So you need a new fleet Leigh?

Letís get this into a worldwide perspective as QFís fleet are but a wee drop in the ocean.....

https://www.pprune.org/rumours-news/...eral-jets.html

What have other airlines done with effected airframes?

https://www.pprune.org/rumours-news/...eral-jets.html

What have other airlines done with effected airframes?

Fake news and fraud

The pay figures are bogus and inflated. Regardless itís still well short of 747 pay

Sunrise isnít the 787 and does much harder flying so the 787 is not relevant

3 half patterns represents fraud and not science. Iíd doubt CASA is going to allow it anyway. If they do itís negligent

All a setup to blame pilots and be a red herring. 787 needs to be improved and SH especially

Sunrise isnít the 787 and does much harder flying so the 787 is not relevant

3 half patterns represents fraud and not science. Iíd doubt CASA is going to allow it anyway. If they do itís negligent

All a setup to blame pilots and be a red herring. 787 needs to be improved and SH especially

your major problem is that, although what you assert used to be the way allowances were considered, modern generations of pilots and cabin crew use meal allowances to inflate their income when applying for loans. Nowadays, the ATO, banks, employers consider meal allowances to be income. All that is different is that there is a certain amount that the ATO considers to be tax free. the horse has bolted. A long time ago on this issue

Any of your Cabin Crew buddies who are using their allowances as income could be in for a nasty surprise if they get audited by the ATO.

I obviously donít know how every airline works, but surely all aircrew are in receipt of allowances that are ďfolded intoĒ salaries as described by the ATO as a taxable part of your income?

https://www.ato.gov.au/Business/PAYG...el-allowances/

Therefore if the tax man is happy to tax the relevant allowances as income Iím sure using em for loan applications etc is above board!

https://www.ato.gov.au/Business/PAYG...el-allowances/

Therefore if the tax man is happy to tax the relevant allowances as income Iím sure using em for loan applications etc is above board!

Join Date: Apr 2009

Location: SYD

Posts: 54

Likes: 0

Received 0 Likes

on

0 Posts

The pay figures are bogus and inflated. Regardless itís still well short of 747 pay

Sunrise isnít the 787 and does much harder flying so the 787 is not relevant

3 half patterns represents fraud and not science. Iíd doubt CASA is going to allow it anyway. If they do itís negligent

All a setup to blame pilots and be a red herring. 787 needs to be improved and SH especially

Sunrise isnít the 787 and does much harder flying so the 787 is not relevant

3 half patterns represents fraud and not science. Iíd doubt CASA is going to allow it anyway. If they do itís negligent

All a setup to blame pilots and be a red herring. 787 needs to be improved and SH especially

The correct way to lodge allowances is to add your total allowances to your gross salary.

Then you claim the max reasonable amount back for every night you were away.

The ATO views allowances as income. They also want to see what you spent it on. If you donít keep a travel diary and you do get audited, they will treat your allowances as income and they will tax your marginal rate on it.

Hence why you need to declare it.

Then you claim the max reasonable amount back for every night you were away.

The ATO views allowances as income. They also want to see what you spent it on. If you donít keep a travel diary and you do get audited, they will treat your allowances as income and they will tax your marginal rate on it.

Hence why you need to declare it.

I obviously donít know how every airline works, but surely all aircrew are in receipt of allowances that are ďfolded intoĒ salaries as described by the ATO as a taxable part of your income?

They are not considered income by anyone except for maybe a few cool aid drinking management types and a few angels who have no idea how aviation works it would appear.

your major problem is that, although what you assert used to be the way allowances were considered, modern generations of pilots and cabin crew use meal allowances to inflate their income when applying for loans. Nowadays, the ATO, banks, employers consider meal allowances to be income. All that is different is that there is a certain amount that the ATO considers to be tax free.

the horse has bolted. A long time ago on this issue.

the horse has bolted. A long time ago on this issue.

2) Whether allowances are considered income or not, they are generally spent on exactly what they were designed to be spent on. Living when away from home.

3) Is there a point to your interest in allowances? Will it help get Qantas back on track after years of neglect? Will it help any 73 be inspected for wing cracks any faster?

Thread Starter

Join Date: Sep 2017

Location: Europe

Posts: 1,674

Likes: 0

Received 0 Likes

on

0 Posts

3) Is there a point to your interest in allowances? Will it help get Qantas back on track after years of neglect? Will it help any 73 be inspected for wing cracks any faster?

Hypothetically, even if Little Napoleon breaks away from his marital bliss and "cuts" a deal any new type he has admitted is at least four years away.

In four years, the fleet metrics left unchecked will be much worse. The capital expenditure requirements more onerous.

What has been evident is that the mood of the financial community has changed a little with respect to Qantas. Once jovial and light hearted, with Little Napoleon taking the audience on a magical fantasy ride of aviation wonder, the analysts are now a little more attentive with respect to the fleet, the future and indeed succession.

By usual industry metrics he has had a long run, with little to show other than personal remuneration.

The analysts that talked it up can just as easily ask harder questions. Off script he performs terribly.

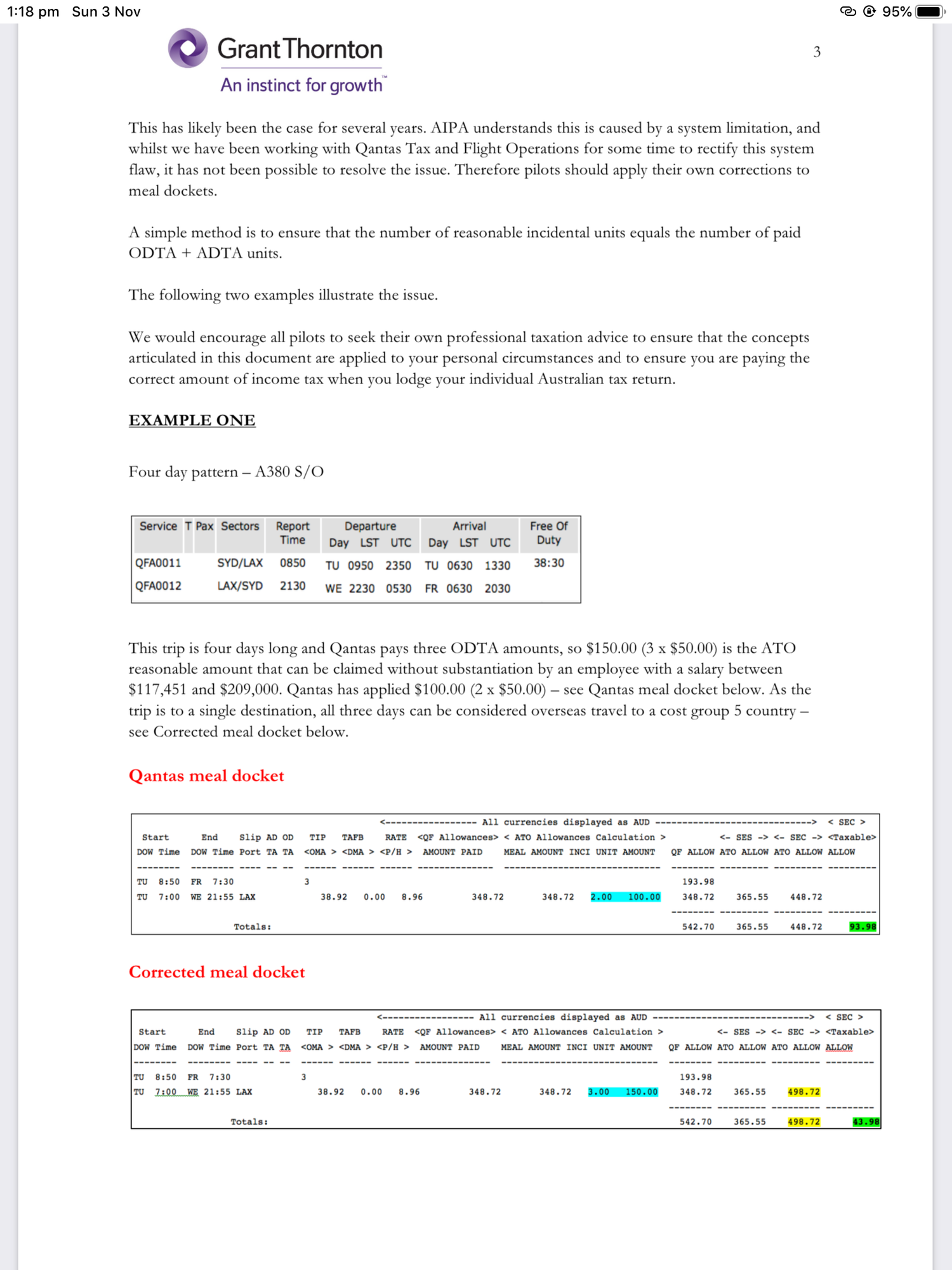

As you can see there is a taxable component

Is there a point to your interest in allowances? Will it help get Qantas back on track after years of neglect? Will it help any 73 be inspected for wing cracks any faster?

Qantas longhaul pilots don’t get paid a salary. Short haul pilots get paid a salary. Then they get other money as well.

Each two weeks they get an amount of money that goes into their nominated bank account. It is the amount left over after deductions, one of which is tax.

Some of it is meal allowances, some of it is ODTA/ADTA.

Various parts of the gross of that money get taxed at different rates for different reasons.

I never said that the ATO thought that allowances were part of salary. All I said was that these days a lot of aircrew use meal allowances to inflate their income so that a bank will give them a bigger loan. No more no less.

Some people choose to include meal allowances and superannuation when describing how much someone is paid. I’m not one of them.

Each two weeks they get an amount of money that goes into their nominated bank account. It is the amount left over after deductions, one of which is tax.

Some of it is meal allowances, some of it is ODTA/ADTA.

Various parts of the gross of that money get taxed at different rates for different reasons.

I never said that the ATO thought that allowances were part of salary. All I said was that these days a lot of aircrew use meal allowances to inflate their income so that a bank will give them a bigger loan. No more no less.

Some people choose to include meal allowances and superannuation when describing how much someone is paid. I’m not one of them.

Yeah you did........

And people still should not be using it as part of a loan application

your major problem is that, although what you assert used to be the way allowances were considered, modern generations of pilots and cabin crew use meal allowances to inflate their income when applying for loans. Nowadays, the ATO, banks, employers consider meal allowances to be income. All that is different is that there is a certain amount that the ATO considers to be tax free. the horse has bolted. A long time ago on this issue.

.JMís keyboard is SMOKIN.

Now once again, how the HELL is this banking conversation (which I am happy to discuss in great depth) relating in ANY way to the point of the thread. Which (as I read it) is the fact Qf don't have;

a) the right management

b) making anything like the right decisions

c) nor showing any capability of genuinely forward thinking strategic decision making

d) to achieve anything like the right fleet/partner/destination mix, or

e) any ambition excepting their world class expertise and truly exemplary efforts in personal remuneration at the expense of anything that is in the long term interests of the Company.

f) It doesnít take much for the shorts get their teeth into something like this

Come on Alan!

Sounds like Alan took Patrick out for a nice long lunch and talked up buying new aircraft ďpossiblyĒ next year, as a thinly veiled attempt to divert attention away from the pickle fork controversy.

Sounds like Alan took Patrick out for a nice long lunch and talked up buying new aircraft ďpossiblyĒ next year, as a thinly veiled attempt to divert attention away from the pickle fork controversy.