Qantas Expands International Routes

Just putting it out there.

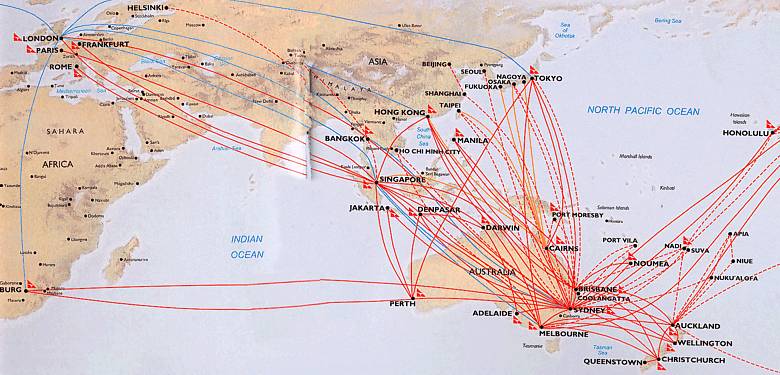

What about if Qantas had services beyond SIN from East Coast Australian cities to say, UK and Europe that Perth flights could complex with ?

This would surely help support a more appropriate aircraft for international Ops than a 737 ex Perth AND create a network Australia wide for those desirous of a Qantas airframe for travel to/from Europe ?

Oh, thats right........

This would surely help support a more appropriate aircraft for international Ops than a 737 ex Perth AND create a network Australia wide for those desirous of a Qantas airframe for travel to/from Europe ?

Oh, thats right........

Join Date: Oct 2007

Location: Antipodes Islands

Posts: 94

Likes: 0

Received 0 Likes

on

0 Posts

PER-SIN !

The have got to be joking!

The cancelled service was an A330 and in my opinion one of the best regional flights they did out of Perth.

I can survive an A320 (Jetstar) and even a 737 (Qantas) for 5 hours but I really don't want to!

They had pretty full loads on the A330 service so why the downgrade?

The cancelled service was an A330 and in my opinion one of the best regional flights they did out of Perth.

I can survive an A320 (Jetstar) and even a 737 (Qantas) for 5 hours but I really don't want to!

They had pretty full loads on the A330 service so why the downgrade?

Need to build the service up after the damage done by withdrawal??

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

Originally Posted by Standard Unit

What about if Qantas had services beyond SIN from East Coast Australian cities to say, UK and Europe that Perth flights could complex with

There really isn't a need either, since QF can leverage EK metal. It isn't essential to use QF metal. Revenue is still derived with codeshare partners vv.

Originally Posted by Mahatma Kote

I can survive an A320 (Jetstar) and even a 737 (Qantas) for 5 hours but I really don't want to!

They had pretty full loads on the A330 service so why the downgrade?

They had pretty full loads on the A330 service so why the downgrade?

A full plane doesn't mean viable yield. You can run a plane full, at a loss, easily. That is the basis of the A330 removal originally. It is a very saturated market, and is way over capacity for the region, blanketed by too many LCC's that are undercutting heavily, and dumping unsustainable fares. Capacity and pricing are irrational. This is clear.

The SQ "lay down beds" are not all that flash, having tried to stop myself sliding to the floor for many hours on a sin - BNE flight.

The service is great, the food good, but the Seats are nothing special.

Not sure that a 737 has a lower seat mile cost than a 330 so a full flight on a 330 should generate more profit than a full 737, the clincher is whether they can fill the 330.

If they can't - and they get say 180 on average per flight, then a 737 will be far more profitable, as the sector cost of a 330 will be much greater than the sector cost of a 737.

The other part of the equation is what else they could be doing with the airframes. If the 737 is already in Perth and doing a lot of sitting around because of the schedule, and the 330 isn't, then it is biased towards using the 737.

It also depends on when the flights depart and arrive. Are they scheduled to sync with domestic flights from inter and intra state? Do a bunch of miners on FIFO arrive in time to connect with the flight to Singapore or does the flight from Singapore arrive in time to get someone coming from Asia onto a FIFO flight to a mine site.

You can't look at the individual city pairs in isolation.

The service is great, the food good, but the Seats are nothing special.

Not sure that a 737 has a lower seat mile cost than a 330 so a full flight on a 330 should generate more profit than a full 737, the clincher is whether they can fill the 330.

If they can't - and they get say 180 on average per flight, then a 737 will be far more profitable, as the sector cost of a 330 will be much greater than the sector cost of a 737.

The other part of the equation is what else they could be doing with the airframes. If the 737 is already in Perth and doing a lot of sitting around because of the schedule, and the 330 isn't, then it is biased towards using the 737.

It also depends on when the flights depart and arrive. Are they scheduled to sync with domestic flights from inter and intra state? Do a bunch of miners on FIFO arrive in time to connect with the flight to Singapore or does the flight from Singapore arrive in time to get someone coming from Asia onto a FIFO flight to a mine site.

You can't look at the individual city pairs in isolation.

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

1. Jetstar

2. Scoot

3. Air Asia (if your prepared to do the quick hop over to KL (SIN / KUL / PER fares have been cheaper than direct with the above airlines)

I have also seen cheaper fares on other Asian carries with a stop.

Western Australia has a small population. In additional to all the 'full service' capacity - the market is saturated.

Singapore is funnelling traffic into their hub, for onward travel. They are not and 'end-of-line' carrier. You cannot compare Qantas and Singapore airlines. Different traffic dynamics. You will have customers on SQ with onward travel e.g. Europe. You'll find with JQ / QF et al, it is point-to-point traffic, with maybe some minor regional asia flying on partner airlines.

Qantas (Oneworld / QF FF) will embrace the service from a loyalty benefit.

2. Scoot

3. Air Asia (if your prepared to do the quick hop over to KL (SIN / KUL / PER fares have been cheaper than direct with the above airlines)

I have also seen cheaper fares on other Asian carries with a stop.

Western Australia has a small population. In additional to all the 'full service' capacity - the market is saturated.

Singapore is funnelling traffic into their hub, for onward travel. They are not and 'end-of-line' carrier. You cannot compare Qantas and Singapore airlines. Different traffic dynamics. You will have customers on SQ with onward travel e.g. Europe. You'll find with JQ / QF et al, it is point-to-point traffic, with maybe some minor regional asia flying on partner airlines.

Qantas (Oneworld / QF FF) will embrace the service from a loyalty benefit.

SQ have an A330 on the route, Scoot have a B787 and J* an A320 so the high and low ends of the market are well catered to already with direct flights. With a flight time of around five hours it's not really worth the inconvenience of a plane change to save a few dollars.

Perhaps QF are trying to cater for the passengers who still want an Asian stop over on the way as they can connect with EK and other code share partners Singapore.

Perhaps QF are trying to cater for the passengers who still want an Asian stop over on the way as they can connect with EK and other code share partners Singapore.

T-Vasis: What are you smoking? A quick look at our bilaterals allow unlimited 5th Freedom rights out of UAE. Both passengers and freight. The problem is places like France that have put unrealistic barriers(150 seats three times a week). Another problem is Dubai, like London cannot handle anymore traffic. Bypass it all together with the right aircraft. Scoot, Air Asia and Jetstar are all loss making low-cost carriers! Frequent Flyers pay a lot more than holiday makers. An end of the line carrier, eh? Just like Air New Zealand! Qantas did have a Network until Geoff Dixon gutted it. 57% of Qantas Frequent Flyers prefer to go through Asia to Europe and Alan Joyce creates a typical point to point airline type operation, no wonder he can only offer B737s. Bite the bullet and buy 35 B787-9s, even better still paint the Jetstar ones and put in J Class lie down seats and divert the A380 through Singapore from Melbourne and take back what was Qantas traffic that has left. Air New Zealand and Cathay have shown the way, all Qantas needs to do is give up on the Jetstar dream, easier said than done with the current bunch.

It will be nice to see the "national flag carrier"* serving an overseas destination from Perth.

However, SQ offer four flights a day on a B777 or A330. I cannot see people flocking to a B737.

The budget conscious have Tiger, Scoot and Jetstar to choose from.

*meaningless phrase

However, SQ offer four flights a day on a B777 or A330. I cannot see people flocking to a B737.

The budget conscious have Tiger, Scoot and Jetstar to choose from.

*meaningless phrase

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

Thanks Busdriver007. You must be 'challenged' with comprehension.

I said the bilaterals need to be "workable," and unlimited with freedmen rights needs to be in place, in order for Qantas to operate viably. That is a two-part need. You even clearly point out the issue with France, which was a factor for Qantas' exit from France many years ago. So I am not "smoking" anything; you issue sits with you and your comprehension of written text.

And what aircraft do your propose that can do this adequately without any payload restrictions both ways?

A sweeping statement. Jetstar has proven to be profitable in different years. Airlines won't be profitable year-on-year. Even the big legacy carriers have run losses. You know this.

Oh dear, now you're showing your position is grasping for threads. The old QF versus Air NZ comparison. You know very well they are not like-for-like. How many 'one-stop' carriers operate into NZ and directly compete with Air NZ compared to how many operate into Australia to compete with QF? How many one-stop carriers operate to Europe from NZ? Air NZ cherry picks its markets. Mostly narrow, and very limited competition. On most of them, Air NZ code-shares with the competitor. Have a look at their network and competitors.

Much unprofitable. Rome comes to mind... It was all VFR traffic into Rome.

Where does this statistic come from?

The B737 provides the best route economics for the market. Qantas would not do it otherwise...

Again a poor comparison. Cathay enjoys the hub and spoke model in Asia to funnel. End-of-line airlines always suffer.

The "Jetstar dream" is critical. If Jetstar does not do it, someone else will. Remember anyone can come into this country and do what they like. Lion Air continues to consider. If that happens, you'll see industry pain. Blame your Government...

I said the bilaterals need to be "workable," and unlimited with freedmen rights needs to be in place, in order for Qantas to operate viably. That is a two-part need. You even clearly point out the issue with France, which was a factor for Qantas' exit from France many years ago. So I am not "smoking" anything; you issue sits with you and your comprehension of written text.

Bypass it all together with the right aircraft

Scoot, Air Asia and Jetstar are all loss making low-cost carriers

An end of the line carrier, eh? Just like Air New Zealand

Qantas did have a Network until Geoff Dixon gutted it

57% of Qantas Frequent Flyers prefer to go through Asia to Europe

The B737 provides the best route economics for the market. Qantas would not do it otherwise...

Air New Zealand and Cathay have shown the way

The "Jetstar dream" is critical. If Jetstar does not do it, someone else will. Remember anyone can come into this country and do what they like. Lion Air continues to consider. If that happens, you'll see industry pain. Blame your Government...

T-Vasis:

Aircraft-even the B777LR can do Perth-Europe WITHOUT restrictions. It already can do Dallas-Adelaide WITHOUT restrictions and it is an old technology aircraft!

Jetstar would never have survived without the mother ship and the Asian franchises are NOT profitable! Remember Orangestar? The holding company of Jetstar Asia went broke in 2011 because "it could not meet it's obligations"(not my words), in other words Qantas had to buy it out and create Newstar with QF money and write off it's debt. $63 million worth of "goodwill". Air New Zealand is PROFITABLE (sustainably so and not because of write downs). Geoff Dixon and James Strong failed to understand that airlines need a network and he proceeded to shut it down and buy the wrong aircraft. 57% came from Qantas' own research in 2009(i was there) yet they went ahead with shutting down European services through Asia. Air New Zealand and Cathay recognise that in long-haul flying the Front pays for the Back! Look at the most expensive fares across the Tasmen, invariably they are ANZ and guess what they have some of the cheapest, that is why they shut down Freedom. The Australian Government has a lot to answer for, This is something that we can agree on. In the real business world the negotiators responsible for giving away our bilaterals without something in return shows a level of naivety common in Australia. As a US Senator said to me "What is wrong with your Politicians in Australia, Don't any of them have children?"

Aircraft-even the B777LR can do Perth-Europe WITHOUT restrictions. It already can do Dallas-Adelaide WITHOUT restrictions and it is an old technology aircraft!

Jetstar would never have survived without the mother ship and the Asian franchises are NOT profitable! Remember Orangestar? The holding company of Jetstar Asia went broke in 2011 because "it could not meet it's obligations"(not my words), in other words Qantas had to buy it out and create Newstar with QF money and write off it's debt. $63 million worth of "goodwill". Air New Zealand is PROFITABLE (sustainably so and not because of write downs). Geoff Dixon and James Strong failed to understand that airlines need a network and he proceeded to shut it down and buy the wrong aircraft. 57% came from Qantas' own research in 2009(i was there) yet they went ahead with shutting down European services through Asia. Air New Zealand and Cathay recognise that in long-haul flying the Front pays for the Back! Look at the most expensive fares across the Tasmen, invariably they are ANZ and guess what they have some of the cheapest, that is why they shut down Freedom. The Australian Government has a lot to answer for, This is something that we can agree on. In the real business world the negotiators responsible for giving away our bilaterals without something in return shows a level of naivety common in Australia. As a US Senator said to me "What is wrong with your Politicians in Australia, Don't any of them have children?"

Join Date: Sep 2005

Location: australia

Age: 59

Posts: 425

Likes: 0

Received 0 Likes

on

0 Posts

The Jetstar franchise internationally has been a disaster.

The name should be changed to the 'Money pit'.

T-V, The 'Jetstar dream' has turned into a nightmare.

Massive capital injections in North asia, over 10 years of losses in singapore, only one very small profit in that whole time. And let's not mention the disaster of Vietnam. Ok, I mentioned it.

But wait for the huge bonuses coming up for AJ after the engineered massive losses last year so that we have a big 'turnaround' this year.

Jetscar is not the answer.

We need a 330 to compete with SQ. a 737 will not cut it but at least the Perth FF punters can now accumulate/burn points on this route if they want to. They probably all have FF with SQ anyway.

The name should be changed to the 'Money pit'.

T-V, The 'Jetstar dream' has turned into a nightmare.

Massive capital injections in North asia, over 10 years of losses in singapore, only one very small profit in that whole time. And let's not mention the disaster of Vietnam. Ok, I mentioned it.

But wait for the huge bonuses coming up for AJ after the engineered massive losses last year so that we have a big 'turnaround' this year.

Jetscar is not the answer.

We need a 330 to compete with SQ. a 737 will not cut it but at least the Perth FF punters can now accumulate/burn points on this route if they want to. They probably all have FF with SQ anyway.

Join Date: Aug 2009

Posts: 509

Likes: 0

Received 0 Likes

on

0 Posts

Aircraft-even the B777LR can do Perth-Europe WITHOUT restrictions.

Jetstar has delivered profitability. Maybe not as a Group, but certainly Australia has delivered year-on-year profit. The Asian businesses - well. There is more to it than just EBIT performance. There are synergies the benefit the Group as a whole. Subsequently, of the Group underlying results deliver sustainable returns, than this is what is fundamental. From the financial results of Jetstar for this fiscal, Singapore and Australia are in the black. Japan is still in start-up, but improving, and Vietnam is still in early start-up. Whilst this is the market commentary, from Jetstar, you have to take this on good faith. The results will prevail eventually.

Air New Zealand is PROFITABLE (sustainably so and not because of write downs).

in long-haul flying the Front pays for the Back

Jetscar is not the answer.

We need a 330 to compete with SQ

Qantas has to install infrastructure is so many geographical ports, due to end-of-line operations. That means kitchen in each port, fleet presentation in each port. Engineering in each port etc. This is costly. Especially for narrow, thin operations.

Singapore doesn't. It has it in one port - Singapore. All other ports are subcontracted via very aggressive tenders, driving absolute benefit in unit cost to Singapore airlines.

The economics will never be simpler for hub carriers entering into AUS, and QF (or any Australian carrier) exiting AUS. This is why Virgin mostly operates all airline operations via sub-contractor e.g. catering, cleaning etc. It has the ability to tender, and driver cost improvement. Qantas has established, legacy operations. This is costly and hard to change.

Many airlines are prepared to take the hit on one market, due to strong margins on the other. SQ could in fact be doing this. But you won't know this. It is unfair to make a claim, when you do not have any insight into SQ's operating economics on this market. Most people seem to think simply because there is a service, it must be making money. Rome for QF did not make money for more than 12 years. But Qantas continued to operate, simply to avoid losing the FCO slots, since once released, they are typically impossible to recover in the future, at slot constrained ports.

SQ is carrying primarily through-traffic. Through-traffic doesn't travel on QF. The options to Europe, on 'same carrier' were limited, or don't exist. Remember that you also had to go to London or Frankfurt, versus direct. Unless price was significantly better, you'll go SQ to get to ZRH with one stop. And you maintain the same metal all the way. It is also an easier sell for travel agents.

SQ is carrying primarily through-traffic. Through-traffic doesn't travel on QF. The options to Europe, on 'same carrier' were limited, or don't exist.

The gifting of QF pax who wish to travel to Europe to Emirates is madness. They book QF end up on Emirates, they enjoy the experience, which website do you think that they will go to next time?

Qantas has to install infrastructure is so many geographical ports, due to end-of-line operations. That means kitchen in each port, fleet presentation in each port. Engineering in each port etc

Singapore doesn't. It has it in one port - Singapore. All other ports are subcontracted via very aggressive tenders, driving absolute benefit in unit cost to Singapore airlines.

etstar has delivered profitability. Maybe not as a Group, but certainly Australia has delivered year-on-year profit. The Asian businesses - well. There is more to it than just EBIT performance. There are synergies the benefit the Group as a whole. Subsequently, of the Group underlying results deliver sustainable returns, than this is what is fundamental.

The bottom line is that QF management have been distracted by Jetstar and taken their collective eyes off the ball. Probably as a result of AJ being the father of Jetstar. Jetstar has COST QF money. There is no accounting standard in the world that would show otherwise.

T Vasis... You fairly represent the attitude of current Qantas management. Allow me to tell you why I, at least, find it annoying.

1. QF red tail fleet decisions have been mismanaged. Wrong choices have been made over the last 15 years. No need to bash the dead horse but it's a massive horse never acknowledged by management. It's one of the biggest factors in QF's recent woes. Cue Air NZ comparisons whilst acknowledging your points.

2. Jetstar, Internationally has underachieved. Yet it has been given capital. Qf was told to get further capital it had to meet its cost of capital. The hypocracy is frustrating. Put simply, the Ivory tower must be disappointed. Unfortunately, thousands of employees have lost their job.

3. The attitude under Joyce has been Jetstar can do, Emirates can do, Air NZ can do...Qantas can't do. Your previous post also suggests this annoying attitude. If management showed the same tenacity advancing the QF business as they did defending the Jetstar money pit, it may be easier to argue that they didn't, in fact, take their eye off the ball in favour of some pipe dream. Unfortunately, thousands of people have lost their job.

4. Joyce grounded Qantas. It is his legacy. I will never forgive him. It was the wrong decision saved by a weak government.

5. The recent management decisions to improve aircraft utilisation and to change the value of the fleet to reduce depreciation expense, is not rocket science. In fact, I see it as another clear example of this management failing their stakeholders. Why wasn't it done years ago?

The prevailing attitude I have is that management gave up on Qantas for the last 5 years. Brushed it under the carpet. It's very sad.

1. QF red tail fleet decisions have been mismanaged. Wrong choices have been made over the last 15 years. No need to bash the dead horse but it's a massive horse never acknowledged by management. It's one of the biggest factors in QF's recent woes. Cue Air NZ comparisons whilst acknowledging your points.

2. Jetstar, Internationally has underachieved. Yet it has been given capital. Qf was told to get further capital it had to meet its cost of capital. The hypocracy is frustrating. Put simply, the Ivory tower must be disappointed. Unfortunately, thousands of employees have lost their job.

3. The attitude under Joyce has been Jetstar can do, Emirates can do, Air NZ can do...Qantas can't do. Your previous post also suggests this annoying attitude. If management showed the same tenacity advancing the QF business as they did defending the Jetstar money pit, it may be easier to argue that they didn't, in fact, take their eye off the ball in favour of some pipe dream. Unfortunately, thousands of people have lost their job.

4. Joyce grounded Qantas. It is his legacy. I will never forgive him. It was the wrong decision saved by a weak government.

5. The recent management decisions to improve aircraft utilisation and to change the value of the fleet to reduce depreciation expense, is not rocket science. In fact, I see it as another clear example of this management failing their stakeholders. Why wasn't it done years ago?

The prevailing attitude I have is that management gave up on Qantas for the last 5 years. Brushed it under the carpet. It's very sad.

Last edited by crosscutter; 19th Apr 2015 at 07:59.

Japan is still in start-up, but improving, and Vietnam is still in early start-up.

You conspicuously failed to mention Jetstar Hong Kong. Presumably it's in "embryonic start-up".

Join Date: Oct 2007

Location: Australia

Posts: 129

Likes: 0

Received 0 Likes

on

0 Posts

Qantas has to install infrastructure is so many geographical ports, due to end-of-line operations. That means kitchen in each port, fleet presentation in each port. Engineering in each port etc

Singapore doesn't. It has it in one port - Singapore. All other ports are subcontracted via very aggressive tenders, driving absolute benefit in unit cost to Singapore airlines.

QF cannot do the same because?

On the other hand, QF used to do the lions share of foreign airline ground handling in Australia until the past few years when anecdotally contracts were given away by management jacking up prices by 50+%.