Qantas Shares! how low can they go?

Thread Starter

Join Date: May 2004

Location: Hollywood

Posts: 101

Likes: 0

Received 0 Likes

on

0 Posts

Qantas Shares! how low can they go?

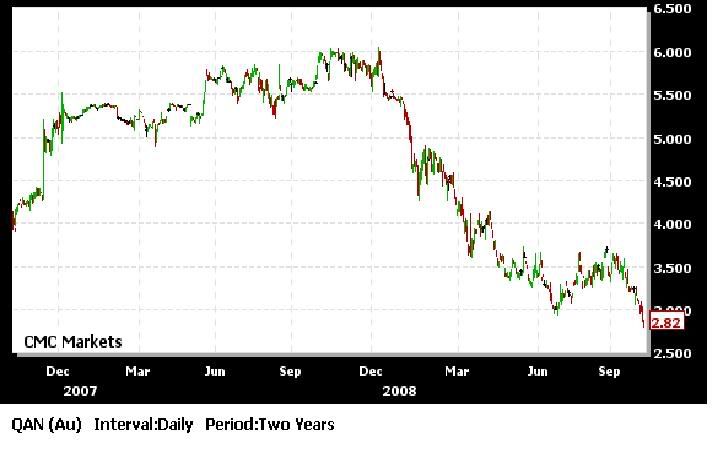

Well Qantas shares have hit a dismal $2.81 today and looks like it will continue to go down. Dixon is about to leave, although with a tidy pay packet despite under his control having almost half the value of the company wiped out since its peak.

This seems to be for many reasons, obviously the current world wide economic crisis is a major factor. But what else has contributed? What could have been done better? Qantas has always had a bit of an invincible attitude to things in the past and has usually come out the tough times very well.

BUT.... The current reputation of qantas is at an all time low in the public and some say financial eyes. (justified or not I'll leave it for others to say) Safety incidents, failed APA Takeover, industrial trouble, morale, rising fuel....!!!

With the company taking so many hits, how long until it takes a bigger toll? Dixon said a long time ago they needed to merge with another airline. Is this a real possibility now? Is Joyce the man to turn it around? To me it has a little tinge of ansett pre demise about it. What do you all think?

This seems to be for many reasons, obviously the current world wide economic crisis is a major factor. But what else has contributed? What could have been done better? Qantas has always had a bit of an invincible attitude to things in the past and has usually come out the tough times very well.

BUT.... The current reputation of qantas is at an all time low in the public and some say financial eyes. (justified or not I'll leave it for others to say) Safety incidents, failed APA Takeover, industrial trouble, morale, rising fuel....!!!

With the company taking so many hits, how long until it takes a bigger toll? Dixon said a long time ago they needed to merge with another airline. Is this a real possibility now? Is Joyce the man to turn it around? To me it has a little tinge of ansett pre demise about it. What do you all think?

The shares may be down but let's face it, who's aren't? My view is that Qantas will survive as it has faced just about every adversity that life can throw at it, despite some questionable leadership in recent years. The new team has some challenges ahead but as we all know a new broom can cleanse; we are already seeing signs of this process before GD is out the door.

Another factor that will see Qantas through is the sheer professionalism of its staff at almost every level. Crew responded magnificently in the OJK and QPA saga and now ground staff are showing what can be done to maintain normal operations without two fleet units. Bravo all.

Just how many more incidents the Rat can take before the travelling public totally loses confidence in the carrier is probably a bigger and more concerning issue than the current economic situation.

Another factor that will see Qantas through is the sheer professionalism of its staff at almost every level. Crew responded magnificently in the OJK and QPA saga and now ground staff are showing what can be done to maintain normal operations without two fleet units. Bravo all.

Just how many more incidents the Rat can take before the travelling public totally loses confidence in the carrier is probably a bigger and more concerning issue than the current economic situation.

Yes but does the ASX mirror safety incidents? morale? public reputation? industrial problems????  ...

...

And even if so is it still ok that the company is worth half its previous value??

I think the post asked all those questions and what is going on?? Fair question I think.

Oh yeah.... next

And even if so is it still ok that the company is worth half its previous value??

I think the post asked all those questions and what is going on?? Fair question I think.

Oh yeah.... next

Join Date: Oct 2004

Location: 38,000 ft

Posts: 394

Likes: 0

Received 0 Likes

on

0 Posts

Lets look at the share price even further. Over a 10 year period the price is almost exactly the same. It has been higher, mainly due to a dubious takeover bid, but it is pretty much the same price.

You have probably received some dividends over that time period but would it have been worthwhile owning shares in this company over ten years compared to someone like CBA whose share price has actually doubled over this time.

You have probably received some dividends over that time period but would it have been worthwhile owning shares in this company over ten years compared to someone like CBA whose share price has actually doubled over this time.

Join Date: Aug 2005

Location: PPrune nominee 2011!

Posts: 1,561

Likes: 0

Received 0 Likes

on

0 Posts

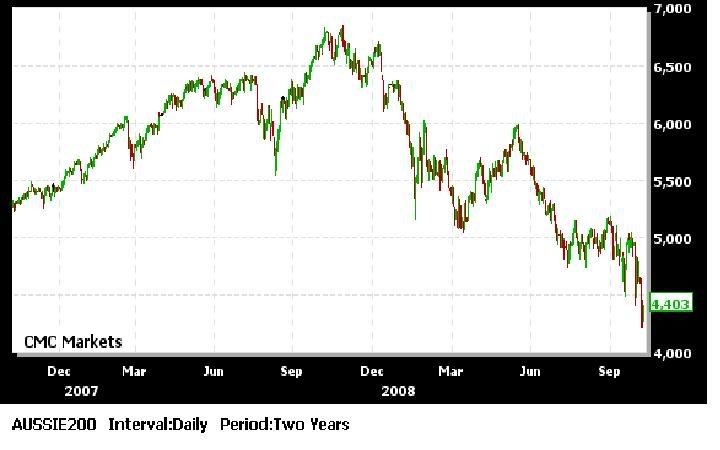

Everyone is taking a huge hit on the stockmarket in recent weeks - just look at your superannuation!

Nearly all super funds have taken a hit, there were some news items to the exact amount lost

Shame, but NEXT!

Nearly all super funds have taken a hit, there were some news items to the exact amount lost

Shame, but NEXT!

Join Date: Mar 2007

Location: Roguesville, cloud cuckooland

Posts: 1,197

Likes: 0

Received 16 Likes

on

5 Posts

Rio Tinto 19/05/08= $157.45/ now=78.01

BHP 16/05/08=50.00/ now= 29.84

BSL 20/06/08=12.29/ now=6.10

FMG 25/06/06=13.15/ now= 3.30

CBA 1/11/2007= 62.16/ now= 42.40

Random picks from the ASX100. All good well-managed australian companies trading at a fraction of their highest valuations in the last year or so.

Why aren't you guys questioning whether their performances are due to

BHP 16/05/08=50.00/ now= 29.84

BSL 20/06/08=12.29/ now=6.10

FMG 25/06/06=13.15/ now= 3.30

CBA 1/11/2007= 62.16/ now= 42.40

Random picks from the ASX100. All good well-managed australian companies trading at a fraction of their highest valuations in the last year or so.

Why aren't you guys questioning whether their performances are due to

safety incidents? morale? public reputation? industrial problems

Join Date: Dec 1999

Location: Metung RSL or Collingwood Social Club on weekends!

Posts: 645

Likes: 0

Received 0 Likes

on

0 Posts

Pammy - don't fuss over the share par price, look at the dividends !

I bought QAN shares @ $2.95 and my first dividend realised 17 cents/share.

Two years ago when the par price was $ 6.25 iI was still getting 18 cents/share in dividends.

The latest dividend was 17cents/share and the par price is back around $3.50.

NEVER speculate in Airline stock - invest in a profitable airline, long term and you can't lose!!

Thanks Geoff

I bought QAN shares @ $2.95 and my first dividend realised 17 cents/share.

Two years ago when the par price was $ 6.25 iI was still getting 18 cents/share in dividends.

The latest dividend was 17cents/share and the par price is back around $3.50.

NEVER speculate in Airline stock - invest in a profitable airline, long term and you can't lose!!

Thanks Geoff

Join Date: Oct 2007

Location: gold coast QLD australia

Age: 86

Posts: 1,345

Likes: 0

Received 0 Likes

on

0 Posts

I am a shareholder, and quite frankly I don't give a rats A$se how low they go as long as Macbank and Allco never again have the opportunity to try to take it over. Had that gone ahead, we would have had another Ansett, as they would have stripped it of all assets (a la Murdoch and Abeles) to keep themselves afloat, and 36,000 people would be looking for a job. The whole world is in a spiral dive at the present time (though "Our Kev" is in denial) hold on to your hats for the next twelve months, as we watch our super go down the gurgler (and for a self funded retiree it is very unpleasant, might have to put the missus back to work, infact I have already told her she might have to get a job in the mines) no sense of humor that girl.

Join Date: Dec 2007

Location: Australia

Posts: 161

Likes: 0

Received 0 Likes

on

0 Posts

I rarely find myself agreeing with Captain Kremin but I do so wholeheartedly now.

Qantas is a strong company, excellent routes, strong balance sheet, good board and new management team, excellent order book, great brand and complimentary subsidiaries. Add to that robust unions, entrenched experience base and an extraordinarily strong domestic market position.

Talking Qantas prospects down is mean-spirited and in any case non-productive. Ansett and all the other carriers that died along the way over the last 25 years, typically died from lack of all or most of the above attributes. In their last years they were carcasses on life support. Absolutely nothing like Qantas.

Qantas is simply a major company, not perfect but coping well in tough times and with a higher than normal focus on operational issues that for now obscures a clear view of an excellent overall performance.

End of story.

Qantas is a strong company, excellent routes, strong balance sheet, good board and new management team, excellent order book, great brand and complimentary subsidiaries. Add to that robust unions, entrenched experience base and an extraordinarily strong domestic market position.

Talking Qantas prospects down is mean-spirited and in any case non-productive. Ansett and all the other carriers that died along the way over the last 25 years, typically died from lack of all or most of the above attributes. In their last years they were carcasses on life support. Absolutely nothing like Qantas.

Qantas is simply a major company, not perfect but coping well in tough times and with a higher than normal focus on operational issues that for now obscures a clear view of an excellent overall performance.

End of story.

(though "Our Kev" is in denial)

You can be rest assured he probably knows more about where we are heading, than we do about 'tying our shoe laces'. I would say that the old image of the 'duck swimming' would sum up those at the top at the moment. If the last lot were so smart why didn't they tell us we were heading to the bottom. Exactly the opposite message from Howard & co just 9 months ago. I do not believe our position would be 1 bit changed, whoever won last years election.

This situation is well beyond the control of any Australian government and basically we are just along for the ride and thanking our lucky stars for coal and iron ore and slightly better regulations.

Sorry for the thread drift but sometime silly statements cannot be let pass without rebutal.

Thread Starter

Join Date: May 2004

Location: Hollywood

Posts: 101

Likes: 0

Received 0 Likes

on

0 Posts

$2.63 when I last checked.

A lot of people getting quite defensive here when we are openly just asking is qantas on the right coarse. Yes many many companies are down, but the discussion was, has it all been handled correctly?. What could have been done better to prevent them perhaps following suit of so many other companies. I am sure that the banks going bust atm are not saying well its ok cos other banks have.... so its not our fault. A recent article i read commented on the multiple problems Q was facing, (i.e the recent incidents/public perception industrial etc etc). Again is this contributing to their current financial woos.

In such a tightning market, qantas is getting yet another fleet type also. (380) Is this a smart move? How many types are that? Is the answer from the new Joyce man to continue the cannibalisation of mainline flying. You can only cut so much in essential operating costs and employee conditions. As i said reminds me a bit of ansett. I hope I am wrong...

A lot of people getting quite defensive here when we are openly just asking is qantas on the right coarse. Yes many many companies are down, but the discussion was, has it all been handled correctly?. What could have been done better to prevent them perhaps following suit of so many other companies. I am sure that the banks going bust atm are not saying well its ok cos other banks have.... so its not our fault. A recent article i read commented on the multiple problems Q was facing, (i.e the recent incidents/public perception industrial etc etc). Again is this contributing to their current financial woos.

In such a tightning market, qantas is getting yet another fleet type also. (380) Is this a smart move? How many types are that? Is the answer from the new Joyce man to continue the cannibalisation of mainline flying. You can only cut so much in essential operating costs and employee conditions. As i said reminds me a bit of ansett. I hope I am wrong...

Last edited by PammyAnderson; 10th Oct 2008 at 02:21.

Join Date: Feb 2002

Location: Sydney, Australia

Posts: 590

Likes: 0

Received 0 Likes

on

0 Posts

Is this a piss-take Pammy on the thread about how low the VB share price can go?

Perhaps Pammy would like to ask why the QF share price is down to near its float price many years ago.....but QF has paid a handsome dividend every year since its float!

As opposed to Virgin Blue that floated at some $2.25 to Mum and Dad investors under the huge fanfare of that grinning publicity-seeker Branson and his whingeing, whining little side-kick Brett Godfrey.

The VB float was touted as one of the great investments for Australians by Sir Dick and is now floundering at about 33 cents.

And the only time it every really paid a dividend, Branson himself complained like an old mole and complained to the board bitterly.

Gee Pammy, spoken to any Mum and Dad investors about how much they have been taken for a ride and what exactly they think of Branson and Godfrey? Let me guess.........

And while we're at it, lets start a new service to the USA (where the economy is on the verge of collapse/recession) with a new and expensive aircraft type.

Let's sell tickets without an AOC, whinge about having to refund the money, whine about the Boeing strike, delay the start until God-knows-when, p1ss off the travelling public that purchased tickets in good faith and head straight into financial oblivion by operating to a destination with a collapsing economy being made even more expensive to travellers by the falling AUD$!

And dont expect much traffic coming the other way for a few years either because the Americans are feeling it even worse than us and their worst is yet to come.

Now thats an airline I would love to work for.......not!

Perspective Pammy......perspective!

Perhaps Pammy would like to ask why the QF share price is down to near its float price many years ago.....but QF has paid a handsome dividend every year since its float!

As opposed to Virgin Blue that floated at some $2.25 to Mum and Dad investors under the huge fanfare of that grinning publicity-seeker Branson and his whingeing, whining little side-kick Brett Godfrey.

The VB float was touted as one of the great investments for Australians by Sir Dick and is now floundering at about 33 cents.

And the only time it every really paid a dividend, Branson himself complained like an old mole and complained to the board bitterly.

Gee Pammy, spoken to any Mum and Dad investors about how much they have been taken for a ride and what exactly they think of Branson and Godfrey? Let me guess.........

And while we're at it, lets start a new service to the USA (where the economy is on the verge of collapse/recession) with a new and expensive aircraft type.

Let's sell tickets without an AOC, whinge about having to refund the money, whine about the Boeing strike, delay the start until God-knows-when, p1ss off the travelling public that purchased tickets in good faith and head straight into financial oblivion by operating to a destination with a collapsing economy being made even more expensive to travellers by the falling AUD$!

And dont expect much traffic coming the other way for a few years either because the Americans are feeling it even worse than us and their worst is yet to come.

Now thats an airline I would love to work for.......not!

Perspective Pammy......perspective!

Last edited by TIMMEEEE; 10th Oct 2008 at 02:59.

Join Date: Jun 2007

Location: With Ratty and Mole

Posts: 421

Likes: 0

Received 0 Likes

on

0 Posts

Fair Value in a Falling market

The money that has been made on the stock market over the last 5 years has gone.

But there are some great bargains out there at present.

Warren Buffet maintains that to buy a stake in a company:

1.A company should make something that everyone needs

2.It should be profitable and well run

3.It should provide an income stream.ie dividend.

4.It should offer fair value when compared with asset backing.

There are a lot of companies that now meet these criteria.

Now is a good time to buy.

Airline stocks have always been stocks to avoid.

But....with Qantas shares approaching float price you'd have to be tempted.

Dont try to pick the bottom of the market before buying.

Do the research and if a company meets the above criteria...buy them

But there are some great bargains out there at present.

Warren Buffet maintains that to buy a stake in a company:

1.A company should make something that everyone needs

2.It should be profitable and well run

3.It should provide an income stream.ie dividend.

4.It should offer fair value when compared with asset backing.

There are a lot of companies that now meet these criteria.

Now is a good time to buy.

Airline stocks have always been stocks to avoid.

But....with Qantas shares approaching float price you'd have to be tempted.

Dont try to pick the bottom of the market before buying.

Do the research and if a company meets the above criteria...buy them

Well Considering the price is now at $2.58 I think this thread has something other to do than VB sorry to say Timmee. Is that yours and others only defence to any questions about qantas?

I notice there was nothing about pammys points and questions?

IE the leadership? Could this price been avoided? The recent continuing incidents? Public confidence and safety perceptions? The industrial problems? The moral? Fleet expansion?

From reading the thread Pammy only asked, have or are these things contributing? FAir enough I think.

Show some maturity for once and try not turn it into a vb thread as your only defence for what are some obvious genuine questions.

I think the mum and dad investors of Qantas who bought up near $6.00 are probably hearing the pain you are chatting about too. At $2.58 now they're for the first time below what VB once was. I wonder if they will keep following them..

Just cos VBs shares are woeful should it be ok Qantas shares are also. And as the thread said, could it have been avoided?

I notice there was nothing about pammys points and questions?

IE the leadership? Could this price been avoided? The recent continuing incidents? Public confidence and safety perceptions? The industrial problems? The moral? Fleet expansion?

From reading the thread Pammy only asked, have or are these things contributing? FAir enough I think.

Show some maturity for once and try not turn it into a vb thread as your only defence for what are some obvious genuine questions.

I think the mum and dad investors of Qantas who bought up near $6.00 are probably hearing the pain you are chatting about too. At $2.58 now they're for the first time below what VB once was. I wonder if they will keep following them..

Just cos VBs shares are woeful should it be ok Qantas shares are also. And as the thread said, could it have been avoided?

Last edited by SilverSleuth; 10th Oct 2008 at 05:46.

Join Date: Jan 2008

Location: sydney

Posts: 468

Likes: 0

Received 0 Likes

on

0 Posts

I sold my shares after the bid failed back in July 07 and got $5.75 per share, multiplied by xxxx thanks very much. It was a nice bonus to go with my redundancy from 10 months before.

I am not much into the share market but to me now seems like a great time to buy QF shares again. $2.60 odd is a bargain.

And who knows. they might even employ me again in the future so that they can make me redundant a few years down the track.

And another thing about airline shares. I remember when ANZ got bought out by their government and their share were a dsmal 50-60c. That was just a gold mine waiting to be plundered. If only I had some cash to make a purchase back then.

Oh well

I am not much into the share market but to me now seems like a great time to buy QF shares again. $2.60 odd is a bargain.

And who knows. they might even employ me again in the future so that they can make me redundant a few years down the track.

And another thing about airline shares. I remember when ANZ got bought out by their government and their share were a dsmal 50-60c. That was just a gold mine waiting to be plundered. If only I had some cash to make a purchase back then.

Oh well

Join Date: Oct 2007

Location: gold coast QLD australia

Age: 86

Posts: 1,345

Likes: 0

Received 0 Likes

on

0 Posts

Maxter, thankyou for pointing out my inadequate ways, but you see I am not so warm and fuzzy about Dear Leader. To my way of thinking the Labor Party was elected in 07 on its eviromental and workchoices ticket, its history of poor economic management is well documented, and Rudds poor performance on the 7.30 report the other night, when he refused to answer any question, but used political speak (in otherwords said twenty minutes of twaddle) when all the punters want to know is,will they still have a house and a job next year? Not to hard really. Of course I don't expect the bloke to use the R word and start a stampede, but anybody with half a brain realises that Australia simply occupies the best cabin on the Titanic, (beautifully put in the Australian today) and to keep saying "We will be alright Jack" is pure crap. As a self funded retiree, my super is in a spiral dive, and I would like nothing better than the whole bloody mess come to a successful end. I did not flog myself around the skies, in just about anything with wings, for forty nine years to end up in a one bedroom flat with a one bar heater, and it is of great concern to me(and a lot of other people) that tweedledum and tweedledee are in charge.

Join Date: Jun 2007

Location: With Ratty and Mole

Posts: 421

Likes: 0

Received 0 Likes

on

0 Posts

T.Green

Vent your anger at the super heroes of Wall Street.

This mess began about 18 months ago and is now reaching a crescendo.

Way before Rudd was elected

If Howard was in power he would be facing the same mess and be just as powerless.

There is a lesson here dont put all your eggs in one basket.

Spread the risk...shares property cash,antiques ,stamps,vintage cars.

By the way we are not heading into a recession..more like a bloody depression.

Your shares will recover...but it will take awhile.

.Hold onto your hat ..there is still a little way to go...down.

Word is another 1000pts off the Dow

This mess began about 18 months ago and is now reaching a crescendo.

Way before Rudd was elected

If Howard was in power he would be facing the same mess and be just as powerless.

There is a lesson here dont put all your eggs in one basket.

Spread the risk...shares property cash,antiques ,stamps,vintage cars.

By the way we are not heading into a recession..more like a bloody depression.

Your shares will recover...but it will take awhile.

.Hold onto your hat ..there is still a little way to go...down.

Word is another 1000pts off the Dow

Join Date: Sep 2006

Location: Melbourne

Posts: 1,569

Likes: 0

Received 0 Likes

on

0 Posts

Might be a good time to buy QF shares while they are as low as the moral is, when they go under the current 'Rudderless" Govt might bail those share holders out 'cause we can't have the famous 'red rat' dissapear, wouldn't put it past 'em !

CW

CW