Time for a little 'perspective' Mr Joyce?

Thread Starter

Join Date: Sep 2017

Location: Europe

Posts: 1,674

Likes: 0

Received 0 Likes

on

0 Posts

Time for a little 'perspective' Mr Joyce?

If it is true a long serving employee has been disciplined penning a critique of policy. If it is also true that the childish response suggests staff have clouded perspective, then this ought clear it up.

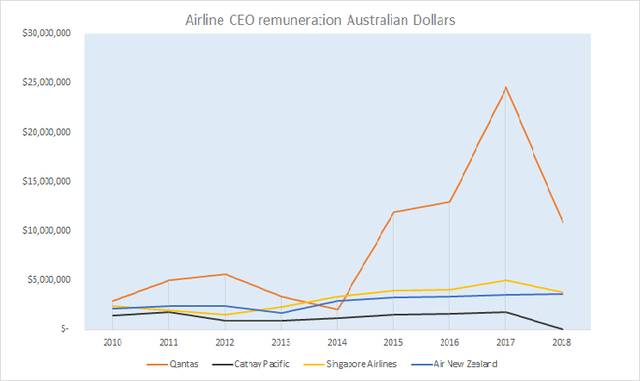

Indeed Mr Joyce has 'transformed' airline CEO remuneration, amassing nearly AUD $80 million in the same time that a peer CEO at Singapore Airlines, Mr Goh Choon Phong has grossed nearly AUD $28 million.

We note Mr Clifford's axiomatic explanation, that Mr Joyce's remuneration is less than FY17, but it still is nearly three times higher than Mr Goh Choon Phong. True to form as ever, but as usual misses the point.

Surely then Mr Joyce for this level of remuneration has indeed 'transformed' the company?

Mr Goh Choon Phong earned over AUD $4 billion for their shareholders at SIA, in contrast Qantas statutory profit is less than $800 million

It would appear that perspective is indeed subject to being clouded,

A comparison of audited facts suggest the self anointed 'greatest airline management' might be a little deluded.

Last edited by Rated De; 8th Sep 2018 at 07:48. Reason: CX FY18 results are interim and thus unaudited

Join Date: Jul 2014

Location: Harbour Master Place

Posts: 662

Likes: 0

Received 0 Likes

on

0 Posts

ALAEA Fed Sec the data on the MiG is inaccurate.

You need to include his earlier earnings as Jetstar CEO, sourced from 2005 ~ 2008 Qantas Annual Report

2008 2,395,414

2007 1,659,238

2006 1,423,530

2005 1,418,599

---------------------

Total $6,896,791

You need to include his earlier earnings as Jetstar CEO, sourced from 2005 ~ 2008 Qantas Annual Report

2008 2,395,414

2007 1,659,238

2006 1,423,530

2005 1,418,599

---------------------

Total $6,896,791

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

I don't think it is right to compare profit after tax as a measure of company performance on business in different jurisdictions, with different laws, and who are operating in different business cycles, and using non-statutory measures.

And in terms on Alan's renumeration; wasn't the spike a result of his LTIP vesting, which is part of his renumeration package, and linked to various metrics, which have been realised?

And in terms on Alan's renumeration; wasn't the spike a result of his LTIP vesting, which is part of his renumeration package, and linked to various metrics, which have been realised?

I don't think it is right to compare profit after tax as a measure of company performance on business in different jurisdictions, with different laws, and who are operating in different business cycles, and using non-statutory measures.

And in terms on Alan's renumeration; wasn't the spike a result of his LTIP vesting, which is part of his renumeration package, and linked to various metrics, which have been realised?

And in terms on Alan's renumeration; wasn't the spike a result of his LTIP vesting, which is part of his renumeration package, and linked to various metrics, which have been realised?

Wasn’t it very fortunate for Joyce that the “write down” of Company assets happened to coincide with the start of the executives Long Term Incentive Plan. It nicely meant that the shares that they were to receive were locked in at the lowest possible price (circa 83 cents) and over the next four years, the company was magically profitable with resultant significant gains in the share price - aided, of course, by using some of the profits to buy back shares (thus keeping the share dividends fairly lean).

It can only be considered luck that the share price was extremely low at the start of the LTIP yet was in the stratosphere when it matured - I don’t know why the institutional shareholders aren’t looking into this more actively considering they were denied share value and dividends while when the share price was being driven down.

It can only be considered luck that the share price was extremely low at the start of the LTIP yet was in the stratosphere when it matured - I don’t know why the institutional shareholders aren’t looking into this more actively considering they were denied share value and dividends while when the share price was being driven down.

Thread Starter

Join Date: Sep 2017

Location: Europe

Posts: 1,674

Likes: 0

Received 0 Likes

on

0 Posts

Wasn’t it very fortunate for Joyce that the “write down” of Company assets happened to coincide with the start of the executives Long Term Incentive Plan. It nicely meant that the shares that they were to receive were locked in at the lowest possible price (circa 83 cents) and over the next four years, the company was magically profitable with resultant significant gains in the share price - aided, of course, by using some of the profits to buy back shares (thus keeping the share dividends fairly lean).

It can only be considered luck that the share price was extremely low at the start of the LTIP yet was in the stratosphere when it matured - I don’t know why the institutional shareholders aren’t looking into this more actively considering they were denied share value and dividends while when the share price was being driven down.

It can only be considered luck that the share price was extremely low at the start of the LTIP yet was in the stratosphere when it matured - I don’t know why the institutional shareholders aren’t looking into this more actively considering they were denied share value and dividends while when the share price was being driven down.

Extreme luck. Considering that an asset impairment is management prerogative, it was extremely lucky that the metrics the remuneration committee 'chose' for Mr Joyce were set at an equally low level to achieve the amazing 'transformation'

Join Date: Nov 2007

Location: Bexley

Posts: 1,792

Likes: 0

Received 0 Likes

on

0 Posts

ALAEA Fed Sec the data on the MiG is inaccurate.

You need to include his earlier earnings as Jetstar CEO, sourced from 2005 ~ 2008 Qantas Annual Report

2008 2,395,414

2007 1,659,238

2006 1,423,530

2005 1,418,599

---------------------

Total $6,896,791

You need to include his earlier earnings as Jetstar CEO, sourced from 2005 ~ 2008 Qantas Annual Report

2008 2,395,414

2007 1,659,238

2006 1,423,530

2005 1,418,599

---------------------

Total $6,896,791

I have some sympathy with Alan. If employees didn’t have such clouded judgement, one can only surmise that his remuneration (‘luck’?) may have been so much greater and maybe a dollar of profit might have been able to have been made during his tenure.

Clearly that embarrassing and appalling demonstration of bullying and managerial ineptitude has ruffled sequinned feathers in some way or the thread wouldn’t have been removed. This would suggest it was indeed genuine. What a disgraceful performance.

Clearly that embarrassing and appalling demonstration of bullying and managerial ineptitude has ruffled sequinned feathers in some way or the thread wouldn’t have been removed. This would suggest it was indeed genuine. What a disgraceful performance.

Thread Starter

Join Date: Sep 2017

Location: Europe

Posts: 1,674

Likes: 0

Received 0 Likes

on

0 Posts

And in terms on Alan's renumeration; wasn't the spike a result of his LTIP vesting, which is part of his renumeration package, and linked to various metrics, which have been realised?

The STIP (short term incentive plan) includes such interesting metrics as:

- Underlying PBT A management approved profit (Non statutory) measure (How lucky is that?)

- Such novel benchmarks as the Bain and Company "Net Promoter Score" (by management consultants, for management-You're Welcome!) https://en.wikipedia.org/wiki/Net_Promoter

- Punctuality ( He gets a bonus from OTP!)

- Domestic network advantage (what does that mean?)

- Board’s assessment of Operational Safety (like asking your barber if you need a haircut really)

Qantas’ 3-year TSR performance compared to:

– ASX100 companies

– A global airline peer group

– ASX100 companies

– A global airline peer group

Over the 3-year performance period of the 2016–2018 LTIP (LONG TERM INCENTIVE PLAN)

the Qantas share price grew from $3.16 to $6.16,

the Qantas share price grew from $3.16 to $6.16,

Lucky wasn't it!

Last edited by Rated De; 7th Sep 2018 at 12:37.

Moderator

I wonder if it was the moderators under legal threat or the Captain who started it under duress from the company?

PPRuNe Moderators did not delete the thread

Nunc est bibendum

Maybe it wasn’t the captain who wrote the letter who started the thread and whilst he didn’t mind it being discussed on in general terms, didn’t want the text out in public? As such he asked whoever posted it to take it down?

According to yesterday’s news, Joyce’s pay has nosedived to about half that of the previous year - no wonder he is so upset about the letter. How is anyone supposed to survive on only $12m - $13m?. Forget about donating the bonus to the drought stricken farmers, we need to give it to poor Alan.

Join Date: Apr 1999

Location: Brisbane

Posts: 451

Likes: 0

Received 0 Likes

on

0 Posts

This action clearly fails the Pub Test. AJ and his senior advisors have failed to accurately read the room here.

With several pilot EAs due for renegotiation in the near future, I suspect that this current senior management team will only bargain with a modicum of honesty if they have the threat of protected industrial action on the table.

It will be interesting to see whether the pilot groups and their union/s move for overwhelming no votes followed by the lodgement of a PIA application.

PG

With several pilot EAs due for renegotiation in the near future, I suspect that this current senior management team will only bargain with a modicum of honesty if they have the threat of protected industrial action on the table.

It will be interesting to see whether the pilot groups and their union/s move for overwhelming no votes followed by the lodgement of a PIA application.

PG