VA pilots worried about employment 2021

How has Elizabeth not been sacked? Or the entire board who has overseen the last 5-10 years.

Borghetti was an idiot driven by ego and revenge who made so many stupid decisions and thought he was a bit smarter than he was..... yet Elizabeth approved them all and continued to trumpet his talent and direction.

She needs to take accountability and should have left a long time ago. Although having met her she seems as self assured as him so that’s probably unlikely she would admit any fault.

i think all shareholders and employees need to get together and demand her immediate removal.

Borghetti was an idiot driven by ego and revenge who made so many stupid decisions and thought he was a bit smarter than he was..... yet Elizabeth approved them all and continued to trumpet his talent and direction.

She needs to take accountability and should have left a long time ago. Although having met her she seems as self assured as him so that’s probably unlikely she would admit any fault.

i think all shareholders and employees need to get together and demand her immediate removal.

What a weak effort by Scurrah in his latest release. It appears VA are in denial of their problems and the impact Covid-19 will have on the economy and the airline business. Then again it could be due to ignorance. Does he not read what QF are doing.

In short VA will reduce SYD-LAX by 2 frequencies per week for approx. 1 month. Reduce BNE-HND by 4 frequencies per week for approx. 1 month.

There are a few other changes but nothing to write home about.

Ps. Princess Cruises are mothballing their 18 cruise ships as soon as possible for 2 months at this stage. Disney Cruises suspended immediately, Disneyland, Disneyworld and Universal Studios closed until further notice.

In short VA will reduce SYD-LAX by 2 frequencies per week for approx. 1 month. Reduce BNE-HND by 4 frequencies per week for approx. 1 month.

There are a few other changes but nothing to write home about.

Ps. Princess Cruises are mothballing their 18 cruise ships as soon as possible for 2 months at this stage. Disney Cruises suspended immediately, Disneyland, Disneyworld and Universal Studios closed until further notice.

Last edited by B772; 13th Mar 2020 at 00:30.

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

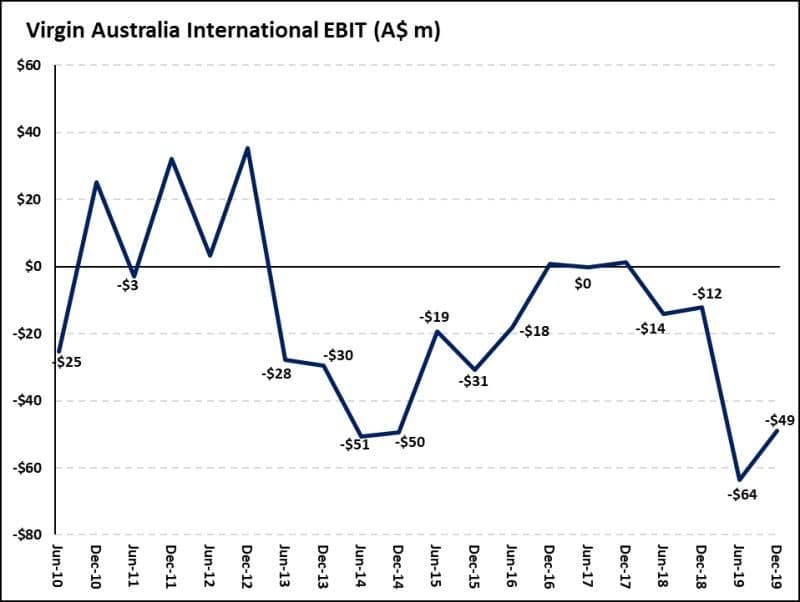

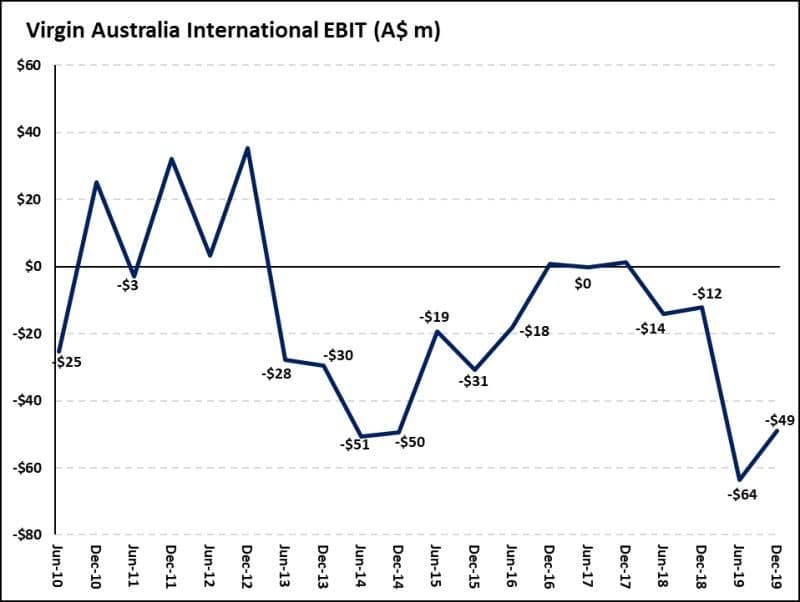

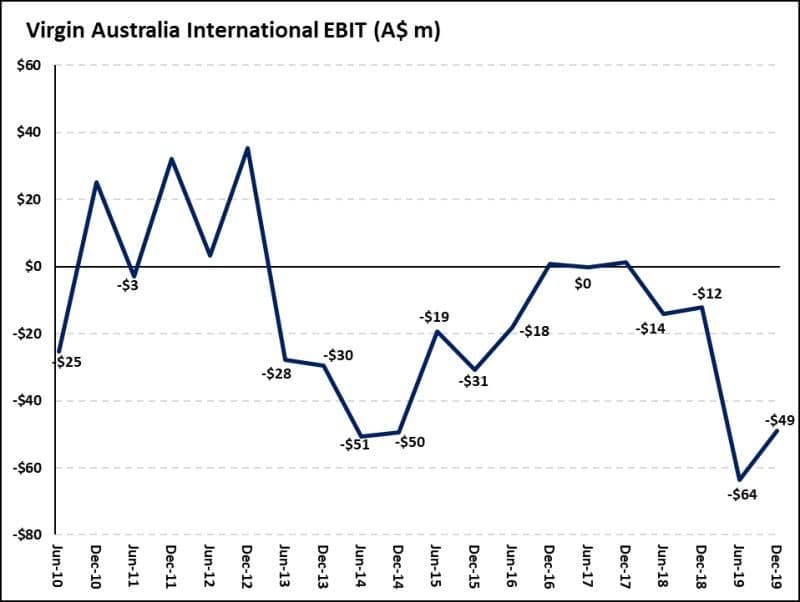

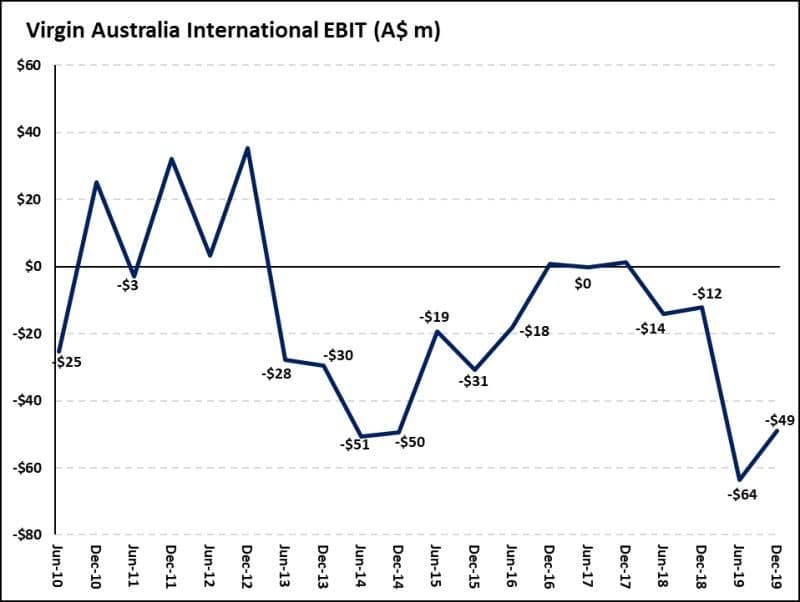

14 of the past 20 half yearly EBIT outcomes for Virgin Australia International have been negative. This is not sustainable. The international business is a significant contributor to the poor performance of the Virgin Australia Group (VAG) over the past decade, culminating in a 2019 loss at the PBT level for VAG of A$472m. The domestic business is holding VAG together with an EBIT of A$70m over 2019. Despite the string of poor financial outcomes, the international business represents almost 40% of VAG available seat kilometres and likely to tie up more than 40% of the aircraft assets of the business. The advocates for the international business will talk about the benefits it provides the domestic business in terms of network effects. Only Virgin will know what these look like but at the market level, around 10% of domestic PAX either take an international flight after or before a domestic flight. These positive effects are unlikely to dominant the negative. The bottom line is that it is extremely difficult to make money in the international business because it is far more competitive than domestic. While the domestic market is a duopoly, international markets can have up to 6 aggressive, high quality, lower unit cost players that are very difficult to compete against.

Link

Link

Even if you put aside the endless garbage about 'cash flow positive' (if you're a business and you don't make a profit, you're NOT sustainable in the long term, especially when you can't even make a profit after having BILLIONS tipped in by corporate owners)... the share price was between 40-50c when the previous CEO took over and we've now had a year or two of the new CEO and where is it now ... trading at 5.7c when I looked just a minute ago... but been hovering around the 10-15c mark for months.

This company had/has potential, but it has been utterly destroyed by monumental incompetence, by leaders in many cases, who are stunning examples of intellectual incapacity... WHO buys another airline to expand the business and then closes half its routes and places aircraft against the fence only to pay through the nose for a competitor to do the flying for them... WTF was the point then of purchasing Skywest? If that wasn't enough you've got the cockup with the 737/A320, letting the A320 drivers go on the basis they'd get approval on the AOC for the 737 but they couldn't even do that until something like the THIRD attempt... not to mention the DPS debacle, this is supposed to be a PROFESSIONAL airline group and they can't even manage to put DPS on a sustainable basis for one of their subsidiaries without completely cocking that up as well. OzJet was a tiny airline with a dozen head office staff and even they could successfully get DPS on their AOC and start operating without any problems (there's were mainly financial).

There are numerous other calamitous stuff-ups along the way too, choosing the wrong computer platforms which are completely useless at the coalface even in normal operations and less capable that a 45 year old platform used by Air NZ.

There are some wonderful people working at VA and TT and it's just a damn shame that these colossal morons have nearly destroyed this company in the space of a decade and left it potentially teetering on the brink while not taking one single pay cut or giving up a single bonus from my memory, the previous CEO even being paid more than Alan Joyce at one stage for the incredible achievement of turning in one loss after another. People who work there talk of anyone with expertise being shown the door as well, that's some pretty strong arrogance to be the purveyors of a total corporate cockup and still have the gall to throw aside people who know what they're doing and might help you dig yourself out of the hole.

If anything, Paragraph is too damn nice in his comments.

There's a reason why the previous bloke was derisively referred to in the competitor as 'mini-me'.

Last edited by AerialPerspective; 13th Mar 2020 at 01:13.

14 of the past 20 half yearly EBIT outcomes for Virgin Australia International have been negative. This is not sustainable. The international business is a significant contributor to the poor performance of the Virgin Australia Group (VAG) over the past decade, culminating in a 2019 loss at the PBT level for VAG of A$472m. The domestic business is holding VAG together with an EBIT of A$70m over 2019. Despite the string of poor financial outcomes, the international business represents almost 40% of VAG available seat kilometres and likely to tie up more than 40% of the aircraft assets of the business. The advocates for the international business will talk about the benefits it provides the domestic business in terms of network effects. Only Virgin will know what these look like but at the market level, around 10% of domestic PAX either take an international flight after or before a domestic flight. These positive effects are unlikely to dominant the negative. The bottom line is that it is extremely difficult to make money in the international business because it is far more competitive than domestic. While the domestic market is a duopoly, international markets can have up to 6 aggressive, high quality, lower unit cost players that are very difficult to compete against.

Link

Link

Virgin - $1 billion, all borrowed from it's corporate owners.

You can't quote a share price difference based on the last few days and use it as an argument. Qantas shares are far more robust than VAH. One is still worth between $3-4 and the other is worth 5c on current trading, it was over 70c ten years ago and more than $2 at one stage. The coronavirus will pass and Qantas will recover, VAH probably will not as it has very few, if any, levers that it can pull.

Qantas cash in the bank - between $3-4 billion (which it owns).

Virgin - $1 billion, all borrowed from it's corporate owners.

You can't quote a share price difference based on the last few days and use it as an argument. Qantas shares are far more robust than VAH. One is still worth between $3-4 and the other is worth 5c on current trading, it was over 70c ten years ago and more than $2 at one stage. The coronavirus will pass and Qantas will recover, VAH probably will not as it has very few, if any, levers that it can pull.

Virgin - $1 billion, all borrowed from it's corporate owners.

You can't quote a share price difference based on the last few days and use it as an argument. Qantas shares are far more robust than VAH. One is still worth between $3-4 and the other is worth 5c on current trading, it was over 70c ten years ago and more than $2 at one stage. The coronavirus will pass and Qantas will recover, VAH probably will not as it has very few, if any, levers that it can pull.

the misinformation on this thread is astounding and it is pretty disappointing to read comments from posters who would like to see VA fail. Your cash facts are misleading also. Cash in bank is cash in bank. It doesnt matter where it originated from. VA has about $1 billion, QF has about $1.7 billion. Yes QF also has assets they can sell but that is different to cash in bank...

Join Date: Dec 2001

Location: Australia

Posts: 197

Likes: 0

Received 0 Likes

on

0 Posts

That's all very well chadzat, but what some of the debt instruments that are maturing over the next 12 months ????

They have to be funded for VAH to survive, and the cash reserves (and I don't believe it's $1 billion) will take a huge haircut.

Ansett before it fell over had considerably more "cash" and we all know the outcome there.

Everyone better hope COVID-19 is resolved sooner rather than later, otherwise things will get really tricky for a lot of companies and global economies in general.

They have to be funded for VAH to survive, and the cash reserves (and I don't believe it's $1 billion) will take a huge haircut.

Ansett before it fell over had considerably more "cash" and we all know the outcome there.

Everyone better hope COVID-19 is resolved sooner rather than later, otherwise things will get really tricky for a lot of companies and global economies in general.

The really sad part is the needless panic due to Covid19. Economies wrecked, lives ruined, jobs lost etc etc all because of the headless chickens on social media and the political class pandering to it.

Its the flu for God’s sake, albeit with a slightly higher mortality rate among those over 80.

China has long been the epicentre of respiratory illnesses, I cannot recall even once when I didn’t get sick after flying as a passenger on a domestic Chinese airline.

The problem for us in the Southern Hemisphere is that the worst is yet to come as the winter approaches.

My fingers are firmly crossed that Virgin will survive and there will be no job losses. A government bailout may be a good idea.

Its the flu for God’s sake, albeit with a slightly higher mortality rate among those over 80.

China has long been the epicentre of respiratory illnesses, I cannot recall even once when I didn’t get sick after flying as a passenger on a domestic Chinese airline.

The problem for us in the Southern Hemisphere is that the worst is yet to come as the winter approaches.

My fingers are firmly crossed that Virgin will survive and there will be no job losses. A government bailout may be a good idea.

Join Date: Oct 2013

Location: New Zealand

Age: 71

Posts: 1,475

Likes: 0

Received 0 Likes

on

0 Posts

A virus called ‘CEO’

Well said AP. And yes, I have actually tried to be nice in my commentary. Some people on here don’t want to know the true state of play and would rather click their heels and dream nice thoughts about everything being ok and that there is nothing to be concerned about. VA and QF cannot be compared. Two different models with different financial status. Simple. As for the argument that ‘one should not discuss past travesties’, well I’m sorry but that is naieve and sticking your head in the sand. Previous management are relative to this discussion. It’s called ‘follow the bouncing ball’. It is a buildup of the past 10 or so years of mismanagement that has placed VA in a perilous situation. You can’t blame it all on a virus that has been around for 10 weeks on VA’s current position. And that is a relevant point because some existing Managers and Board have been around through all of these issues and are still here providing direction. Their competency has gotten better? Their ability to manage change in a way that builds the airlines viability has gotten better? I don’t think so. Elizabeth pushed for the Train Driver to come onboard as CEO of a commercial airline. Way different to managing a lazy Government owned cash cow. I dont believe this to be a good fit, not a good decision in a time of need. The Board should have taken a walk along with the the CEO.

As for the ‘little bloke’ who took his millions and jumped from the sinking ship; 35 years in the one company will give you nothing more than a one sided view of the world. He only knew one business model. He only knew the framework of one company. Once he started at VA and the leash was removed he was given a playground filled with lots and lots of different toys and the permission to buy new ones!!! Bad mistake.

Now the man with the mono-brow has been tasked to do something that is above his pay scale. The management of the airline from the day that it started to grow into a real competitive business have been an abject failure. Successive useless CEO’s, useless CFO’s and useless Board members. Godfrey was punching above his weight from 2013, the Italian was punching above his weight for the duration of his long tenure, now Scurrah is punching above his weight with no solid aviation background. With COVID potentially playing havoc with the world for months to come, maybe longer, and then flow-down affects to run for years, this company needs a really talented team on the flight deck to pull it out of its nosedive. I’m not confident that it does.

As for the ‘little bloke’ who took his millions and jumped from the sinking ship; 35 years in the one company will give you nothing more than a one sided view of the world. He only knew one business model. He only knew the framework of one company. Once he started at VA and the leash was removed he was given a playground filled with lots and lots of different toys and the permission to buy new ones!!! Bad mistake.

Now the man with the mono-brow has been tasked to do something that is above his pay scale. The management of the airline from the day that it started to grow into a real competitive business have been an abject failure. Successive useless CEO’s, useless CFO’s and useless Board members. Godfrey was punching above his weight from 2013, the Italian was punching above his weight for the duration of his long tenure, now Scurrah is punching above his weight with no solid aviation background. With COVID potentially playing havoc with the world for months to come, maybe longer, and then flow-down affects to run for years, this company needs a really talented team on the flight deck to pull it out of its nosedive. I’m not confident that it does.

Last edited by Paragraph377; 13th Mar 2020 at 03:29.

‘Just the flu’ is totally underplaying the threat. It is not the disease itself that is the problem but the shear number of people that will become infected if the virus goes uncontrolled. Hospitals will quickly become overwhelmed. Australia with a population of circa 25 million means 15 million infections of which 150,000 - 300,000 will die with 3,000,000 requiring hospital care of which 1,000,000 will require ICU care. Now, I don’t think the Aussie hospital system has nowhere near enough resources to deal with those numbers so it is likely that anyone over 60-65 years old will be denied ICU treatment and told to do their best at home. This is the kind of event that could lead to society breaking down, minor crimes going un-investigated, all elective surgeries delayed and people curfewed at home. Of course the other option is to introduce social distancing measures, close borders when required and limit movement in an attempt to slow the spread to allow the health system to treat smaller numbers over a longer period. The thing the world is lacking is a co-ordinated strong plan, instead we have wishey washey policies being implemented in a haphazard way. I said it when this appeared in January and I will say it again, we have at least another 6 mo this of total disruption ahead and any business in a fragile state now won’t survive. On the up side at least when the recovery starts in the global economy is will be strong and quick.

Join Date: Nov 2005

Location: UK

Posts: 137

Likes: 0

Received 0 Likes

on

0 Posts

The VAH share price is nothing more than a reflection of market risk pricing.

It should be no surprise with the company performance and COVID19.

The statement today to the ASX identifies further reductions in services, additional cost savings and confirms suspension of earnings guidance FY20 due to COVID 19.

The first debt maturity is late in 2021. They will need to have the cash for that.

It should be no surprise with the company performance and COVID19.

The statement today to the ASX identifies further reductions in services, additional cost savings and confirms suspension of earnings guidance FY20 due to COVID 19.

The first debt maturity is late in 2021. They will need to have the cash for that.

Join Date: May 2007

Location: Western Pacific

Posts: 721

Likes: 0

Received 0 Likes

on

0 Posts

Looks like things will get worse before they get better.

https://www.businessnewsaus.com.au/a...ng-grace-.html

https://www.businessnewsaus.com.au/a...ng-grace-.html

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

PS with no solid aviation background

Not quite right. He has many years both in airlines and the travel industry at various levels. He does not need to be a specialist. That's why he has a leadership team. He needs to make good business decisions based on the information provided to him. Having a background in aviation means nothing anyway. A) you learn as you go, B) it is about business acumen and strong leadership in a CEO role. There are enough smart people to advise him as requirerd.

The first debt maturity is late in 2021. They will need to have the cash for that.

Not quite. They can refinance their debt, as they have done previously. Whilst obtaining further debt is challenging - it isn't impossible. I hear that Finch rated VA today as B+ and stable.

Entertaining read on PS @ https://www.smh.com.au/business/comp...17-p53sa6.html

Not quite right. He has many years both in airlines and the travel industry at various levels. He does not need to be a specialist. That's why he has a leadership team. He needs to make good business decisions based on the information provided to him. Having a background in aviation means nothing anyway. A) you learn as you go, B) it is about business acumen and strong leadership in a CEO role. There are enough smart people to advise him as requirerd.

Not quite. They can refinance their debt, as they have done previously. Whilst obtaining further debt is challenging - it isn't impossible. I hear that Finch rated VA today as B+ and stable.

Entertaining read on PS @ https://www.smh.com.au/business/comp...17-p53sa6.html

i guess my sarcasm was lost on you AP. That was my point exactly.

the misinformation on this thread is astounding and it is pretty disappointing to read comments from posters who would like to see VA fail. Your cash facts are misleading also. Cash in bank is cash in bank. It doesnt matter where it originated from. VA has about $1 billion, QF has about $1.7 billion. Yes QF also has assets they can sell but that is different to cash in bank...

the misinformation on this thread is astounding and it is pretty disappointing to read comments from posters who would like to see VA fail. Your cash facts are misleading also. Cash in bank is cash in bank. It doesnt matter where it originated from. VA has about $1 billion, QF has about $1.7 billion. Yes QF also has assets they can sell but that is different to cash in bank...

Whatever Qantas' cash, it's evident that they are far more capable of weathering a storm like this than VA and no, I don't want to see VA fail either, but I am astounded at the continual string of bad decisions that have happened at VA and while I hope it doesn't fail, if it does, it will be the staff that pay the price, not the people who've stuffed up repeatedly and collected millions for their trouble.