarantee you are surrounded by whatever has gone before and is trapped in those fibers. At least the Leather seats you could wipe down with disinfectant every now and then, not surer they even do that. All you have to do is check out the windows for the grimy hair and face residues from previous passengers to have an idea of what soils the seats your head and backside are rubbing into. I've seen some pretty nasty stuff on seats, from urine, to blood to stuff I can't identify, usually a quick wipe to remove the visible evidence, and sounds like QF were using water wet cloths at best. I remember the days they had the small replaceable head covers on the seats, with velcro so they could be changed. Now your hair just wipes in whatever was before.

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

Ha Ha, that’s funny. Yep, I noticed that also, and the weird thing is that I’ve met him in person and don’t recall his melon looking so big. Perhaps it has grown as he ages? A giant head on tiny shoulders, like an orange sitting on top of a toothpick!

The saddest/most telling thing about the 4 Corners story was the last couple of quotes from staff:

”We feel like management hate us”

That sums up the way aviation management has evolved, particularly since the pilots dispute of 1989 and the privatisation of Australian/Qantas.

A similar thing has happened at Cathay Pacific recently, a textbook example of how to stuff up what was once a quality product. Invariably the cause is egotistical CEO’s, hellbent solely on shareholder returns and lining their own pockets.

The direct result is that inevitably the airline product suffers and once great airlines become mediocre at best.

Impractical and unrealistic to re-nationalise airlines (though we should have got a stake in QF after that huge government capital injection) but there’s got to be some circuit breaker to halt this corporate greed.

”We feel like management hate us”

That sums up the way aviation management has evolved, particularly since the pilots dispute of 1989 and the privatisation of Australian/Qantas.

A similar thing has happened at Cathay Pacific recently, a textbook example of how to stuff up what was once a quality product. Invariably the cause is egotistical CEO’s, hellbent solely on shareholder returns and lining their own pockets.

The direct result is that inevitably the airline product suffers and once great airlines become mediocre at best.

Impractical and unrealistic to re-nationalise airlines (though we should have got a stake in QF after that huge government capital injection) but there’s got to be some circuit breaker to halt this corporate greed.

The attitude of any business flows from the directors. The directors of Qantas don’t care. They is getting their big pay checks and running Qantas down because they ‘know’ that airlines will be mostly banned under the global warming overlords. The directors, by appeasing the global warming overlords know they will have another cushy directorship to go to once Qantas, and most other airlines, is done. No director cares about somebody who is looking for a long term career in the airlines because they don’t see themselves there in the long term…

Apparently, Qantas management has this belief that when the sun goes down and the wind don’t blow that the power just works under some miracle.

Yer just gotta ‘believe’…

“…From this year all Qantas Group buildings will be powered by 100 per cent renewable electricity in Australia…”

https://www.qantas.com/content/dam/q...ction-plan.pdf

QANTAS’ ISSUES NOT ‘ALL THE CEO’S FAULT’ ARGUES CHAIRMAN

Qantas chairman Richard Goyder has said Alan Joyce and his executive team have done “exceptionally well” in a strongly-worded riposte to the CEO’s critics.Writing in the AFR, Goyder hailed his senior staff for steering the airline through a pandemic that “sent other airlines and their creditors packing”.

It comes amid criticism that Joyce’s annual salary increased by 15 per cent to $2.27 million despite a string of problems to plague the business, including record delays and hours-long call wait times.

The 900-word opinion piece argued most aviation companies globally are grappling with the same problems as Qantas.

“This is what happens when you shut down an entire sector for more than two years,” he wrote. “Companies make deep cuts to survive. Skilled people walk away because the uncertainty seems endless.”

He said Qantas is now well on its way to fixing its problems, quipping, “If you haven’t heard this, it may be because the data showing the improvement received far less media attention than stories showing how bad things got.

“In the meantime, the corporate obituary writers have been busy. Their analysis has (mostly) been unencumbered by what’s happening at other airlines, or that Qantas’ performance has turned around.”Goyder then said in order to “set the record straight”, he would give a “quick response” to common criticism.

In a section titled, “It’s all the CEO’s fault”, he said, “People who think Qantas couldn’t have failed or was enriched by government handouts are simply wrong.

“We don’t shy away from the service failures that happened as the airline restarted. But any reasonable assessment has to start with looking around the world and Australia to see how Qantas compares in an industry that is working incredibly hard to get back on its feet.

“We will continue that hard work to meet the high standards all stakeholders expect from us.”

In 2022, Qantas has faced a string of problems, including huge delays at Easter, hours-long call wait times, and even a revelation that the cabin crew of a Qantas A330 were made to sleep across seats in economy.

Last year, the Federal Court ruled the Flying Kangaroo was wrong to outsource 2,000 ground handling roles and subsequently rejected an initial appeal.

The airline last week insisted Joyce’s salary was effectively 77 per cent lower than pre-pandemic levels because of the lack of an annual bonus. Joyce also took no pay for three months in 2020 and for one month in 2021, alongside periods of reduced pay.

In August, Australian Aviation reported how Qantas recorded an underlying loss before tax of $1.86 billion in its full-year financial results.

Joyce said the result takes the before tax impact of COVID-19 on the wider group to $7 billion, which he called “staggering”.

“The past year has been challenging for everyone. We had to ramp down almost all flying once Delta hit and stay that way for several months before ramping back up through multiple Omicron waves as we all learned to live with COVID-19 in the community,” said Joyce.

https://australianaviation.com.au/20...gues-chairman/

What Alan Joyce is leaving Qantas, as the cost of capital rises dramatically, is a capex mountain like nothing in the airline’s history. Michael Quelch

What Alan Joyce is leaving Qantas, as the cost of capital rises dramatically, is a capex mountain like nothing in the airline’s history. Michael QuelchIt is certainly arguable that the best use of $400 million, in the company’s current position and after more than a decade of capital underinvestment, was handing it back to the owners and propping up the share price.

Murray anticipates Qantas shares returning to pre-COVID levels (north of $7) and calculates that one of “the two main sources” of Qantas profits being even higher in 2024 than in 2019 is its international flying (including Jetstar’s).

“When you look at international capacity today, Qantas is back to 60 per cent of where they were pre-COVID, but the other carriers are only back to 50 per cent,” he said.

Murray’s data points seem disobliging to the argument he wants them to support.

Using the latest available data from the Bureau of Infrastructure and Transport Research Economics, the Qantas Group’s international market share fell from 29.5 per cent in June 2019 to 26 per cent in June 2022, despite the near total evaporation of capacity operated by Chinese and other East Asian carriers.

By comparison, Singapore Airlines’ (group) market share has nearly doubled to 20.5 per cent from 10.5 per cent. Emirates, Qatar, Air New Zealand and United – all natural premium competitors – have each grown their share.

Total passengers carried between Australia and the United States has nearly halved from June 2019 simply because Qantas and Jetstar have more than halved theirs. Delta and United are back to where they were.

Qantas is currently so short of international aircraft that its dog-tired mid-range A330s are operating ultra-long haul routes to India and Los Angeles with severe payload restrictions and crew sleeping alongside the passengers.

Yes, that’s mostly due to COVID – as mothballed A380s take many months to reactivate – but it is also a product of strangled fleet investment through the Alan Joyce era.

To be clear, Joyce has done many, many good things at Qantas, particularly effectuating a lower and more flexible cost base. Until recently, these efficiency measures were even legal!

In 2008, Joyce inherited Geoff Dixon’s order for 20 A380s and 65 787s and a fleet whose average age “is forecast to remain between 8.5 and 8.9 years [based on] the existing contractually committed long-term fleet plan…”

Until June 2019, nearly 11 years into the job, Joyce had never ordered a single new aircraft for Qantas mainline.

Joyce might’ve been right to defer and then cancel eight A380s, though those could’ve been cycled in to replace the oldest ones (now 14 years old). Reducing the 787 order to just 25 inarguably killed a great deal of potential growth. The average age of the fleet, meanwhile, has blown out to 14.7 years while Qantas has returned more than $3 billion to shareholders.

The Qantas fleet has never been this old.

The A330s are now, on average, 16 years old (the eldest are 20), yet Qantas has still ordered no replacement for them. Doing so will require capex – not built into forecasts – of approximately $US9 billion ($13.5 billion) at list prices, and then take many years to arrive.

The mainline domestic fleet of 737-800s is now, on average, 15 years old (nearly a third of them are 20), and is worked harder than almost any other 737 fleet in the world. These 74 planes are at the absolute twilight of their usable lives and replacing them will cost approximately $US8.5 billion at list prices. Qantas placed that order, for A320neos, with Airbus in May this year. Airlines have been receiving this aircraft since 2016 but Qantas will get its first just before Christmas of 2023.

Qantas has also ordered 12 A350-1000ULRs, which can fly non-stop from Australia to London and New York, to arrive from 2025. These will cost $US4.2 billion at list prices.

On international routes, Qantas is competing with much younger fleets. Singapore, for example, has retired all 12 of its initial A380s and since 2016 has taken delivery of 62 A350s and 35 787s. Its fleet is just 6.5 years old. What’s more, Singapore has renewed its fleet while maintaining very strong cashflows.

Joyce has preferred to retrofit new seats onto his old planes. While that has reduced his capex, he runs at a major opex disadvantage on fuel burn and maintenance.

And Qantas loves talking up its sustainability credentials but when you willingly fly aircraft that burn 25 per cent more fuel per passenger than your competitors, your environmental credentials are all too easy to see through.

By rough calculations, in the next decade, the Qantas Group will need to spend up to $US28 billion to replace its fleet without even growing it. Bear in mind this is based on list prices, to which airlines command significant discounts, though this estimate also excludes any replacement of its A380s.

Qantas also needs major, urgent technology investment. qantas.com is absurdly unreliable, constantly crashing on users mid-task. Customers have faced hours-long waiting times on the phone mostly for things they should be able to do, but can’t, on the Qantas app or website. It is a far cry from the seamless mobile touchpoints of most major foreign airlines. It is the shoddy amenity of a virtual monopoly.

This is chronic underinvestment in systems, which is extremely expensive and slow to fix (maybe Joyce could poach some engineers from ANZ Plus?). It is almost completely unrelated to COVID, but has probably done the most damage to customer satisfaction.

These are just some of the reasons why many market participants are maddened by the latest Qantas buyback. They reasonably wonder why anyone would be conducting a buyback at this famished point in the company’s capex cycle.

Of course Pendal and others prefer buybacks to capital expenditure, and this is a powerful incentive for Joyce and the board to prefer them too. Institutional investors prefer buybacks because institutional investors are myopic. They will be long gone from the register by the time a company’s looming bills need to be paid.

Joyce should be leaving Qantas just as these new planes start arriving. His timing will be impeccable.

To repeat, Joyce’s doggedness on the cost side is laudable and the market loves him for it. But what Joyce is leaving his ultimate successor, as the cost of capital rises dramatically, is a capex mountain like nothing in the airline’s history, and one almost entirely of his design.

Agreeable to a fault, chairman Richard Goyder is nowadays performing a vigorous and public defence of Joyce’s honour. Let’s see how that scrubs up in a few years’ time.

By rough calculations, in the next decade, the Qantas Group will need to spend up to $US28 billion to replace its fleet without even growing it. Bear in mind this is based on list prices, to which airlines command significant discounts, though this estimate also excludes any replacement of its A380s.

And that is the same hole Ansett dug itself. This is the main issue with the QF group, with no significant capital partner they have to fund that cost themselves. So small reserves of cash and what looks like good profits pale in comparison with the CapEx required in this industry. AJ looks like he has done a great job, by restricting costs, but this has been at the expense of new equipment. IF like Rex they had in house RnD and maintenance shops capable of extending the life of your prime workhorses, fair enough. But QF outsources most of its maintenance now making older aircraft very expensive to operate. The QF success over the last few years before covid were just smoke and mirrors. Now they really have a fight on their hands moving forward. I do remember a quote from many years ago about new aircraft needing less maintenance so less engineers required, well AJ, the fleet ain't new anymore...

I don't recall fleet replacement being a hole for Ansett. When the AirNZ storm broke in 2001 the domestic fleet's average age was less than 12 years.

https://www.theage.com.au/national/f...07-p58pjg.html

Even before it assumed control of Ansett, the New Zealand airline was well aware of the Ansett fleet’s age and the need to spend at least $4billion in an accelerated replacement program.

Airlines get an average of a 50% discount on the list price anyway. If you have good negotiators and a bulk order you can command even more, especially if they made a good deal whilst the Covid lull for orders was in effect. It is a substantial figure and for a columnist in a financial newspaper to miss something I discovered with 5 seconds of googling doesn’t reflect well on that columnist.

So it’ll be nowhere near $28 billion USD for a full fleet replacement. Even with that figure I’m not sure how the columnist came out with it. $8.4 and $4.2b for the 321 and 350, if they replaced all 330s with 787-9 (a bit of overkill) that’ll only be $7.9b. Which adds up to $20.5b not $28b. Which they wouldn’t even be paying.

The 737 will still be around til middle 2030s so won’t need to be replaced all at once, the 380s have some life left in them and the 330 orders can be spaced out too.

The fleet renewal is going to take some skill to fund properly but it’s not going to be as daunting as he’s making it out to be.

So it’ll be nowhere near $28 billion USD for a full fleet replacement. Even with that figure I’m not sure how the columnist came out with it. $8.4 and $4.2b for the 321 and 350, if they replaced all 330s with 787-9 (a bit of overkill) that’ll only be $7.9b. Which adds up to $20.5b not $28b. Which they wouldn’t even be paying.

The 737 will still be around til middle 2030s so won’t need to be replaced all at once, the 380s have some life left in them and the 330 orders can be spaced out too.

The fleet renewal is going to take some skill to fund properly but it’s not going to be as daunting as he’s making it out to be.

I don't think you get the point that in the airline business fleet renewal is ongoing, not lump sums and done. Jets are not made to last economically more than 15-20 years, 737s are trashed by 10 years in service, so by the time you are getting deliveries of one fleet you need to be actively purchasing the next otherwise you fall behind the 8 ball. If its going to be $10 bill now, it will be another $10 bill to replace that 10 years later and so on and so on, add inflation etc.... The other option is cheap lease 2nd hand so the lower lease offsets the higher operating cost of an older aircraft. But then you have to have 2nd hand available and cheap. I am oversimplifying what is a very complicated decision and there is a myriad of options in-between ownership and leasehold, new and old, etc... but the unifying equation involves a lot of cost.

What has happened with QF is that the fleet replacement has been delayed to stump up the balance sheets a few years running. That means there is a reckoning point where it needs to be addressed.

What has happened with QF is that the fleet replacement has been delayed to stump up the balance sheets a few years running. That means there is a reckoning point where it needs to be addressed.