Qantas half year 2015 financial results

Join Date: Mar 2006

Location: Melbourne

Posts: 472

Likes: 0

Received 0 Likes

on

0 Posts

Yup, the difference it makes. Currency rates and fuel.

And the drain on the company by Jetstar Hong Kong and Jetstar Japan prevented greater profits.

The great strategy of Asia has failed and the Chinese will ensure it continues to fail, particularly when they have the upper hand.

And the drain on the company by Jetstar Hong Kong and Jetstar Japan prevented greater profits.

The great strategy of Asia has failed and the Chinese will ensure it continues to fail, particularly when they have the upper hand.

Aeromedic:

[QUOTE]And the drain on the company by Jetstar Hong Kong and Jetstar Japan prevented greater profits.

The great strategy of Asia has failed and the Chinese will ensure it continues to fail, particularly when they have the upper hand./QUOTE]

As I have consistently said, the Qantas Asian adventure was always going to be a disaster right from the very start.

I also venture to suggest that without the windfall of lower oil prices Qantas would perhaps be still in the Red.

[QUOTE]And the drain on the company by Jetstar Hong Kong and Jetstar Japan prevented greater profits.

The great strategy of Asia has failed and the Chinese will ensure it continues to fail, particularly when they have the upper hand./QUOTE]

As I have consistently said, the Qantas Asian adventure was always going to be a disaster right from the very start.

I also venture to suggest that without the windfall of lower oil prices Qantas would perhaps be still in the Red.

Join Date: Aug 2008

Location: Za farzer land

Age: 53

Posts: 163

Likes: 0

Received 0 Likes

on

0 Posts

Interesting to note, with the 738's being sold and another 74 leaving the qantas fleet, Jetstar will now have more jet aircraft than Qantas. No orders for qantas, but still a few 787's to come to Jetstar and crap loads of A320's on order. Very sad indeed.

Join Date: Nov 2011

Location: Inside their OODA loop

Posts: 243

Likes: 0

Received 0 Likes

on

0 Posts

Originally Posted by Sunfish

I also venture to suggest that without the windfall of lower oil prices Qantas would perhaps be still in the Red.

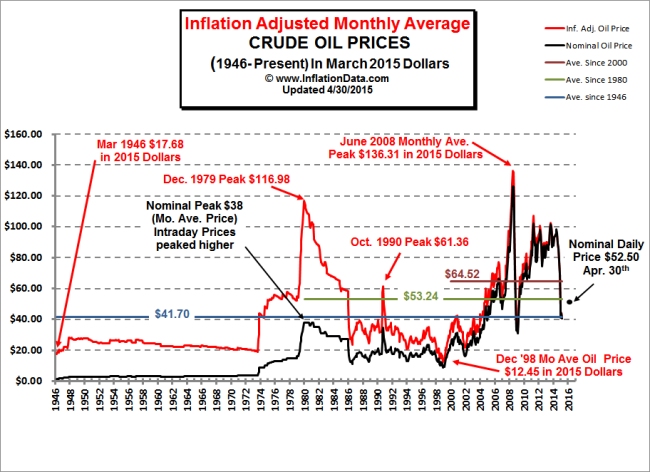

This chart [Note it is inflation adjusted to 2014 dollars]

makes the case for reversion to the mean. It could also explain the choice to go with the A380 in 2000 at a low point in the cycle.

Raw data is here: Historical Oil Prices: InflationData.com