Qantas loses $860 million last year.

Share price went up almost 8% on results day. Overall it has climbed 1.4% in the last year, not too impressive, but easily outperforming the ASX 200 which fell 6%.

The Qantas share price just flew 8% higher on $400 million share buyback

The Qantas share price just flew 8% higher on $400 million share buyback

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

...and UP an insignificant *cough* 35% since July 2020 when the Executive 'Shares for Deferred Salary' scheme was first mentioned.

I'm still trying to understand how the statutory loss is $1billion less than the underlying loss of $1.86B, which is $100M worse than last year.... With EBITDA 32% worse than last year. Also key to add the net tangible assets per share is significantly worse than last year. QF is sitting at NAT -.51cps, compared to REX at +1.36. Loss per share QF at -.45- (.79 Underlying) cps vs Rex on -.45 cps.

The underlying result is before tax and doesn't include one-offs. Statutory is after tax and includes all costs and revenues. There's a $300 million tax benefit, together with one-off benefits of $692 million from asset sales and $22 million in fuel hedges.

That's what I thought, so they have sold more of the farm to prop up the luxury yatch. Hence why asset to share ratio fell significantly. I don't see anything in that result that reads well for the company for future operations, let alone its turning around in a year. The only thing profitable was the 'loyalty program' for the suckers that keep paying for it. Even J* made half a billion loss and they have been full to the hilt. Not sure where AJ thinks he's getting $1 billion in savings from, very much sounds like VA during the final years, selling everything to lessen losses and make marginal profits. Oh but you need those things to operate, so then lease them back at stupid rates.

No. The asset-to-share ratio dive was driven off the back of increased liabilities not a decline in assets. Assets actually went up by nearly $2 billion.

Hahah yes I remember all those ‘Roadshows’ with JB… saying it was ‘“”just a tough environment for aviation of late””…..(despite all other airlines booming and the market being the best in years)……. “but don’t you worry we are the best airline around …..look at all these graphs 📈, next year we are going to be so profitable….!!” And all the happy clappers rejoiced!

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

Hahah yes I remember all those ‘Roadshows’ with JB… saying it was ‘“”just a tough environment for aviation of late””…..(despite all other airlines booming and the market being the best in years)……. “but don’t you worry we are the best airline around …..look at all these graphs 📈, next year we are going to be so profitable….!!” And all the happy clappers rejoiced!

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

Hahah yes I remember all those ‘Roadshows’ with JB… saying it was ‘“”just a tough environment for aviation of late””…..(despite all other airlines booming and the market being the best in years)……. “but don’t you worry we are the best airline around …..look at all these graphs 📈, next year we are going to be so profitable….!!” And all the happy clappers rejoiced!

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

Think I heard that 5 years in row … he must have thought everyone couldn’t remember the prior years roadshow…each year the graph just got steeper and steeper and more ambitious… and it was always next year things would be better……he truly was a fraud.

I know most of you won’t like this but at least AJ can make the tough decisions, has proven to be a very successful CEO and can actually turn the airline around.

I also heard a lot of reasons why VA wouldn't participate in standard industry norms for exchange of passengers because "John said it costs us money" - anyone with 6 months experience in a real airline and a functioning brain knew that was utter nonsense, along with the other crap that he went around spouting, such as when every, ever-larger, loss was announced "Oh, but we're 'cash flow positive" - heard that one at every roadshow - and at the end of the day, he bails before the collapse with millions of dollars (no one may like Joyce but he is on record as turning down bonuses in some years and working for no pay, not this bloke, never took a cent less than was offered, the annual reports would seem to indicate), then collects an AO and takes up several Board positions, choo-choo, on the management-weasel-word-speaker to Board junkie - mostly on Boards that he couldn't possibly know anything about. As for the former Chair's obtuse statement that "Oh, well, he did build a good airline" - NO, V-Australia had done all that so the same teams worked on the Domestic Premium cabins, he did nothing, just spend billions on leases that were over market - I mean how does someone spend all that time at QF, where while not perfect, know how to negotiate leases and fuel-hedging, etc. and NEVER pay full price for an aeroplane, then go to be the CEO of another company and spend through the nose??

This bloke had sh*t on the liver about losing out to AJ and took that to VA where he put all his effort into trying to replicate it so he could satisfy his ego that he ran a big airline too. To anyone who has had any experience with narcissism, the behaviours certainly raise eyebrows.

I was once told by an ex QF employee who had spent time working with some of the divisional leadership that "You know in Qantas Centre they call him 'Mini Me' "

And Brett Godfrey in the early days preceded the Borg when they floated the VB lemon. It had no assets as all aircraft were leased, except for a couple of ****boxes including CZQ. Virgin hasn’t owned airport terminals or infrastructure at all as far as I’m aware, at least not in the early days. Alan still has some wriggle room with assets he can sell to prop up the balance sheet. Maybe he will keep doing that until the bucket of assets is empty, he has maximised the share price as high as possible, and then he will pull the pin, leaving behind a skinned carcass?

Also, it depends what type of leases. If the original 737s were on finance leases then some of them would be owned - in fact, one of the fears when Bain took over was that they would sell the airframes that were owned and lease them back to VA to recoup their investment (i.e. as with Toys-R-Us, make the takeover target pay for it's own takeover). So, VA must have owned several dozen of their airframes and it is entirely unreasonable to expect a start up CEO to have dozens of assets, especially aeroplanes, against an airline that by that time had been in business for nearly 80 years. I'm sure Q.A.N.T.A.S. Ltd. didn't have any assets on the 16th of November, 1920 when it was registered in Queensland, only 1000 Pounds paid-up-capital.

Qantas has plenty of assets and over $3bn in the bank. It went down to something like $1.5-2.0bn during the pandemic and is now back up at over $3bn. That's hardly emptying the coffers. Yes, they sold land, which they'd owned since the 40s or 50s and never done anything with and that was an exceptionally good move because when SWZ opens and traffic moves there, that land around the airport won't be worth sh-t.

Not saying Joyce is perfect, not by a long shot, but I find it very difficult to fault Godfrey having known how highly he was regarded by the staff, in absolute stark contrast to his successor, who was by all accounts, an egotistical popinjay and a wastrel.

The only mistake that Godfrey made, but I can see what would have led him to do so, was refusing the offer to buy the Ansett terminals in SYD and MEL for an extremely low price. Then again, Qantas never 'really' owned their terminals either, they were the beneficiary of 100 year or 50 year peppercorn leases offered to TN and AN decades ago to give them tenure. ALL of the airports are pushing to resume control when the leases end and QF quite cleverly enticed them to buy them out of the leases for hundreds of millions of dollars. That's not selling 'assets', that's no different to selling a 747 that you're going to retire anyway and leasing a new aircraft. Had QF kept the leases, they would have continued to have to pay out to maintain the buildings and then lose them in the end anyway. Now, if there's ever any major problem such as flooding or storm damage, it's SACL or APAM's problem.

Last edited by AerialPerspective; 26th Aug 2022 at 13:31. Reason: Corrected IATA Code for Western Sydney Airport

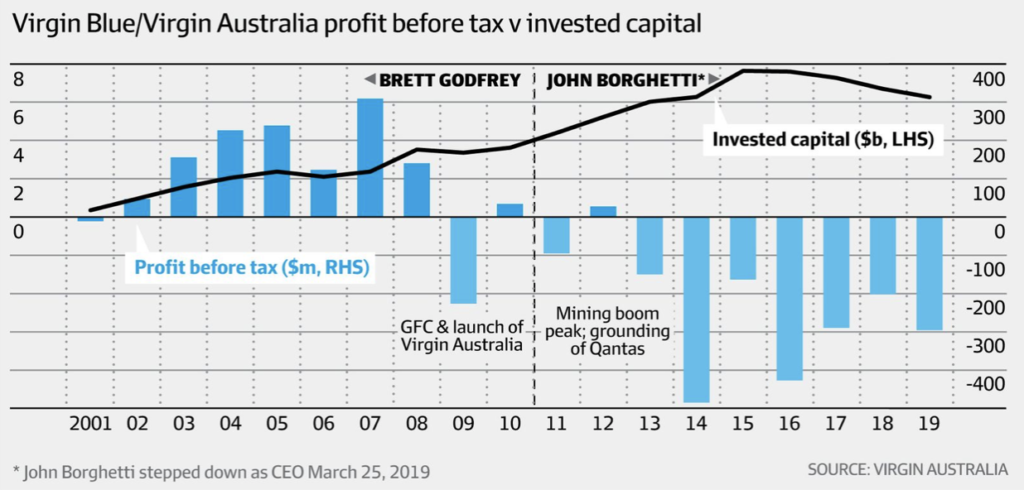

Except that Godfrey ran a profitable airline for his entire time there. He's as good as said that what happened afterward, the billions spent was not what should have been done (he put it in a very diplomatic manner).

Qantas has plenty of assets and over $3bn in the bank. It went down to something like $1.5-2.0bn during the pandemic and is now back up at over $3bn. That's hardly emptying the coffers. Yes, they sold land, which they'd owned since the 40s or 50s and never done anything with and that was an exceptionally good move because when SWZ opens and traffic moves there, that land around the airport won't be worth sh-t.

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

43;

“Not sure which multiverse your BG comes from but in this one he started the rot with the war vs Rex in the E-Jets, which marked the entry into highly unprofitable routes for the type. It was well known that VB was floundering which is why JB got the lease to spend billions to try to align it with foreign carriers so that they would show some interest and offer capital injections, which eventuated and extended the life of VA probably another 8 years at least. Had JB not secured that alignment VA/VB would have folded probably as far back as 2012, we have to remember how much capital SQ, AirNZ and EQ pumped into VA to prop it up. Two things signaled the end for the VA life extension to me, one was AirNZ pulling the pin and second was the sale of the head office for cash to support operations.”

So true. Godfrey is good at running relatively small size businesses. Once VB started to grow significantly he was out of his league, hence the reason he got pushed. That’s why he has spent his later years tinkering with eco tourism and small enterprises. As for the Borg and Scurrah they made huge mistakes with multiple aircraft types and then pushing the stupid frigging hybrid customer service model of not being a full top tier airline and not being an LCC, more of an ‘in between’ airline and it simply doesn’t work.

“Not sure which multiverse your BG comes from but in this one he started the rot with the war vs Rex in the E-Jets, which marked the entry into highly unprofitable routes for the type. It was well known that VB was floundering which is why JB got the lease to spend billions to try to align it with foreign carriers so that they would show some interest and offer capital injections, which eventuated and extended the life of VA probably another 8 years at least. Had JB not secured that alignment VA/VB would have folded probably as far back as 2012, we have to remember how much capital SQ, AirNZ and EQ pumped into VA to prop it up. Two things signaled the end for the VA life extension to me, one was AirNZ pulling the pin and second was the sale of the head office for cash to support operations.”

So true. Godfrey is good at running relatively small size businesses. Once VB started to grow significantly he was out of his league, hence the reason he got pushed. That’s why he has spent his later years tinkering with eco tourism and small enterprises. As for the Borg and Scurrah they made huge mistakes with multiple aircraft types and then pushing the stupid frigging hybrid customer service model of not being a full top tier airline and not being an LCC, more of an ‘in between’ airline and it simply doesn’t work.

And someone asked what universe I am living in, looks pretty damn straightforward to me. One left and the profit went with him. Not much ambiguity there and the big airlines only poured money in because JB was going through it like a drunken sailor.

Not sure which multiverse your BG comes from but in this one he started the rot with the war vs Rex in the E-Jets, which marked the entry into highly unprofitable routes for the type. It was well known that VB was floundering which is why JB got the lease to spend billions to try to align it with foreign carriers so that they would show some interest and offer capital injections, which eventuated and extended the life of VA probably another 8 years at least. Had JB not secured that alignment VA/VB would have folded probably as far back as 2012, we have to remember how much capital SQ, AirNZ and EQ pumped into VA to prop it up. Two things signaled the end for the VA life extension to me, one was AirNZ pulling the pin and second was the sale of the head office for cash to support operations.

QF had assets, they have pretty much sold all the king assets off in the last 20 years and are leasing back key infrastructure. The sale of the land at SY was a big mistake in the longrun for short term gain, pft mascot land losing value??? again what multiverse are you living in. And the cash in the bank enigma, it not 'spare' cash its required cash to prove to debtors that they have the capability to maintain liquidity and service debts in short term disasters. They don't hold that cash for S&G they hold it because its contractually required, to keep the wolves at bey. Companies only carry such large cash reserves if it is a requirement of operation. It should give you an idea of the debt position they are in. I think a key difference between Rex and QF is that QF has been selling assets to prop up revenue, Rex has been investing revenue into assets that assist operations. Which is why the value of the company per share is so high and QF is so low. If you bought all rex shares and sold the company for parts you would get roughly your money back, of you did the same with QF you would be paying more out again to satisfy debtors and contracts after the sale of assets.

QF had assets, they have pretty much sold all the king assets off in the last 20 years and are leasing back key infrastructure. The sale of the land at SY was a big mistake in the longrun for short term gain, pft mascot land losing value??? again what multiverse are you living in. And the cash in the bank enigma, it not 'spare' cash its required cash to prove to debtors that they have the capability to maintain liquidity and service debts in short term disasters. They don't hold that cash for S&G they hold it because its contractually required, to keep the wolves at bey. Companies only carry such large cash reserves if it is a requirement of operation. It should give you an idea of the debt position they are in. I think a key difference between Rex and QF is that QF has been selling assets to prop up revenue, Rex has been investing revenue into assets that assist operations. Which is why the value of the company per share is so high and QF is so low. If you bought all rex shares and sold the company for parts you would get roughly your money back, of you did the same with QF you would be paying more out again to satisfy debtors and contracts after the sale of assets.

And someone asked what universe I am living in, looks pretty damn straightforward to me. One left and the profit went with him. Not much ambiguity there and the big airlines only poured money in because JB was going through it like a drunken sailor.

And yet they have an investment grade credit rating. Must be smoke and mirrors as well.

Profits are a lagging indicator with regards to who generated them, policies in place years before dictate the long term profitability of a corporation. Only outside factors like the GFC and Pandemic can change that in general unless a board is completely incompetent to spend so much in one year it sinks the ship. So the first three years of JB losses are leftover headaches from the previous years. Or are you someone who believes politicians who claim economic changes are their doing 3 months after entering office. BG generated profits at a time you could put a cat in the chair and the company would earn fist fulls of cash, very little competition, Jetstar in its infancy, a massive gap left by Ansett. The GFC sorted out who was successfully running businesses and who was lost at the helm when it got tough. There are very few ways to generate instant profit in business, not many are good for the long term health of the company, things like selling high value assets come to mind or sacking a wad of critical staff.

It might also surprise you to know that Qantas often sold assets during the 70s and 80s. Buildings, hotels and other assets. There were a few hairy years of international downturn in the 70s where asset sales kept the company in a, albeit, small profit territory.

So, I reject that it is a lag from previous years, except in the case of someone like Pan Am where management was hopeless for the better part of two decades.

There is one clear reason why profits dropped at VA. Because someone started spending BILLIONS of dollars. Did VA really need 'The Club'?? An outlandishly expensive piece of real-estate that sucked dollars like a damn bursting and generated virtually no revenue. Not to mention the absolutely ridiculous 'nazi-style' treatment of its own staff who knocked on the door to ask a question and were often told "DO NOT COME IN, STAY THERE". This was all a manifestation of the ego of the person running the joint. The 'Club' was far bigger than any Chairman's Lounge and it, along with an A330 trans-continental operation that I suspect never may a single dollar in profit, was all waste, waste and more waste.

The contribution of the offshore airlines was FAR outstripped by what was spent.

As for sacking critical staff. Which planet are you living on?? The same one where European airlines are cancelling flights wholesale, they haven't contracted out their ramp and baggage because it's been contracted out for decades. So, Qantas got rid of a work group that had caused continual industrial mayhem for decades. Even the 'good old days' they were on strike every five minutes and had working conditions that were over-the-top by any reasonable standard. The same union at Ansett had overtime 'guarantees' for goodness sake. Now how would things like that be achieved without militant flexing of industrial muscle and constantly putting a gun to the company's head, usually just before Easter or similar.

BTW, VA when they were bought by Bain, sacked something like 9000 staff, a far greater proportion of people than QF has - VA's workforce more than halved. They seem to be doing OK now without 'The Club', the fancy and unprofitable 'The Business' and all the rest of the nonsense that sucked up billions. I flew on VA in 'The Business', yes, it was a great product, but so was Ansett's international first and business class, along with being completely unprofitable.

In case you've missed it, the entire industry is struggling, not just Qantas. In some cases, the delay problems are worse overseas. To blame the entire thing on sacking staff is just a perfect case of assuming post hoc ergo propter hoc.

I believe you mentioned Rex. Haha, did you forget the $100-200M they were 'gifted' to save their regional routes by the previous government, which they then used to launch a 737 operation?? All this nonsense about Qantas being a Job-Keeper 'recipient'. They didn't pocket that money, it was paid on to the staff. It's not like the staff went with no pay and the JobKeeper was just put in a Swiss Bank Account........... I know of people that were terminated after JobKeeper started who the companies could have happily kept employing but they decided to downsize on the basis that there was not going to be a prospect of that work for some time.

Do you really think airlines and other companies should just keep paying people and go bankrupt?? The other 'support' was in reduced or waived fees but you had to be operating to be eligible to save by not paying them and everyone got them.

I will however concede that the offshore call centres are a cock up, training obviously wasn't up to scratch.

Last edited by AerialPerspective; 27th Aug 2022 at 17:24.

No one said JB was a good CEO, but you were claiming that BG was. Which was completely against what most working at VA towards the end of his tenure thought.

And seriously wrt to QF we are talking about now, not 50 years ago. QF is operating under completely different conditions today. Selling a hotel is not selling key infrastructure and leasing back, like HQs or the terminals you operate from. Its quite easy to see from this years financials why the equity partners are all joining the fray and pumping cash into competitors. They see a market dominated by a failing encumbent ripe for the picking.

I also think your universe forgot that QF passed $2billion in government subsidies earlier in the year.

Works in Europe as some countries have 20-30% unemployment so cheap labor is not an issue. In Australia its far cheaper to negotiate your own conditions with employees than put your company in the hands of third parties that have a profit margin on top of employee wage costs. as those contractors are just as likely to strike or move companies and leave the contractor short of labor. Again Australia is a very different labor market and aviation market to the rest of the world.

Not sure you understand that VA was in administration. It was resurrected from the dead by cutting back to the bone and then restructuring and renegotiating, it was that or be broken up and the entire workforce put off. QF can afford to maintain its workforce, its previous profits showed it could, but AJ in his infinite quest for more fake profits and bonuses is bleeding the rock to its core. Lay off a huge chunk of workers, remove a huge chunk of liability on paper, forget the issues it causes and possible increase in operational costs...

And seriously wrt to QF we are talking about now, not 50 years ago. QF is operating under completely different conditions today. Selling a hotel is not selling key infrastructure and leasing back, like HQs or the terminals you operate from. Its quite easy to see from this years financials why the equity partners are all joining the fray and pumping cash into competitors. They see a market dominated by a failing encumbent ripe for the picking.

I believe you mentioned Rex. Haha, did you forget the $100-200M they were 'gifted' to save their regional routes by the previous government, which they then used to launch a 737 operation??

As for sacking critical staff. Which planet are you living on?? The same one where European airlines are cancelling flights wholesale, they haven't contracted out their ramp and baggage because it's been contracted out for decades.

BTW, VA when they were bought by Bain, sacked something like 9000 staff, a far greater proportion of people than QF has

Last edited by 43Inches; 27th Aug 2022 at 22:50.